By Roger J Kerr

A medium term view on likely economic conditions, thus inflationary pressures, in nine to 18 months’ time is how the RBNZ operate monetary policy settings.

The fact that the current annual inflation rate is at just +0.4% (below the bottom of their 1.00% to 3.00% allowable range) is not a reason to loosen monetary policy further with further interest rate cuts at this time.

Their forecast of where economic growth and prices pressures will be at in the second half of 2016 is their focus and thus the determinant of monetary policy settings today.

If GDP growth is forecast to be near to 3.00%, annual inflation is above 2.00% in 12 to 15 months’ time and house prices continue to increase over the intervening period, it would appear to be a rather large monetary policy gamble to be cutting interest rates further over coming months.

There are two other important considerations the RBNZ build into their monetary policy setting decision equations:-

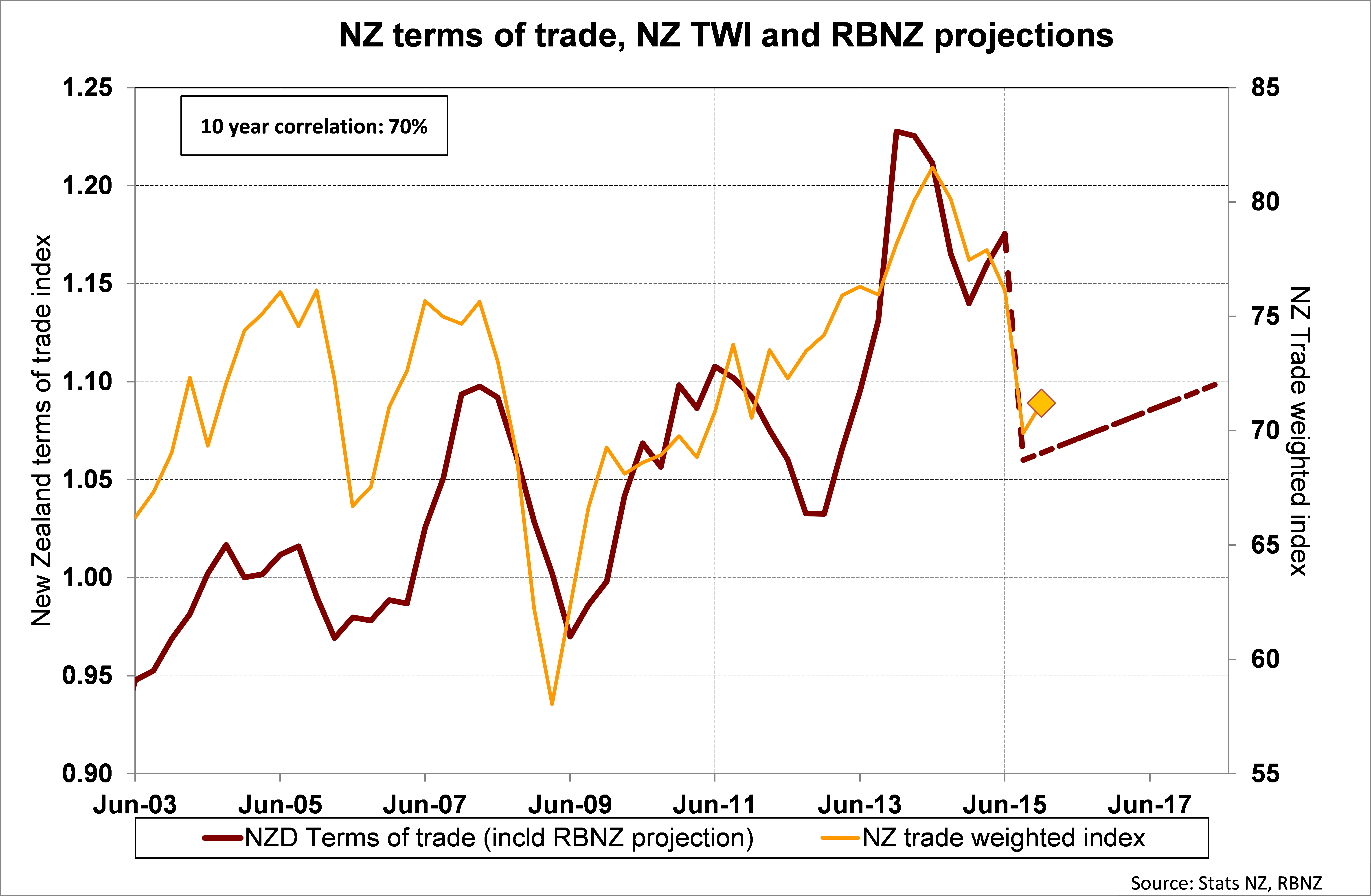

1. The relativity of the NZ dollar exchange rate to our Terms of Trade position

The Terms of Trade Index (ToT) is a measure of our import prices relative to our export prices. The RBNZ reversed their monetary policy settings back in June/July when collapsing dairy prices were set to send the ToT sharply lower. A very negative impact on the NZ economy was anticipated by the RBNZ and they loosened monetary policy accordingly. However, similar to the global market’s panic attack over Greece and China a few months back, the reality is that the outcome today is nowhere near as bad as the doomsayers expected. The ToT will not go as low as the RBNZ anticipated in June, therefore the justification for cutting interest rates to get the exchange rate lower has dissipated.

The current TWI currency index at 72.8 is not out of line with were the ToT will move to over coming quarters given the recovery that has already occurred in dairy prices (around 110 on the ToT index).

2. Global economic growth and financial market conditions

Two months ago global financial and capital markets reacted with extreme volatility to the prospect of a “hard landing” for the Chinese economic slowdown and knock-on negative impacts on the US, European, Asian and Emerging Market economies. However, the equity markets settled very quickly after the Chinese cut their interest rates in August and the sharemarkets recently rebounded back up.

Previous RBNZ concerns about risks with the global economy (which New Zealand depends upon) should be easing. The Chinese have again cut their interest rates last weekend as they use monetary policy stimulus measures to keep their GDP growth rate close to 7.00%. The Chinese economy risk has also greatly dissipated in recent weeks.

Let us see if RBNZ Governor Wheeler reflects these changed economic and market circumstances with his short OCR review statement this Thursday.

To subscribe to our daily Currency Rate Sheet email, enter your email address here.

Daily swap rates

Select chart tabs

Roger J Kerr is a partner at PwC. He specialises in fixed interest securities and is a commentator on economics and markets. More commentary and useful information on fixed interest investing can be found at rogeradvice.com

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.