Giant dairy co-operative Fonterra has made its opening farmgate milk price forecast for the new season that's about to start - and it's a good one of $10.

In an update released to NZX on Thursday, Fonterra also re-affirmed a likely milk price for farmers for the current season ending on May 31, which is also $10 per kilogram of milk solids.

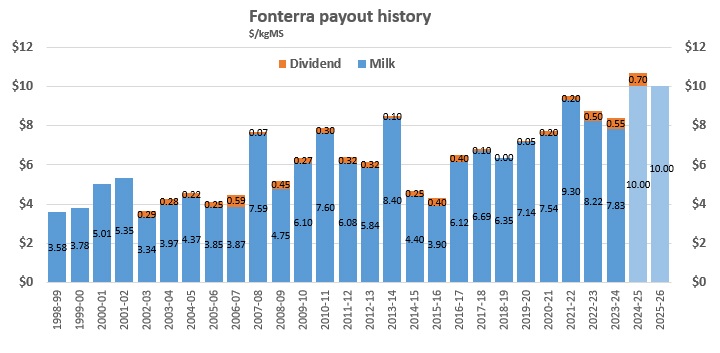

The expected $10 price for the current season is by some margin a record, so, if Fonterra makes $10 next season as well, this will be two very strong seasons back to back.

Fonterra says a milk price of $10.00 per kgMS "equates to around $15 billion into the New Zealand economy. The majority of this flows into regional New Zealand where it plays a strong role helping to sustain local communities".

However, it's early days when talking about next season and Fonterra has demonstrated the inherent uncertainty in global markets by naming a wide $8-$11 range it thinks the ultimate milk price for next season might fall into. It has broken from recent practice by specifically targeting $10 as the price to achieve, rather than the 'midpoint' of the $8-$11 range, which is $9.50.

And the co-operative also firmed up forecast earnings for the current financial year in a range of 65-75c per share, giving a mid-point forecast of 70c.

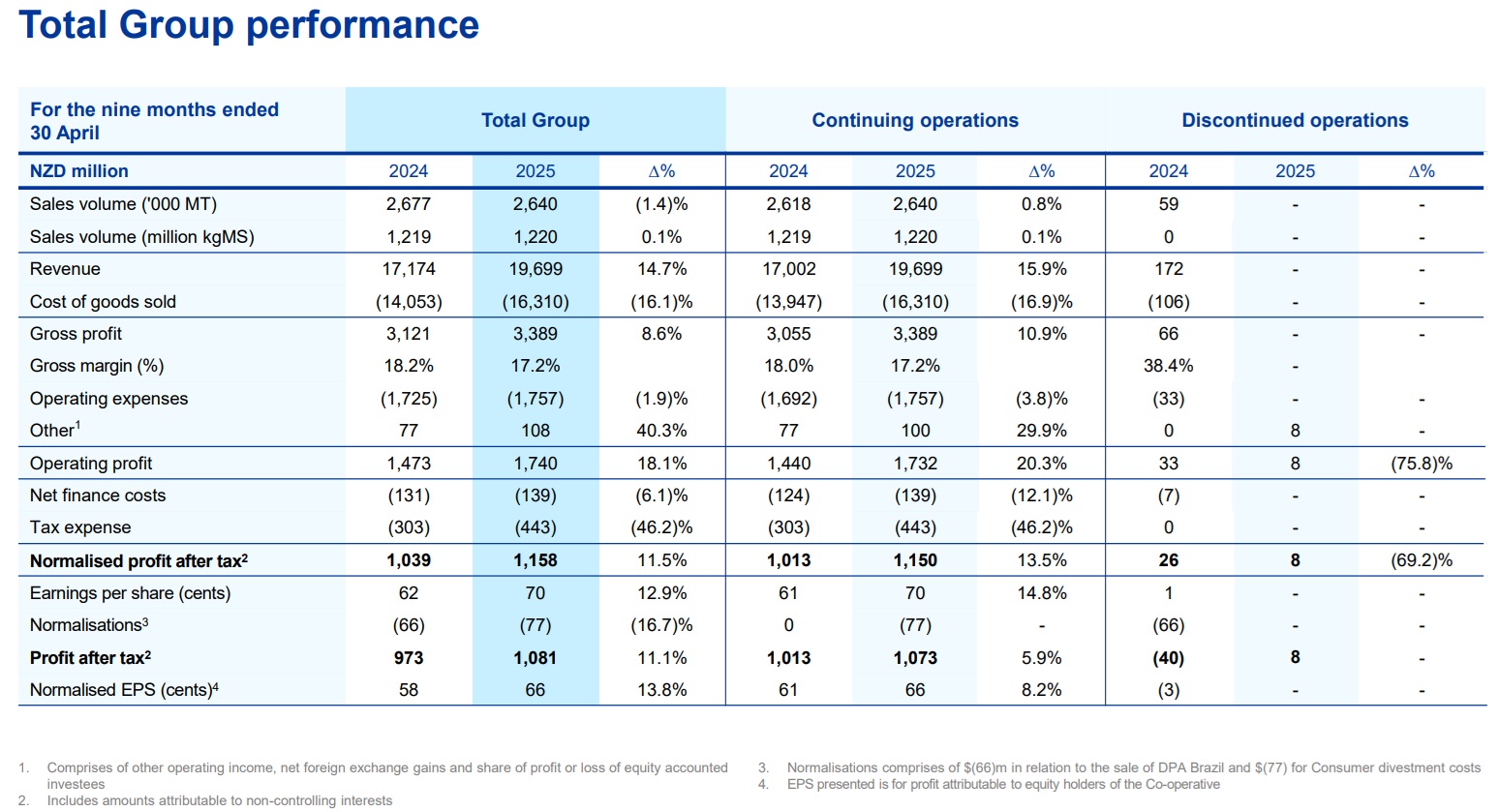

This is on the back of announced 'normalised' earnings after tax for the nine months to April 30 of $1.158 billion, up 11%.

Fonterra gave the following highlights in its statement:

- Normalised* profit after tax: NZ $1,158 million, up 11%

- Normalised continuing earnings per share: 70 cents per share, up 13%

- Return on capital: 11% down from 11.9%

- FY25 full year forecast earnings range: 65-75 cents per share

- 2024/25 season forecast Farmgate Milk Price: $10.00 per kgMS

- 2025/26 season opening forecast Farmgate Milk Price: $10.00 per kgMS

Fonterra has previously announced plans to sell its consumer business, with household name brands such as Mainland and Anchor and has been running a sales process that will see the business, now named Mainland Group, sold either by trade sale or possibly by an initial public offering (IPO), followed by stock market listing.

The co-op gave no definitive update on this process in its Thurday update, saying that "this work is on track as planned and we will seek farmer shareholder approval to divest through a vote in due course". Fonterra "continues to target a significant capital return to shareholders and unit holders following divestment".

It has been estimated Fonterra shareholders might reap as much as $3 billion - about $2 per share - from a successful sale of the businesses, although that was an early estimate and some assets were withdrawn from the sales process, while if Fonterra retains a shareholding that would make a difference to any return too.

This is the dairy industry payout history.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.