The country's biggest bank is reporting that its customers' card spending dropped 0.2% last month on a seasonally-adjusted basis*.

A detailed data pack for June compiled by ANZ chief economist Sharon Zollner highlights that durables spending is recovering "but apparel and hospitality spending remains soft, though the annual decline is easing for these categories".

Nearly all store types saw annual growth in spending tick up again this month and most are now in positive territory in terms of year-on-year growth.

Overall spending is in fact up 1.5% compared with the same time last year.

However, Zollner says looking at the contributions of each category to total card spending growth shows that much of the annual lift is due to "a big jump" [up 3%] in consumables spending versus a year ago - "food price inflation of 4.4% year-on-year will have had a big impact" - as well as less of a drag from hospitality and housing durables.

"It’s only a rough proxy (the weights are off) but dividing total card spend by the Consumer Price Index (including our Q2 forecast) shows the trend in real card spending continues to be flat at best," Zollner said.

As the country's biggest bank, ANZ's figures for card spending are obviously a big contributor to overall card spending nationwide. And the ANZ figures reflect what's been seen recently with the electronic card transactions data put out monthly by Statistics NZ, with those figures for May having shown a 0.2% seasonally adjusted fall.

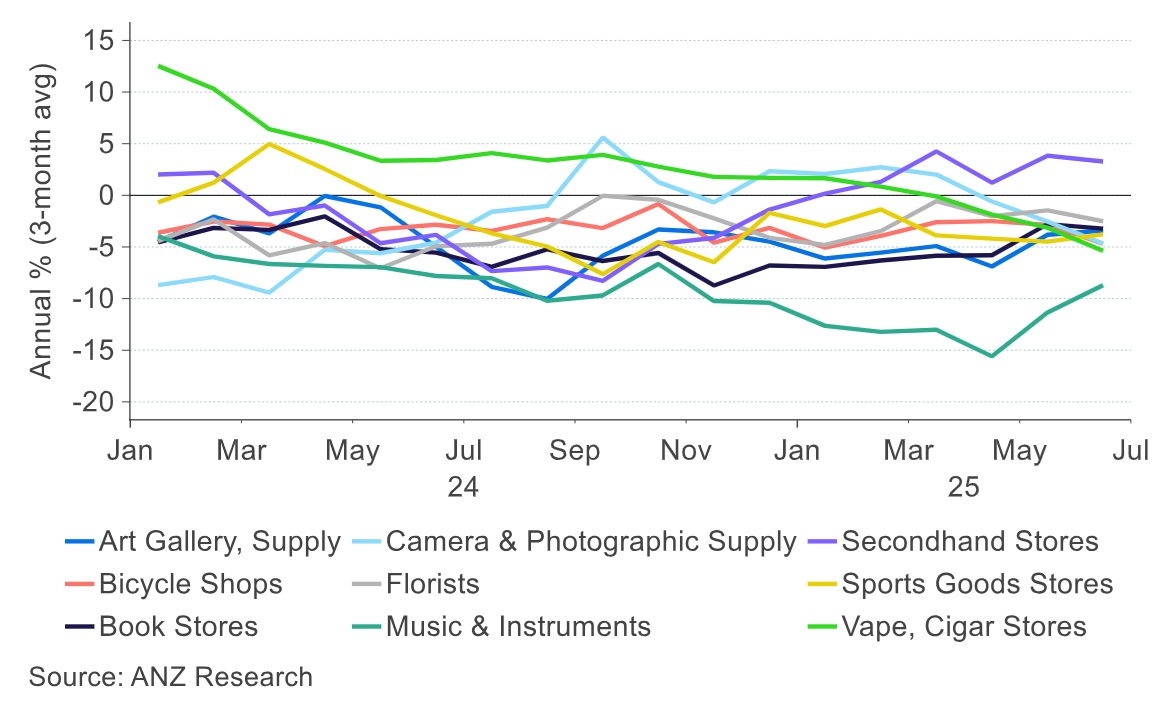

In terms of durables spending, Zollner says this is now increasing, and it's up 2.7% in the past year.

"There’s a wide range of performance in this sector, but overall, spending growth in increasing."

Zollner notes that second-hand stores are achieving the highest annual growth terms in this category, "suggesting there may be a degree of 'trading down' as households continue to watch their pennies".

Zollner says "birthday present" durables like musical instruments, bicycles and book stores are still having a tough time of it.

Spending at vape stores is declining.

"It may not mean less total spend on vapes; it could be that dairies are taking a larger market share. But it’s a marked change after exponential growth pre-2023."

