By Roger J Kerr

Last week's RBNZ Quarterly Survey of Inflationary Expectations results received more media newswire attention than normal.

The survey revealed that on average the respondents expected the annual CPI inflation rate to be 1.6% in two years’ time, the lowest surveyed result in 22 years.

It was hardly startlingly fresh news, however the result announcement caused the NZ dollar to fall in the forex markets as it reinforced the case for even lower interest rates.

The immediate negative reaction by financial markets was perhaps somewhat understandable as it is widely known that the RBNZ themselves place a lot of store on future inflationary expectations when plotting their monetary policy settings, which is all about future economic conditions.

To judge this survey's results as to whether it is that influential on the RBNZ's own economic analysis and considerations, we need to consider who the survey respondents are and how accurate the survey has been historically in forecasting subsequent inflation rates.

The RBNZ have confirmed that they survey about 70 (or thereabouts) economist/market analyst types at banks, funds management firms, stockbrokers, investment banks and a few large corporates. All people with a view, and perhaps influence, when it comes to future economic conditions and thus likely inflation, however, hardly folk who are important price-setters in the real economy.

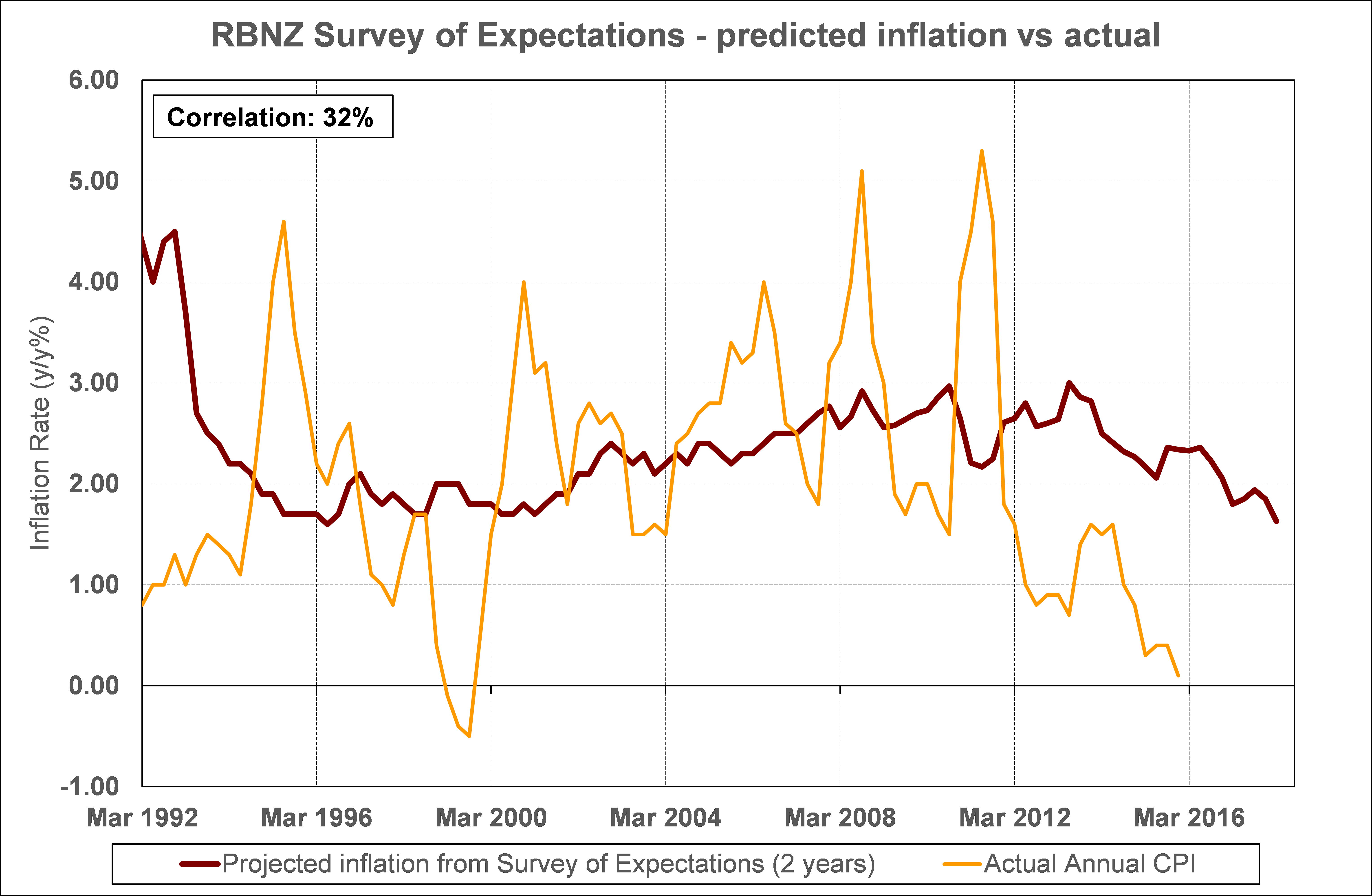

The first chart below plots the survey of where respondents predicted annual inflation to be in two years’ time with actual CPI inflation figures over the last 24 years.

