'The tide has turned' for the New Zealand economy, ANZ chief economist Sharon Zollner says.

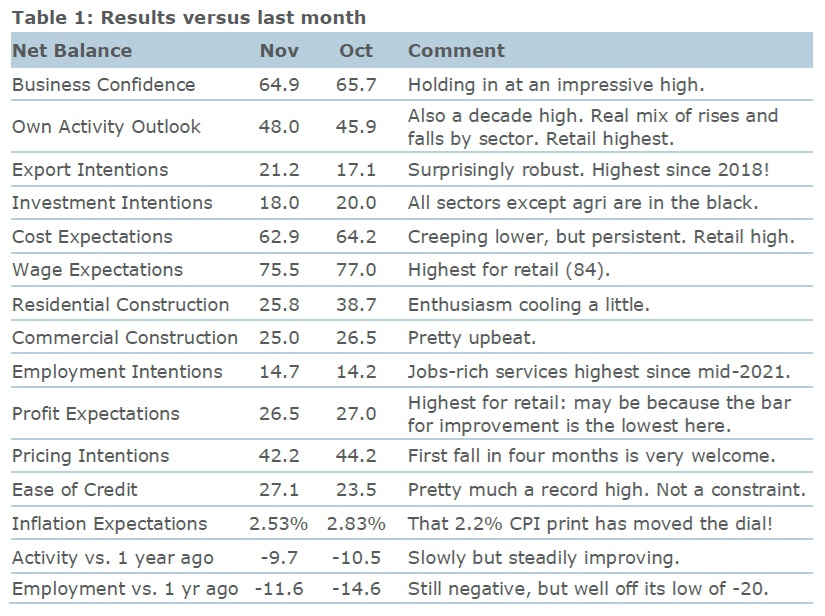

Results of the latest monthly ANZ Business Outlook Survey show that while business confidence eased very slightly - from high levels - in November, the measure of expected own activity rose again.

Zollner said the improvement in experienced activity also continued, suggesting that interest rate cuts are changing actual behaviour, not just expectations.

"The economy is clearly still very weak, but things are starting to turn higher."

She said the survey "does pour cold water" on the idea of large emergency Official Cash Rate (OCR) cuts being necessary to "scrape the economy off the floor".

"There is real pain out there – and both unemployment and business failures are likely to continue to increase for some time.

"But those two measures tell you where the economy has been, not where it’s going. Firms are saying that things are looking brighter," Zollner said.

Commenting on the survey results, Westpac senior economist Michael Gordon said the surge in confidence in recent months has followed the rapid turnaround in the Reserve Bank’s stance, from warning about the possibility of an interest rate hike in May, to delivering 75 basis points of OCR cuts (at the time of the survey) with the strong likelihood of more to come.

"We’re forecasting a 0.2% fall in GDP for the September quarter, followed by a modest 0.3% increase in the December quarter. The RBNZ’s forecasts in yesterday's Monetary Policy Statement were identical to ours. While the business confidence survey has certainly been more ebullient than other high-frequency indicators, it generally supports our view of a return to modest growth in the economy," Gordon said.

Zollner said that in good news for the RBNZ, inflation expectations dropped markedly in the latest survey, likely influenced by the announcment of an annual rate of inflation of 2.2% as of the September quarter. Pricing intentions also fell as did the average amount by which they intend to raise them.

"Cost expectations over the next three months eased slightly. Both cost expectations and pricing intentions remain above pre-Covid levels but are trending in the right direction.

"Firms’ numerical estimates of their own costs over the next three months eased from 2.3% to 2.0%, falling for every sector except retail.

"Business inflation expectations have fallen much more quickly than those of consumers.

"Not only are inflation expectations falling – firms (like the RBNZ itself) are also becoming more certain about their expectations. That will help cement price-setting behaviour that’s consistent with inflation at target."

Zollner said that reported expected ease of credit is at "pretty much" a record high.

"Credit conditions are, by this measure at least, not going to be a significant constraint on the economic recovery."

Business confidence - General

Select chart tabs

22 Comments

Creates a mental picture of Sharon in a lettered sweater, mini skirt and pom poms.

If your Christmas bonus depended on talking up sentiments so that gullible Kiwis borrow larger sums of money from your employer, this is exactly the kind of commentary you would provide.

Also, someone at ANZ must be snorting Christmas snow dust when writing those comments in Table 1.

"In good news for the RBNZ, inflation expectations dropped markedly, Zollner said, likely influenced by the announcment of an annual rate of inflation of 2.2% as of the September quarter. "

Shows how pointless it is to ask these questions. If their answer is based on what has happened, you may as well just look at what has happened.

The construction sector graph is looking down right delusional. Wishful thinking perhaps

Hard to say because it's such a varied sector.

My order book is full till 2026. I've hired another person and might take on two in the new year. The majority of other trades and tradies I know, are fairly flat out, some trying to hire, and some that laid people off 6+ months ago are now regretting their decision.

Canterbury’s economy seems a bit more resilient than most regions in the country

Maybe.

I'm not in Canterbury. Neither are some of the other companies I speak to.

So if there's optimism in the construction sector, it's potentially for a reason. Just maybe not distributed evenly across the country.

All dropping the OCR is going to do is to restart the lunacy that is the property market. We just don't learn, do we?

The_Golem,

I think it was Bernard Hickey who said that the NZ economy was a property market with a few bits and pieces tagged on. If so, then our only 'hope' must lie in rebooting the house market surely?

I have lived here in retirement for 21 years now and this is home, but I increasingly wonder whether any of my grandchildren will be able to stay, even if that want to. There are of course bright spots in the economy, but there are just not enough of them to halt a gradual descent into mediocrity.

Mediocrity is aspirational in Aotearoa

Except for our sailors

It really is. We don't have the drive and hustle of Americans, nor the maniacal approach to work of many East Asians, or the desperation of many developing nation workforces. We'll do enough to get by and then just chill by the beach.

Or summon our rich Anglo Saxon heritage of moaning about things without actually doing anything to improve things.

Wasn't always that way. Look at how this nation built infrastructure in the first fifty years of its founding. Roads, railways, power grids, ports. All done with fewer than one million population.

Motivation and incentive. Life's pretty good in 2024, there's not the impetus.

Its not all about property. Spare a thought for us entrepreneurs and business owners.

Sorry, we reward the value takers not the value makers. We subsidise and undertax lazy speculation on property, while taxing company income more than we should.

If we wanted to grow productivity - beyond lip service - we might change. But too many older politicians and voters are too invested in living beyond their means by having following generations pay the cost.

I'm reading but not feeling anything. If I feel anything, my internal balance triggers send out a psyops warning. Like reading propaganda on Ukraine repelling the Russian invasion, it's difficult to understand what's real and what's not.

Prospects locally, and especially in the EU with Ukraine, are still looking grim despite all the propaganda.

Load of garbage

Translation?

"The economy is about to go gang busters! Quick - by an 'investment' property before it is too late."

Many are doing just that.

It seems that the Greater Fools are returning.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.