Beef+Lamb NZ's mid-season report on the red meat and wool sectors is a detailed assessment and puts figures to what most farmers already know. While stock prices have fallen, they are still above the five-year average but with high inflation farm profitability is looking at falling by around 30%.

Of the three main meat products covered (lamb, mutton and beef) mutton has taken the heaviest hit with a drop in returns of -23%. This is likely largely due to the elevated prices that have been achieved previously due to demand from China where mutton got some favour as a substitute for the pork shortage due to African swine fever. Pig numbers have returned to pre-ASF levels and unfortunately mutton has not been able to diversify its sales as well as lamb and beef have. The result is the annual average mutton price for the 2022-23 season is forecast at 430 cents per kg, down -23% on 2021-22, and -11 per cent below the five-year average.

Lamb which has been able to move to a wider spread of markets has been able to ‘cherry pick’ and as a result although still down -12% on the previous year at 760 cents per kg for 2022-23, but is +2% above the five-year average. Beef has out-performed sheep meat although still -6.1% below the previous season with estimated 2022-23 average annual price is 611 cents per kg for P steer/heifer (270-295kg), 405 cents per kg for M cow (170-195kg), and 602 cents per kg for M bull (270-295kg).

All these projections are predicated on the Kiwi dollar being at 63 US cents. Currently it is at 61.5 US cents and has been tripping along at around the 63 US cent mark average since December 2022 (give or take a cent). At this level New Zealand exports are seen to be competitive against international competition.

Lamb demand whilst still strong(ish) and is expected, along with all meats, to strengthen in the second half of the season is perhaps a little disappointing given the decrease in numbers. Sheep numbers in general are down -2.5% in June compared to the same time in the previous year (25.15 million). A bit more surprising given the swing to cattle that has been taking place in the last decade is the number of beef cattle at 30 June 2022 is estimated at 3.84 million, down -3.1% on the previous June. Beef cattle numbers have ranged between 3.72 and 3.97 million for the past five years.

Perhaps the increase in forestry areas is starting to impact on all livestock class numbers?

The number of dairy cattle at 30 June 2022 is also estimated to have decreased -4.3% to 5.92 million. Wool, worth a minor mention, shows that shearing costs outweigh returns (except for the finer and Merino flocks) and there is little light to see any great turn around here. Wool is making up about 5% of total farm returns.

The fall in prices however, is only one side of the coin and it is the lift in costs that will be of greater concern to farmers as this is more difficult to control. Fertiliser, lime, and seeds expenditure have shown increases +6.1% on the previous year and despite farmers reducing these inputs they still make up around 19% of the total farm expense bill. Over all the largest increases are forecasted for interest, fertiliser, fuel, shearing and wages. No surprises there.

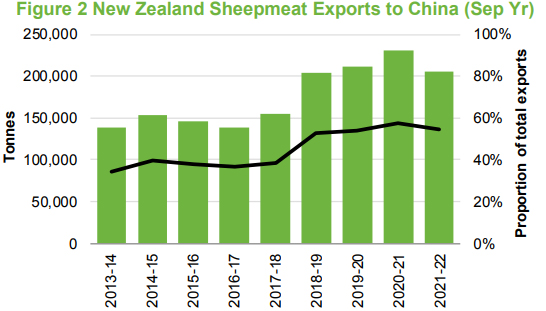

Despite some flattening off in proportion of total exports, largely as a result of Covid -19 lock-down policies, China is still and likely to remain the dominant destination of sheep meat. Total sheep meat consumption in China has lifted around +2.3% in the past decade because of these factors. Despite this growth, sheep meat remains a small, niche market, making up only 4% of total consumption.

Source: Beef + Lamb New Zealand Economic Service, New Zealand Customs

While New Zealand numbers of lamb are likely to continue to decline, in Australia largely due to wetter seasons (as opposed to droughts) production is being seen to lift. The Australian sheep flock is estimated to expand to 79 mln head, its highest level since 2007. Lamb slaughter is forecast to reach 22.6 million in 2023, a +2.7% increase on the previous year. The average carcass weight is also forecast to increase in 2023.

Internationally, sheep meat production is forecasted to grow at +1.6% while demand increase at +1.5% annually. The growth in production, apart from Australia, is being seen to occur in lesser developed countries and regions and therefore not a great supply threat to New Zealand producers.

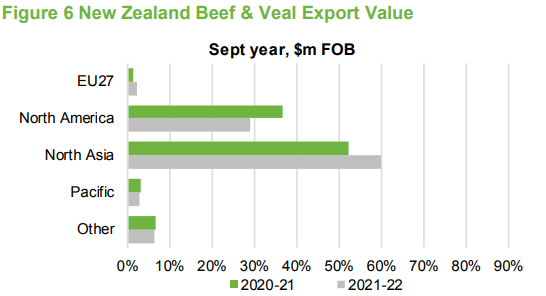

One of the conditions that may aid increased returns for beef and especially from China is a recent outbreak of “Mad Cow Disease” (BSE) in the Brazilian herd. For New Zealand beef exports China has been outperforming the US in term of value and volume in recent years and this is seen likely to continue.

