By Roger J Kerr

Both the deflation doomsayers and the inflation scaremongers received supporting information to their diametrically opposed views for NZ inflation last week.

The greater than expected 0.5% decrease in prices over the December quarter was largely due to lower food and petrol prices, which the RBNZ are required to “look through” and disregard as long as they do not feed into second-round decreases on general inflation.

One would certainly expect airfares to go down with the massive drop in crude oil and jet-fuel prices. However, airlines like Air New Zealand operate a disciplined and fairly rigid forward hedging policies on jet fuel, so do not get too excited about immediate cheap flights.

Annual inflation near to zero is due to short-term price movements that are not expected to recur. Who actually forecast crude oil to fall below US$30/barrel when it was US$100/barrel 15 months ago? Calls for the RBNZ to immediately cut the OCR further, based on the very low actual inflation rate for 2015, will have to be rebutted as the RBNZ’s job is to look forward, not backwards.

I do not expect the RBNZ to vary their wording at this Thursday’s OCR review statement too much from what they said in early December. Recent global investment/financial market volatility will get a mention, however the impact from that on the NZ economy is negligible as the consumer and business confidence survey results over this last week have shown.

The information that supports the view that numerous price increases are on the horizon over coming months came from the quarterly QSBO business confidence survey last week.

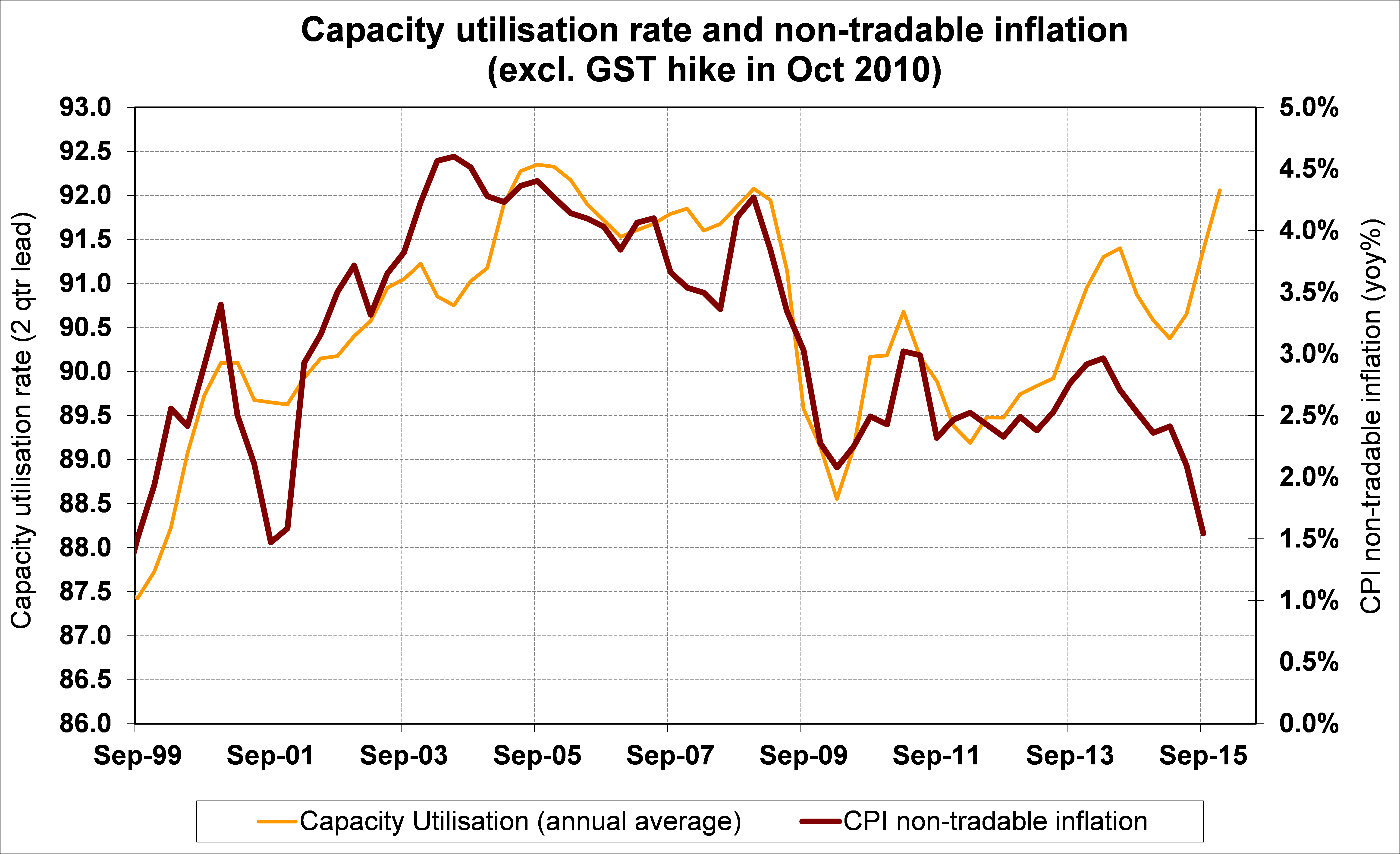

The capacity utilisation measure that records how busy manufacturers are, increased to a four year high of 93.2% (which is the second highest recording since the series commenced). At some point the bottlenecks caused by running flat tack will push these manufacturers to increase their prices. They can only increase selling prices if they believe the customers will wear it and the competitors will follow suit.

The likelihood that these price increases can occur is elevated currently as the importing competition is not as competitive with the NZD/USD exchange rate at 0.6500 compared to when it was above 0.8000. The chart below displays a massive divergence between capacity utilisation and non-tradable inflation. Something has to give, unless the world is an entirely different place in respect to supply and demand drivers of inflation. Which apart from technology advancements, I believe the same old cause and affect paradigms still hold.

To subscribe to our daily Currency Rate Sheet email, enter your email address here.

Daily swap rates

Select chart tabs

Roger J Kerr is a partner at PwC. He specialises in fixed interest securities and is a commentator on economics and markets. More commentary and useful information on fixed interest investing can be found at rogeradvice.com

13 Comments

