New Zealand now has its lowest unemployment rate in over 10 years and highest employment rate since Statistics New Zealand began the current employment series 30 years ago.

The New Zealand dollar shot up by about three-quarters of an American cent to hit US67.4c - its highest level since early August.

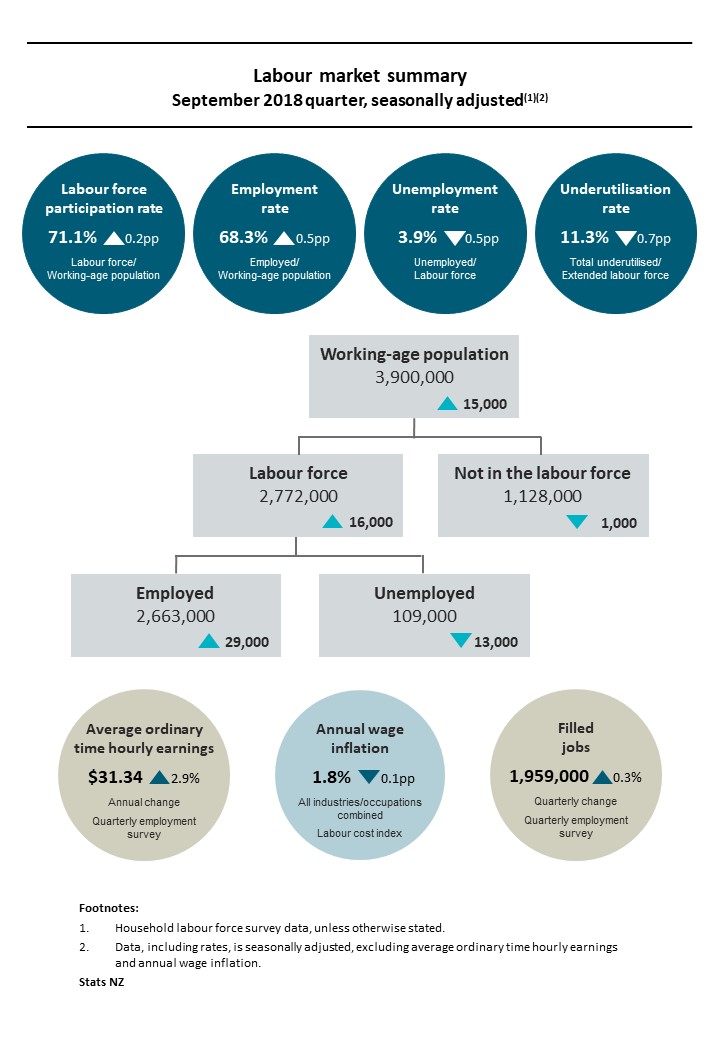

According to Stats NZ as of the September quarter the unemployment rate plummeted to 3.9% from a revised 4.4% in the June quarter.

The fall was completely unexpected by economists, who had generally been forecasting a figure of about 4.5% and inevitably there will be questions as to whether this is a 'rogue' result, though Stats NZ has immediately defended the voracity of the data, saying they are "confident" of the result and by stating that large changes in the rate - both up and down - have occurred before, while labour market figures tend to lag other economic indicators.

The falling unemployment and rising employment - with the rate gaining to 68.3% - if taken at face value give lie to the falling business confidence survey results that have been seen since this Coalition Government came in late last year. The 'participation rate' including all those actively seeking work rose to 71.1%, which is also a record.

Wage growth remained subdued, with private sector wages climbing just 0.5% in the quarter and 1.9% for the year.

ANZ senior economist Liz Kendall said Wednesday's data "were undeniably" strong and give the Reserve Bank - which has its next review of interest rates on Thursday - more breathing room to see how developments unfold.

"The tone of the RBNZ’s press release may reflect this strength tomorrow, although the RBNZ may also be wary of noise in the data.

"On balance, today’s data are a more consistent with a stick-to-the-script tone than a more dovish outcome, although the projections themselves will already be finalised and the RBNZ will, as always, emphasise the medium-term outlook and risks. We remain comfortable with our call that the OCR will remain on hold, but today’s data reaffirms that there are risks on both sides of the ledger. Waiting and watching developments remains a prudent approach."

Kiwibank chief economist Jarrod Kerr and senior economist Jeremy Couchman say the labour market data was "decidedly strong" and "the third in a trifecta of glamour statistics we economists love the most", with the other two having been strong GDP figures and higher inflation figures.

