By Roger J Kerr

The first law of economics is that changes in both demand and supply cause a change in the price of the good or service. The lack of wages growth in both the US and NZ economies over recent years despite the two strong labour markets (low unemployment rates) raises the issue as to whether something else is happening that we do not know about.

The conventional economic models are based on the premise of:-

Strong GDP growth = strong labour market = rising wages = rising inflation = higher interest rates as monetary policy is tightened in response.

My argument would be that increasing wages and inflation in both the US and New Zealand are currently merely delayed, not permanently obliterated.

Whilst high levels if inwards immigration and Kiwis not leaving home has increased the New Zealand labour supply and thus subdued wages increases to date, in the US that has not been the case.

Like everything to do with how economies tick, the devil is in the detail.

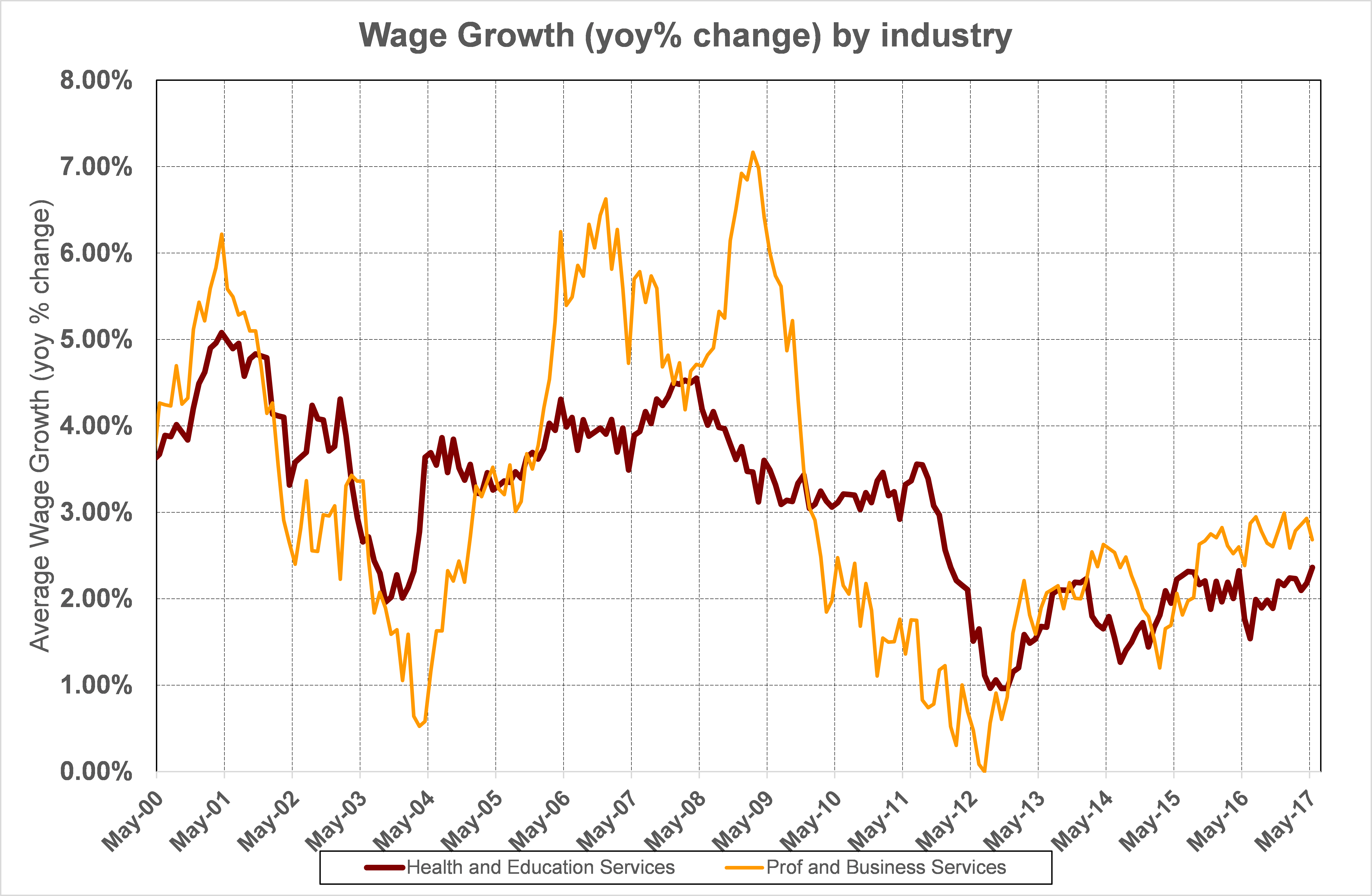

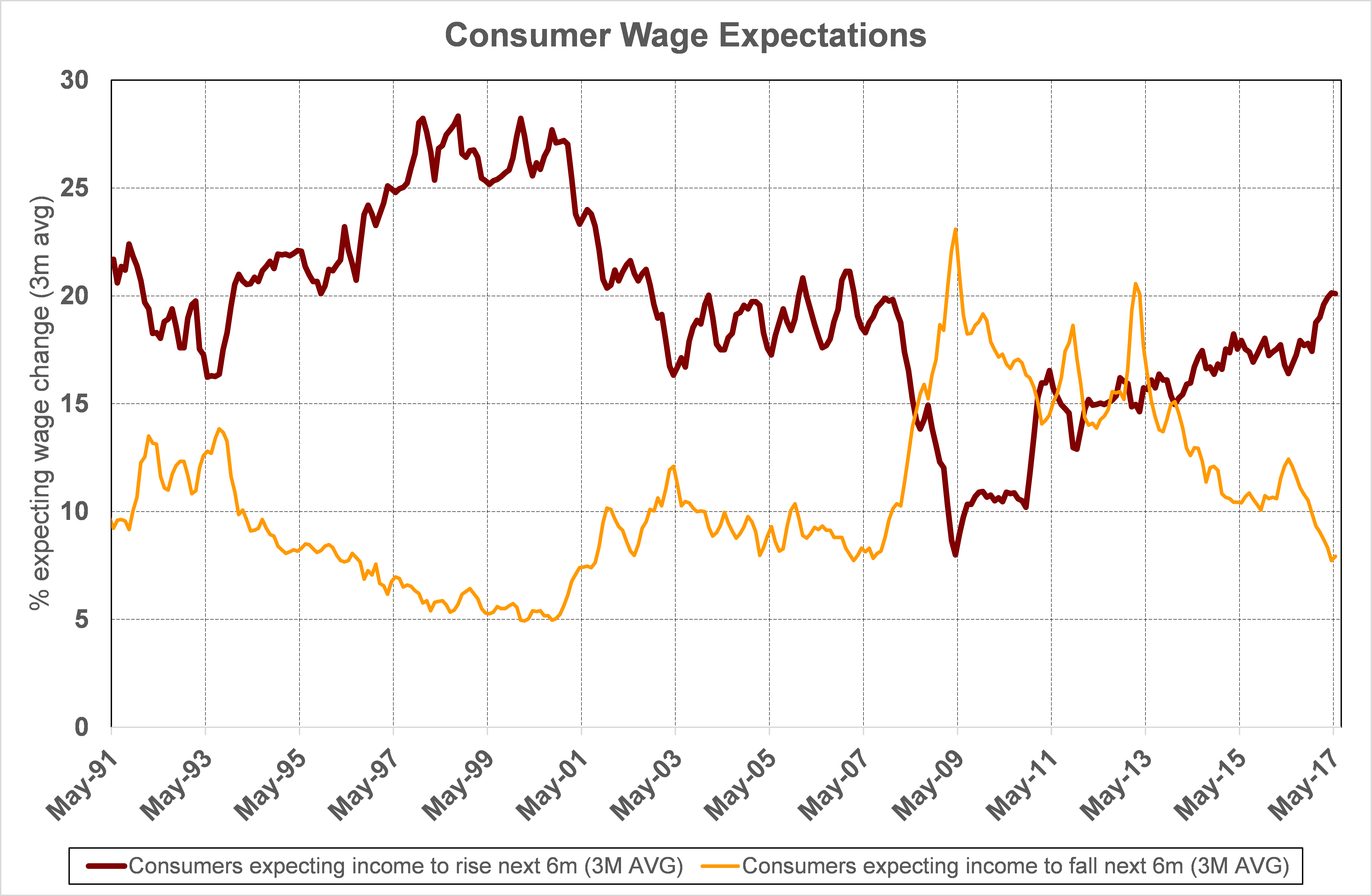

The growing industry sectors in the US economy are health, education and business services. The first chart below indicates upward momentum in wages growth in these sectors. The second chart tells us that US consumers are certainly expecting significant wage increases.

The US Federal Reserve continues to expect US inflation to be pushed higher from the strong labour market and thus wage increases.

The US interest rate markets currently reject the Fed’s view and their pricing of future interest rate changes indicates that they do not believe wages and inflation will increase.

Both cannot be right, however I would back the Fed’s analysis and therefore we must expect material increases in both US short-term and long-term interest rates over coming months/years.

Daily swap rates

Select chart tabs

Roger J Kerr contracts to PwC in the treasury advisory area. He specialises in fixed interest securities and is a commentator on economics and markets. More commentary and useful information on fixed interest investing can be found at rogeradvice.com

19 Comments

So depressed incomes long term are the new normal perhaps.

So long as we don't have a financial melt-down that leaves us in the same position as the US with 20% high income and 80% low income earners.

The inflation and higher pay will only happen once the money taps open to get projects completed. Every project just seems like a gamble in the current environment.

Yes IMHO and this only continues while we are in the stagnation zone we are now in, once we drop out? ik.

The US interest rate markets currently reject the Fed’s view and their pricing of future interest rate changes indicates that they do not believe wages and inflation will increase.

Large players in the US market are aware that if they get their predictions wrong that they will face financial difficulties. However very large players are knowingly too-big-to-fail and the US Govt/Fed shall bail them out with an infusion of cheap capital. The biggest risk a large player in the US faces is if they do not loan out enough low cost capital they will be smaller than their competition and not get rescued in the event of potential difficulties.

