The latest ANZ Business Outlook Survey is showing that the economy is recovering, "but that it's still hard going here and now", ANZ chief economist Sharon Zollner says.

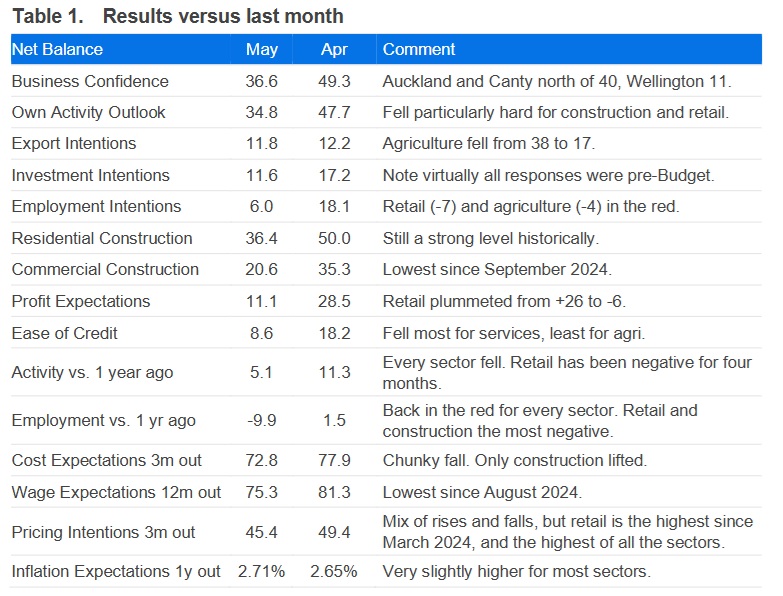

The May survey results show that business confidence fell 12 points to +37 in May, and expected own activity fell 13 points to +35.

"Past own activity (the best GDP indicator) fell from 11 to 5, while past employment fell back into negative territory at -10," Zollner said.

"Pricing and cost indicators are benign. One-year-ahead inflation expectations lifted marginally from 2.65% to 2.71%.

"Activity indicators overall continue to portray an economic recovery," Zollner said.

She said that as in the April survey there were movements within the month that were masked by the headline figures – "this time in a positive direction as the global turmoil settled down".

"There’s still plenty of scope for more volatility, but for now, some of the initial hit to confidence, own activity expectations, profitability and investment intentions has dissipated, but employment intentions continue to languish.

"Pricing and cost indicators eased. Inflation expectations are of particular interest, given the small lift seen in other surveys. It’s marginal stuff and consistent with the [Reserve Bank's] own inflation forecast.

Zollner noted that firms were still finding it "difficult to pass cost increases through to prices".

"Looking at the detail, firms on average expect costs to rise 2.5% over the next three months, while they expect to raise prices by just 1.7% over the same period," she said.

She said this was "an environment in which the RBNZ can support growth".

"Expected and reported wage increases were also benign. Overall, there are not any obvious grounds for the RBNZ to be overly concerned about the recent tick higher in some surveys of inflation expectations," Zollner said.

"If we start to get upward surprises on domestic data or inflation then that’s a different story, but failing that, we expect the RBNZ will ultimately take the Official Cash Rate to a low of 2.5% to shore up the economic recovery as it faces into global headwinds."

BNZ head of research Stephen Toplis said that for the BNZ economists, the key message they took from this survey is the ongoing pressure on businesses facing into the domestic economy.

"Activity levels might be holding up, but businesses are struggling to make any money out of it," he said

"Both the retail and construction sectors report that they expect profits to fall. While there is a tendency for businesses to be pessimistic regarding profitability, the weakness expressed in retail and construction is well below average. The fact that a net 61.8% of retailers still intend to raise prices might be as much about trying to stay afloat as anything else."

In contrast, Toplis said, the agriculture sector again stands out as the best place to be in the economy right now with profit expectations (relative to average) much stronger than any other sector.

"Folk in the cities would do well to remember that the country, as a whole, would be performing so much worse were it not for the income flows currently coming through rural New Zealand."

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.