"The purple patch of cool Kiwi data takes the risk of an [Official Cash Rate] cut off the table. The screws have tightened a little further on the RBNZ’s decidedly dovish view. A view they are likely to defend for now at least. The RBNZ is meeting its labour market mandate to support “…maximum levels of sustainable employment”. This leaves the Bank focused on inflation. Inflation is coming, and wage growth is ready to play its part," they say.

They believe the next OCR move by the RBNZ will be a hike, and one that is delivered around May 2020 – six months or so earlier than the Bank is currently signalling.

BNZ head of research Stephen Toplis said he did not expect to see the RBNZ's statement on Thursday to look much different to the last interest rate review.

"We also accept that the Household Labour Force data probably slightly overstate the true tightness in the labour market. Nonetheless, they are yet further evidence that this economy is operating at or above potential and that, as a result, there must be a very real risk that inflation rises to, and stays above, the mid-point of the RBNZ’s target mid-point.

"Furthermore, RBNZ policy is about aiding sustainable growth and employment. Allowing things to get too tight risks the need for an aggressive policy response that could create unnecessary volatility in both output and employment.

"We don’t expect the RBNZ to change its main message tomorrow but the odds of it being forced to a tightening bias by February next year are certainly rising."

ASB senior economist Mark Smith expects that wage inflation will progressively firm from late 2019, with the OCR starting to move up from 2020.

"This expectation is conditional on the economy retaining sufficient momentum to push inflation higher. On the basis of today’s figures the hurdle to an OCR cut has certainly increased. Plenty can happen between now and then and the RBNZ will want to see concrete evidence of firming inflation before lifting the OCR. This looks to be 2020."

This is the release from Statistics New Zealand:

The seasonally adjusted unemployment rate fell to 3.9% in the September 2018 quarter, Stats NZ said today.

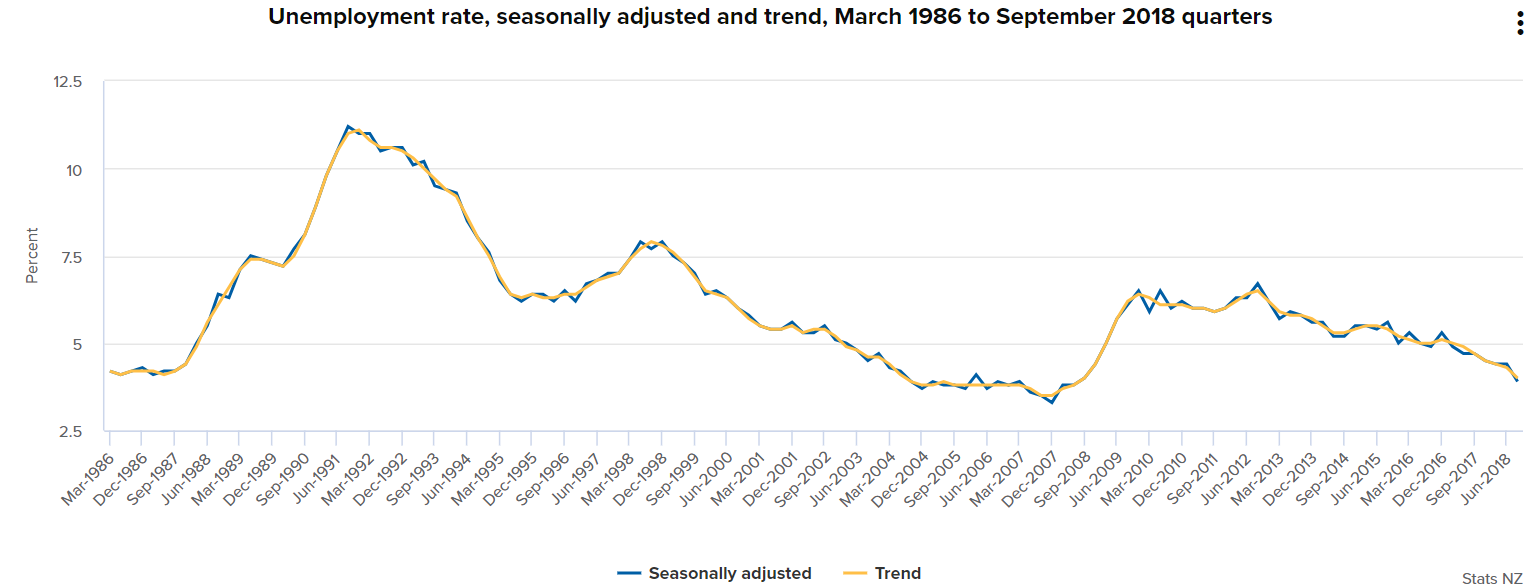

This is down from 4.4% last quarter and is the lowest unemployment rate since the June 2008 quarter, when it was 3.8%.