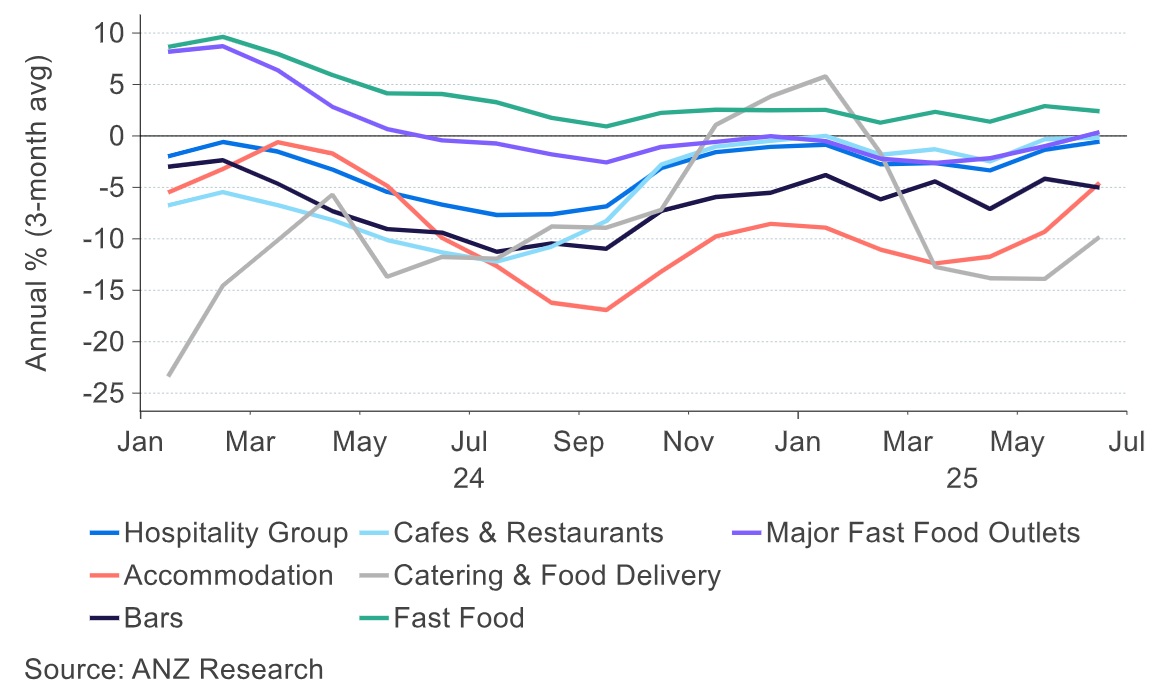

The year-on-year decline in hospitality spending is easing (to -0.6%), helped by a 0.3% lift this month, she says.

"There’s evidence of “trading down” here too, in the fact that fast food is outperforming other forms of dining out. Card spend at bars is down, but spend at liquor shops is too. So it’s not just that people are moving their social gatherings to the home."

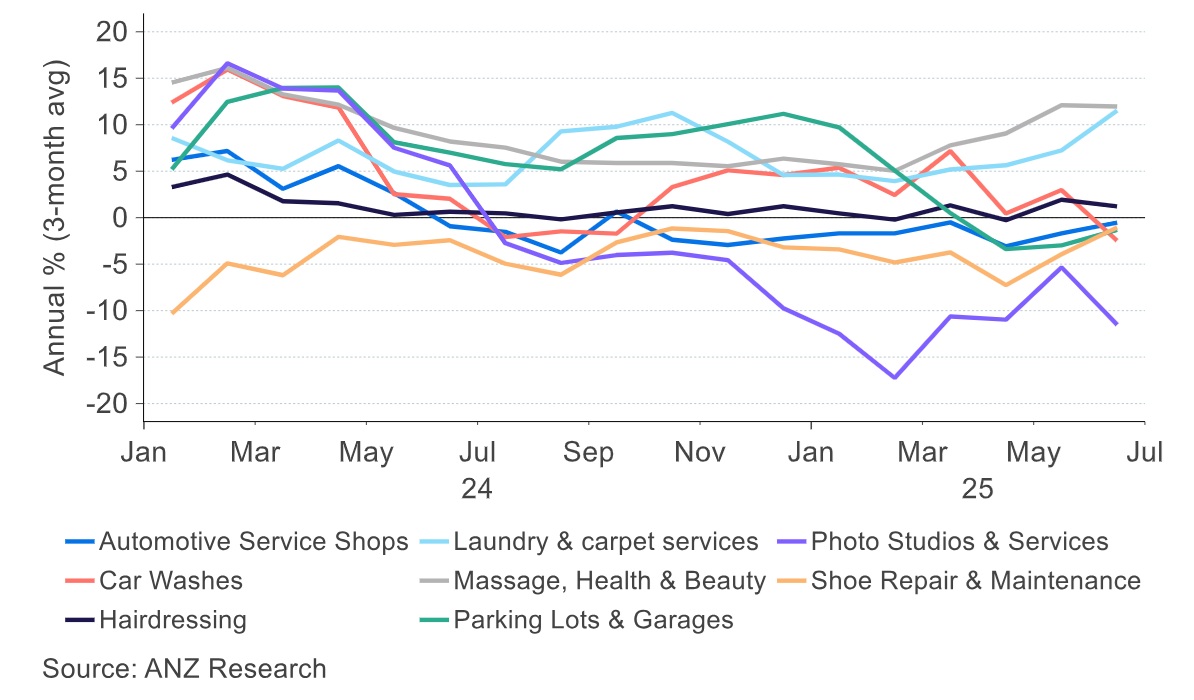

Zollner says services is another "very mixed category", but annual growth is positive, just, at 0.7%.

"We’re looking after ourselves, and carpets and our hair, but going DIY on photographing the results," she says.

*ANZ reports spend on a seasonally adjusted, 3-month average basis.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.