Source: Beef + Lamb New Zealand Economic Service, New Zealand Customs

Demand for beef has not had the same drop off as has been experienced by sheep meat although there are more competitors in the market. China is (as always) the world’s largest importer of beef. Globally production is expected to fall -1% in 2023 and with the Ukraine war push up feed costs. Both issues should help New Zealand beef remain competitive.

Still to be factored into the forecasts are the impacts of adverse weather, the heavy rain events and disruption to farm management and more in the North Island and the prolonged dry period which has impacted on the Southland – Otago region. None of these are going to be positive.

The only good in aspect is that farmers have come out of good recent returns and looking ahead returns also look likely to be improving. The big things to watch for are the Kiwi dollar relativity, Russia and perhaps the Brazilian BSE outbreak.

Y Lamb

Select chart tabs

P2 Steer

Select chart tabs

7 Comments

You do realise the average "Profit" - $146k is before - Tax, drawings, rent, principal repayment and capital expenditure payments - $146k to cover all this and thats the average remember - whats the bottom 50% doing ?

This is why Im overrun with farmers desperately trying to find a future – its dire for many with Interest rates up, input cost up and product prices down – it was bad before this now its – well really bad (that’s being polite). Im even getting depressed trying to help drag them out of holes and have a chance.

The poor family farmers are sick and tired of hearing they are making profits from their farming bodies when the truth is they would be better of driving a bus in town with 4 weeks annual leave. Talk about the mental destruction of your own people – BE HONEST.

Wool well face the facts - are your production costs going to go down? With a farming mate yesterday - $40 an hour for someone to run the wool press.

If you look at the trend from 1990 of decrease in sheep numbers its a continual fall - the largest fall when the forest estate shrunk as well so its not trees Im afraid. ITS THE LACK OF PROFIT IN SHEEP FARMING - SIMPLE.

Even my farming mates tell me thats the problem - they don't blame trees its the lack of cash dropping out the end.

Im getting agents now sending me properties for sale with listed prices 50% less than 12 months ago - I pick by the end of this year the values will be at 2020 levels again and in some regions farms for sale everywhere with no buyers as forestry buyers step right back. TAF - Trading amongst farmers which is what many seem to want - good luck.

I am sorry to read that state of affairs Jack. The late 80s crisis in farming is still a painful memory.

I asked our local supermarket butcher why they no longer sell mutton. Because they don't have the overhead rails the carcasses have to be carried from the delivery truck, and health n safety don't allow that for mutton weight carcases anymore. Hard to beat a roast mutton or mutton chops😋.

I agree with you Jack Lumber that the frothiness of the peak prices underpinned by forestry have gone for now. I don't believe we are going back to pre forestry prices but somewhere in between. Maybe closer to $1,000 a stock unit than $2,000.

Would be interesting to know how much forestry proceeds was recycled back into another farm purchase and how much left farming completely. I haven't heard a single winge by a farmer about another selling to trees. The anger is directed at government legislation that encouraged this to happen.

$146k doesn't sound much but that is 'average' and average for a sheep and beef farmer means close to sixty years old, debt free and running a below scale farming business.

Agree. The problem is how does a new farmer buy the land and stock on that income? That's the problem I'm seeing. It's having enough cashflow to finance anything plus pay out sibling's. At any land price it's almost impossible on that income level.

The higher land prices allowed some to escape and have a good retirement plus leave the family something. That's gone from what I can see so there may have been complaints about policy but what now when they can't sell or at much lower prices?

And it will be interesting to see what happens if we get to involved with AUKUS. My works buyer told me if China stops buying our products expect $2 a kilo at the works for lamb.

And don't think China won't do it as we are only a fraction of their meat market.

Hardly a new problem . It's been around since the mid 90s when dairy expansion started to push up the price of land. The dairy boom hid these problems , then forestry . There is no other place to go now.

I've banged on about it before but we have to figure out a proper and fair tennant farming system. Unfortunately our pure free market ethos (that stood us in good stead to seek efficiency) does not support this.

The other part of the solution is updated more efficient production systems , increased lambing frequency, feedlot finishing and sheep milking for example.

A commenter mentioned the 80s we are still feeling the effects of this , the most innovative and visionary farmers where culled out. Generally it was the conservative who survived.

I would say it was the debt free that survived , and brought up farms of those that went under, so they own 6 or 7 farms today.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.