The fall in the unemployment rate in the latest quarter reflected a fall in the number of unemployed people (down 13,000) and a strong rise in employment (up 29,000). This quarter’s employment rate rose to 68.3%, the highest rate since the series began more than 30 years ago.

The fall in unemployment, in tandem with a fall in underemployment, was key to the underutilisation rate falling to 11.3%.

“While this quarter’s unemployment rate is outside market expectations, we know New Zealand has a small economy with a dynamic labour market, and large changes, both up and down, have happened before – in late 2012 and 2015,” labour market and household statistics senior manager Jason Attewell said.“We also know labour market measures tend to lag behind other economic indicators, which have shown strong and widespread growth in 2018. We’ve seen population growth in the regions, reports of more job ads, high levels of migration and tourism, growing retail sales, and rising exports.”

“Labour market data is most valuable when placed in the context of a time series. The trend series, which reveals the underlying direction of movement, has now fallen for seven consecutive quarters,” Mr Attewell said.

The likelihood that someone would move out of unemployment, from one quarter to the next, rose in the September 2018 quarter when compared with previous September quarters.

A tight labour market can lead to low unemployment – when demand for workers increases to the point where people who are not in the labour force, or are unemployed, secure employment almost immediately on wanting a job.

In the latest quarter, 109,000 people were unemployed – 13,000 (10.5%) fewer than in the June 2018 quarter, with 8,000 fewer women and 5,000 fewer men. For both sexes, this mainly reflected 11,000 fewer unemployed youth (15–24-year-olds).

There were 6,000 fewer youth unemployed and not in education, which led to the not in employment, education or training (NEET) rate falling to 10.1 percent. The fall in NEET youth was primarily influenced by men and women aged 20–24 years.

There were also:

- 5,000 fewer youth who were unemployed and in education

- 7,000 more youth in education and employment

- 5,000 more youth in education and not in the labour force.

In the year to the September 2018 quarter, 73,200 (unadjusted) more people, as measured by the household labour force survey (HLFS), were employed (up 2.8%) – 45,200 more women and 28,000 more men.

These regions had significant employment growth:

- Auckland – up 34,600 (3.8%)

- Waikato – up 8,400 (3.3%)

- Otago – up 6,700 (5.5%)

- Gisborne/Hawke’s Bay – up 6,400 (6.5%)

- Taranaki – up 4,300 (7.1%).

Annually, filled jobs, as measured by the quarterly employment survey (QES), increased 1.2% (unadjusted) – 23,500 more jobs. Of this increase, 17,500 were held by women and 6,000 by men.

Differences between filled jobs in the QES and employment numbers in the HLFS can largely be explained by differences in survey coverage. The QES excludes some industries (including agriculture), and those who are self-employed without employees (to better fit international standards). Conversely, the HLFS only includes usually resident New Zealanders, so can exclude some temporary seasonal labourers.

The labour cost index (LCI) increased 1.8% in the year to the September 2018 quarter, while the analytical unadjusted LCI increased 3.3%. Private sector wages increased 1.9%, while public sector wages increased 1.5%.Within the QES, wages also grew annually. Average ordinary time hourly earnings increased to $31.34 (up 2.9%). Private sector average ordinary time hourly earnings increased 3.6%, to $29.38, while for the public sector the increase was 1.6%, to $39.31.

Average weekly earnings (including overtime) for full-time equivalent employees (FTEs) also increased annually, up 3.3% to $1,212.82 per week.

Weekly earnings

Select chart tabs

Unemployment

Select chart tabs

110 Comments

Nic Johnson, please remind me of your unemployment prediction for the not too distant future. Was it 6% by early 2020 and 7.4% before end of 2021? Bwahahaha

BulLSHit

Did you read the article? Lowest rates of unemployment since 2008. What happened in 2009-2011 while you were still at school? The graph on the article may help you out with this one very easy to find. from under 4% to 7%. Amazing!

