The latest quarterly Reserve Bank Survey of Expectations has shown a sharp spike in expectations of the level of inflation in a year's time and also an upward move in the expectation for house prices.

This survey, a New Zealand-wide quarterly survey of business managers and professionals, carries a lot of clout with the RBNZ. The central bank has been known to make changes to the Official Cash Rate largely based on the outcomes of this survey in the past.

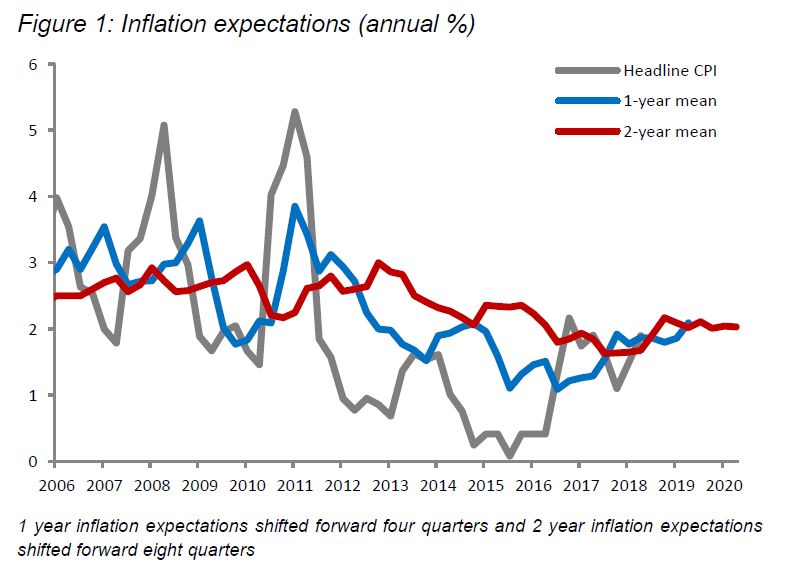

The latest survey shows that the mean expectation for inflation in a years' time is now 2.09%, sharply higher than the 1.86% recorded in the last quarterly survey released in August.

However, the result is consistent with what's happening at the moment to inflation as a result of the sharply higher fuel prices.

What the RBNZ does look more closely at is the expectation for inflation in two years' time - and this paints a much more comfortable picture for the central bank. The expected inflation level two years out is now seen as 2.03%, which is actually slightly down on the 2.04% figure in the last survey.

House price expectations are a recent addition to this survey and have thus far been muted. However, in the latest survey there's some signs of life - with the house prices in a year now seen as 2.86% higher, which while only a modest lift, is rather higher than the 2.43% figure in the last survey.

But like general inflation, however, this effect is seen by survey respondents as fizzling out - and the outlook for house price in two years' time is seen as just 2.31%, down from 2.42% in the previous survey.

This again is consistent with the views of some in the market that there may well be a bit of a short term lift in house prices this summer followed by a flattening and even decline.

Elsewhere in the survey, and in news that will offer encouragement to the Government, the expectations for GDP growth have increased, while the picture for unemployment still sees a low level of unemployment - although nothing like as low as the actual figures that came out earlier on Wednesday and after the survey had been conducted.

GDP growth over the next year is now seen at 2.44%, up from 2.32% in the last survey, while the unemployment rate in a year from now is seen as 4.4%, just slightly up from 4.39% in the last survey.

18 Comments

For those that can't understand why the RBNZ is not raising the cash rate in an inflationary environment. Here is a bit of explanation. The RBNZ can't afford to recognise inflation nor can it risk the rate of credit growth slowing any further than it has already. hence, inflation (look through that, it'll come down). House prices, (despite the obvious signs otherwise here and in Australia) we'll encourage to try and get the credit growth the economy needs to survive. It's good watching.

They aren’t raising interest rates because the inflationary outlook doesn’t warrant it yet.

So you’re now giving us an explanation as to why RBNZ isn’t/won’t raise rates, but you’ve previously said they are going to raise rates next year, up to an eye-wateringly high 3.5% by 2021. Which one is it -

A) can't afford to recognise inflation nor can it risk the rate of credit growth slowing any further due to interest rate hikes; or

B) going to start a series of interest rate hikes next year.

It's the end game BLSH before they have to raise rates to preserve the currency.

What will inflation be in 2019 when RBNZ starts to hike rates? And don’t you think RBNZ would want to avoid the “risk the rate of credit growth slowing any further due to interest rate hikes” during the 2019 recession that you predicted?

Hi BLSH.

