By Roger J Kerr

The recent employment data would have surprised the serial economic doomsayers, as the strong employment growth and sharp fall in the unemployment rate were completely at odds to the pessimistic picture they like to paint.

Whilst the Household Labour Force Survey data can be erratic and prone to subsequent revisions, the underlying message was that the economy (outside the dairy industry) is humming along and there are jobs available to those that want them.

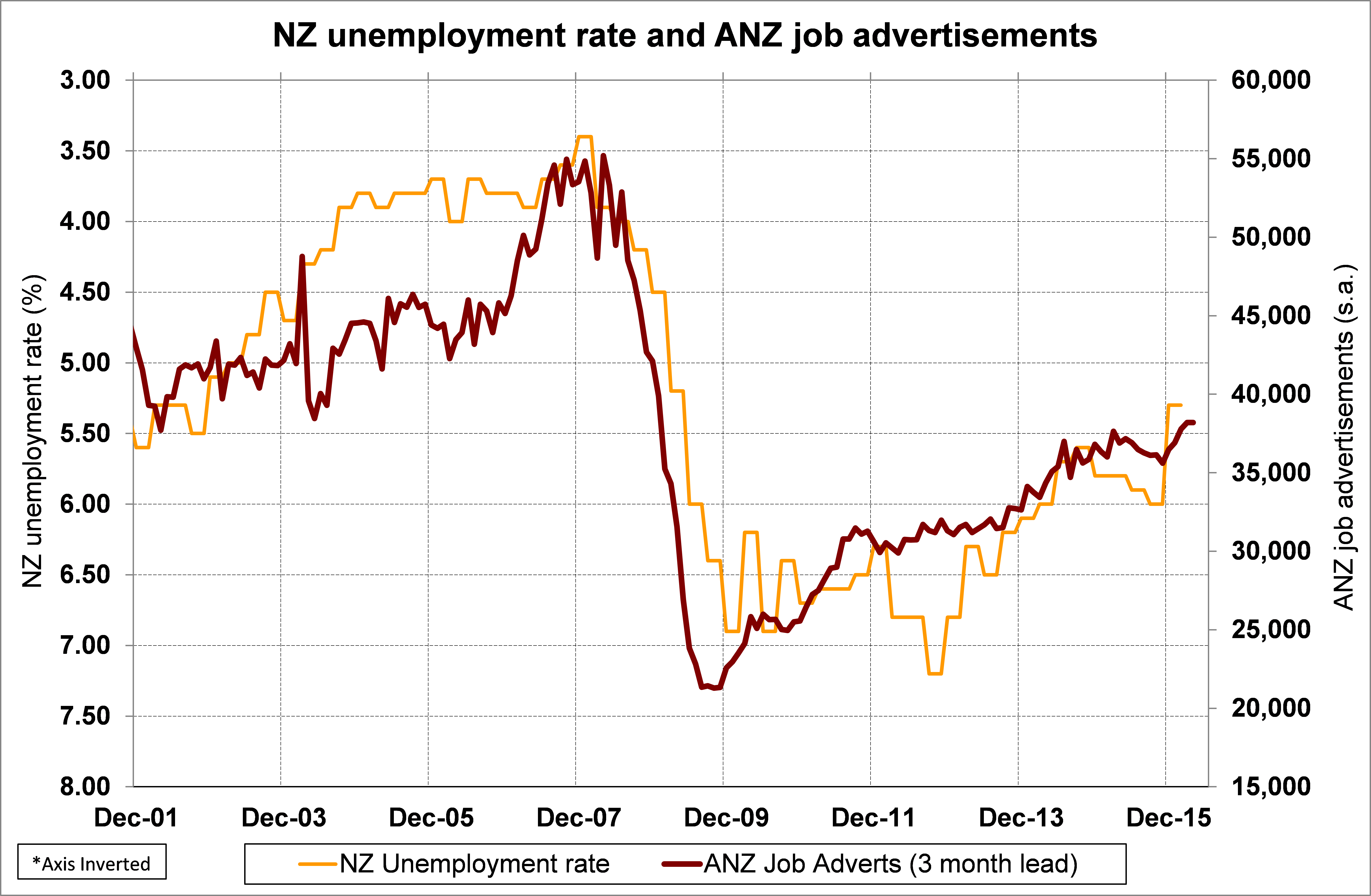

Job adverts, as measured by the ANZ (chart below) and also from Trade Me data, have been pointing to stronger jobs growth as many industries such as tourism, constructions, services and manufacturing are running at full tilt.

Low interest rates and the lower exchange rate are clearly prompting along business investment and expansion decisions.

Job adverts as a lead-indicator were already pointing to an unemployment rate below 5.50% at this time, a long way from the 7.00% unemployment rate forecast by some bank economists for mid-2016!

