By Gareth Vaughan

Australasia's big four banks are set to post combined record annual cash profit, albeit with their growth rate down significantly year-on-year.

ANZ Banking Group, owner of New Zealand's ANZ and National banks, reports its annual financial results on October 25. BNZ's parent National Australia Bank (NAB) follows on October 31, and the Westpac Banking Group, parent of Westpac New Zealand, on November 5. The fourth big bank, ASB's parent Commonwealth Bank of Australia (CBA), has a June 30 balance date - as opposed to September 30 like the other three - and reported its annual results in August.

Based on CBA's A$7.1 billion cash profit, and analysts' forecasts for the other three banks, combined, the four are expected to post annual cash profit of about A$25.1 billion (about NZ$31.7 billion). That's about A$800 million, or 3%, up on last year's record A$24.3 billion. At 3%, the combined profit growth is down from 13% in 2011, when their combined cash profit rose A$2.8 billion from A$21.5 billion in 2010.

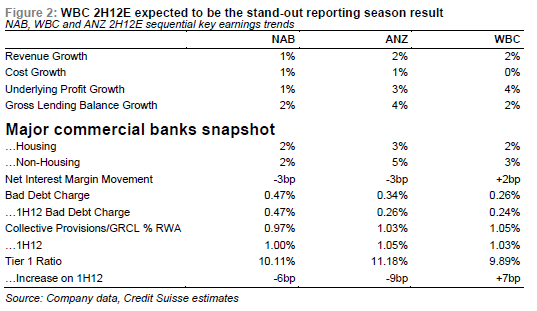

In a bank reporting season preview note, Credit Suisse analysts Jarrod Martin, James Ellis and Omkar Joshi say operational trends they're watching for include a peaking of New Zealand earnings growth, competitive pressure on institutional bank margins, and benign consumer asset quality trends.

Key "upside risks" the Credit Suisse analysts point to include an incrementally stronger outlook for pre-provision profit growth with higher prices for customers and easing funding costs both benefiting margins, emerging structural productivity programme outcomes reducing costs, and market share gains boosting major bank business lending balance growth. Key "downside risks" are capital with potential additional regulatory 'burdens" ahead of Basel III rules coming in from January 1, 2013, and burgeoning significant item expenses "retarding" capital accumulation.

'More aggressive accounting practices'

"With significant item changes in earnings estimates expected from each of the banks reporting, earnings quality is becoming increasingly an issue, along with trends for rising capitalised expenditure and declining collective provision coverage, highlighting the incrementally more aggressive accounting practices being adopted in a slower growth environment," Martin, Ellis and Joshi said.

ANZ is expected to post underlying (cash) profit of about A$5.9 billion, up about A$200 million, or 3.5% year-on-year. It's expected to pay a final dividend of A77 cents per share (versus A76c), giving total dividends for the year of A$1.43 versus A$1.40, with a payout ratio equivalent to 66% of profit. Of particular interest will be whether ANZ meets CEO Mike Smith's target, set in late 2007, of making 20% of group earnings from its Asia, Pacific, Europe and America division (read Asia) by the time of these annual results. In August Smith said he expected this target would be met.

NAB is expected to post cash earnings of A$5.6 billion, up a bit over A$100 million, or 2%, with a final dividend of A91c per share, versus A88c, giving total dividends for the year of A$1.81 per share versus A$1.72, and a payout ratio of 72% of profit.

Westpac is expected to deliver cash earnings of about A$6.5 billion, up nearly A$200 million, or 3%, with a final dividend of A83c per share versus A80c, giving total annual dividends of A$1.65 a share versus A$1.56, and a payout ratio of 78%.

In August CBA posted record cash profit of A$7.1 billion, which was up 4%. Its return on equity fell 90 basis points to 18.6% but the group paid a final dividend of A$1.97 per share, equivalent to 89% of second-half cash profit and an increase of 5%. CBA's total annual dividends, including its A$1.37 per share interim dividend, rose 4% to A$3.34 per share. That's equivalent to 75% of annual profit.

ASB reported record net profit after tax for the year to June 30 of NZ$685 million, which was up NZ$117 million, or 21%. ASB paid CBA ordinary dividends worth NZ$500 million versus NZ$280 million in its previous financial year.

In May ANZ NZ reported a NZ$79 million, or 13%, rise in half-year underlying profit (or cash earnings) to a record NZ$684 million as its operating income rose 6% and operating expenses just 1%. Its annual dividends are in track to reach NZ$1 billion for the first time since 2009.

Also in May, Westpac NZ reported a NZ$64 million, or 24%, rise in half-year cash earnings to a record NZ$333 million with net interest margins up six basis points and impairments on loans dropping 9%. And BNZ's half-year cash earnings surged NZ$102 million, or 36%, to a record NZ$385 million with its net interest margins up 17 basis points to 2.41%.

This article was first published in our email for paid subscribers this morning. See here for more details and to subscribe.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.