Coming to the end of 2022, it is worthwhile having a look both back and forward at the on-farm market situation and try and see if any clues really exist as to how the season for red meat is going to progress.

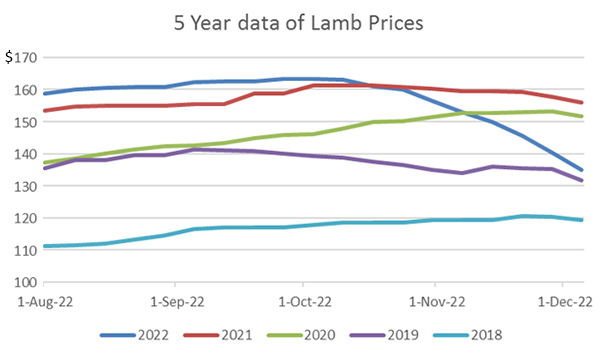

One thing we do know is that on-farm inflation and costs are going to rise. If inflation comes down from current levels it will be likely it is because interest rates have gone up so whatever way you look increasing costs are likely. Sheep meat makes up the bulk of the ‘average’ sheep and beef farm income at approximately 60% of income but lately schedule prices appear to have gone into free-fall despite what was meant to be a healthy outlook a short time ago. So, what is driving the fall?

Firstly, this is the time of year is when processors depress schedules and start to make their profits. Normally there is an increasing number of both lambs and mutton coming forward increasing demand for works space and reducing the processors need to offer carrots. Shipping times of getting lamb to the UK to cash in on the Christmas premiums have also passed so there is limited demand from the works to meet that deadline. That given, the works will still be competing for animals to keep them functioning at efficient and economic levels and if one works doesn’t take up the opportunity to take in stock their competitor will be more than happy to, even if it means reduced margins.

This year the impact of Covid is still having an impact, however 2020 and 2021 also had impacts occurring, likewise lack of imported labour problems existed back then also and those years differed very little in their pattern to the years (2018-19) previous to Covid influences.

The other big influencer of farm-gate prices can be the NZ$ versus the US$. However, looking at data over the same periods that cannot not be offered as a reason for the current decline. The Kiwi is bouncing around at relatively low levels which should favour returns to farmers. As mentioned before in regard to Alliances record profit last year, which coincided with record lamb prices to farmers, it was good to see both parties ‘winning’. The way 2022-2023 is shaping up it is looking like a return to the old days of winners and losers.

Daily exchange rates

Select chart tabs

The processors who are all hauling back prices, pretty much across the board, (venison excepted) are all saying pretty much the same story. Works are facing issues getting staff, both onto the payroll and then to turn up to work with “severe cases of absenteeism” being experienced (some no doubt due to covid). This is leading to less chains functioning to cope with the build-up of supply. The biggest difference currently being experienced over the last few previous years is the increase in global inflation.

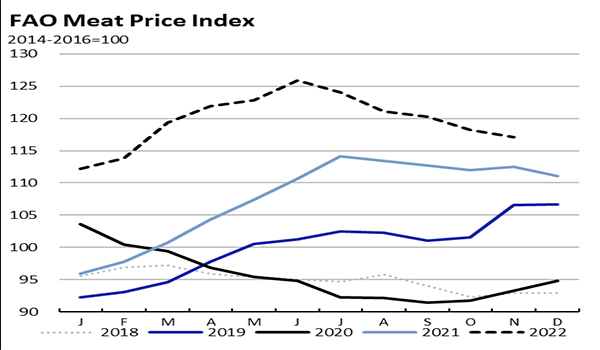

However, despite this the FAO meat price index which is made up of the weighted average of poultry, pork, bovine and ovine (likely included goat) is still considerably ahead of previous years

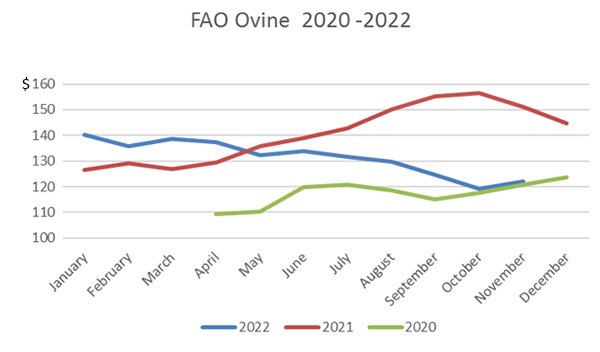

Just looking at the Ovine data alone (below) and over the last 3 years (April 2020 to November 2022) it does show that international trends have some similarity to the farmgate trend although I’m not convinced too much can be drawn from the comparison given it goes in different directions at different times.

Beef + Lambs NZ Situation Outlook for lamb is certainly more buoyant than what the current schedule falls would indicate and while everything is fluid in trade, they were not predicting a dramatic decline in prices. While they predict a slower expansion in China for 2023, they still predict an expansion (+1.5%). They also predict farm prices will fall (-5.8%) although a large slice of this is due to having less lambs to sell (-2.1%). So, apart from the works and the ability they have to control what the farmer receives there are no glaringly obvious reasons for the price declines of which only hindsight will show where they bottom out.

Beef, fortunately, has a clearer outlook and most commentators are in agreement that at least for the Q2 and Q3 periods next year there should be an upturn in returns due to the reduced global production (the Putin influence) and hence higher demand.

Ironically, inflation is given as one of the reasons for the upturn in beef prices, however it is also given (by a processor) as one of the reasons for the reduced demand and returns for lamb. China’s influence is also given as an underpinning for the beef market by Beef + Lamb NZ. Again, counter to the lamb ‘story’.

So, call me a cynic but the current falls in schedules looks to me to be more about works ability to manipulate the local market rather than any real or clear signals coming from oversea. The result likely to be a return to the ‘good old days” of winners and losers. Just when the trade looked to be moving to newer maturity.

Y Lamb

Select chart tabs

5 Comments

Beef is largely produced in America (the continent), Australia, NZ and Europe, that are experiencing high inflation, thus the supply price is increasing. Ovine (including goat) is the most widely eaten meat and is produced across the Middle East, Turkey, Africa and India as well as Europe. Those countries are likely not experiencing the same inflation because...

Factories are efficient when running at optimal production. It may very well be that Processors need to pay market prices to secure pipeline of animals to process. This would benefit farmers. And if demand continues to increase overseas...

I think you mean food processing facilities. They are at their most efficient when fully staffed. Which is impossible at present. Will the Immigration minister cave in, and instruct the department to process visas more quickly? I suspect not.

Might be good news for Christmas at the WJ residence.

Totally agree. SFF has adopted a much harder line on beef pricing this year. At times their bull schedule in particular has been up to 60c kg below other NI processors.

Under the new ownership structure SFF has obviously become more profit driven which is good for their long term survival but if driven too far removes any supplier loyalty they had built as a supplier co-op and the rest up here are all privately owned so shareholder focussed.

Farmers never received the full benefit of the international pricing for beef.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.