9th September 2018 prediction

'Growth will turn negative in the first quarter of next year and NZ will be in recession by the end of the second quarter (2 consecutive quarters of negative growth). Australia will be suffering a similar fate and before Q4 of 2019 one of the Australian banks will be trying to tap its government up for funds to shore up its capital ratios (My money is still on Westpac because they've been bleating the most inconsistency over the last 4-5 months, albeit CBA could also pose an issue because of the size of their loan book). Interest rates will be rising by Q4 2019 to hold up a heavily sold NZ dollar. There's a few predictions for everyone that I'm quite happy to have on record. Sound nuts? Maybe, but this old squirrel has seen what happens when a housing market dominates an economy and where banks have leant too much interest only debt and too many high multiple mortgages at the top of the cycle.

Okay let's carry on then. Unemployment will hit 6% by Q2 2020 rising to a peak of 7.4% by Q4 2021. Reserve bank rate will be 2,5% by Q4 2020 and 3.5% by Q4 2021. prices will fall 15-20% at the lower end of the market 25-35% in the middle and 40-50% at the upper/luxury end of the market. The bottom of the market will be 2023/24 a couple of years later than your prediction but ready for your next upswing. In essence a heavy top down correction because of tighter credit from banks and lack of cash from foreigners at the margin, many of whom will be forced to flee with big foreign bank losses.'

BulLSHit

Don't forget about the coming pension crisis too. This is a very good watch about the risks that the boomers have taken on, all of which about to go pop. I think they describe their behaviour as 'shit or bust'!'

Well said Nic. Agent TTP, leveraged BLSH and Houseworks are about to experience something completely foreign to them - a downturn and theft of equity. Only then, can they proclaim they're experienced.

I will admit, the strength of the labour market has surprised me as has the longevity of this cheap credit fueled house of cards it's heavily reliant on. Oh how quick the lot will turn.....

Meanwhile, in other breaking news... "Wellington homeowners will be popping the champagne this week with the release of the latest ratings valuations"

Hi RP. Should have posted this here.

Here is a very simple explanation of the reducing unemployment rates. The boomers are now hitting retirement age and as they make up such a large part of the population their removal from the jobs market makes the figures look a lot better than they really are. The big bulge of people entering retirement, will also reduce consumption and increase the selling assets to fund life without an income. The births spike of 1950-1955 are now 63-68 and many will want to sell risky assets before they stop working! And we have a wave of this for the next 10-15 years, with fewer Generation Xer's to prop it up and millenials already saddled with too much debt. A perfect storm!

I will take the other side to every single forecast you make to the tune of $100 each, to be donated to charity. The first forecasts are NZ & Aust GDP to be negative in Q1 & Q2 2019 and an Australian Bank approaching the State for a capital injection. You can choose whatever housing index you want. All interest rates refer to the official cash rate. My charity is Te Whare Rokiroki.

Te Whare Rokiroki are going to be in the money on this.

Showing a bit of a gamblers mentality there Te Kooti. Be careful that's how housing bubbles happen!

It's not called gambling when the expected value is greater than 1. Either back your view or wind your neck in.

I'd like to nominate the Auckland housing shelter as the beneficiary.

So you've accepted?

Of course. The housing collapse is going to be enormous.

The bet isn't about the collapse.

It's about the accuracy of your (foolishly) precise forecasts.

nymad.

The predictions will all be close enough to have made my point. Besides the homeless shelter or the Maori women's centre will get the benefit of some funding that they both will need - tough times ahead old chap!

It is a foolish bet (i'd have given you 3 to one on most of it), but you had the good spirit and honor to back yourself and there will be no losers given where the cash is going.

Te Kooti

What generally happens when unemployment rates go low? I'll give you a clue, the FED is raising their interest rates, the Bank of England did the same this Summer (unemployment rates around 4%). Canada, yep raising interest rates. Why aren't we? Because we need the debt stackers to get their houses in order first, otherwise an orderly recession becomes a full on slump.

When the FED goes to 2.5% in December, little ole NZ is going to see a falling dollar, even more imported inflation and subsequent wage pressures.... because there is no slack in the employment rate. The only way to calm this down will be rate hikes, otherwise fixed incomes get smashed. Thankfully 40% of the mortgage debt is held by just 8% of households so the risks really are skewed to very few when the rates do start climbing in the second half of next year...

*EV > zero

Is it not > than the amount wagered - which I assumed to be 1? Toss of a coin for $1, EV = 50%*$2 + 50%*$0 = $1.

True. You can normalise it to 1, as you have. Same concept.

Technically though in a fair game though you would say that your EV is zero. Not EV = 1.... Amount expected to win - amount wagered.

If it is not a gamble, (long run) EV must be > 0.

'Annually, filled jobs, as measured by the quarterly employment survey (QES), increased 1.2% (unadjusted) – 23,500 more jobs. Of this increase, 17,500 were held by women and 6,000 by men.'

