At Wharf Gate (AWG) prices received for export logs in January were virtually unchanged from December prices with a $1 per JASm3 increase in some grades. The prices dropped in February by an average of $6 per JASm3. This drop was primarily due to the NZD strengthening against the USD.

The market outlook for China remains steady, while the India demand outlook is mixed with the construction market slow, but packaging is in strong demand.

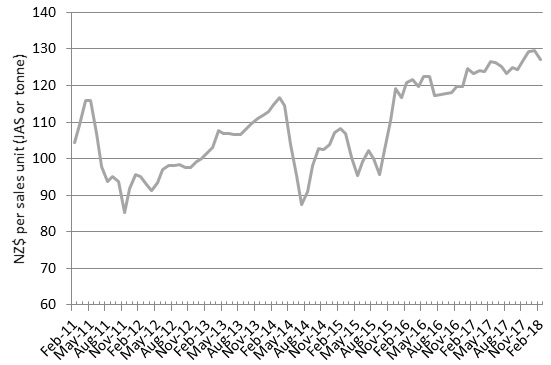

The PF Olsen Log Price Index reached another record of $130 in January, but dropped to $127 in February. (See PF Olsen Log Price Index below). The average sale price is currently $12 per tonne above the three-year average.

Domestic Log Market

Pruned

The domestic demand for pruned lumber is now improving after a quiet start to 2018. The lower value pruned grades are in more demand than the higher value pruned grades. Mills however, report good export sales with demand from Europe and the US in particular increasing after the holiday period. The Asian market is very strong with high demand for “narrows”. These are boards less than 5 inches in width. Log supply and log pricing has generally been steady.

Unpruned

Sawmills producing unpruned lumber have reported a very slow start to 2018 with January sales well down on January 2017 volumes. It appears there is a cautious approach to 2018 as people wait for further direction from the new government. Most mills also have to pay a higher price for unpruned logs, due to price increases for Quarter 1 log supply that were mostly negotiated last year.

Export Log Market

2017 Log Exports

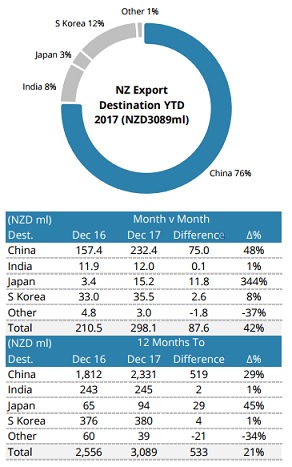

As the following charts show China in 2017 once again increased its percentage share of the supply of New Zealand export logs. China purchased an additional $519M worth of logs in 2017 than in 2016. Over 2017 China absorbed 76% of New Zealand’s export logs by value. This was up from 71% in 2016.

New Zealand Log Exports by Destination

Courtesy: Champion Freight

China

The China log market was extremely stable through 2017. This stability is forecast to continue through 2018 for the main reasons listed below;

-

The new China Building Code in August will recognise radiata pine.

-

The continuation of manufacturing reforms in China.

-

The Chinese government’s ban of harvesting indigenous forests in China is favourable for demand of imported logs and wood products into China.

-

Russia signalling tariff increases on wood exported to China.

Radiata pine structural timber included in Chinese Code of Design for Timber Structures

The revision of the Chinese Code of Design for Timber Structures GB50005 is to be published on 1 August 2018.

Of interest to producers of radiata pine structural timber will be the inclusion of design properties for grades and sizes of NZ radiata pine.

The grades included are SG6, SG8, SG10, SG12 and SG15.

Sizes included are 45x75, 45x90, 45x140, 45x190, 45x240 and 45x290.

To be able to use the design properties stated, the timber must be graded and verified according to NZ rules, i.e. verification must be done to NZS 3622, with third party auditing.

This means that for the first time engineers in China will be able to design buildings using the NZ grades and sizes.

WPMA cooperated with SCION in getting these NZ radiata pine grades included in the revision and received extensive assistance from Ministry for Primary Industries and Indufor Group.

Work is now being done to develop the handbook for GB 50005, coordinated by WPMA and SCION; meetings are attended by Dr Minghao Li from University of Canterbury and Bill Lu of Indufor Group. Assistance is again being provided by MPI and also by the Ministry of Foreign Affairs and Trade.

Source: Wood Processors & Manufacturers Association.

PF Olsen understand this adoption of radiata pine within the China building code will remove a significant constraint to adoption of light-framed house construction. Radiata pine also continues to be increasingly adopted for uses beyond its utility role as support for the construction of concrete buildings and infrastructure. Making radiata pine logs into finger-jointed solid lineal mouldings, edge-glued panels, furniture and doors creates more resilient end-use markets as products are not only sold domestically in China, they are also exported in large quantities to markets in South Korea, the USA and Europe.

As mentioned in previous Wood Matters, China has stepped up its manufacturing reforms (e.g. shutting down inefficient manufacturers) through a combination of removing government subsidies/cheap credit and much stricter, and more heavily policed, environmental (emission/pollution) regulations. This has resulted in the relocation of wood processing clusters and a migration of processing to more mechanised, modern facilities. The result should be a more sustainable manufacturing sector.

Last year the China government commenced its “Natural Forest Protection Plan”. Estimates of the reduction in supply from this plan are as high as 45M m3 per year.

Fluctuations in exchange rates and shipping costs will likely continue to have the greatest impact for log prices received by New Zealand forest owners, for the foreseeable future.

India

There are usually log stocks of around 120,000m3 at themain port of Kandla. Log stocks are currently low at 85-90,000m3. While low log stocks will drive some sales the market outlook is variable. The real estate and construction sector is currently weak with demand not expected to pick up until Quarter 3 of 2018. The packaging demand is strong as manufacturing and exports perform well. The strengthening of the Indian Rupee (INR) against the US Dollar (USD) over 2017 has improved the purchasing strength of the Indian log buyers.

The recent Indian budget has increased customs duty on a range of imports to support the governments ‘Make in India’ push. This budget removed the 3% ‘Education Cess’ on the custom duties amount, and replaced it with a 10% ‘Social Welfare Surcharge’ to be levied on aggregate duties of customs on imported goods. As this change only occurred last week we don’t know what impact this may have, if any.

Ocean Freight

Ocean Freight prices have firmed $1-3 US over the last two months.

Foreign Exchange

The NZD has appreciated from 0.6980 against the USD in mid Dec 2017 to 0.7524 in mid-February 2018. This movement alone would remove NZ$13.47 when a m3 is sold at say US$130 and converted back to NZD.

PF Olsen Log Price Index to February 2018

The PF Olsen Log Price Index increased by $1 to reach a record $130 in January. (PF Olsen started the index in March 2010). Due to the decrease in export log prices the index dropped back to $127 for February. The index is currently $6 higher than the two-year average, $12 above the three-year average, and $17 higher than the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – February 2018

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||

| Feb-18 | Dec-17 | Nov-17 | Oct-17 | Sep-17 | Feb-18 | Dec-17 | Nov-17 | Oct-17 | Sep-17 | |

| Pruned (P40) | 182 | 182 | 182 | 182 | 182 | 185 | 181 | 180 | 179 | 179 |

| Structural (S30) | 128 | 124 | 120 | 120 | 120 | |||||

| Structural (S20) | 112 | 110 | 109 | 109 | 108 | |||||

| Export A | 142 | 148 | 144 | 137 | 138 | |||||

| Export K | 135 | 140 | 136 | 131 | 132 | |||||

| Export KI | 123 | 130 | 127 | 122 | 123 | |||||

| Pulp | 47 | 47 | 47 | 47 | 47 | |||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only..

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.