If it were not for the increase in the housing component of the CPI, the CPI inflation would have been significantly negative. I doubt that we have seen the full impact of the falling oil price come through in the wider market as most products have an energy cost component. Is housing going to keep on rising or will we see a correction? My guess is that there is a significant risk of a deflationary period ahead of us.

Could this get to a Japan type situation???????????

I think the world has been doing a japan for several years now and that includes us!

The RBNZ seems to be happy constantly running 1% below the target band just to make sure they never run 1% over it - we will not see more than 4% inflation any time soon.

A small bit of inflation would hardly be a negative at the moment, but deflation will be a killer with such indebtedness.

"inflation rate for 2105, will " 2015? I hope

"The information that supports the view that numerous price increases are on the horizon" I think for 7 odd years now businesses have wanted to put up prices but find their sales collapse when they do. So when you can show me the consumer can afford to pay, I will agree, otherwise I do not.

In terms of imports however I am getting the feeling china is dropping prices ie start to amke up for that exchange deficit.

Roger assumes the RBNZ should apply the wait and see longer time frames......but I think they should be more responsive in the short term.

Thanks Roger

Interesting view for holding based on the capacity utilisaton rate but best to remember that this measure is probably being undermined by rapid technology changes. For example throughout the economy new technology is increasingly undermining the ability of firms and workers to increase prices as competion is nearer and more immediate that ever before. However, I fear the RB being so conservative and backward looking may think the same as you - sigh.

Roger Kerr, what agenda or interests do you have for continuously talking up inflation ? INFLATION IS DEAD ! Has been dead for the last 7 years, will be dead in the near and medium term future. INFLATION IS DEAD

Roger points to the increasing divergence between capacity utilisation and non-tradeable inflation and says "that something has to give". As always,in his world,this means that we are just about to experience big price increases as retailers coin it in,followed by higher inflation and consequently,higher interest rates.Since the RBNZ is,as he constantly reminds us,required to' look through' short-term noise,then he presumably believes that they should start raising rates NOW.

I think he should start to consider a career change.

Exactly! Retailers can try and put prices up, but (a) there's plenty of junk floating around these days so somebody will undercut and (b) the wage slaves already have their income well and truly carved up amongst all the suppliers of life necessities. There's nothing left to give. You're dreaming Roger.

If only I were young again..I would show em all what for.

A fool and his money are soon parted.

A fool and his money can have a fantastic life in New Zealand, as long as he/she/them does not get mixed up with competing with others and stop wasting it.

