By David Hargreaves

It will be a reasonably happy Reserve Bank, but an ever-more grumpy Government after release on Wednesday of the the latest quarterly Reserve Bank Survey of Expectations.

This survey, a New Zealand-wide quarterly survey of business managers and professionals, carries a lot of clout with the RBNZ. The central bank has been known to make changes to the Official Cash Rate largely based on the outcomes of this survey in the past.

Generally what's looked at most closely is the expectation for inflation in two years' time.

From the RBNZ perspective, the latest result is a very stable one, showing that the expectation is little changed from the last survey three months ago, with the expected inflation rate in two years time now 2.04% compared with 2.01%. As far as the next 12 months are concerned, the expectation is for 1.86% up from 1.8% in the last survey.

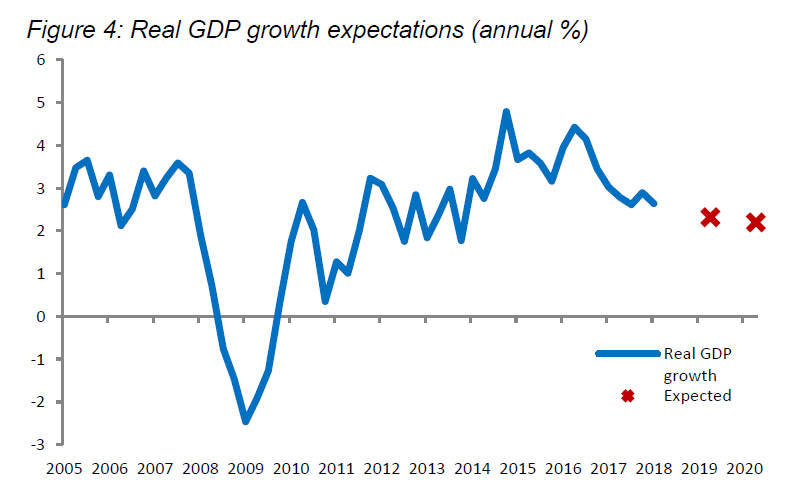

However, from the perspective of a Government under the pump from falling business confidence, the latest expectations of economic growth will not be pretty reading.

On the same day Finance Minister Grant Robertson was speaking to business leaders and attempting to soothe their concerns about future growth prospects, the survey shows that respondents have slashed their expectations of the forward GDP growth rate in the past three months.

Whereas in the last survey the expected GDP growth rate over the next 12 months was 2.64%, now it has been pared back to 2.32%.

And the outlook for two years time is arguably even worse. The two-year expectation of growth rate has been slashed from 2.7% as of the last survey to just 2.2%.

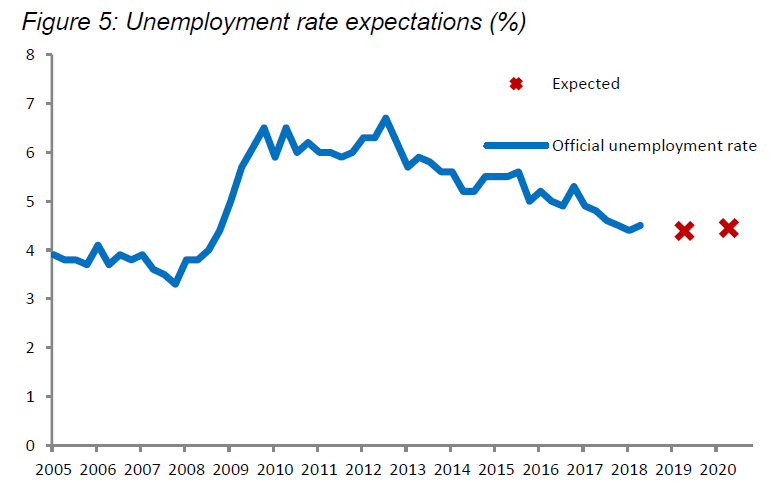

In terms of making its interest rate decisions, the Reserve Bank of course now also has to consider employment.

Here the news for the RBNZ is again positive and stable, with the survey showing that the unemployment rate in one year is expected to be 4.39% and increase to 4.45% two years’ time. The seasonally adjusted official unemployment rate reported by Statistics New Zealand for the June 2018 quarter was 4.5% (this was released after the survey was completed).

Expectations for wage rises are perhaps surprisingly muted, with one year ahead expectations for annual growth in wages having increased from 2.81% to 2.88% while two years ahead expectations remained at 2.93%.

And further positive news for the RBNZ, but less so for homeowners is that there's been little change in expectations for house price growth. The survey respondents expect house price growth of 2.43% in the next 12 months, down from 2.74% in the last survey, while the expectation for two years out has risen slightly to 2.42% from 2.15%.

19 Comments

Mmmmm.. the RBNZ have got it wrong. Don't they listen to Grant Robertson.

lol, .. apparently no one is listening to GR ... not sure if he is looking at a different set of data and talking to the wrong crowd !!

Ok, so now everyone is wrong other than the CoLs and their leaders...

Is she going to listen , take notice, and change the tunes? ... or wait for a more gloomy surveys in 3 months?

Do they really believe that wff, student payout, and other injections will change the cost of doing business and bring other costs down when they have pumped fuel and other costs up ...?

The drama continues and the comedy is getting very boring ... need a bit more exciting twists in the play !!

Ok, so now everyone is wrong other than the CoLs and their leaders...