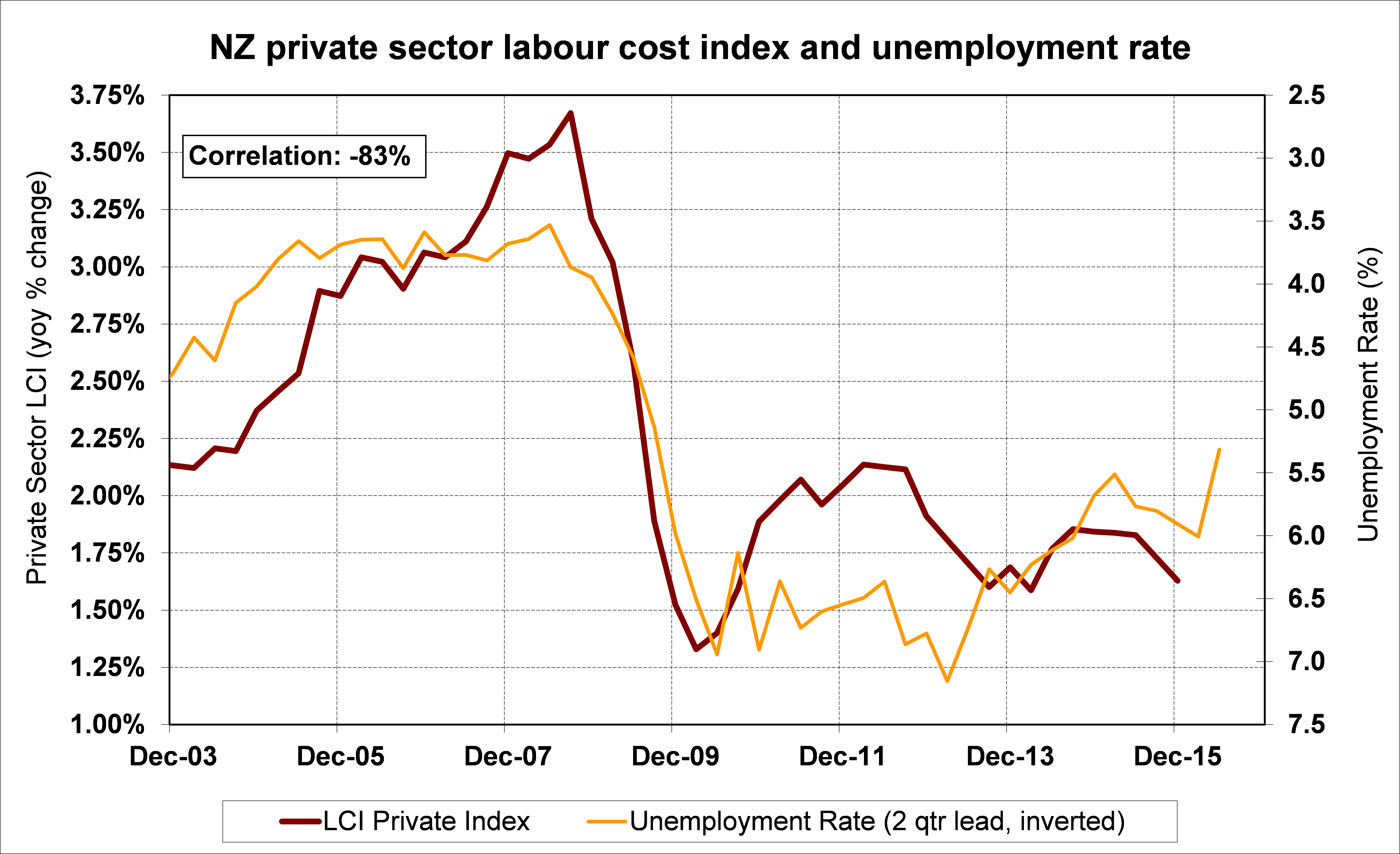

As a consequence of the tighter labour market conditions it should be expected that upward wages pressures will emerge (second chart below).

The benign wage inflation environment business firms have enjoyed over recent years (helped by immigration inflows of returning Kiwis and far fewer heading across the ditch) may be coming to an end.

To subscribe to our daily Currency Rate Sheet email, enter your email address here.

Daily swap rates

Select chart tabs

Roger J Kerr is a partner at PwC. He specialises in fixed interest securities and is a commentator on economics and markets. More commentary and useful information on fixed interest investing can be found at rogeradvice.com

4 Comments

Jobs are only created to serve the incoming migrants. So it's a bit of a self serving circle, and not an indication of the economy as a whole.

.

Yes, tourism is up, but that's largely cyclical.

.

Any company who has any type of automated task - especially computer based - is outsourcing those tasks to offshore centres where labour costs are low.

.

The economy is a dead duck, I believe ASB reported so, yesterday.

There was no growth, if you take out what was produced for the increase in population.

If the Government did not support the massive immigration we have, then we would not need so many people to service them with the housing mess and our overburdened infrastructure.

The job figures do not show the dire strait of our economy.

We have never had so many industries employing part timers on a minimum wage. These people are classified as employed, making the figures look good.

When the milk figures come out tomorrow, it will be seen that very few farmers are making any money.

Is all this humming in the correct KEY?

I've been without a job for 18 months and you are right,there are jobs out there if you want one,however if your of a certain age you have no show of getting one

ps I am not on the dole due to my wife working and having saved hard when i was working.

According to Roger,"The benign labour cost environment may be coming to an end" and given what he has previously written,presumably he believes that the RBNZ should 'look through' the very low inflation rate and RAISE interest rates before the tsunami of wage inflation overcomes us. Yea right Roger.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.