Domestic prices for structural and industrial logs increased up to $5 per tonne in many regions in response to the recent price increase for export logs.

Prices for pruned logs have remained relatively stable in the North Island with small increases in the South Island.

The At Wharf Gate (AWG) prices for export logs increased an average of $2-$3 per JASm3.

Significantly increased shipping costs for logs to China was covered by increases in sale prices in China, as well as the NZD weakening against the USD. CFR sale prices in China are at record high levels.

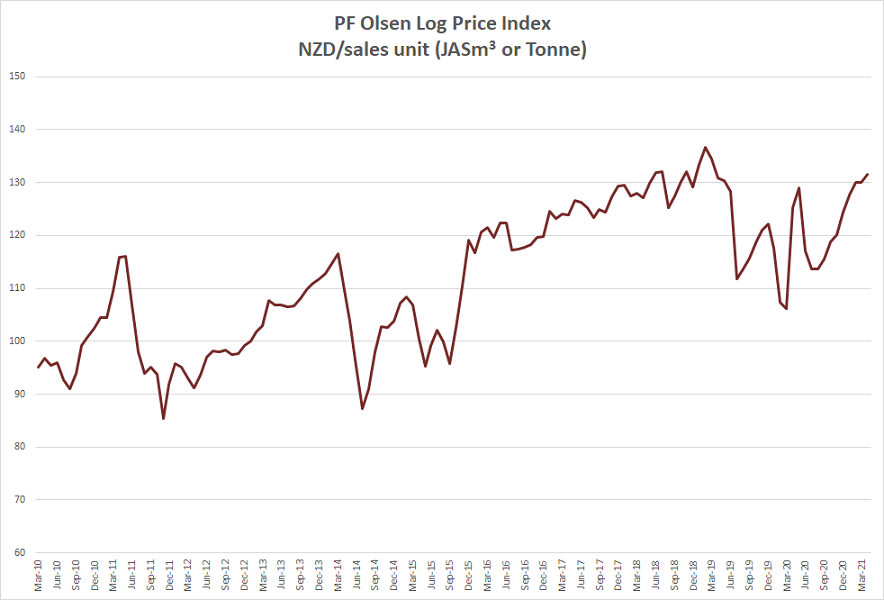

The PF Olsen Log Price Index increased $2 to $132 in April due to the increase in domestic and export saw log prices. The index is currently $11 above the two-year average, $8 above the three-year average, and $8 above the five-year average.

Domestic Log Market

Log Supply and Pricing

Log prices have increased an average of $5 in most regions for structural and industrial logs. The pruned log price has always remained relatively constant and is less affected by export pricing. Good weather has meant high harvest volumes.

Sawn Timber Markets

Mills are trying to expand capacity to meet demand. Red Stag will open a facility in Rotorua next month to produce CLT (cross laminated timber). This will initially add approximatley 5% to the wood processing capability in New Zealand.

Many mills have reported unprecedented levels of orders. While demand is undoubtedly extremely high, a shortage of supply can create further demand and some mills are not sure if some of the current orders are “ghost orders”, where customers are placing the same order with more than one mill to see who can deliver.

Demand is strong across every product. Mills report the pallet market is in very short supply as the kiwi fruit season was very good and we are now entering carrot and onion season. Many mills have also been upgrading timber (usually this material comes from closer to the pith of the log) that may have been used for pallets into other grades.

Prices for export sawn timber continue to increase in New Zealand export markets. The prices for sawn timber in China have continued to increase faster than the log prices. The average increases this year have been over 30%. Price increase have already been nominated for the remainder of Quarter 2 and these have been agreed by the buyers with no hesitation.

Export Log Market

AWG log prices

The AWG prices for export logs increased by about $2 per JASm3 in most North Island ports. Some more intense competition in a couple of South Island ports lead to more significant increases of $5-$6 per JASm3.