The survey has never actually correctly picked a subsequent increase or decrease in the annual inflation rate (correlation very low at 32%).

Again, it is no great surprise that the survey participants always believe inflation will be very close to 2.00%, which off course is the mid-point of the RBNZ's target range.

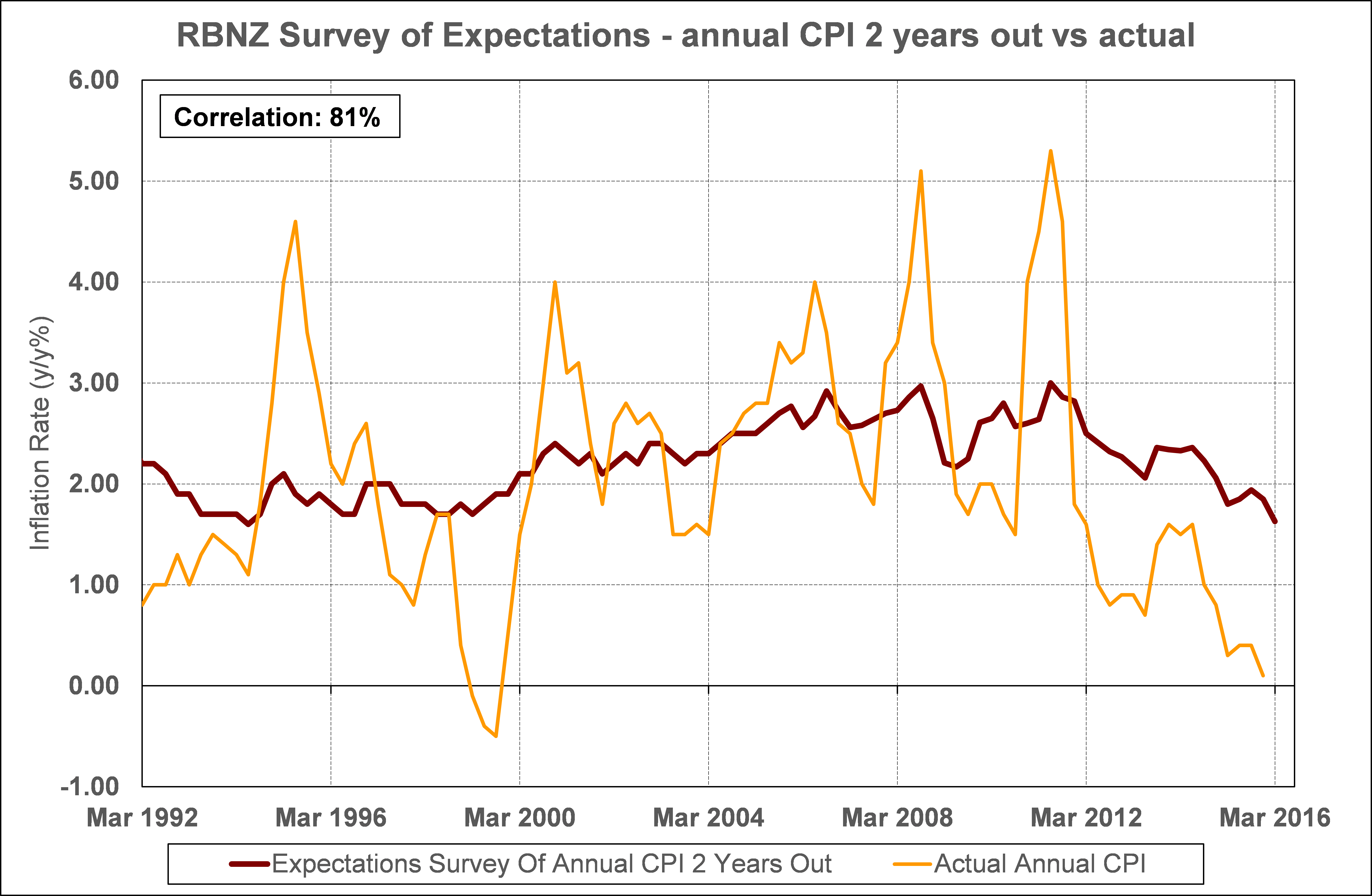

The second chart suggests that most respondents determine their two-year forecast inflation as being very close to where inflation was at the time they made the forecast (correlation high at 81%).

The survey is not a very reliable forward indicator of future inflation and thus should be taken with a grain of salt.

Interestingly, the Kiwi dollar selling related to the announcement was very short-lived.

The RBNZ could also be advised not to read too much into the survey result as well.

To subscribe to our daily Currency Rate Sheet email, enter your email address here.

Daily swap rates

Select chart tabs

Roger J Kerr is a partner at PwC. He specialises in fixed interest securities and is a commentator on economics and markets. More commentary and useful information on fixed interest investing can be found at rogeradvice.com

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.