Oil price

US jobs market shrinks unexpectedly; ditto retail sales; US faces inflation surge; Canada PMI strong; China FX reserves up again; some commodity prices jump; UST 10yr at 4.13%; gold and oil rise; NZ$1 = 59 USc; TWI-5 = 62.7

9th Mar 26, 7:19am

50

US jobs market shrinks unexpectedly; ditto retail sales; US faces inflation surge; Canada PMI strong; China FX reserves up again; some commodity prices jump; UST 10yr at 4.13%; gold and oil rise; NZ$1 = 59 USc; TWI-5 = 62.7

US employment shrinks unexpectedly; US retail sales dip; Canada PMI rises; Gulf oil supplies in crisis; metals rise; eyes on seabed mining; UST 10yr at 4.11%; gold rises while oil jumps again; NZ$1 = 59 USc; TWI-5 = 62.7

7th Mar 26, 8:37am

68

US employment shrinks unexpectedly; US retail sales dip; Canada PMI rises; Gulf oil supplies in crisis; metals rise; eyes on seabed mining; UST 10yr at 4.11%; gold rises while oil jumps again; NZ$1 = 59 USc; TWI-5 = 62.7

US data soft facing sharp energy cost rises; China lowers its growth target; Australia household spending growth slows; global freight rates rise; UST 10yr at 4.14%; gold eases while oil jumps; NZ$1 = 58.9 USc; TWI-5 = 62.6

6th Mar 26, 7:27am

47

US data soft facing sharp energy cost rises; China lowers its growth target; Australia household spending growth slows; global freight rates rise; UST 10yr at 4.14%; gold eases while oil jumps; NZ$1 = 58.9 USc; TWI-5 = 62.6

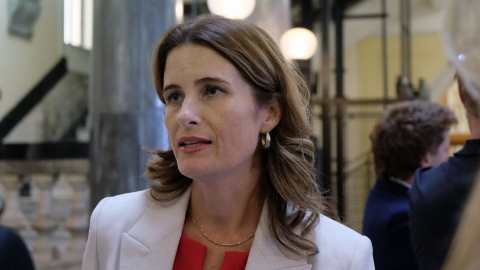

Duration and scale of Middle East conflict expected to be key factors in terms of impact on NZ economy, Finance Minister Nicola Willis says

5th Mar 26, 5:43pm

3

Duration and scale of Middle East conflict expected to be key factors in terms of impact on NZ economy, Finance Minister Nicola Willis says

Confusion from PMIs in both the US and China; Taiwan export orders surge again; Australia GDP rises more than expected; fertiliser prices leap; UST 10yr at 4.08%; gold rises while oil eases; NZ$1 = 59.3 USc; TWI-5 = 62.9

5th Mar 26, 7:25am

11

Confusion from PMIs in both the US and China; Taiwan export orders surge again; Australia GDP rises more than expected; fertiliser prices leap; UST 10yr at 4.08%; gold rises while oil eases; NZ$1 = 59.3 USc; TWI-5 = 62.9

Stagflation fears loom large; dairy price rise; US sentiment drops; China focuses on next 5-year plan; EU inflation up; Australia current account deficit widens; UST 10yr at 4.06%; gold drops while oil jumps; NZ$1 = 58.8 USc; TWI-5 = 62.5

4th Mar 26, 7:20am

60

Stagflation fears loom large; dairy price rise; US sentiment drops; China focuses on next 5-year plan; EU inflation up; Australia current account deficit widens; UST 10yr at 4.06%; gold drops while oil jumps; NZ$1 = 58.8 USc; TWI-5 = 62.5

Oil, LNG and KiwiSaver: What the US–Iran conflict could mean for New Zealand’s economy, and what the Government is watching

3rd Mar 26, 4:24pm

17

Oil, LNG and KiwiSaver: What the US–Iran conflict could mean for New Zealand’s economy, and what the Government is watching

US PMI's rise on prices, not orders; most other PMIs rise on strong new order flows; China FDI shows recovery; some key commodity prices jump; air cargo rises; sea freight rates leap; UST 10yr at 4.06%; gold and oil rise; NZ$1 = 59.3 USc; TWI-5 = 62.9

