By Roger J Kerr

There was a surprise in last week’s 0.0% inflation numbers for the June that no-one picked.

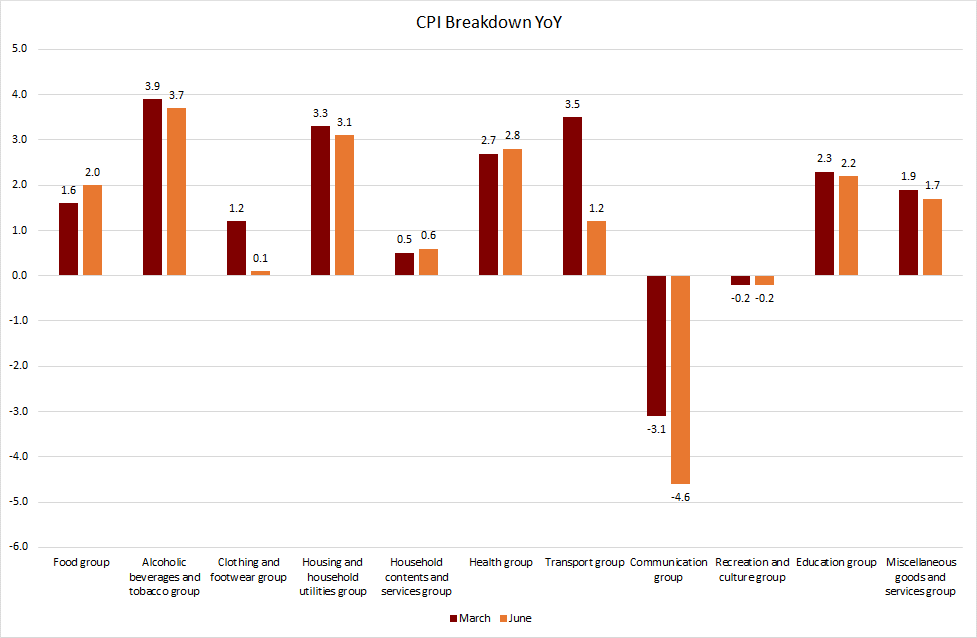

The significant reduction in communication prices has continued over the last 12 months, and as the chart below depicts these price decreases appear to be the only factor keeping annual inflation so low.

The question going forward has to be for how long can falling household internet and mobile costs continue?

I have always said that fierce competition in the economy is the best way to maintain low inflation.

However, you do wonder about for how long the squeezed profitability margins at the three mobile service providers can go on for.

We will see if the RBNZ address this sort of inflation analysis in their 10 August statement.

The financial markets will be looking closely at the RBNZ’s update inflation forecasts in the 10 August Monetary Policy Statement.

