Businesses are indicating they will be looking to raise prices in coming months, according to the first ANZ Business Outlook Survey of the year.

And ANZ chief economist Sharon Zollner says the net percent of firms expecting to increase their prices [over the next three months] lifted sharply "and is heading in the opposite direction to the RBNZ’s [Reserve Bank's] inflation forecasts".

She says the good news in the latest survey is that much of the surge in activity indicators in December [when business confidence hit a 30-year high] has been largely maintained into January, despite the bounce in interest rates following the RBNZ's November Monetary Policy Statement (MPS).

"The next few months will show whether talk of rate hikes this year will snuff out momentum. That talk won’t be dampened by signals that inflation pressures could be turning higher in a way that doesn’t look consistent with the RBNZ’s (or our) inflation forecasts," Zollner said.

"It is very early in the economic recovery for that to be the case. Potential causes are rapid margin recovery (a risk the RBNZ talked about in the MPS), or the degree of spare capacity in the economy being less than expected," Zollner said.

"We are forecasting the first OCR hike to come in December this year, but if these pricing intentions manifest in hard data, it’ll come earlier than that.

"On the other hand, if the fall in the activity indicators this month proves to be the start of a meaningful loss in momentum, risks could tilt back the other way."

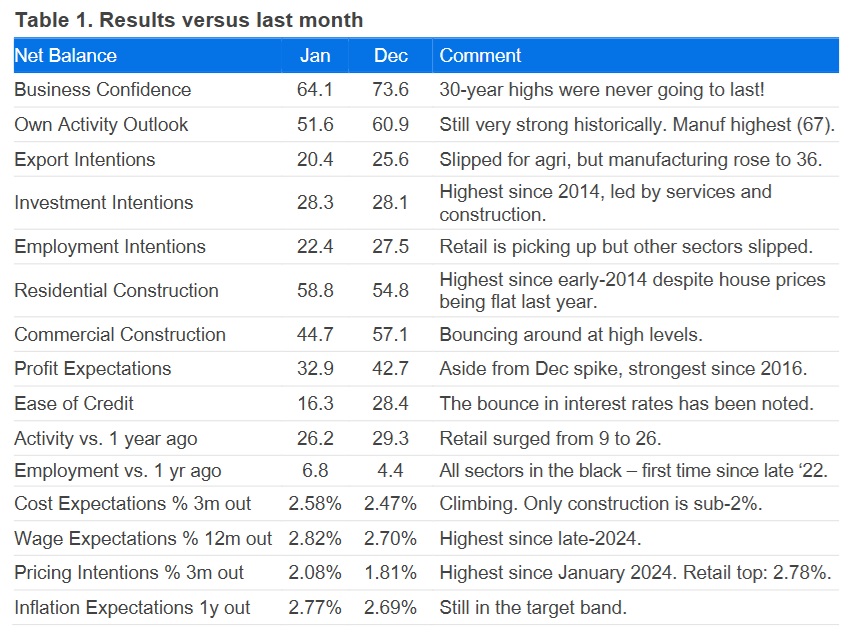

In terms of some of the detail in the survey, business confidence dropped 10 points from its 30-year high of 74 in December, "but at 64 it is still extremely strong". Expected own activity dropped 9 points, "but at 52 it is also historically very high".

Past own activity eased 3 points to 26, the second-highest read since August 2021, while past employment lifted 3 points to +7, the highest since October 2022.

Inflation indicators were up: the net percent of firms expecting to raise prices in the next three months lifted 5 points to 57%, the highest read since March 2023, and the amount by which firms expect to raise prices also lifted from 1.8% to 2.1%, the highest rate in two years.

Wage pressures are starting to lift modestly and inflation expectations are the highest in 15 months.

"The economy has clearly turned higher. Reported past activity (the best indicator of GDP) is suggesting a solid Q4 GDP result could be on the cards, with a broad-based lift, and the strength has been largely maintained into January," Zollner said.

6 Comments

Bodes well for a coalition return

Still think last OCR cut was a monetary policy error.

Is this the shortest interest rate cycle ever.

Yes and a very highly elevated, low part, of this cycle......

The current housing market values require 3% mortgages, to just sustain current values.

Market "growth" needs less than 2.49% mortgages.

The market is kaaaaarked.

The market needed 3% mortgages to sustain 2021-2022 prices.

The bigger concern should be on jobs and businesses Normally there's been sufficient "good times* before a rate hiking cycle to help sustain through a recessionary period.

Instead there's been maybe 12-18 months of just ok trading, after a couple of years of taking a beating.

Yes agree.

I still see these current values as unsustainably, much too high.

Untill rental yeilds revert to between 7 to 10%, the market wont find many buyers.

Buyers paying today prices, are risking soo much!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.