We must have an awful lot of female construction workers building all those shanty towns around Auckland... Good on them, I'm all for equal opportunities!

Go the Baby Boomers, I love it

Hello reti-red poppy

After pressing the Read More button on your comment, I very quickly got remorse for doing so and hit Read Less ... why did I bother with that crap?

one of the Australian banks will be trying to tap its government up for funds to shore up its capital ratios

Do you think so ? whats the capital ratio requirements for banks in Aus ( and in NZ ) ? how bad is it right now ?

Even if they gonna struggle for capital, they could turn the credit-creating power to capital-creation power and get out of it

G-H,

You can find the capital ratio requirement ratio for NZ banks by going to the RBNZ Dashboard. It's there under capital Adequacy.

I would be interested in an explanation of their capital creation power.

Hi Nic Johnson,

Appreciate if you would drop the use of crude words (as in your opening posts today). It's possible to be "colourful" - without resorting to that sort of vocabulary.

Nic - you write some really worthwhile/interesting stuff here and I do respect the right to your own opinion......

But you can do even better by watching your language in places (as can a few others here).

Cheers - and please do keep up those stimulating contributions!

TTP

What's your point. .. when people like you rattle off, do you expect any different

TTP.. Will do old chap. I just couldn't help myself from using BLSH's initials to have a bit of fun following his invitation.

Best wishes

Nic

Hi Nic,

I actually didn't pick up on your "play upon words". And I now think it was quite clever!

A bit of fun - as you say.

TTP

Hi TTP.

Don't you think it's quite interesting that no one here has commented that historically when a nation reaches full employment, interest rates are often raised by central banks to reduce the risks of inflationary pressures. That's what happened with the FED last year when unemployment went close to 4% interest rates went up.

https://www.cnbc.com/2017/06/21/the-jobs-market-may-be-past-full-employ…

I think it’s more that “those who learn from history keep it to themselves to profit.” There’s many correlations that are clear to see if you care to look with an open mind.

Yes, let’s not get precious about a bit of name calling. But definitely don’t give the credit to Nic. I think it was Wankiwi that used it first.

BulLSHit

It was me, old chap.. I've been using it for quite some time.. TTP has just been the first to comment on it that's all.

Low unemployment and low interest rates are key to property market activity.

Unlikely there will be a significant upswing soon in the housing market - but neither is a significant downturn likely.

In any case, a steady market has its virtues.

TTP

Low interest rates? ??

You still kidding yourself. .

Rbnz got it wrong with both gdp and unemployment. .. will be surprised if they stick to their old story

At 3.9% unemployment, we are really seeing the "unemployable" left overs.

No wonder the Uniions are stirring and strikes are coming at the rate of one a week.

The next problem is the chronic shortage of labour which can only be filled from overseas workers coming here as immigrants. .

But immigration is falling and many want it to fall much further.

Which is to be then?

Low unemployables, or chronic labour shortages and more strikes?

Neither.

"there will be questions as to whether this is a 'rogue' result..... New Zealand has a small economy with a dynamic labour market, and large changes, both up and down, have happened before... if taken at face value give a lie to the falling business confidence survey results that have been seen since this Coalition Government came in late last year."

Not much different to what unemployment data is showing in Australia whre income growth is effectively dead and many vacancies with high-incoming earning opportunity (IT, engineering) are being filled by immigrants.

This is not supposed to an outcome of credit-driven, population-driven economics. This should not be looked upon as good news.

You are right in saying our youth here is missing out on high-skilled employment opportunities to experienced migrants.

Companies operating in developing Asian countries have no option but to mass train graduates for job openings and a low employment and training cost base makes it easy for them to do so. The complex nature of offshored tasks and high attrition rates expose entry-level employees to several growth opportunities within those companies.

As a result, despite abysmal education standards in India, techies, accountants and engineers from the nation tend to do better than their NZ and Aussie-bred counterparts.

It's a fallacy to think you can use immigration to solve labour shortages (except for perhaps small numbers of specialist, highly trained positions), because immigration adds more to the demand side of labour than it contributes to the supply side, especially when they first arrive and every new migrant needs to be supplied with housing and transport.

3.9% is one person in 26 unemployed. Some will be taking holidays between jobs but it still equates to an average worker having about 18 months unemployment in a lifetime.

But the figure that matters is the 11.3% under-utilisation rate which equates to one person in 9. These are the people who want more work. You qualify as employed if you do 1 hour per week. This is where the free-flowing 3rd world exploited docile worker is messing up the life of New Zealand citizens.

