The value of the country's trade exports exceeded imports for the second month in a row in May.

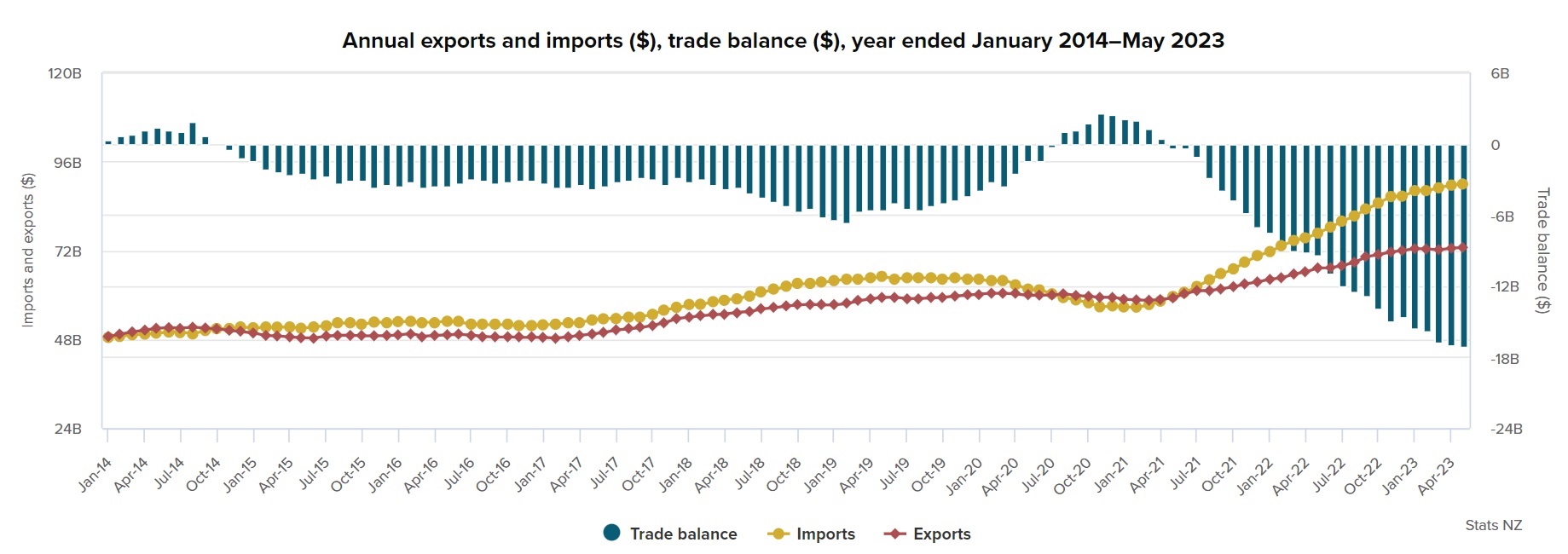

But that didn't stop the running 12-month deficit between exports and imports hitting a new all-time high of $17.1 billion.

