October AWG prices for export logs were unchanged from September. CFR log prices in China have remained stable, as have shipping costs, aside from short‑lived increases, while the NZD’s relative recent weakness against the USD continues to influence AWG prices.

Demand remains subdued in both China and India, coinciding with the Mid‑Autumn and Diwali festivals, respectively. Log Inventory in China remained stable around the Chinese holiday period. However, log demand in China remains flat during a period when it would typically rise seasonally.

Domestically, log prices and demand have seen little change, with the industry cautiously anticipating a potential summer revival in construction activity. Mills are also having to cope with increased tariffs on exports to the United States.

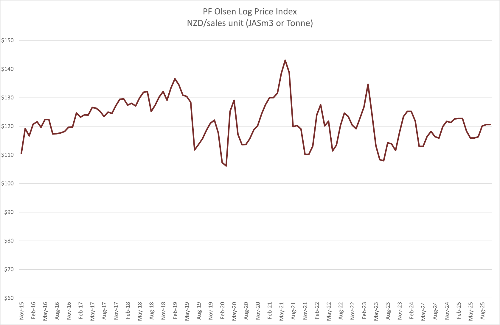

The PF Olsen Log Price Index remains at $121. This is $1 above the two-year average and level with the five-year average.

Domestic Log Market

Sawmills producing clear-wood sawn timber for export to the United States are having to contend with higher tariffs that are making their products less competitive.

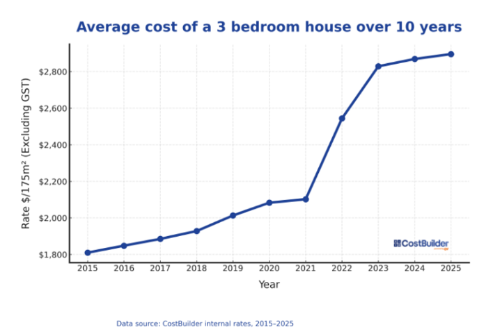

Construction cost increases in New Zealand remain flat with annual cost increases now around 1%, and just 0.4% in the September 2025 quarter. This is providing some certainty for pricing projects, that wasn’t the situation post-covid with the disrupted supply chains.

In a recent AEOCOM New Zealand Infrastructure and Building Survey, a shortage of skilled workers was the most cited risk by participants to a construction recovery. Interestingly while 80% of the industry are extremely, very or moderately worried about the impact of climate change and extreme weather events and say natural disaster preparedness tops investment planning priorities, low-carbon transition is least prioritized in planning. This doesn’t bode well for increasing the use of timber in construction projects.

Export Log Markets

China

CFR prices for A-grade logs remain in the range around USD 115-118 per JASm³ for October vessel arrivals. Some log exporters tried to increase prices in China in the second half of October but were unsuccessful. The market does not currently see enough log demand to justify price increases. Daily pine log port offtake is still around the 55k m3, and the outlook for construction activity is extremely negative.

Softwood log inventories remain unchanged at approximately 2.4 million m³, which is a positive sign after the Mid-Autum festival. Demand for pruned logs has softened and it is sap-stain season with shoulder seasons in both New Zealand and China meaning temperatures are conducive to fungal growth.

The Caixin China General Manufacturing PMI rose to 51.20 in September. This reverses two months of sub-50 readings which signalled contractionary pressures. The People’s Bank of China’s (PBOC) recent monetary easing stance aims to support growth without stoking inflation. The data suggests that the central bank’s calibrated liquidity injections and interest rate adjustments are beginning to stimulate industrial activity. Industrial production grew 5.10% YoY in August, and fixed asset investment rose 6.30% YoY, both signalling underlying industrial strength. Key sub-indices also improved with new orders rising from 50.80 to 52.00 and output climbing from 50.60 to 51.50.