Agree.

"But the figure that matters is the 11.3% under-utilisation rate which equates to one person in 9. These are the people who want more work. " - wrong. many of these people ( not all of course ; the exact percentages are difficult to know.. ) have never worked and have no interest in working . So your under-utilization calculation is off..

Add 3.9% to 11.3% - about one in six New Zealanders. I concur there are some physically unable to work and there are drug addicts and lay-abouts - but not one in six. There has to be missing potential - it is better for NZ to get them working rather than the 5 out of 6 who work fulltime be taxed to pay them welfare benefits.

Gees, I wonder what questions will Bridges, Bennett & Co. bring to the Parliament when the only two bullets in their gun chamber were GDP and job creation.

Business confidence surveys!!! what a sham...

they were basically playing the markets...

so who was betting on low rates?????

Business confidence indeed, I was going to post this. Two big takeaways - business confidence is a political statement and a dangerous one at that and, as you say, rates are going up sooner. If you bought a house thinking 4% was forever you are in for a shock.

No bank lends by calculating loan servicing at 4% interest rate, it' 6 - 7%

Hi PP2F and Hardly,

With all due respect, business confidence surveys are NOT a sham.

Rather, they are an important tool for the systematic monitoring of economic activity. Without these surveys, economic forecasting (and analysis) would be much more difficult (and much less reliable).

Note that reputable economic agencies (such as NZIER) invest a great deal of resources in their survey methodology to ensure the results are as robust as possible.

TTP

What crap. .

Under the previous labour term, there was consistent negative business confidence even though the gdp was fairly good

Are you an Australian citizen collecting NZ pension as well? You comment just like another I know. All wind n hot air, not many noodles

Look like it will be 2026 when the Nat boys have any opportunity to get back in!

BACK IN????

They get back into parliament everyday to keep the seats clean..

They actually need a good clean, always smell a bit fishy...these days.....

In fact a clean sweep is what is needed, butt they is hanging onto their seats by a whisker.

I still say they feel entitled, all clean, no whitewash, but some stick out like a sore thumb, hitching a lift to Japan at the total cost of 24,000 dollars, obviously living off the Fat of the Land of the Long White.....Cloud.

Getting murkier by the day...these Fat Cats should be circumspect......but then...Voters would have to be awake to see that Fat is not what it appears to be...and certainly not a blessing in disguise.

All take and no give...need an elastic belt....next Election.

Whack em out the door. Get some lean and mean replacements, these have been licking the cream for way, way, way too long.

And that includes...the Speaker....it is certainly does not speak to or for me... I cannot afford em....

How about YOU?.

The speaker? nah, we need him to be there so we can buy concert tickets from him

Is that part of the new Reality...buy and sell tickets...and clip em....unheard of before in a Speaker...I thought they was there for balance, not hush tones....

How much does it cost for one of those seats?

$100k for two?

I like the chart option "Pay premium public sector over private sector %", in the first chart, now standing at an astonishing 31%...

Organisations are primarily run for the benefit of those running them.

Peak employment?

Maybe not. https://www.businessinsider.com.au/australian-construction-levels-2018-….

If that is true then there will probably be an influx of Kiwis heading home soon. Just depends whether we have work for them or not.

I hope you are right. This could turn into a boon with much-needed additional capacity for the construction and its affiliated sectors to grow. I guess not only Kiwis returning home but also out of work Aussie construction workers looking for payday.

Could also lower the labour cost of building.

Awesome, bring back those builders

A good result and from what I am seeing it seems right and not a rogue survey. The labour market is tight and it is hard to find people in a lot of fields. The difference between now and 10 years ago is there isn't the exburence that there was - maybe that is a good thing.

And despite what the hardcore partisans scream, the previous National Gov did a good job economically and this current one is doing a good job economically overall. Of course there are faults and those should be discussed but let's take down the hyperbole a notch or two.

Perhaps unemployment this low will prompt investment in useful assets like plant and machinery - we might actually improve productivity......

Amen to that :-). I really hope this wellbeing framework that TSY have put together focuses on productivity as a replacement for GDP in terms of the key economic metric that is measured.

See https://treasury.govt.nz/publications/dp/start-conversation-value-new-z…

One of the things they will be measuring is ""What is the strength of New Zealand's national identity in relation to other group identities such as those based on ethnicity, religion, region, etc.?""

The section on human capital is full of interesting stuff too. One quote ref productivity "The discrepancy between our skill use and productivity is not because our skills are low". But they will be measuring skill (education) but I;ve no idea if they are measuring productivity.