3rd Mar 26, 7:19am

32

US PMI's rise on prices, not orders; most other PMIs rise on strong new order flows; China FDI shows recovery; some key commodity prices jump; air cargo rises; sea freight rates leap; UST 10yr at 4.06%; gold and oil rise; NZ$1 = 59.3 USc; TWI-5 = 62.9

Risk aversion to grip markets, causing volatility; US PPI jumps recently; eyes on US cockroaches; Korean exports star again; China car overstock & TD flows grab attention; UST 10yr at 3.96%; gold and oil rise; NZ$1 = 60 USc; TWI-5 = 63.4

2nd Mar 26, 7:19am

27

Risk aversion to grip markets, causing volatility; US PPI jumps recently; eyes on US cockroaches; Korean exports star again; China car overstock & TD flows grab attention; UST 10yr at 3.96%; gold and oil rise; NZ$1 = 60 USc; TWI-5 = 63.4

[updated]

Financial markets worry about growing risks; US data mixed; Canada popular with investors; Singapore data strong; container freight rates dip; UST 10yr at 4.02%; gold dips, oil firm; NZ$1 = 59.7 USc; TWI-5 = 63.2

27th Feb 26, 7:20am

37

Financial markets worry about growing risks; US data mixed; Canada popular with investors; Singapore data strong; container freight rates dip; UST 10yr at 4.02%; gold dips, oil firm; NZ$1 = 59.7 USc; TWI-5 = 63.2

Gigantic surge in global debt; US data tame; Taiwanese jobless low, EU inflation low; China warns US over new tariffs; Australian inflation stays high; UST 10yr at 4.04%; gold up, oil softish again; NZ$1 = 59.9 USc; TWI-5 = 63.3

26th Feb 26, 7:19am

41

Gigantic surge in global debt; US data tame; Taiwanese jobless low, EU inflation low; China warns US over new tariffs; Australian inflation stays high; UST 10yr at 4.04%; gold up, oil softish again; NZ$1 = 59.9 USc; TWI-5 = 63.3

Revenge tariffs in new twist; US economic data mixed; US voters tired of erratic Trump; Canada factories slow; China holds LPRs; EU car sales dip; UST 10yr at 4.03%; gold down, oil softish; NZ$1 = 59.7 USc; TWI-5 = 63.2

25th Feb 26, 7:20am

18

Revenge tariffs in new twist; US economic data mixed; US voters tired of erratic Trump; Canada factories slow; China holds LPRs; EU car sales dip; UST 10yr at 4.03%; gold down, oil softish; NZ$1 = 59.7 USc; TWI-5 = 63.2

Reaction to US tariff-tax mess weighs on markets and trade; US data underwhelming; Fed says US 2025 job gains were an illusion; iron ore price falls; UST 10yr at 4.03%; gold rises again, oil on hold; NZ$1 = 59.7 USc; TWI-5 = 63.1

24th Feb 26, 7:19am

13

Reaction to US tariff-tax mess weighs on markets and trade; US data underwhelming; Fed says US 2025 job gains were an illusion; iron ore price falls; UST 10yr at 4.03%; gold rises again, oil on hold; NZ$1 = 59.7 USc; TWI-5 = 63.1

China returns after CNY holiday to IMF critique; Japan & India rise; Malaysia exports swell; US tariff decision; US data tame & US growth slows; UST 10yr at 4.09%; gold rises, oil up again; NZ$1 = 59.7 USc; TWI-5 = 63.3

23rd Feb 26, 7:19am

11

China returns after CNY holiday to IMF critique; Japan & India rise; Malaysia exports swell; US tariff decision; US data tame & US growth slows; UST 10yr at 4.09%; gold rises, oil up again; NZ$1 = 59.7 USc; TWI-5 = 63.3

Tariff-taxes illegal says US Supreme Court; US expansion slows sharply; US sentiment stays weak, consumer costs rise faster than incomes; Japan and India rise; UST 10yr at 4.08%; gold stable, oil up again; NZ$1 = 59.7 USc; TWI-5 = 63.3

21st Feb 26, 8:36am

19

Tariff-taxes illegal says US Supreme Court; US expansion slows sharply; US sentiment stays weak, consumer costs rise faster than incomes; Japan and India rise; UST 10yr at 4.08%; gold stable, oil up again; NZ$1 = 59.7 USc; TWI-5 = 63.3