I believe they are coming, I know 3 people, all within the tech industry that have renegotiated their salaries significantly higher this year, and I know a number more looking, specifically due to higher salary expectations.

Tech/digital, Media and Advertising industries are really getting trapped between not being able to find the skills/talent and squeezing profit margins. All of this pushes us closer to recession in my opinion, property prices, profit margin squeezes and higher employee wage expectations.

You might believe they are coming but will they be across the board so as to affect inflation?

There are lots of tech style jobs in Pune where locals with PhD's are a fraction of the cost of say here in NZ or the US etc.

Most programming skills you'll ever need covered are here https://pangara.com/our-talent-tech-freelancers

Pangara was founded by a Swedish guy who started Vietnam's first ecommerce platform and sold to Alibaba. The USD35 per hour fee might be higher than in India, but you have superb support English-speaking account management and you'll be less likely to spend much time plugging all the holes. This company is mainly working for the Scandinavian market at the moment.

and fractionally as good as well. I dread having to ring support knowing what the first line is now like its going to waste days of my time.

Ah but this is overall wage inflation v the spot market. So sure where there is demand and a supply shortage you either pay or go without. Means while many if not the majority get little or no pay increases, and maybe even pay cuts (lost job take a new one on less money) Then we have to allow for inflation BTW so in my case as an example this is the 5th year of only an inflation adjusted pay rise, so I am breaking even. I agree on the continuing margin squeeze and I suspect why so many ppl are so dead set against a CGT its the only place in their portfolio making any $s.

There a small group of "specialists" who can command high wages but the growing majority need to have lower wages to hold the financial system together... A deflationary spiral is kicking in.

And the trend is collapsing aggregate demand ... reflected in unsustainably low Oil prices.

The Opec members revenue trend highlights the shrinking pie ... http://crudeoilpeak.info/opec-paper-barrels

This trend cant hold indefinitely.

And no. its got nothing to do with the shale miracle.

https://srsroccoreport.com/dominoes-begin-to-fall-bhp-chairman-says-20-…

similarly themed article on zerohedge claiming energy production is declining http://www.zerohedge.com/news/2017-07-02/looming-energy-shock.

Chris Martenson has been crowing doom and gloom for years now, and there have been pretty amazing opportunities to make money in that time. If you weren't investing during the roaring 20's you would have had your arse handed to you on a plate in 1929.

Still deflationary spiral and economic Armageddon is consistent with Steve Keens excessive debt theory which seems plausible to me.

"The US interest rate markets currently reject the Fed’s view and their pricing of future interest rate changes indicates that they do not believe wages and inflation will increase."

Looks like the banks don't believe or share the Federal Reserves sentiments to me.

"The first law of economics is that changes in both demand and supply cause a change in the price of the good or service"

How come our current intelligent government does not accept the basic economic that for any meaningful solution - have to tackle supply as well as demand unless it suits them to support housing ponzi that has been going on to suit vested interest.

Our tax base is based on what? basically the housing market. So if you stagnate or even crash that housing market then your tax base takes a hit, the swing voters confidence in you takes a hit and its bye bye Government benches.

My argument would be that increasing wages and inflation in both the US and New Zealand are currently delayed, and in fact probably permanently obliterated.

It seems unlikely to me real wages will rise substantially or rapidly in New Zealand given it has constricted labour rights, a low bar to immigration and poor productivity. It didn’t happen during the recovery and it’s certainly not likely to happen now what little growth there was is tapering. It’s also unlikely there will be substantial political change as, despite a decade of stagnation, Kiwis still seem pretty happy with the approach of the current government and there is no Kiwi Jeremy Corbyn pushing for a genuine left wing alternative.

I dont think people are happy with the current government at all. Look at the sentiment on this website and consider what sort of demographic would read an economy focus website.. The middle and aspiring middle class in Auckland ,if they didn't already own assets, have been absolutely eviscerated by wage stagnation and hyperinflation of house prices caused by foreign buyers.

Teachers, firefighters and tradies are fleeing Auckland. The lower class and working class has also been hit hard by tobacco more than doubling in price since 2012. A lot of individuals don't actually stop smoking they just drive themselves and their families into poverty with price rises like that, in the BOP alone 24000 such individuals coughed up 90 million in excise tax last year Imagine what that's doing to the local economy! Actual inflation of the things that matter like rents and housing is through the roof, and yet we're told that inflation is low. Its hard to imagine food prices rising in percentage terms as they're already extremely expensive by world standards. I'm not even going to mention immigration.

For the first time in New Zealand's history the Labour party and Green party have joined forces and NZF seems to be singing from the same anti-neoliberal hymn sheet. You could be right though. To be honest after reading dirty politics and going to GCSB & TPPA rally's I thought National were toast during the last election and they won with a huge majority.

The teachers and nurses unions have managed to keep their members wages low in this country through their archaic national awards. The only way these people will get the wages they deserve is to go it alone and negotiate individual contracts like just about every other industry has in NZ.

Disagree. With your model, a handful of "Rockstar" rhetorically gifted self promoting extroverts will clean up and the rest get to live on crumbs. The meek don't inherit the earth, they get to tithe the winners.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.