Since unemployment is so low: could software people please start being more aggressive with your salaries? You milksops working at 80k as intermediate developers in AKL/WLG are flooding the market with low-balling employers. Not to mention you degenerate 'seniors' who don't even get six figures.

saving4AUhouse - If you are really unhappy about your pay packet you could always get a job milking cows.

My pay packet is alright, but every so often I'll look for jobs... so many time wasters thinking I am going to move to Auckland/Wellington for 95k.

That's the state of our tech industry here and our politicians somehow kid themselves into believing that we are in direct competition with US companies for top talent.

Forget the Valley, intermediate developers make about US$96k in Houston or Dallas-FW area working for non-tech F500 companies. The cost of living in Auckland is 5-10% higher than that at these locations and one makes US$55-65k (if lucky) for an unknown company.

In the tech area (well where I am anyway), it's flooded with developers from the Far East willingly to do the same job for 30% less in salary - their work quality is a bit debatable.

I put the blame squarely on tech workers. The demand from employers is there, grow up and ask for more money.

I work at a large firm as a senior financial analyst often doubling up as a scoping / pricing specialist for our complex service offerings. There isn't much job competition in this field from locals or expats as it isn't the most obvious career choice and the job involves a fair bit of interaction with stakeholders along with robust tech and quant skills.

However, the pay is arguably low compared to international standards, even Australia pays a lot more to staff performing similar data-heavy tasks. Other countries desperately need such skills but not NZ where most large employers enjoy monopolistic market position; there is still surprisingly limited demand for advanced data analytics in the job market.

This is why folk leave nz

A great result. Caveat that it is based on a survey so there is a margin of error.

The labour underutilisation rate is what counts. And that stands at 11.3% still. Which is a lot of people wanting more hours. Myself included.

Nobody would want more hours if they were being handsomely rewarded for the hours they're doing now. People want more hours for more income.

Simple explanation for everyone. The boomers are now hitting retirement age so as they make up such a large part of the population their removal from the jobs market makes the figures look a lot better. Big bulge of people entering retirement, reducing consumption and selling assets to fund retirement. The births spike of 1950-1955 are now 63-68 and many will want to sell risky assets before they stop working! And we have a wave of this for the next 10-15 years, with fewer Generation Xer's to prop it up and millenials already saddled with too much debt. A perfect storm!

Exactly. Just look around the RV/motorhome/caravan community and see how many are cashing in the 4-bedder, and splitting the proceeds to a new RV and associated toys, plus a term investment to supplement the NS income stream.

Demography is destiny (unless there is massive net migration - oh, wait)...

This is the problem immigration was designed to fix. But instead the new brought their aged parents and grand parents...and associated health needs (and qualification for ns and everything else). what a shambles.

Why wouldn't they take advantage of the system? New Zealanders are extremely naive.

Didn't National change around the parenting rules for immigrants towards the back of their tenure?

Yes, they did change a few things around that area, not entirely sure of teh details. Now if we could just change the law so only citizens could vote, that'd be one more step in the right direction.

Mid 2016 - as usual arbitrary change by INZ. As with all population and immigration policies in NZ no debate in parliament let alone asking the publics opinion.

It sounds like a return to my younger days - jobs a plenty. Didn't like your salary; got bored with your job; - you moved on and up - simple as that. I was a manager at 30 and the house paid off late 40s - giving one so much more choice in life. I went back to Uni - got a post-grad degree and started working part-time, on contract by choice. To me, this is the dream life - hope it starts happening for so many more now.

Would the graphic in the article not disprove that claim? Working-age population up 15,000, labour force up 16,000 and not in labour force down 1,000. I don't disagree that what you have mentioned will happen in the near future but the changes from this article are not corelated to boomers hitting retirement age.

Or have I misinterpreted these figures.

Everytime the unemployment rate drops this low is just prior to a financial disaster. We still have poor utilisation of the population because the unemployment figures don't tell the whole story.

Also if employment was so high then I wouldn't be bombarded with qualified people looking for work. Yet I don't look to employ anyone at the end of the "business cycle" despite some of my work being counter-cyclical. I'm even looking at automating workload and applying some simple machine learning to some of my processes. Not the greatest time to seek employment.

A lot of the qualified people approaching you will already be in work. That's the way to make more money these days, monkey branch your way up.

