The September AWG prices for export logs remained relatively unchanged from August prices. Pricing was flat to two dollar increases in most ports apart from Gisborne, where prices increased approximately $16 per JASm3 due to a partial easing in the shipping congestion costs. Harvesting and wood products manufacturing has resumed outside of Auckland. Domestic demand for wood products is likely to be affected by shortages of associated building materials. This may just mean production of sawn timber can catch up with demand, so not a significant concern to the wood processing industry at this stage.

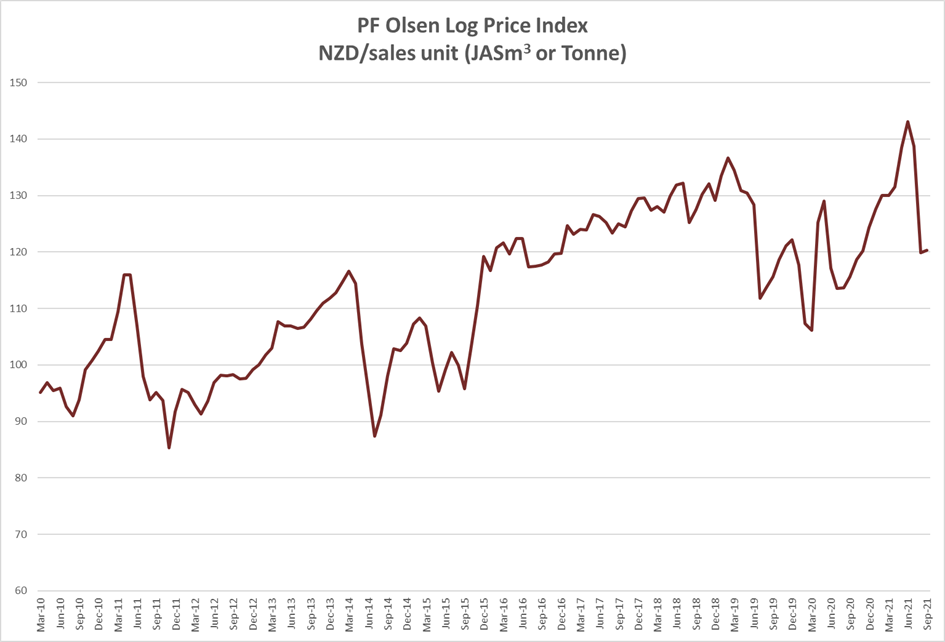

The PF Olsen Log Price Index for September is $120. The index is currently $3 below the two-year average, $4 below the three year-average and $5 below the five-year average.

Domestic Log Market

Log Supply and Pricing

Log pricing is relatively unchanged as we are into the last month of Quarter 3.

Sawn Timber Markets

A lack of building supplies will stall house buildings and delay new starts reducing demand for sawn timber products. In some cases, builders may switch to certain home improvements and renovations to try and avoid some of the material shortages.

Most building supplies manufactured in New Zealand come from Auckland. There is likely to be increased shortages of building products due to the extended Covid-19 lockdown in Auckland. While the NZ government has made exemptions for eight companies in Auckland supplying steel, insulation, and plasterboard to resume production, they are limited to a total of 100 workers across all eight. There are also significant shortages of overseas produced materials due to shipping congestion. This is not likely to improve in the short term.

As an example, home builder Winton said builds outside of Auckland were operating at half speed because of a lack of materials and inability to get subcontractors and project managers on-site (at Level 3). Developer Grafton Downs who have understandably postponed stages 7A and B of its Paerata Rise development in Auckland stated, “we’re trying to work out what our delays are going to be with our construction materials because we’re hearing about shortages, and it’s not good if our titles are pushed out”. Adding to the building backlog around the county, council inspections were not resumed until Covid Level 2. Industry participants expect it will take until mid-November for the sector to ramp up again.

Export Log Market

AWG Prices

There was little change in AWG pricing in North Island ports apart from Gisborne. The loading of logs into ships continued at Covid-19 Alert Level Four, and a dispensation was provided in Gisborne to cart-in bush stocks for the last couple of days at Alert Level Four. This helped to reduce the queue of log vessels at Eastland Port. Even though AWG pricing for logs at Gisborne increased $16 per JASm3, the pricing levels at Gisborne could increase by about the same amount again if demurrage costs were all but eliminated.

China

The CFR price for A-grade logs in China has increased 10 USD per JASm3 this month. Prices for A grade logs currently range from 175-182 USD per JASm3, depending upon the sharing of demurrage costs between seller and buyer. The daily port off-take of logs is still stubbornly low at 65k m3 per day. Log stocks in China have not increased but there is a lot of volume on boats queuing at Chinese ports. Some industry observers estimate log stocks could be over 7m m3 including all the volume on the water.

