It’s no secret that China is the main driver of global dairy prices; in fact they have a major impact upon the price of all traded food internationally. This should come as no surprise given it is the second largest population (as a country) and has a growing middle class.

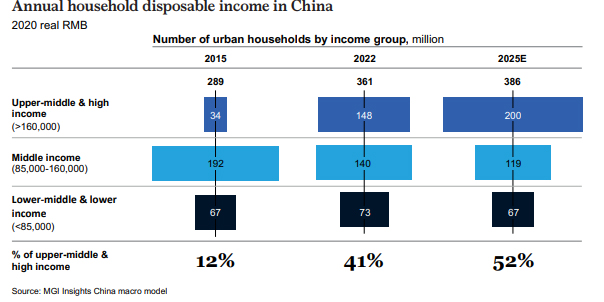

In fact, at the moment it is the largest middle class, depending upon the criteria used to measure affluence. Some say within China say it is over 707m (50%) considered to be in the middle class. Perhaps a more realistic measure is that from 2002 -2018 the numbers joining the ‘middle class’ is said to have averaged 27% per year to have gone from 1% to 25% and climbing with an expectation that it will reach 40% of the total population by 2030. The graph below (from 2020 data so a bit speculative for the current time period) gives a good breakdown of where the money is.

Never mind the numbers, it is clear that it is large and still has plenty of growth ahead. Despite the recent downturns including in China there is still growth there, lower than previously but it appears to be ahead of most OECD nations as a percent of GDP.

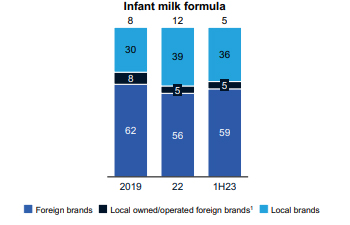

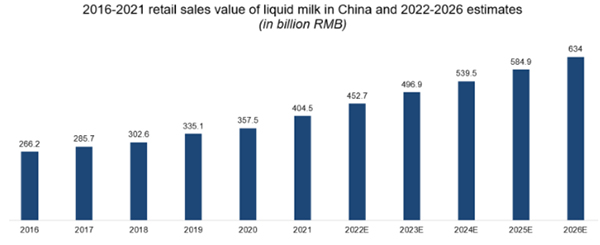

Food spending in particular is up 4.8% (in the first half 2023) over the same time last year and up 15.8% over 2021. The numbers below relating to infant formula are a little more circumspect and the reduction of “local brands” while up on 2019 is down for the first half of 2023 is a little surprising given the drive to ‘buy local’ occurring in China.

It may just be that the snapshot is too small a period to get an accurate trend. Reports do say that Chinese consumers are becoming more frugal in spending and practising “smart shopping” I.e. going for the best value.

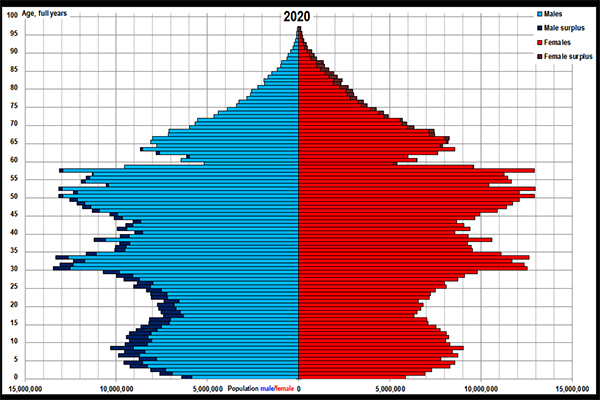

One area that could be of concern now and going into the future is the Chinese demographic make-up. We know that the population is starting to fall driven by reduced births and the graph below also shows that it is being compounded by the ‘over representation’ of males around the age of when couples are having children.

Source: Wikipedia

This out of balance make-up looks like it may continue for another decade or so yet. Looking at this data it would start to make you wonder if relying on infant formula as the future income earner for New Zealand dairy is the correct product mix.