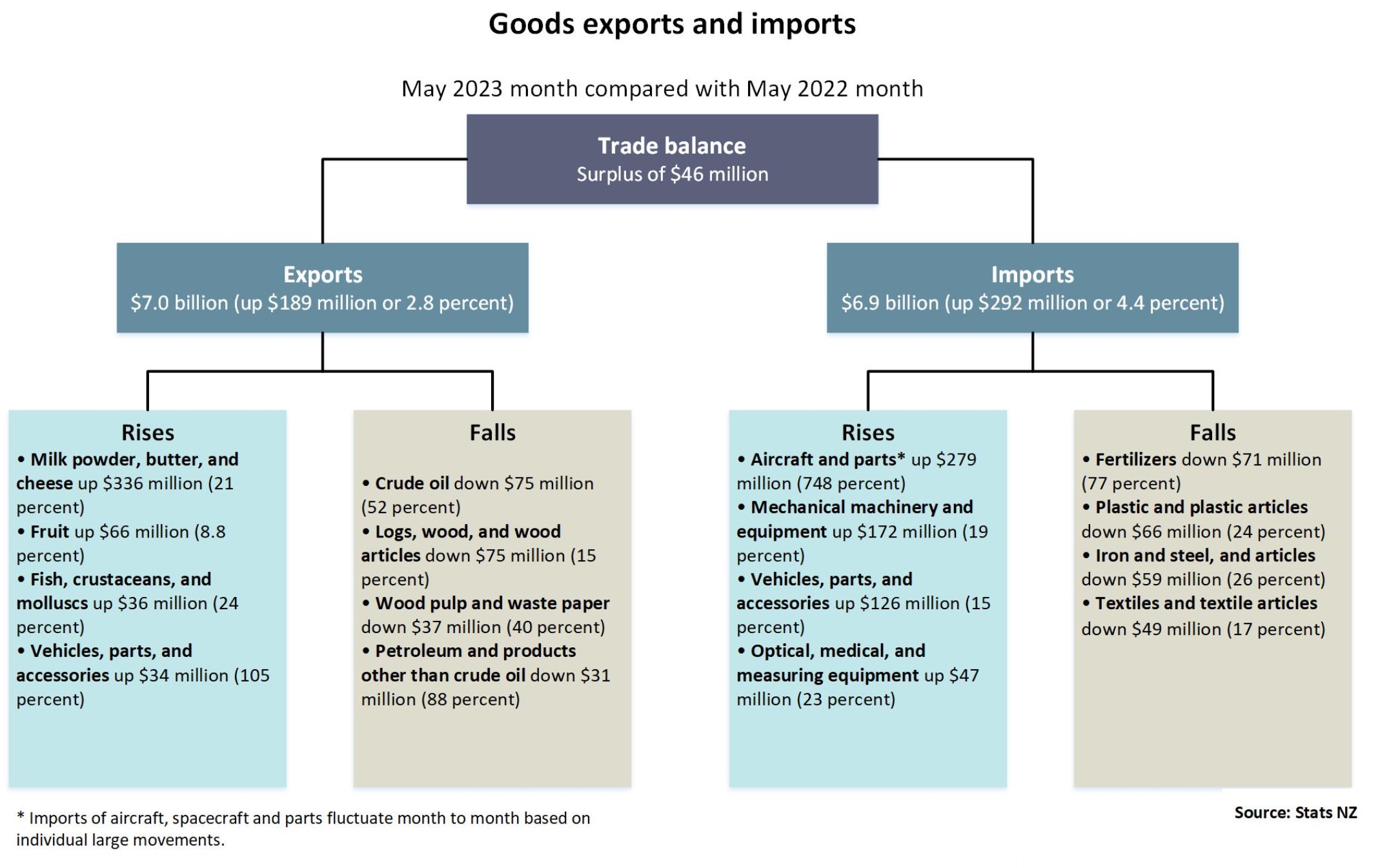

Stats NZ said that in May we had a trade surplus of $46 million, following on from a surplus of $236 million in April. These past two months have seen the first monthly surpluses in a year. However, both April and May last year were in surplus and recent history shows those two months usually do record a surplus.

And the reality is that the May 2023 trade surplus was down from one of $148 million in May 2022.

However, the latest month was affected by a bumper $317 million worth of the very volatile aircraft and parts imports. This figure was up $279 million (748%) compared with the same month a year ago.

Stats NZ describes the overseas merchandise trade statistics as providing information on imports and exports of merchandise goods between New Zealand and other countries, while the balance of payments figures (including the current account) record the total value of all the country's transactions with the rest of the world.

Figures released last week showed that our current account deficit dropped in March to $33 billion, which meant that it was now 8.5% of GDP, down from 9% in December. That's still very high and will be being watched by the international credit rating agencies.

But back to the latest merchandise trade figures, Stats NZ said that in May goods exports were $7.0 billion, which compared with May 2022 was up $189 million (2.8%). Goods imports rose $292 million (4.4%), to $6.9 billion. The figures are rounded.

Below are the highlights of the latest month's figures:

In terms of the annual figures to May and compared with the year to May 2022, annual goods exports were $72.8 billion, up $5.5 billion from the previous year. Annual goods imports were $89.9 billion, up $13.2 billion from the previous year. The annual trade balance was a deficit of $17.1 billion. In the year ended May 2022 there was a deficit of $9.4 billion.

During the early stages of the pandemic we were running monthly trade surpluses. In fact, as recently as April 2021 the rolling annual trade balance was in surplus.

Moody's Analytics senior economist Katrina Ell said it was impossible to do New Zealand's foreign trade figures justice without exploring the important dairy export category.

"As a reminder, the dairy industry directly contributes about 3% to New Zealand's GDP and 23% to merchandise exports.

"Headline dairy exports were up by an impressive 21% y/y [year-on-year] in May. Of that, the largest milk powder category grew an impressive 18%, primarily on higher quantities as unit prices were down by 21%.

"Dairy trade is relatively less sensitive than hard commodity prices to the unrelenting softer global growth picture and recent weakening in dairy prices is primarily on the back of improved supplies in the Northern Hemisphere. We expect relatively ample supplies will keep downward pressure on dairy prices in coming months."

Looking ahead, Ell said that consumer-sensitive imports will struggle "as earlier aggressive monetary tightening increasingly filters through to weaker retail trade".

"New Zealand entered a technical recession in the March quarter and domestic demand is not expected to get sustained relief as the Reserve Bank of New Zealand keeps its laser focus on ensuring inflation remains on an entrenched down trend.

"In the June quarter we're likely to see only a temporary bounce in activity from reconstruction efforts following the cyclone and flooding events that plagued the country from late January through to February."