While the Caixin PMI suggests modest expansion in the manufacturing sector, the official NBS (National Bureau of Statistics) Manufacturing PMI for September was 49.8, indicating contraction. This divergence highlights that smaller, private firms (captured in the Caixin survey) are seeing a pickup in activity, while larger state‑owned and traditional manufacturing enterprises remain under pressure. The mixed readings reinforce a cautious outlook for log demand: while some segments may support consumption, overall construction and industrial demand remain subdued. The construction industry in China is now dominated by state owned companies.

India

Sawmilling operations in Gandhidham are currently experiencing labour shortages owing to the overlapping impact of the Diwali holidays and the recent state-assembly elections in Bihar. Labour participation is expected to normalise by mid-November, at which point post-Diwali production should resume full steam. Domestically, green sawn timber prices have recovered to approximately INR 531–551 per cubic foot.

Sawn timber derived from New Zealand pine logs arriving via Tuticorin is gradually re-entering the southern Indian supply chain—targeting markets in Chennai, Bengaluru and Hyderabad. Seasonally, demand remains constrained. Tuticorin is currently under the influence of the north-east monsoon, which typically suppresses construction and timber offtake until the rains recede in late December or early January. That said, the gradual re-entry of imported sawn timber may slightly ease supply pressure, though competition from domestic alternative species and local production remains a factor.

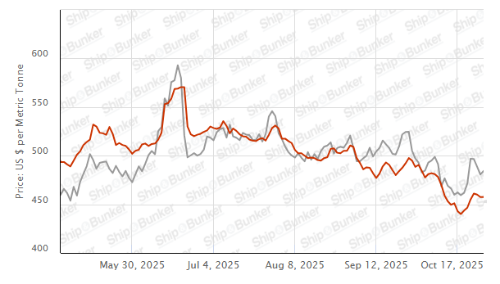

Ocean Freight

Ocean freight rates have firmed slightly for shipping New Zealand logs to China. The cost for shipping logs from two north island ports to one port in China rose to USD 34 per JAS m3 mid-month but has recently settled back to USD 32 per JASm3.

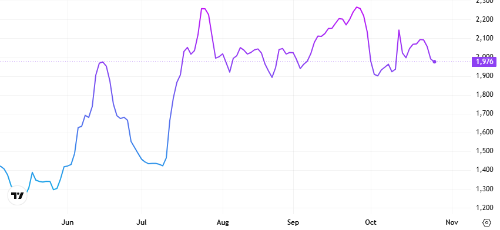

The BDI is a composite index derived from three sub-indices representing different vessel sizes: Capesize (40%), Panamax (30%), and Supramax (30%). It reflects the average daily USD hire rates across 20 major ocean freight routes. While most New Zealand log exports are transported via Handysize vessels (not directly included in the BDI), this segment remains closely influenced by broader trends in the index.

Baltic Dry Index (BDI)

Source: TradingEconomics.com

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index - October 2025

The PF Olsen Log Price Index remains at $121. This is $1 above the two-year average and level with the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent

a broad average of log grades produced from a typical pruned forest with an

approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – October 2025

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Oct-25 | Sep-25 | Aug-25 | Jul-25 | Jun-25 | May-25 | Oct-25 | Sep-25 | Aug-25 | Jul-25 | Jun-25 | May-25 | |

| Pruned (P40) | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 190 | 190 | 185 | 180 | 180 | 180 |

| Structural (S30) | 120-145 | 120-145 | 120-145 | 120-145 | 120-145 | 120-145 | ||||||

| Structural (S20) | 93-100 | 93-100 | 93-100 | 93-100 | 93-100 | 93-100 | ||||||

| Export A | 125 | 125 | 125 | 117 | 116 | 116 | ||||||

| Export K | 116 | 116 | 116 | 108 | 107 | 107 | ||||||

| Export KI | 107 | 107 | 107 | 98 | 97 | 97 | ||||||

| Export KIS | 98 | 98 | 98 | 89 | 88 | 88 | ||||||

| Pulp | 50 | 50 | 49 | 46 | 48 | 48 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.