New Zealand mills producing sawn timber from unpruned logs report steady domestic sales while not as spectacular as last year in some regions.

The price increase of 5-7% on May 1st to domestic customers has not reduced demand.

The demand for pellets and packaging continues to be strong as we move from the apple picking season to the kiwifruit picking season.

The overseas markets for unpruned sawn timber will consume everything NZ mills can supply with recent monthly incremental price increases. The sawmills supplying clear lumber report strong and growing demand from the USA and European markets.

Sales in the China log market are very strong with current daily port off-take a very healthy 90-100,000m3 and softwood log inventory has dropped to around 4Mm3. The Indian market remains subdued and there may be a softening of demand from Korea as the government takes a new direction after the impeachment of their president. Log exports from NZ to China have increased 16% year-on-year to March 2018.

At-Wharf-Gate (AWG) prices received for export logs in May increased by $3-$5/m3 depending upon the grade and length. The increase in AWG prices is mainly due to the weakening of the NZD against the USD. There was a modest increase in CFR prices for logs in China by an average of $1m3. Shipping costs also dropped slightly over April.

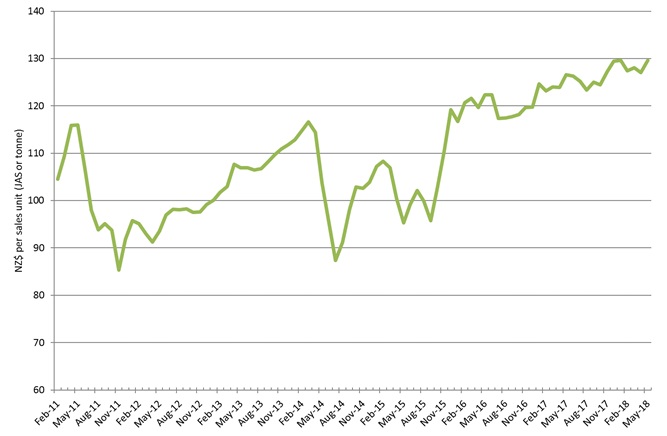

Due to the increase in AWG prices for the export logs, the PF Olsen Log Price Index increased by $3 to $130. (See PF Olsen Log Price Index below). The Index is currently $10/m3 above the three-year average.

Domestic Log Market

Pruned

The domestic demand for clear sawn timber remains steady. Exports sales are still strong, with both the main markets of the USA and Europe showing strong demand.

Many mills report log supply is the best it has been all year. We do often see a lift in supply at this time of the year as crews harvesting woodlots rush to complete blocks before the onset of winter. We also see crews move back to the pumice of the central north island to the benefit of the mills located in this area.

Unpruned

Sawmills producing unpruned lumber continue to report steady sales (allowing for a spike in April sales by purchasers avoiding lumber price increases). Many mills will now review their stock management as we approach the winter season during which demand for structural lumber often softens. We didn’t however, see much of drop in demand through last winter in NZ.

Very recently more lumber from Europe has appeared in Australia. This is untreated lumber and may be destined for the industrial grade. The Australian market is a net importer of lumber and does occasionally experience shortages in this grade as it doesn’t have as much industrial grade arising from the production of structural logs as NZ. The strengthening of the AUD against the EUR has also increased the spending power of the Australian buyers.

The export markets remain strong, so volume is still redirected to first Australia then further afield. Most NZ mills supplying overseas markets report strong demand with small but steady monthly price increases.

Many mills are resigned to further log price increases as the AWG prices are forecast to stay consistent. For the average mill in NZ logs cost are about 50% of their total production costs. Log supply is sufficient in most regions with the exceptions of Northland and Canterbury where a gap in the age class will continue to lead to supply issues.

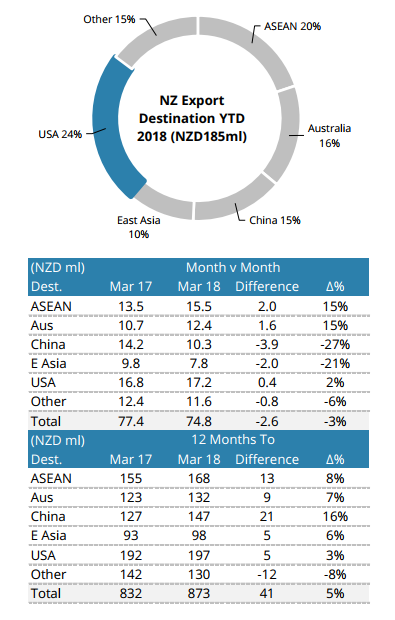

NZ Sawn Timber Export by Destination

Chart courtesy of Champion Freight

Export Log Markets

China

There is a lot of activity in the China log market with daily port off-takes estimates as high as 100,00m3. While estimates of the total softwood inventory vary at present the estimates are around the 4Mm3 level, which is a significant reduction from last month.

There is concern amongst some log traders that an escalating trade war with the USA could spill into wood products and restrict the ability of wood products manufacturers in China to sell their wares to the USA (e.g. doors, edge-glued panels, frames). This could ill-effect demand for logs from New Zealand.

These ornate picture/mirror frames are one of many wood products China exports to the USA and which could be jeopardised by a trade war.