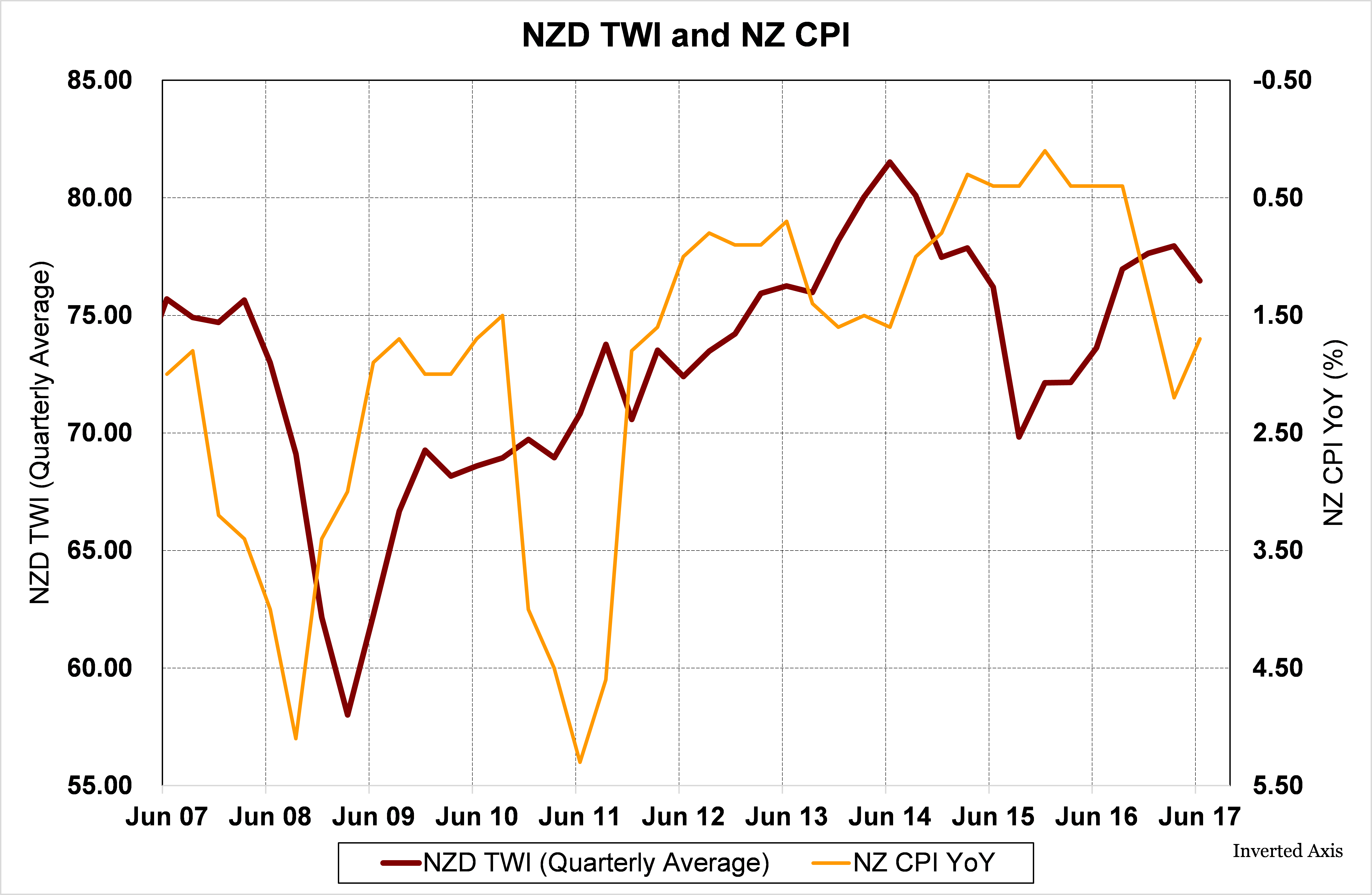

The NZ dollar exchange rate has traded substantially above their assumed level for this time, therefore they must be forced to reduce their March 2018 inflation forecast to below 1.00%.

It takes nine months for higher exchange rate movements to feed through to lower imported goods prices.

The RBNZ will not be too happy that misplaced statements about interest rates by their mates over at the RBA in recent weeks have sent both the Aussie and Kiwi dollars higher against the USD.

Daily swap rates

Select chart tabs

Roger J Kerr contracts to PwC in the treasury advisory area. He specialises in fixed interest securities and is a commentator on economics and markets. More commentary and useful information on fixed interest investing can be found at rogeradvice.com

5 Comments

Telco's can go very low , its a bit like airlines , they must run the buisnesses "tight" and keep costs down

"I have always said that fierce competition in the economy is the best way to maintain low inflation."

Well done, Roger.

You must be one of the truly great economic theorists of our time.

nymad,

Precisely my own view,but seemingly some people pay for Roger's 'words of wisdom'. Bizarre.

One would imagine that the telcos would have fairly modest operating costs - once the network is in place its just a ticket clipping/looting operation. With declining cost of capital they can well afford to lower prices.

Remind me; how would lowering interest rates encourage them to raise prices. Rinse and repeat for every sector in the economy.

A lot of the cost I imagine is labour / staff. By subcontracting out support offshore, you can cut that right down. You however will annoy and lose a certain percentage with doing this. But if all of them are doing it, then not so much.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.