19 Comments

A preview of our future when Gen Alpha get to vote. But then many will head to Aus mines, how ironic

The younger generations that are the noisiest when it comes to Climate, are also the most likely to head to Australia to work in their mines.

The CCC, climate change commission already want to shrink the ag sector and next will be the international tourists and students.

Ironically those industries help provide us with the foreign exchange we need

Catch 22

I don't think they're necessarily the noisiest when it comes to the climate, it was the 1960s to 1980s when people were protesting nuclear etc.

The '60s and '70s protests were dominated by issues such as the Vietnam War, environmental protections, women’s rights, homosexual rights and the anti-nuclear movement.

https://www.rnz.co.nz/national/programmes/afternoons/audio/2018750276/h…

They're probably more likely to go work in the mines because they don't want to spend half their working life in NZ paying rent to some 80 year old boomer or some corporate landlord that now owns the property after discharging the reverse mortgage.

"they don't want to spend half their working life in NZ paying rent to some 80 year old boomer or some corporate landlord that now owns the property after discharging the reverse mortgage."

The construct seems to ALWAYS revert to the property debate. If/when the economy sinks never mind about ppty prices, they will be lower than a tuber

I'd rather discuss how we should show respect to 80 year kiwis.

Forest Gump said it; "Stupid is as Stupid does" the fact that NZdan cannot lose his blinkered paradigm speaks more to his ability to think and the validity of his comments.

But I would ask the question, are there any stats that talk to who exactly are landlords in NZ? Media reports I read suggest most are post boomer generations, but are there any known facts. Or are NZdans comments what we truly think, just based on ill formed, ignorant assumptions?

I expect property prices play a part, but surely there are far more obvious reasons why young, fit and healthy people perhaps with no children are more likely to go overseas to work in the mines than an older, less fit, more settled and richer cohort.

The ones going to the mines are not necessarily the same ones making a fuss about climate change.

Yay.. We are making money from the world. That's how it should be. We should work hard to make things that the world would want.

A better idea would be to work smart. Let's make our money work harder to make things that the world wants. One key way to do that on-scale is if we make it much harder to make money off housing.

Quite staggering how much is energy importing.

Buy an E.V. ;-)

Quite staggering how much is vehicle importing.

Buy an E.Bike. ;-)

Yea everyone buy an EV and we can then import even more dirty boat loads of coal to charge them up… 👍

Or look into quiet mini wind turbines for your house and/or solar and/or if you're lucky enough to live rurally with a viable stream, mini hydroelectric. You can make hydroelectric from an old washing machine with the right knowledge. Less reliance on the system lowers personal risk of exposure and potentially long term cost

there's plenty of geothermal and wind generation just waiting for the demand / price signals to be built.

How far can you travel on 1.5 calories using different modes?

https://www.tiktok.com/@the.data.guy/video/7244176481935445294?_r=1&_t=…

I see that the exports of Fish, Crustaceans and Molluscs are up 24%. I hope this is being harvested sustainably or we could be banning oil exploration whilst also exporting our biodiversity. Resulting in a poorer population from reduced oil revenues and no way of collecting free kai moana as we have sent it all overseas.

Quite a drop.in fertilizer imports

Almost all to do with the natural gas prices which sets the underlying price of it. I bet we aren't importing less quantity.

It also is why our food prices have been going ballistic. It takes a season for the price to get through to retail, next year we might find food prices are actually going backwards instead, though likely Supermarkets will absorb this.

A lot of fertiliser comes in containers. Shipping prices have fallen a long way from the Covid peak. Also it has been wet, grass has grown through the summer so farmers didn’t need fertiliser. Product that wasn’t sold in the Autumn remains for spring so no need to re-order from overseas. Farmers are also facing 10% interest rates so only applying maintenance rather than capital fert. There is also a reduction in nitrogen use due to the new limits. All in all the market is falling.

Ah, the old conundrum, primary products our salvation. Yes, those nasty farmers who need to be reigned in to stop them polluting the streams we all used to swim in, you know, the ones just downstream of the town sewerage discharge.

The problem was strongly articulated by Professor Mike Joy who advocated serious destocking. Personally I have no arguement with his calls, it is just that they have consequences,...as he is finding out. His Uni. job with VUW has been disestablished, to try to solve the University's budget problems.

There is no "joy" in him losing his job, but it encapsulates the stark facts of NZ life. We have wonderful primary products to sell to willing customers. But the cost of being greedy as a nation (ie wanting a champagne lifestyle on a beer income) is environmental cost of pressures of primary production, on one hand, or, on the other, reducing primary exports to save the environment. The latter choice comes with a need to find alternative product to sell, or the acceptance of a more frugal lifestyle. And that choice inevitably will be evidenced by closure of universities, crummy transport, no new hospitals.

Of course, we can continue to do what we always have done,...borrow more foreign currency & hope for a miracle.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.