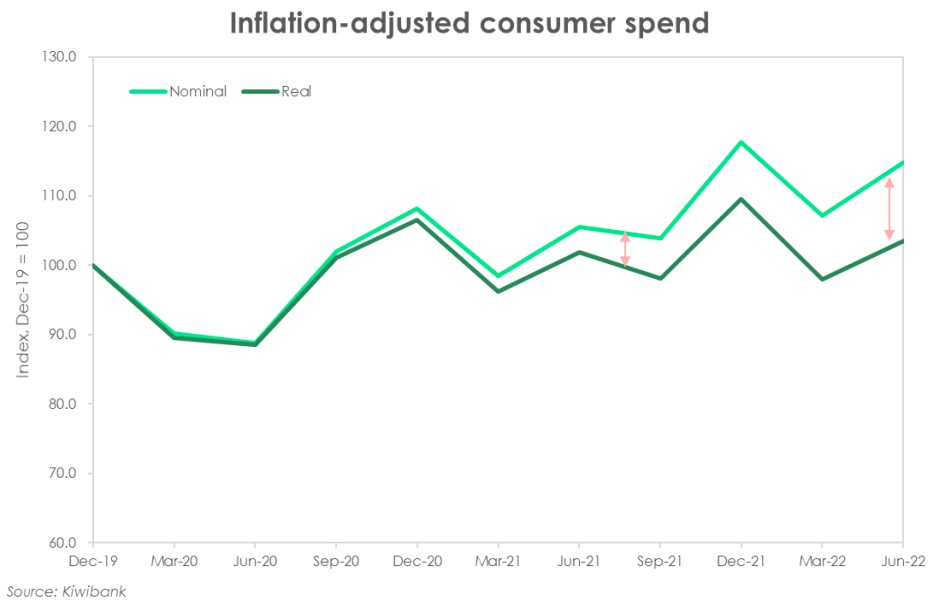

Spending bounced back in the June quarter, according to the latest quarterly release of spending data from Kiwibank customers but much of the bounce has come from higher prices - and actual transaction growth has been outpaced by dollar growth.

Kiwibank chief economist Jarrod Kerr, senior economist Jeremy Couchman and economist Mary Jo Vergara said after the knock to spending in the March quarter due to Omicron, consumer spending rose in the June quarter.

"Inflation, however, is also working behind the scenes. The continued rise in consumer prices is propping up the value of transactions. And the growth in dollars spent looks to be outpacing the growth in the volume of transactions," they said.

They said they suspect inflation was running at around 1.4% in the June quarter.

The slower rise in real spend may "suggest that Kiwi are tightening their purse strings".

Compared to a year ago, the value of Kiwibank credit card transactions is up by 6.1%. The number of transactions however is down 5.2%.

"Kiwi are tapping, swiping and inserting their cards fewer times."

The data showed that Kiwibank electronic card spend rebounded 7.1% in the June quarter after a 9% drop in the March quarter.

"The rise in spend was supported by the move into the Orange Covid traffic light setting, just in time for the Easter holidays. Hospitality spend was especially strong as vaxxed Kiwi were out and about."

The economists said entertainment spend rose 61% over the June quarter. "Despite Covid still in the community, we’re learning to live with the virus."

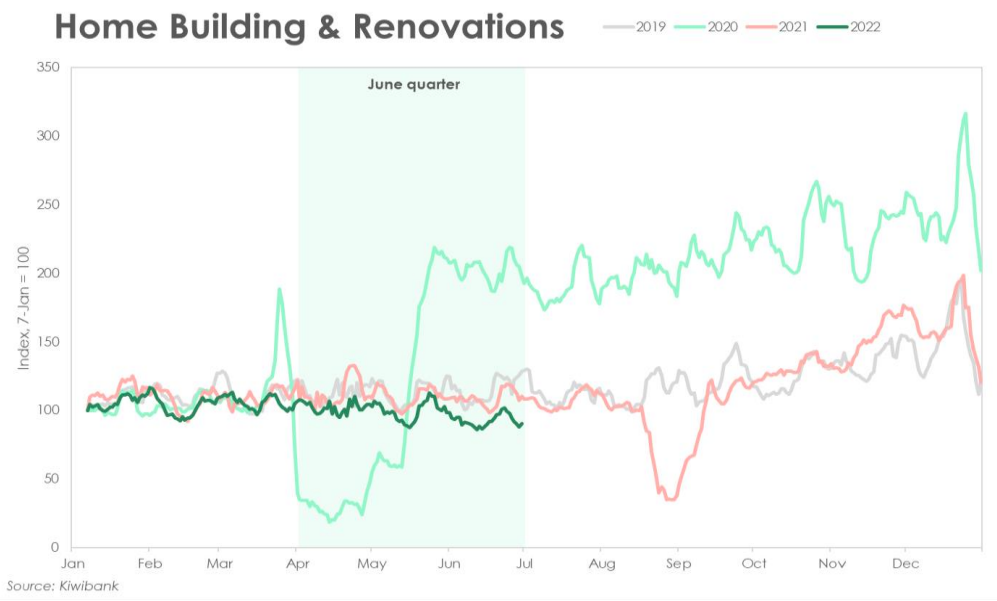

However, housing-related spend was down 1.5% over the quarter.

"Consumer confidence has hit record lows, credit is harder to get, and the housing market is in a sustained funk. Households are just not in the mood to splash out on big-ticket items. Kiwi are spending less on the home."

In particular, spending on hardware was 5% down in the quarter.

"Supply shortages of key building supplies are also likely to be playing a role here," the economists said.

"At present, inflation is particularly strong on anything building related. Therefore, the volume of spending on hardware must have taken an even larger tumble in the June quarter."

Flight booking spend continued to rise over the June quarter. Compared with a year ago, spend is up 107.4%.

"A decent chunk appears to be on international travel too. Card present spend offshore is well on its way back to pre-covid levels," the economists said.

"However, some of the international bookings will be one-way. We continue to expect a growing net migration outflow heading into the end of the year."

The emergence of new strains of Omicron "poses a risk to domestic travel spending".

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.