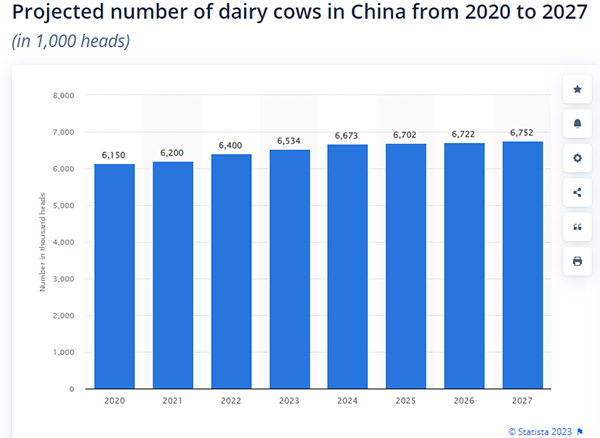

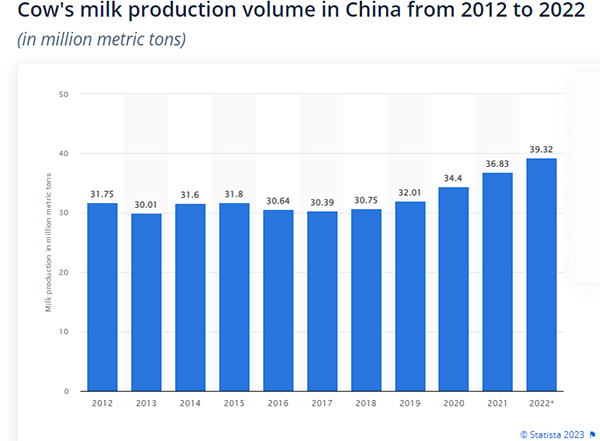

The other area to watch in China is its own domestic dairy production. We know that it is increasing and that consumers are now having more confidence in purchasing it.

Along with the additional cow numbers, production per cow is also lifting and despite being flat(ish) for a number of years is now starting to climb, judging by the gross figures, as production is increasing at a faster rate than cow numbers. In the years 2020 to 2022 cow numbers increased 4%, while milk increased over 14%. Even allowing for some lag time a substantial jump.

In 2021 Reuters reported “Spurred on by near record highs for raw milk prices and government subsidies, just over 200 new Chinese dairy farm projects were announced last year, according to consultancy Beijing Orient Dairy. Its analysis shows that 60% of the new projects have set their sights on 10,000-plus cows and in total the plans call for some 2.5 million cows - roughly half of China's current milking herd - to be added in the coming years”.

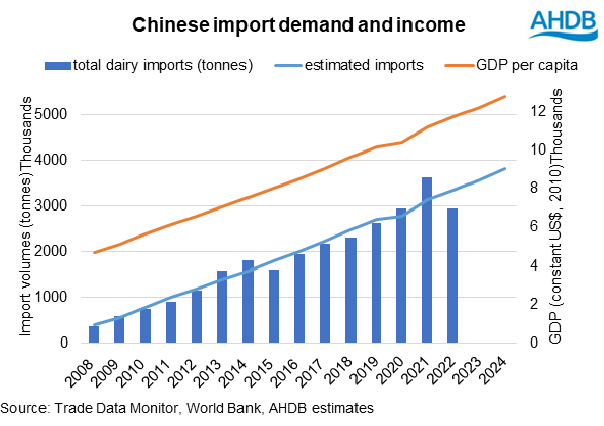

Looking at the projected cow numbers above it doesn’t yet appear that these numbers are being captured. Reuters have also said that (only) 70% of China’s milk demand is being met by imports. They felt this was still a wide gap and as the AHDB graph below shows a healthy upward trend. Although the 2023 numbers are not included and with them along side 2022 it may not look so healthy.

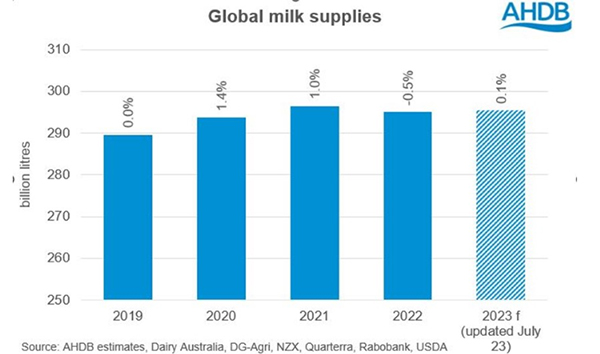

Looking at these numbers and projections, it does appear that there will be a medium-term uplift in prices, mainly because world production is flat (see below).

