Business confidence as measured by ANZ's Business Outlook (ANZBO) survey for November has hit its highest level in 11 years.

And ANZ chief economist Sharon Zollner says the improvement in sentiment "is rooted in an improvement in experienced activity, not just hope".

"That provides a degree of reassurance that the lift will be sustained this time," she said.

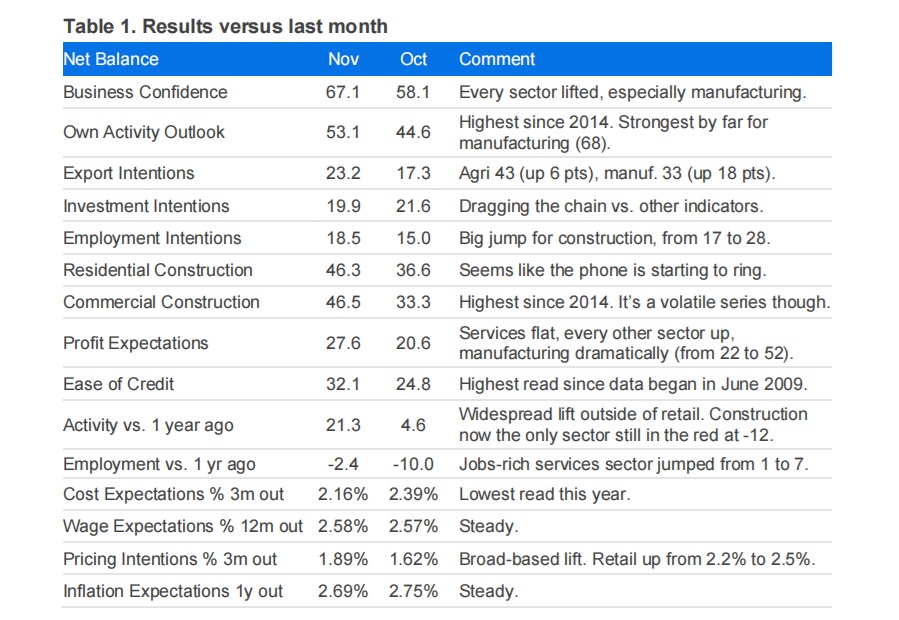

Business confidence rose another 9 points from 58 to 67 in November, while expected own activity lifted 8 points to a net 53%, also the highest in more than a decade.

"Encouragingly, the optimism seems rooted in recent experience: past own activity leapt from +5 to +21, the highest read since August 2021, while past employment lifted 8 points to -2," Zollner said.

Westpac senior economist Michael Gordon, commenting on the survey results, said this was the first month to fully capture the response to the Reserve Bank's larger 50 basis-point Official Cash Rate cut in early October.

"At face value these results would seem to endorse the RBNZ’s attempt to provide a ‘circuit breaker’ to get economic growth moving again. But we note that this particular survey was always at odds with the idea that businesses had fallen into a funk in the first place – confidence in the year-ahead outlook has remained high throughout 2025 and was only slightly dented by the US tariff announcement in April," Gordon said.

"What was most encouraging in the November survey was that there was evidence of an improvement in firms’ actual performance, not just their expectations."

ANZ's Zollner said with the recovery underway and CPI inflation at the top of the 1%-3% target band, "we don’t expect the RBNZ to cut the OCR again this cycle barring unexpected developments".

In the latest survey inflation indicators were "mixed", Zollner said, with the net percent of firms expecting to raise prices in the next three months lifting from 44% to 51%. That's the highest since March, but those expecting cost increases eased 2 points to 74%. One-year-ahead inflation expectations were steady at 2.7%.

"Reported past activity is suddenly looking much brighter for every sector except construction, though it is off its lows too," Zollner said.

"Reported past employment is also rising, off weaker levels."

The net percent of firms expecting to increase their prices lifted, while remaining in recent ranges, while cost and inflation expectations were little changed.

"Wellington remains the weakest region in terms of both experienced and expected activity, but it didn’t miss out on the improvement this month.

"The lift in past activity this month was broad-based regionally, but was particularly dramatic in Auckland and the South Island outside of Canterbury," Zollner said.

11 Comments

Maybe things will find an equilibrium at a sensible pace.

What's the shampoo ad, it won't happen overnight, but it will happen.

With no net immigration or property boom, how strong will the recovery be?

Maybe it'll actually be a recovery, rather than just another line of speed?

Surely anything lasting happens instantly with a nice cash injection, rather than slowly, over time.

yeah 2 lines

Nope.

With an energy and resource injection.

Sigh.

Even cash is just future-resource/energy-expectation proxy.

Not really sure why RBNZ cut rates again to be honest - inflation near the top end of mandate and now business confidence at 11 year highs.

See my remark other thread.

Business is told by the MSM, plus the vested-interest banks and by their own seekings-of-status (often so much life devoted to be a something, that there is not enough remaining to alter course anyway) that they can be confident.

No resource-depletion figures, no rate of entropy quoted - it's apparently all in the mind(s).

Good luck with that - tealeaf and entrail territory.

Business confidence is a pretty crap survey TBH. Most of the time it is as simple as "National good, Labour bad" (even though businesses probably do better under Labour).

Weird

I have believed for many years now that 0.25% cuts are almost pointless, its the big cuts that get things moving. Had the RBNZ only cut 0.25% last review, I doubt this survey would be anywhere near as good.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.