A fool and his money can exist in splendid isolation, deep in the heart of nowhere.

NZ is Paradise, but not in the Big Cities.. not now that most towns are a gamblers lot.

So do not go, where the lot are. Cash up, move away.

As long as this fool can keep away from all forms of temptation and worldly goods, he/she/them/ can exist on a pittance.

Food is the major problem, in life, so is a simple roof over one's head. Try long run iron.

Or a tent, a cheap caravan, or even a van, with a portaloo, and a bucket. But please don't do it and just chuck-it.

Even a little boat with a cabin. You can rock yourself to sleep at night.

But if this fool thinks he/she/them can compete with Money Launderers, Politicians with their hands in your pockets, Public Servants with no servility whatsoever, when trying to put a simple roof over ones head, then I am afraid, one must resort to borrowing more heavily, being a debt slave for life and keeping all the above in the lifestyle, they have all become accustomed to.

Do not do it. Simply walk away, go bush, go hide, do not rent.

Write a book, go fishing, walk, grow food, whatever, get back to basics.

Then we will see who is the bigger fool, in the long run. Those with cash, or those with debt.

It might only take a few months...with no rental income, or Mortgage payments.

If the fools combined resources, god forbid, then they can live the life of Riley, not the wishes of Mr Key.

Avoid work like the plague, avoid big debt, big business, is my advice.

Nothing that is rated, taxed and temptations a plenty.

Try picking fruit in the Bay of Plenty. Try fresh water, not bottled.

(Beware may need to boil it, we ain't as clean and green as we used to be, but way cheaper).

One week in 4 will keep the wolf from the door.

The treadmill of life is not what we were born to do.

It should not take two to pay a mortgage....ever.

But we have certainly perfected it.

But if you want to be a serf for life, get a bleedin house, fill it with rubbish and keep watching that damn box on the wall, to see what else you can waste your hard earned munny on.

Or buy a cheap rental....so that other mugs can pay your way. Oh, no such thing...I hear you cry...?,,Just ask yourself..Why? Who have I got to blame...?

The overheads..that is who.

Once bitten, twice shy.

If only I were young again..I would show em all what for.

A fool and his money are soon parted.

A fool and his money can have a fantastic life in New Zealand, as long as he/she/them does not get mixed up with competing with others and stop wasting it.

A fool and his money can exist in splendid isolation, deep in the heart of nowhere.

NZ is Paradise, but not in the Big Cities.. not now that most towns are a gamblers lot.

So do not go, where the lot are. Cash up, move away.

As long as this fool can keep away from all forms of temptation and worldly goods, he/she/them/ can exist on a pittance.

Food is the major problem, in life, so is a simple roof over one's head. Try long run iron.

Or a tent, a cheap caravan, or even a van, with a portaloo, and a bucket. But please don't do it and just chuck-it.

Even a little boat with a cabin. You can rock yourself to sleep at night.

But if this fool thinks he/she/them can compete with Money Launderers, Politicians with their hands in your pockets, Public Servants with no servility whatsoever, when trying to put a simple roof over ones head, then I am afraid, one must resort to borrowing more heavily, being a debt slave for life and keeping all the above in the lifestyle, they have all become accustomed to.

Do not do it. Simply walk away, go bush, go hide, do not rent.

Write a book, go fishing, walk, grow food, whatever, get back to basics.

Then we will see who is the bigger fool, in the long run. Those with cash, or those with debt.

It might only take a few months...with no rental income, or Mortgage payments.

If the fools combined resources, god forbid, then they can live the life of Riley, not the wishes of Mr Key.

Avoid work like the plague, avoid big debt, big business, is my advice.

Nothing that is rated, taxed and temptations a plenty.

Try picking fruit in the Bay of Plenty. Try fresh water, not bottled.

(Beware may need to boil it, we ain't as clean and green as we used to be, but way cheaper).

One week in 4 will keep the wolf from the door.

The treadmill of life is not what we were born to do.

It should not take two to pay a mortgage....ever.

But we have certainly perfected it.

But if you want to be a serf for life, get a bleedin house, fill it with rubbish and keep watching that damn box on the wall, to see what else you can waste your hard earned munny on.

Or buy a cheap rental....so that other mugs can pay your way. Oh, no such thing...I hear you cry...?,,Just ask yourself..Why? Who have I got to blame...?

The overheads..that is who.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.