But with China the only country to be really increasing their volumes, although last year in the Dairy Exporter there was a report of milk dumping occurring due to over-supply domestically. This is one of a number of mixed messages coming out about Chinese demand as earlier this year a report showed a steady increase in consumer consumption.

So this is why “medium term” things should be positive. Beyond that I believe questions need to be asked, “what is the future for dairy?”.

China is already the world 3rd largest producer and they have shown they can manage quality control to the point where they satisfy their domestic consumers. So, it may only be a matter of time before they start exporting, certainly their rate of imports must be likely to reduce.

Probably one big question will be around their costs of production. New Zealand should have an advantage there growing grass, but with a possible $8.40 per kg MS cost for many even that has to be questioned.

Northern hemisphere countries should reduce first with higher costs but with governments propping up food production, even that is questionable. So, dairy beyond 2030 may look quite different to today. Just don’t ask me what that will be.

16 Comments

Would be interesting to see a comparison of input costs, many farmers are leveraged to the hilt here and land costs and interest rates are sky high. No idea what land costs for farmers in China are. Labour costs are also much higher here.

They don't have enough feed for their cows so not a great cost model. They annually import at least 4 million tonnes of lucerne alone from the US.

There is no reason for China to stop importing any primary goods from New Zealand, and no worry on the bilateral trade to keep on increasing, providing a stable and improving diplomatic relationship between the two.

Chinese population is plummeting, that's a very good reason to stop importing primary goods. As the article mentions, less babies = less infant formula, followed shortly by less teenagers (we are already there) and then less adults.

While that's great for the planet, it's not so good for NZ dairy exporters

Plummeting? It will take centuries. Life expectancy may increase and old people enjoy dairy too. A reduction in China's population will leave the average Chinese citizen better off. Compare average wages and poverty levels in China and India and it is clear that an ever increasing population is no longer the secret to success. In fact it hasn't been since the age of steam replaced human physical man-power with mechanised power.

NZ dairy exporters do not need to worry about the number of customers (potential 10 billion) but they should worry about competition from places with shorter supply lines and lower wage costs.

centuries? It started falling in absolute terms a decade ago. The reason Chinese consumption hasn't taken off when covid zero ended? An ever smaller number of consumers, particularly the under 40s.

Agree per-capita income is more important to the average citizen, and a lower population in the long run will allow that. But again for NZ dairy exporters a reduction in chinesse demand does not paint a rosy picture.

https://zeihan.com/new-chinese-demographic-data-population-collapse/

That demographic chart, if you turn it sideways it kinda resembles the ATM stock price.

The rules of compound interest apply to decline too. If you start with 1,400 million and your population declines by 10% per decade then after two centuries you still have 170 million. A sizeable market. Artifical milk in ten years is a bigger threat.

Where do you get 10% reduction per decade? Seems a bit low

Using this nice little calculator, with a starting population of 1.3B, average age of 39, and a birth rate of 0.8, I get 250M in 100 years, and almost 0 by 200 years, though I presume we can expect the birth rate to pickup before then

As the article mentions, less babies = less infant formula, followed shortly by less teenagers (we are already there) and then less adults.

Milk formula for seniors is a great opportunity and there is substantial demand (Fonterra's brand is Anlene). The Chinese popn is not going to drop off a cliff overnight.

instead of sending them milk powder we could always move to sending them stock, oh that's right we were doing that and it will be started again after the next election

A few people will get rich from teaching them how to fish, instead of selling them the fish.

Vietnam-China trade deal proposes easier access to Vietnam mkts for Chinese dairy products. Many companies are already vying for market share before the Chinese move. For ex, Korean company Orion has partnered with Thai dairy company Dutch Mill for some quite interesting propositions (https://www.kedglobal.com/food-beverage/newsView/ked202308080002 _.

Fonterra and NZ dairy brands have largely failed in ASEAN in terms of innovation. Chinese dairy companies know what they're doing and produce interesting products that consumers want.

NZ has lost it's biggest price advantage - consumer trust.

Or more accurately other countries including China itself are rapidly gaining credibility with consumers and eroding the "super profits" our primary products used to have.

Delete

What a load of Bollocks

touché

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.