By Roger J Kerr

The RBNZ failed to take our advice last week to hold off on cutting the OCR until the March quarter’s CPI inflation numbers are released in mid-April.

They clearly do not see the NZ dollar depreciation over the last 12 months feeding into higher prices for imported consumer goods as they have a forecast of just +0.20% for the March quarter inflation change.

My reading of the situation with importers/retailers is that the legacy hedging has all run out in 2015 and they are now implementing substantial price increases of up to 10% as they cost and price off a much lower 0.6500 exchange rate. Not a lot of discussion about this in last Thursday’s Monetary Policy statement, it is all about NZ importing global deflation for the RBNZ.

In Australia, their inflation rate ramped up sharply in the December quarter due to the AUD depreciation over the previous 12 months. Retailing may be a little more competitive in NZ than Ozland, however fundamentally the retail markets work the same and I believe it is only timing differences and we may well say a first quarter inflation number above consensus forecasts.

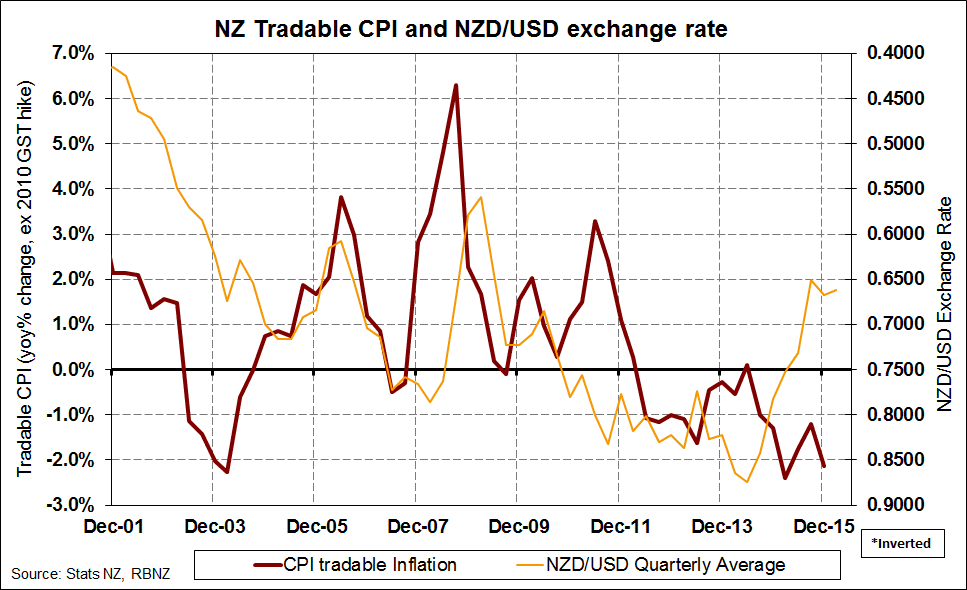

Tradable inflation is heading back to +2.00% (refer chart below). As actual annual inflation to 31 December 2015 is so low, I guess the RBNZ concluded that they have a fair amount of wiggle room to play with if inflation does track higher and earlier in 2016.

At the risk of being overly picky, my view of the Monetary Policy Statement was that it was a little dated in that the global financial/investment market volatility and uncertainties they highlighted as reflecting concern about global economic growth, may have been true in the month of January, however equity and commodity markets have settled down significantly through February/March.

Oil and many commodity prices have moved sharply higher in recent weeks, demonstrating that trading conditions and prices are not predictable and thus not always negative for the economies of our trading partners.

Another justification cited as a reason why it was appropriate to cut the OCR again was the decreases in inflationary expectations and this can be a self-fulfilling prophecy on actual inflation results.

As commented previously in this column, the RBNZ’s own survey of inflationary expectations (Where do you forecast the annual CPI inflation rate to be in two years’ time?) has a very limited participation universe of about 80 people. Basically a bunch of economists from banks, investment banks and fund managers who are not actually price setters of goods and services in a commercial sense. The accuracy of actual inflation being near to the forecasts of two years’ prior is poor (a very low 30% correlation).

A fair counter argument supporting the need for a rate cut at this time was that borrowers (dairy farmers in particular) do not need their interest rates going up because the banks’ own debt funding margins have increased. The OCR cut helps to off-set that debt cost increase.

To subscribe to our daily Currency Rate Sheet email, enter your email address here.

Daily swap rates

Select chart tabs

Roger J Kerr is a partner at PwC. He specialises in fixed interest securities and is a commentator on economics and markets. More commentary and useful information on fixed interest investing can be found at rogeradvice.com

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.