Uruguay is reported to now be exporting 3M m3/annum of logs to China. The country has a lot of pine (e.g. P ellioittii) and the predominantly flat terrain sees low logging rates of about USD 10/m3. In contrast, however, transport distances from forest to port are 250-400km resulting in costs of USD 32-35/m3 for trucking. This wood becomes more competitive as CFR price rises and could take radiata pine market share. Currently sales of South American logs are supplementing NZ radiata supply. These logs are usually sold at a discount to NZ radiata and are predominantly used as concrete formwork in construction. Many Chinese log buyers are starting to realise that buying cheap can often cost more in the long run as often this product doesn’t last as long in service as the NZ radiata, which on average can be reused more times. The Uruguayan supply chain is used to supply logs for the pulp market and logs are often left lying around to dry out, which reduces their shelf life in China.

India

The Indian log market has remained relatively quiet for several reasons outlined below:

-

Labour issues in Gandhidham/Kandla in April and May reducing processing capacity.

-

The Indian Rupee USD cross rate has moved from Rs63-Rs67 to 1USD in one month, whereas the local NZ pine lumber prices have only moved from Rs471 to Rs481, which is insufficient to offset the effect of the exchange rate movement.

-

While the GST liquidity issue seems settled, the Indian banking system is under pressure with importer sawmills being unable to roll-over or extend Letters of Credit repayment periods. This has made buyers cautious about buying more stock than they absolutely need.

-

New rules have also made it difficult to change manifest or resell cargo once it lands on the wharf in India.

Some NZ exporters have held back from shipping to India over the last few month, and this has kept stocks at reasonable levels. Stock levels in Kandla are approximately 150,000m3 which is about one month’s consumption. Tuticorin has some 5,000 of old stock moving out gradually, and demand should allow for a vessel every 40-45 days.

Expected labour arrivals from mid-May will increase processing capacity and traders aim to get lumber prices into the Rs501 level by the end of May. This makes log imports commercially viable and should increase demand for logs.

Shipping costs to India are about $40/m3 depending upon the number of load and discharge ports. Sale price for logs are expected to remain about USD157-159 largely following the China market. Demand is currently driven by the packaging market with a preference for A and K grade logs above 4m in length.

Korea

While the world sees closer relations between North and South Korea, the South Korean economy is struggling after the impeachment of its president Park Geun-hye. Recent policy has not been small-business friendly and many small businesses are taking a cautious wait-and-see approach. This may mean subdued demand from Korea for NZ logs.

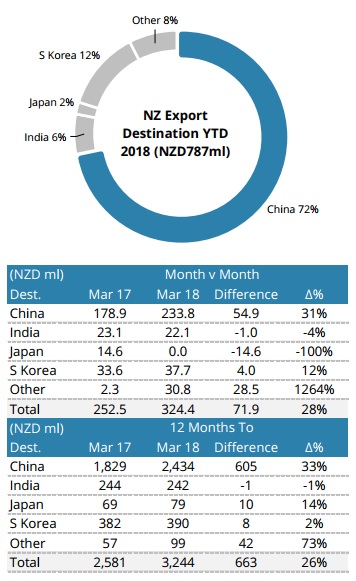

NZ Log Exports by Destination

Chart courtesy of Champion Freight

Ocean Freight

Log exporters report a slight drop in shipping costs over April although the Brent Oil Price has increased recently. The freight demand outlook is mixed. There is a modest global positive outlook, but the Chinese government’s pollution controls are reducing heavy industrial action in China. These anti-pollution measures have driven demand away from lower quality local and Australian supplies toward Brazilian ore which must travel a longer distance tying up Capesize capacity. There is ample vessel capability as vessel scrapping was reduced in 2017 as shippers saw signs of a recovery in freight rates. Market commentators estimate the global freight market is oversupplied by an estimated excess of 5,000 ships of 40,000dwt capacity. It is highly unlikely that increased scrapping of ships will occur to balance the market. The average age of the global dry bulk fleet has already fallen to around 8.8 years, from 14.2 years in 1999, and ship owners face reduced investment returns should they retire vessels any younger. Also, the dry bulk market is highly fragmented, with a wide variety of participants ranging from small independent operators to large state-owned players. Differences in financial wherewithal and business agendas mean that not all share the same sentiment and urgency about balancing the market.

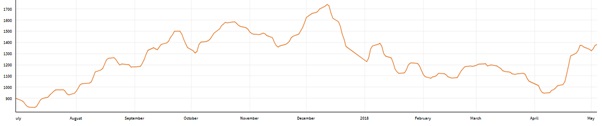

Singapore Bunker Price (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capesize (40%), Panamax (30%), and Supramax (30%). It displays the average USD hire paid per day across 20 ocean shipping routes.

Source: Lloyds,BDI

Foreign Exchange

The NZD was worth 0.7043 USD at the end of April, when AWG prices were set for May. This is a drop from 0.7243 at the end of March.

PF Olsen Log Price Index to May 2018

Due to the increase in price for export logs, the PF Olsen Log Price Index increased by $3 back to the record high of $130 for May. The index is currently $6 higher than the two-year average, $10 above the three-year average, and $16 higher than the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – May 2018

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||

| May-18 | Apr-18 | Mar-18 | Feb-18 | Dec-17 | May-18 | Apr-18 | Mar-18 | Feb-18 | Dec-17 | |

| Pruned (P40) | 172-190 | 182 | 182 | 182 | 182 | 192 | 187 | 185 | 185 | 181 |

| Structural (S30) | 128 | 128 | 128 | 128 | 124 | |||||

| Structural (S20) | 112 | 112 | 112 | 112 | 110 | |||||

| Export A | 144 | 140 | 142 | 142 | 148 | |||||

| Export K | 137 | 133 | 135 | 135 | 140 | |||||

| Export KI | 127 | 125 | 128 | 123 | 130 | |||||

| Pulp | 49 | 47 | 47 | 47 | 47 | |||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only..

A longer series of these prices is available here.

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.