After a six-month spending freeze, the New Zealand Government has committed more than $1.1 bln to public-sector construction projects. This is a welcome boost that could provide a lifeline for the country’s struggling timber processing industry.

At Wharf Gate (AWG) prices for export pine sawlogs were steady in September. Prices for sawlog pine remained the same as August prices, while pruned pine logs and Douglas fir lifted on the back of reduced inventories in China. Log stocks and prices in China have remained stable, with daily demand is increasing as construction activity gains momentum in cooler conditions.

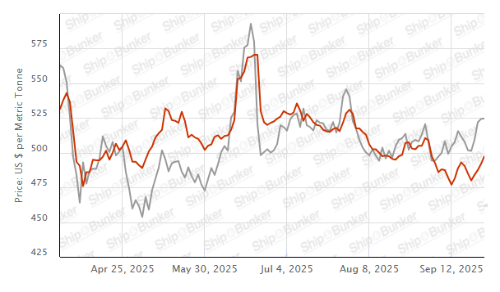

Increased ocean freight costs will be partially offset by a weaker NZD against the USD.

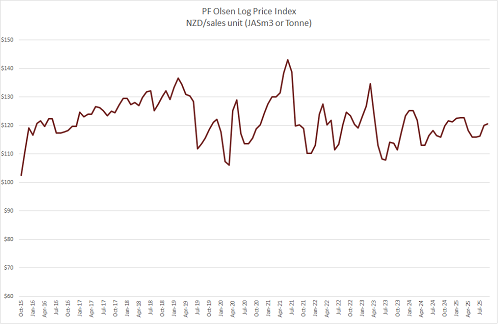

The PF Olsen Log Price Index rose to $121, sitting $2 above the two-year average and in line with the five-year average.

Domestic Log Market

The New Zealand Government has emphasised infrastructure investment as a central feature of its 2025 Growth Budget, with planned spending across construction, transport, health, and regional development. This includes $600 m for defence housing, $413 mln for fast-tracked school infrastructure and $100 mln to modernise hospitals. In parallel, the Fast-track Approvals Act 2024 is designed to accelerate consenting for large-scale infrastructure, housing, and development projects, potentially reducing delays and lifting project throughput. A draft 30-year national infrastructure plan has also been released, forecasting capital investment to rise from approximately $20 billion currently to more than $30 billion by the 2050s, targeting critical needs in hospitals, electricity, resilience, and transport.

These policy measures signal stronger demand prospects for structural framing timber, formwork, and infrastructure-related wood products in the medium term. However, the timing of any material uplift remains uncertain, with many projects still in planning or consenting phases. Government procurement standards and sustainability policies could swing more demand toward sawn-timber and engineered wood products if “low-carbon building” becomes a stronger priority.

Export Log Markets

China

CFR prices for A-grade logs remain in the range around USD 115 per JASm³ for October vessel arrivals. Prices for pruned logs increased about USD 10 per JASm3 due to the low inventory of pruned logs. The larger P40 pruned logs now sell around the USD 160 per JASm3 range.

Log demand in China has increased slightly over the last month to just over 60,000 m³ per day. As expected, log demand has increased due to increased construction activity as temperatures drop in China. Domestic prices in China are also stable.

Softwood log inventories have decreased slightly and now sit at approximately 2.45 million m³, of which radiata is approximately 2.18m m3. There is currently less Douglas fir stock in China as a significant proportion of this supply was from the Nelson region. The harvest in this area is now concentrated on salvaging the windthrown pine, with a small amount of Douglas fir harvested to sustain local mills.

The Caixin China General Manufacturing PMI slipped into contraction in July, falling to 49.5 from 50.4 in June - a reversal that undermined expectations of sustained momentum. Output contracted for the second consecutive month, weighed down by weaker export orders amid persistent global trade uncertainty. Purchasing activity showed a modest rebound after two months of decline, and input costs rose for the first time in five months. However, selling prices continued to fall, highlighting intensifying competition in the manufacturing sector. Business sentiment improved slightly, though it remains subdued relative to the long-term average.

India

Gandhidham has entered the Navratri festival season from 22 September, with depressed demand and lower prices for sawn timber. Green sawn timber prices have reduced approximately 4% to INR 511-521 levels. The market expects about six vessels with pine logs to arrive at Kandla Port during October.

Tuticorin is entering the winter monsoon rainy season and demand will reduce until the rains recede in mid-December. Increased prices for kiln dried sawn timber in Europe and the strengthening Euro against the Indian Rupee, could improve the demand for green radiata pine sawn timber in South India.

The weakening of the INR against the USD is another limiting factor for Indian log buyers.

Shipping costs

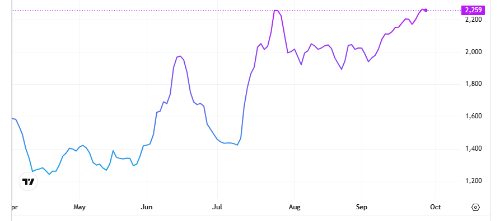

Ocean freight rates have firmed slightly for shipping New Zealand logs to China. The benchmark for dry bulk rates, the Baltic Dry Index (BDI) has returned to the July peak earlier this year.

The BDI is a composite index derived from three sub-indices representing different vessel sizes: Capesize (40%), Panamax (30%), and Supramax (30%). It reflects the average daily USD hire rates across 20 major ocean freight routes. While most New Zealand log exports are transported via Handysize vessels (not directly included in the BDI), this segment remains closely influenced by broader trends in the index.

Baltic Dry Index (BDI)

Source: TradingEconomics.com

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index - September 2025

The PF Olsen Log Price Index increased to $121. This is $2 above the two-year average and level with the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent

a broad average of log grades produced from a typical pruned forest with an

approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – September 2025

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Sep-25 | Aug-25 | Jul-25 | Jun-25 | May-25 | Apr-25 | Sep-25 | Aug-25 | Jul-25 | Jun-25 | May-25 | Apr-25 | |

| Pruned (P40) | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 190 | 185 | 180 | 180 | 180 | 190 |

| Structural (S30) | 120-145 | 120-145 | 120-145 | 120-145 | 120-145 | 120-145 | ||||||

| Structural (S20) | 93-100 | 93-100 | 93-100 | 93-100 | 93-100 | 93-100 | ||||||

| Export A | 125 | 125 | 117 | 116 | 116 | 120 | ||||||

| Export K | 116 | 116 | 108 | 107 | 107 | 111 | ||||||

| Export KI | 107 | 107 | 98 | 97 | 97 | 101 | ||||||

| Export KIS | 98 | 98 | 89 | 88 | 88 | 92 | ||||||

| Pulp | 50 | 49 | 46 | 48 | 48 | 46 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

1 Comments

Domestic pruned to soften.

"News that United States imposed a tariff of 10 percent on imported timber has come as a relief to industry, which expected a higher figure.

Under the order, US importers would need to pay 10 percent for foreign softwood lumber and timber, and 25 percent for foreign timber furniture."

https://www.rnz.co.nz/news/country/574679/timber-industry-welcomes-10-p…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.