Giant dairy co-operative Fonterra is splashing the cash for its shareholder farmers after reporting strong earnings for the financial year ending July 31.

Fonterra said on Thursday that its final farmgate milk price for the year would be $10.16 - which is up from the last estimate of $10.15 announced a month ago. In terms of the milk price forecast for the new season that started in June 2025, that's still an estimated $10, which is the mid-point of the guidance range of $9 to $11.

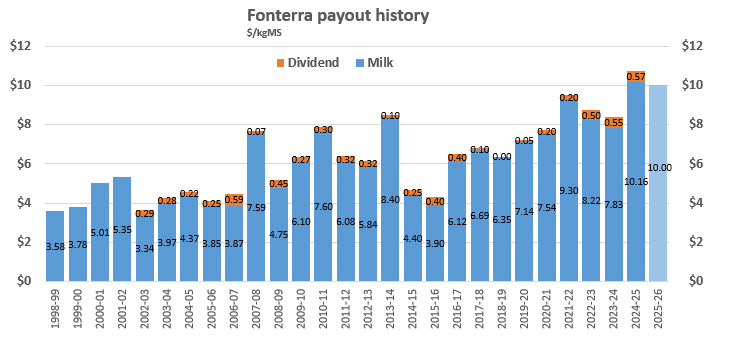

Fonterra is paying a final dividend for the year of 35c, making a total payout of 57c - up from 55c in the previous year. The latest dividend is fully imputed, while last year's dividend was not imputed.

All this is on the back of a profit after tax of $1.079 billion. That's actually down 4% on the profit for the previous period, but the milk price in the current year was up from $7.83 last year - and of course the milk price paid is actually a cost to the company.

In reality, Fonterra's ridden the increased cost of milk much better than it used to do in prior periods.

Fonterra chief executive Miles Hurrell says the financial year has been one of the co-op’s strongest years yet in terms of shareholder returns.

"We continue to see good demand from global customers for our high-quality products made from New Zealand farmers’ milk and this is driving returns through both the Farmgate Milk Price and dividends," he said.

In its release to NZX on Thursday, Fonterra gave the following highlights:

- Total Group revenue: NZ $26 billion, up 15%

- Total cash returns to shareholders: $16 billion, up 30.6%

- Operating profit: NZ $1,732 million, up 13%

- Profit after tax: NZ $1,079 million, down 4%, up 13% tax-adjusted

- Normalised earnings per share: 71 cents, no change, up 13 cents tax-adjusted

- FY25 full year dividend, fully imputed: 57 cents per share, up from 55 cents unimputed

- Return on Capital: 10.9%, down from 11.3%, up from 10.0% tax-adjusted

- 2024/25 final Farmgate Milk Price: NZ $10.16 per kgMS

- 2024/25 season milk collections: 1,509 million kgMS, up 2.6%

- 2025/26 forecast Farmgate Milk Price range: NZ $9.00 – $11.00 per kgMS

- FY26 forecast earnings range: 45-65 cents per share

- 2025/26 season forecast milk collections: revised up to 1,525 million kgMS

Last month Fonterra announced the sale of its global Consumer and associated businesses, including household brand names such as Mainland and Anchor, to France's Lactalis for $4.22 billion, subject to approvals.

Fonterra reaffirmed on Thursday that it is targeting a capital return of $2.00 per share from the divestment proceeds if it progresses, which is equivalent to $3.2 billion.

"The Fonterra Board intends to make a final decision on the amount and timing of the capital return once the sale agreement is unconditional, cash proceeds are received in New Zealand and having regard to other relevant factors including Fonterra's debt and earnings outlook at the time," the co-op said.

"The sale is subject to approval from farmer shareholders, certain regulatory approvals, and separation of the businesses from Fonterra. The farmer shareholder vote is due to take place via a Special Meeting on 30 October 2025."

The co-op announced revised forecast milk collections for the 2025/26 season from 1,490 million kgMS to 1,525 million kgMS, with Hurrell saying that favourable weather conditions experienced during the previous season are forecast to continue through spring, supporting pasture growth.

He said global dairy trade prices continue to be "robust".

"However, the risk of potential volatility in commodity prices and exchange rates from geopolitical dynamics remains," Hurrell said.

Fonterra’s forecast earnings from continuing operations in the 2026 financial year, excluding the businesses to be divested, is 45-65 cents per share.

Hurrell said the forecast earnings were "in line with the strong performance we’ve delivered in FY25".

The annual results presentation is here.

This is the dairy industry payout history.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.