So if National were still in power, confidence would be booming? Why? Yes, I understand that confidence is usually high when you have govts promoting bubble economics. Can you point to an example of any economy in the world that has been able to sustain economic health and confidence through super-normal asset price inflation and roaring private debt? I bet you can;t.

What’s the point of the question? The COL are in power and have to power to act or not. Their supporters will have to take responsibility for the outcome as they had a part in enabling it.

#notmygovernment

So if you voted National will you be taking responsibility for the mass immigration, soaring house price inflation and the resulting mess this caused? Its all well and good opening the flood gates, reaping the short term gains, and not paying for any of the associated infrastructure. Unfortunately someone has to clean up the mess.

And if you vote labour you'll be voting for the exact same thing. They are two sides of the same coin.

What’s the point of the question? The COL are in power and have to power to act or not. Their supporters will have to take responsibility for the outcome as they had a part in enabling it. >

The point of the question is as follows:

-- Is political leadership (the "gubmint") the primary driver of economies?

-- If political leadership is the primary driver, and bubble economics crashes in a screaming heap, which party is responsible? National? The coalition? Both?

Yes, NZ economy in the last 5 years is your example.

and Yes, confidence would have continued to boom as it was in March 2017 ...

Why?, because they had a stable Gov, able to plan and execute, and had solid pairs of hands able to deliver ... Not a bunch of activists and day dreamers learning on the job .... almost all the projects running now were planned 2 years ago ..go figure

Try replacing your company director or CEO with an apprentice and measure your employee confidence no matter how successful the company is !!...

The reason why most people have a job today is because of that " bubble" you hate so much ... and the reason why this CoL was able to dish money out willy nilly is because of the same bubble ...

and now they want to keep the bubble after tasting the money and surpluses it brings ... because they don't have an alternative ....But they are stupid enough to blow it and challenge the Geeze which are laying the golden eggs... so good luck to them.

Instead of listening to the noobs, You can keep reading textbooks and stupid articles to support your belief or you can get down to town and ask the tax generators how they feel and what are they On about !!

There was nothing wrong with the economic health and confidence until this bunch of noobs took over the helm with the disbelief of most NZers.. when a bunch of 13 unelected anonymous NZF directors ( hardly believing their luck) decided who will Govern for the next 3 years ....

No wonder they wanted to remain ANONYMOUS !!

You are so right...

"Try replacing your company director or CEO with an apprentice and measure your employee confidence no matter how successful the company is !!...

I bet the Nats are looking at their apprentice in charge and thinking...if only the CEO had stayed on a bit longer...

They are going to be even gloomier now they can't hire students from the sub-continent to work in their restaurant for 20 hours...or was that 60 hours for 20 hours pay...

"The immigration changes, which come into force in November, will bring in stricter rules for work visas, especially for foreign students with lower-level qualifications or those who are studying in Auckland..."

"The rules have also been tightened for students whose partners want to work in New Zealand.

Until now, international students who are studying for a post-graduate degree can get work or student visas for their partners or children – which means fees-free domestic schooling."

The foreign student debacle of the last few years has been a complete and utter rort.

Education had very little to do with it, if at all in many cases – PR for sale – as most with half a clue were well aware.

However, some hapless individuals in the previous administration mindlessly categorised it as an “export industry” – yes, apparently that was one of the championed economic pathways forward.

And as for the slum generating PTE nonsense – to call it a stupid joke would be far too kind.

Thank you coalition for bringing this inspired lunacy to something of an end.

The govt was well aware that what was really being purchased by the “students” was enhanced residency rights with a path to PR. They were quite happy to wave this rort threw as it was a nice little earner that flattered the growth story and was generally “good for business”. The rort was so obvious that the numbers just ecploded, esp for students from China and India. Sourcing of students from India in particular became an organised racket. Some of the courses offered required little more than daily attendance and a rubber stamp. The whole thing just stank.

Thank you Bobster – a somewhat calmer and more rational version of my verbalised outrage – honestly, the whole debacle simply makes my blood boil.

“Rockstar” indeed….

Even Chong Kee is honest enough to see it is global and that surprise,surprise,some of it may have been caused by debt fuelled frenzy under his watch...

Despite starting with a cheery "morning Mikey" Key's message was a sobering one. Now chairman of New Zealand's biggest bank, ANZ New Zealand, Key said ANZ's seeing rising loan delinquencies, albeit off a low base.

He noted the June quarter 4.1% Gross Domestic Product growth recorded by the United States was "tremendous," but suggested the way it was delivered wasn't. "Very, very large" budget deficits of about 7% of GDP were behind the US growth, Key told Hosking.

"The point isn't that the US has a problem today, but it will have a problem down the track owing the better part of $20 trillion," said Key.

"If you look across to Australia, and to a degree we're seeing it in New Zealand at ANZ, you have had a big build up of private sector debt. Households have borrowed a lot over the last decade or so and that is absolutely slowing down. You're starting to see an increase in [loan] delinquencies - people who are not making their payments on investor properties off a very low base, but [it's] starting to rise."

that would sound so doom and gloom if it wasnt 100% accurate!

Such a shame he didn't communicate and address these realities whilst in charge of the nation.

Inflation is out there, somewhere, and it's coming to a town near you. If it doesn't come then you end up paying for the future with a dollar of the same value or more than today, and thats just not possible, inflating debt away is a critical part of central bank planning.

Yes, that's the current paradigm. Whether central bank planning as we know it is the right paradigm is the million dollar question :-).

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.