By Roger J Kerr

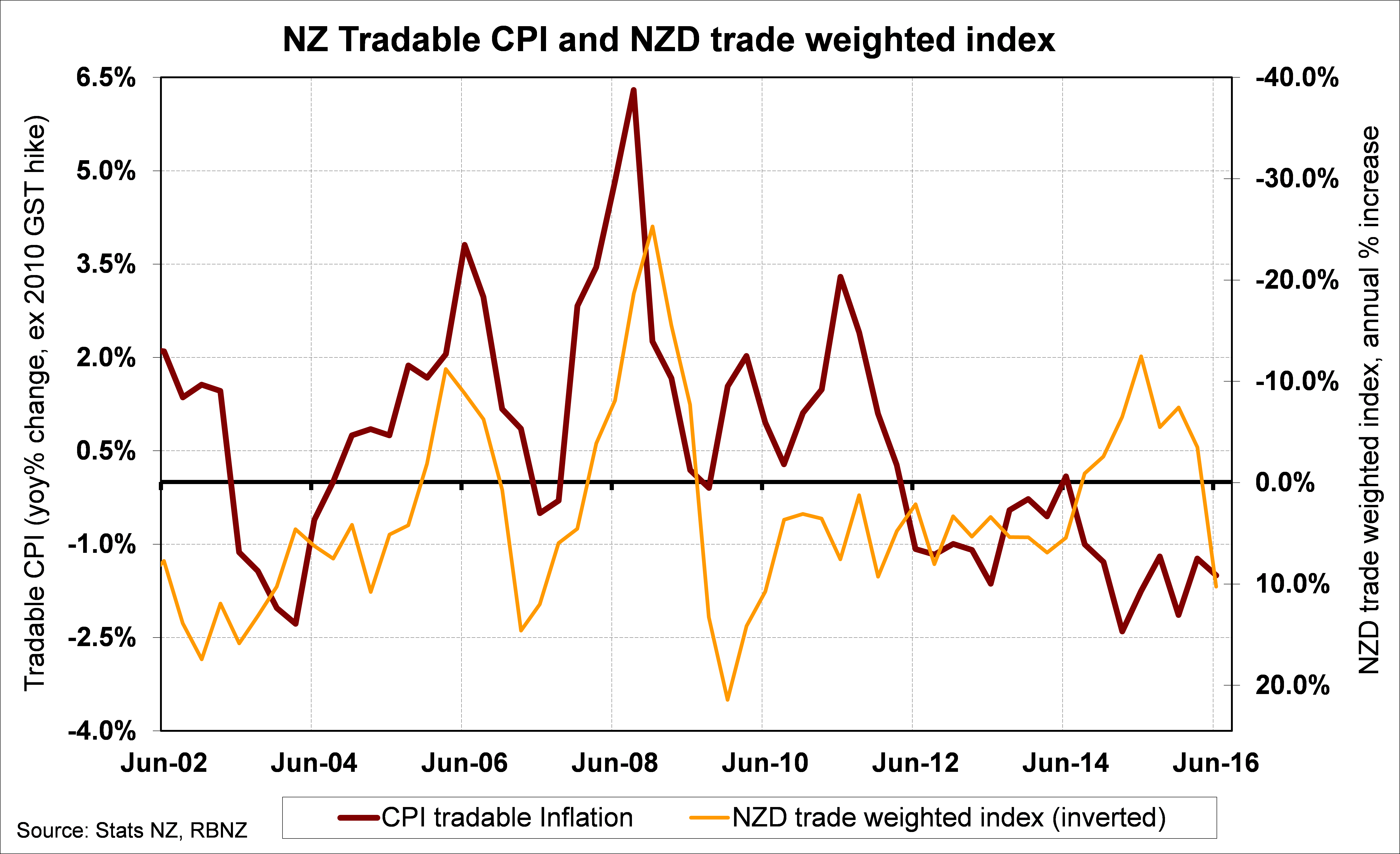

The appreciation of the NZ dollar on a Trade Weighted Index (“TWI”) basis over recent months to 77.80 suggests that tradable inflation in NZ (imported consumer goods) will remain negative at -2% for some time yet.

The reality of the latest currency impact is totally at odds to the RBNZ’s August MPS forecast of an increase in tradable inflation from -2% to +1% over the next one to two years.

If the TWI exchange rate was to fall by 7% to 10% over coming months they might be near to accuracy with their inflation forecast.

Judging by our relatively superior economic performance and rising dairy prices, the chances of a TWI depreciation of that magnitude on its own appears fairly remote.

It will require divine intervention, which is the RBNZ being more aggressive with further loosening of monetary policy over and above what the financial market currently expect.

Unfortunately, the RBNZ are notorious for just producing an updated inflation forecast without taking accountability/responsibility for their previous forecast and explaining why it did not turn out as they expected.

Daily swap rates

Select chart tabs

Roger J Kerr contracts to PwC in the treasury advisory area. He specialises in fixed interest securities and is a commentator on economics and markets. More commentary and useful information on fixed interest investing can be found at rogeradvice.com

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.