Labour are disastrous for the economy.......yeah right

Jobs Boom ? False Optimism before recession is nothing new !

https://www.youtube.com/watch?v=aVZJfz18Bs4

BoJ On 2.3%: ‘the decline in the unemployment rate is insufficient’

"One often hears the question of why prices are not rising even though the unemployment rate has fallen to around 2.5 percent, well below 3.5 percent, which until recently was widely regarded as the structural unemployment rate. My answer to this question is simple: the decline in the unemployment rate is insufficient. [emphasis added]"

https://www.alhambrapartners.com/2018/11/06/boj-on-2-3-the-decline-in-t…

Ageing demographics AJ - people spend less as they get older and used to take on less debt too. That, however could be a major headache waiting here. Average mortgage of the over 55's (I guess over 56's) as this story is a year old now!

https://www.stuff.co.nz/business/money/93285760/Mortgage-at-age-55-No-w…

And could the level of mortgage debt be one of the reasons that North Shore clearance rates are so abysmal. They can't get enough out of the house to clear the debt and buy another one?

https://www.stuff.co.nz/business/property/93278506/mortgages-highest-on…

'Why you should ignore talk of a property market crash'

https://www.oneroof.co.nz/news/35603?utm_id=oneroofemails032

Feel free to ignore it...I'm not. We are already in it.

Already in it? I didn't realise property market crashes were so...flat.

Is this one of those rare "upwards crashes", given that the national House Price Index is up 4.0% year-on-year, and Auckland up 0.4%?

Been boringly flat since "peak" in 2016.

Hi rastus,

What you write amounts to a corruption of the English language.

It's a bit like saying black is white, or night is day. It simply doesn't ring true....... because it isn't true.

TTP

Glad you recognize that and please follow your advice

two points

one banks have already tighten credit here just like aussie , so maybe tony was not told by his bosses or he forgot or god forbid he lied

second we already are at 10 time wages to debt without wage inflation or interest rate drops you hit a natural ceiling of serviceability and i suspect we are already there hence the flat market.

so unless these two factors change there will unlikely be big growth just a flat line until wages catch up

we will see in the next few months how much influence overseas funds had in the Auckland market and if its 3% we are fine, if it was 20% uh oh

BLSH - You're playing with fire there the DGM's really really hate positive people talking common sense !

You are so proudly quoting Tony Alexander, who has been sidelined for ridiculous comments in the past. .

Talk about petty minds

Yes because every millennial should go to their nearest bank and get a $6-800k loan immediately.

Oh, do not worry, I am buying a Pogo-Stick to try and time the ups and downs of Houses, Petrol, Exchange rates and Chinese and Americana Bubble Economics...and the Shanghai Express Loop.

I was gonna buy in China, thank the Lord, I didn't. ..nay couldn't...I was gonna buy in America, but Trump figures, debt is best, so I am going all in.........with him and his billions and Trillions....YAY...

Non-recourse Mortgages.....yay. Cannot lose.

Buy and sell houses with bitcoins.

Is it as safe as Monopoly money?

Safer than Big Mac coins.

Well done everyone. Lots of giggles all round.

Re: Immigration. Just returned from Shanghai & have another million signed up & ready for NZ Inc working & residency application. No need for us to worry, they assure me they're bringing their own millions.

Re: Surveys & polls: My oh my, what are we to make of these. They do try hard to be good, I'll give them that, but it's only a snapshot & probably very urban at that. Remember they are about 'how we feel' as much as about 'how we are really doing' & can therefore be just about anything .... at any time.

Another angle might be (about polls & surveys) do they tell us how we feel about how we are being led. I've not really thought this through a lot, but the standard of leadership in NZ Inc is dire, as is the standard of politics. Are our surveys a relation of the way we feel about our relationships with our leaders & elders (& olders) & those that matter to us. Or do they just point out that we're a bunch of grumpy old men at the bottom of the planet who enjoy being grumpy regardless of what's really going on around us?

PS: I was rung up today by an ex-pat Kiwi looking for a job who tells me he's been in Florida for the last 15 years. If he wants a job he shouldn't be telling me he's been in Florida for the last 15 years for a start, but an interesting reality to an above comment of returning ex-pats. That's it from me, goodnight.

Blah, blow arse blah. Thanks for the lol

"Not in the labour force" = 1.1 million people - of working age.

Why has no one commented on this? What is the status of these people? They're not looking for work?

I am pretty sure actually that if you haven't been for an interview for 4 weeks then you're considered to be in this group.

So if you've given up looking, you are not considered to be unemployed... which of course makes the number look much nicer...

I don't put much stock in these figures. I reckon unemployment and underutilisatin are much much higher, just not being counted.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.