Now I know you read the article on the low levels of unemployment earlier so this should be pretty easy.. What are the risks that an economy faces when employment nears capacity? A bit more inflation on top of inflation is the short answer, wage demands, strikes, public sector pay pressures, higher costs to those on fixed incomes.

Historically when nations reach full employment, what happens to interest rates next. I'll give you a clue, when the US unemployment numbers dropped near 4% in 2017 the FED did what. UK unemployment went below 4% in July, the Bank of England did what?

Sadly we can't raise rates just yet because there are so many plums that have bet the farm on the housing market. and 50-60% of all mortgages come up for renewal in the next 12 months. Call it a temporary 'stay of execution.'

https://www.cnbc.com/2017/06/21/the-jobs-market-may-be-past-full-employ…

https://www.google.co.nz/search?q=uk+unemployment+rate&oq=uk+unempl&aqs…

I’m disappointed that you haven’t answered my interest rate question.

Why do I get the feeling you are going to role out the “it’s a temporary stay of execution” line when your predictions don’t come to fruition next year.

You asked an inflation question, not an interest rate question.

Please watch this. It will help to explain inflation pressures, which is why there will need to be an interest rate response to calm things

https://www.youtube.com/watch?v=eJETJSME9ro

and this

https://www.youtube.com/watch?v=NxlZ-pq0oxE

We don't have a trade surplus to balance our high level of private debt.

.

I think Keen is wrong on the third method of money creation. Running a trade surplus does not mean creation of new base money. That is gold standard thinking. Central banks don't as a rule print more NZ dollars when an exporter earns some US dollars. The NZ exporter converts their US dollars into pre-existing NZ dollars via some forex middle person. Sometimes central banks print money and buy currency to lower the value of their currency but not generally speaking with a floating currency. But running a trade surplus does add to domestic demand and employment - in exchange for other countries' currency. However, some might argue that in economics it always better to receive (get real goods and services in exchange for bits of paper) than to give (send someone else the fruits of your labour and resources). Warren Mosler took on Steve Keen on the money creation via trade surplus thing in this debate https://www.youtube.com/watch?v=yGGgLqiCNHA&t=3461s

Thanks Nic. I'm looking forward to your guest article on Interest.co.nz (wouldn't that be fun :).

Hi Theclap123

It would be but I'm not sure if the revenue streams from bank advertising and real estate would last that long with me providing articles!

Lol, give it go eh? Your comments are well-expressed n backed up with precise references etc... And NZ does need education beyond MSM. Consider it all the same. Not all readers comment etc

Totally agree with theclap, go for it. View points counter to the narrative (especially when backed up as you do) are always needed.

How can one possibly say inflationary expectations at 2.03 % is down on 2.04 % !

The difference of 1 part in 200 is way way less than the possible accuracy of this measurement.

Unchanged would be a far more accurate comment.

How can you have inflation in a low wage, low interest low disposable income environment?

The_4th-estate

When banks create too much money! Hopefully this will explain some of it. Richard Werner spent a long time in Japan during their 25 year slump and has also advised the Bank of England who finally recognised that 'Banks create money' in 2014... It's well worth 12 minutes of your life to watch.

House price inflation. Prices are jacked up on borrowed money.

The sellers then spend this gain on imported consumer products. Assuming cost of goods to port is 60% of the items ticket price then 60% is sent overseas with the rest being wages, tax, local company profits. Let’s not forget that this gain was borrowed by someone else through a bank, it needs to be paid back with interest. How much profit did the banks make this year?

My feeling is the labour underutilisation rate is where you need to look for the inflationary pressures and why the UK US NZ and Japan have all gone passed their supposed NAIRUs and still not much inflation. Lots of people want to work more still...it's still not that easy to get enough hours for a lot of people. When they do get more hours they pay off the mortgage (save) rather than eat out (my strategy).

Inflation occurs when too much spending (from any sector - private, public or foreign) chases too few goods. I don't see where kiwis are going to get income increases to spend much more with current bargaining power, private debt levels and underutilised labour/immigration competition. Government remains austere. Can't see the current account changing much. Maybe we are at "full capacity" but I doubt it given the underutilisation rate. I'm certainly not banking on a pay rise for our household this year beyond 1% and I couldn't easily walk into a better paying job.

Yes, thanks Nic. An interesting presentation. My question was in a sense a retorhical one. I see low interest costs as removing a previously high cost element/input of nearly everything, assuming of course that production of everything is leveraged off debt of some kind. Of course that can also make producing something so cheap or even worthless that its no longer worth making it so why not inflate an asset instead...as for the rest of my question, its hard to spend in an inflationary manner as a consumer when you have too much debt or don't earn enough to have discretionary income...and there is a lot of that about the place.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.