Congestion in China has reached the point where at the end of August approximately six percent (599) of the worlds handy size fleet capacity was queueing off the China coast. This has two effects, high demurrage, and reduced shipping capacity. This congestion has been caused by China authorities reacting to Covid outbreaks by closing ports, delaying berthing, and imposing strict procedures that have reduced ship handling capacity. There has also been strong demand for grain, minerals, and iron ore imports.

There is a concern for the property sector in China as property developer Evergrande faces the risk of default. Evergrande currently has 778 projects underway in 223 cities. The property sector contributes 28% of China’s economy and has been one of the engine rooms for China’s economic development. The Chinese government therefore will most likely intervene in some form. Even if the central government opts to let Evergrande default rather than bail it out directly, authorities are likely to be involved in coordinating the continuation of these projects that employs 163,000 people. There will, however, be short term disruptions.

The Caixin China General Manufacturing PMI fell to 49.2 in August 2021 from 50.3 in July, missing market estimates of 50.2. This was the first contraction in factory activity since April 2020

India

Four log vessels from Uruguay and two log vessels from Australia are forecast to arrive in Kandla in October. Containerised log supplies have virtually dried up.

Sawn timber prices in Gandhidham are weak at INR591 per CFT due to lack of demand from export sector and heavy monsoon rains. Indian exporters are facing acute container shortages for their products, so their demand for pallets is less.

Sawn timber in Tuticorin is also at weak at INR 701 levels. Log buyers have started experimenting with domestic wood like silver oak and rubber, as it could not support high priced pine lumber at INR751.

With wet weather forecast and no sign of the container shortage improving, log demand in Tuticorin is not expected to fully recover until Quarter 1 2022.

Exchange rates

The strength of the NZD against the USD was relatively unchanged between the start of August and the start of September (0.6972-0.7039). This had very little impact on September AGW prices.

NZD:USD

CNY:USD

Ocean Freight

The lowest ever order book to fleet ratio for the dry bulk market has supported increasing rates. Shipping costs from NZ to China now exceed 80 USD per JASm3, when demurrage is included. Charter rates are above 60 USD and there are very few ships where demurrage is less than 20 USD per JASm3. A rule of thumb for rudimentary calculations for assessing the cost of ship delay is 1 USD per JASm3 per day. While shipping rates from New Zealand are high, shipping from Uruguay to China costs 110 USD per JASm3.

Source: TradingEconomics.com

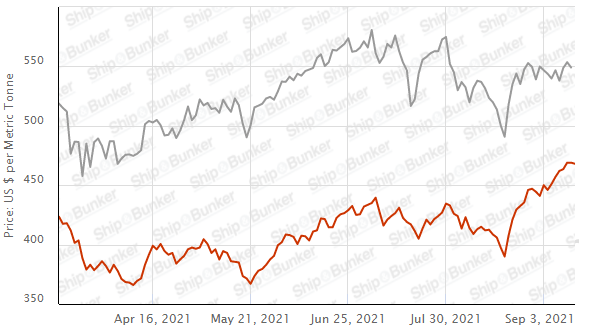

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capesize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in handy size vessels, this segment is strongly influenced by the BDI. The Singapore Bunker Price has continued to edge upward.

Singapore Bunker Price (IFO380) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index – September 2021

The PF Olsen Log Price Index for September is $120. The index is currently $3 below the two-year average, $4 below the three year-average and $5 below the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – September 2021

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Sep-21 | Aug-21 | Jul-21 | Jun-21 | May-21 | Apr-21 | Sep-21 | Aug-21 | Jul-21 | Jun-21 | May-21 | Apr-21 | |

| Pruned (P40) | 180-200 | 180-200 | 180-200 | 180-200 | 175-195 | 175-195 | 194-200 | 194-200 | 194-200 | 204-218 | 200-214 | 184-192 |

| Structural (S30) | 125-160 | 125-160 | 125-160 | 125-160 | 125-139 | 122-136 | ||||||

| Structural (S20) | 105-110 | 109 | 109 | 109 | 109 | 108 | ||||||

| Export A | 128 | 128 | 163 | 171 | 165 | 150 | ||||||

| Export K | 120 | 120 | 156 | 164 | 158 | 142 | ||||||

| Export KI | 113 | 113 | 147 | 154 | 150 | 134 | ||||||

| Export KIS | 104 | 104 | 137 | 146 | 142 | 125 | ||||||

| Pulp | 46 | 46 | 46 | 46 | 46 | 46 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.