China

The CFR prices for New Zealand pine logs in China increased approximately 20 USD over the last month. The price for A grade logs in late April is now around 178 USD per JASm3. Log sellers have started to notice some buyer reluctance at these record high prices. However, there is nothing to suggest that prices will drop, other than history. Log demand is healthy with supply still somewhat constrained, and stock levels are declining downwards. Prices for spruce logs also increased over the month but seem to have reached the point where buyers are quite reluctant to buy.

Softwood log inventory has trended downwards to 4.2m m3 and daily port off-take had increased from 70k last month to 120k earlier this month and is now back to about 100k.

The ban on Australian logs has continued and the volume of logs arriving from Europe has remained at about the 1m mark per month which is down from the peak of 1.5m per month. New Zealand had a high level of log production in March with 23 work-days and good weather. Many ports set records for log volume throughput. Log volumes from New Zealand will reduce as we enter the winter season.

India

The log market in Kandla was improving, and logs were in short supply in Tuticorin before the latest wave of Covid-19 started to engulf India. The log and sawn timber markets are in chaos as port and sawmill workers return to their hometowns, and many workers and owners infected with Covid-19. Lockdowns in Delhi and Maharashtra have also reduced log demand in Kandla. This is now a humanitarian crisis rather than a market crisis. Log demand in India is usually very high at this time of the year, but currently there is utter confusion. The people of India have always been extremely resilient and incredibly resourceful, and our thoughts and prayers are with them as they struggle through this pandemic. I look forward to being able to comment on the log market in India with some normalcy, as it will mean the Indian people have returned to work and life is as normal as possible after this tragic event.

Exchange rates

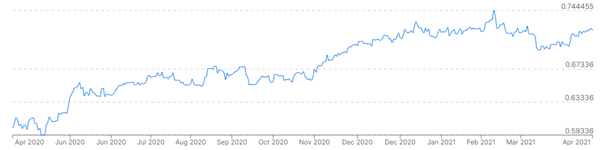

The NZD weakened through March from 0.7233 to 0.6989 USD. This help offset increased shipping costs. The NZD has strengthened through April and this will reduce the gains to NZ forest owners from increased log sale prices in China.

NZD:USD

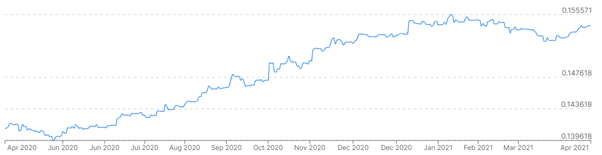

CNY: USD

Ocean Freight

Ocean freight rates to China stabilised and even dropped a bit during the earlier part of April but have since climbed to over $50 USD again from the North Island ports. There is more potential for upside than downside pricing in the short to medium term.

The Baltic Dry Index was sitting at 1200 in November and is now at 2889.

Source: TradingEconomics.com

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capesize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in handy size vessels, this segment is strongly influenced by the BDI.

Singapore Bunker Price (IFO380) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index – April 2021

The PF Olsen Log Price Index increased $2 to $132 in April due to the increase in domestic and export saw log prices. The index is currently $11 above the two-year average, $8 above the three-year average, and $8 above the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – April 2021

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Apr-21 | Mar-21 | Feb-21 | Dec-20 | Nov-20 | Oct-20 | Apr-21 | Mar-21 | Feb-21 | Dec-20 | Nov-20 | Oct-20 | |

| Pruned (P40) | 175-195 | 175-195 | 175-195 | 170-195 | 170-195 | 170-195 | 184-192 | 180-190 | 180-190 | 170-185 | 170-185 | 165-175 |

| Structural (S30) | 122-136 | 118-132 | 118-132 | 115-130 | 115-130 | 115-130 | ||||||

| Structural (S20) | 108 | 108 | 108 | 105 | 105 | 105 | ||||||

| Export A | 150 | 148 | 148 | 138 | 130 | 128 | ||||||

| Export K | 142 | 140 | 140 | 131 | 122 | 120 | ||||||

| Export KI | 134 | 134 | 134 | 120 | 113 | 112 | ||||||

| Export KIS | 125 | 125 | 125 | 115 | 105 | 104 | ||||||

| Pulp | 46 | 46 | 46 | 46 | 46 | 46 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.