RBNZ

ANZ economists say consequences of big dry growing at 'exponential rate'

Loan to value ratio caps and increased sectoral capital requirements seen as the biggest threats to bank profitablity out of the RBNZ's macro-prudential tools

8th Mar 13, 4:07pm

1

Loan to value ratio caps and increased sectoral capital requirements seen as the biggest threats to bank profitablity out of the RBNZ's macro-prudential tools

Reserve Bank of New Zealand says it is to increase its 'on the record' communication

8th Mar 13, 10:19am

Reserve Bank of New Zealand says it is to increase its 'on the record' communication

Bruce Wills says the high dollar is why we need policy reform to help exporters become as competitive as they can be. Your view?

7th Mar 13, 11:28am

Bruce Wills says the high dollar is why we need policy reform to help exporters become as competitive as they can be. Your view?

NZ Bankers' Association wants more detail on RBNZ macro-prudential tools, raises issue of insurance in relation to LVR restrictions

6th Mar 13, 9:32pm

3

NZ Bankers' Association wants more detail on RBNZ macro-prudential tools, raises issue of insurance in relation to LVR restrictions

Matt Nolan looks at unemployment and calls for policies that help match employees skills to employers requirements in a positive way. Your view?

6th Mar 13, 9:26am

45

Matt Nolan looks at unemployment and calls for policies that help match employees skills to employers requirements in a positive way. Your view?

The Reserve Bank suggests it could use more than one of four macro-prudential tools simultaneously to cool excessive credit growth

5th Mar 13, 9:44am

4

The Reserve Bank suggests it could use more than one of four macro-prudential tools simultaneously to cool excessive credit growth

Roger J Kerr says borrowers who missed the bottom in swap rates just before Christmas have another opportunity to fix on this pull-back in market rates. You agree?

5th Mar 13, 9:16am

Roger J Kerr says borrowers who missed the bottom in swap rates just before Christmas have another opportunity to fix on this pull-back in market rates. You agree?

Kiwis' funds under management soar by 12.9% in the past year; biggest gain in recent history

4th Mar 13, 1:28pm

Kiwis' funds under management soar by 12.9% in the past year; biggest gain in recent history

Westpac economists believe RBNZ might use macro-prudential tools within a year to cool the housing market; LVRs won't be the weapon of choice though

4th Mar 13, 11:13am

11

Westpac economists believe RBNZ might use macro-prudential tools within a year to cool the housing market; LVRs won't be the weapon of choice though

The value of home loans on floating mortgages down almost NZ$14 bln since last April's peak as borrowers punt on fixing

1st Mar 13, 4:02pm

1

The value of home loans on floating mortgages down almost NZ$14 bln since last April's peak as borrowers punt on fixing

HiFX's Dan Bell takes a look at the correlation between the NZ dollar and gold price and the potential for US money printing to end

1st Mar 13, 11:38am

43

HiFX's Dan Bell takes a look at the correlation between the NZ dollar and gold price and the potential for US money printing to end

Nearly NZ$1 bln more loaned on houses in past month, most for nearly five years; amount loaned up 4% in the past year, the biggest rise for four years

28th Feb 13, 3:33pm

5

Nearly NZ$1 bln more loaned on houses in past month, most for nearly five years; amount loaned up 4% in the past year, the biggest rise for four years

Finance Minister Bill English expects macro-prudential tool memorandum of understanding with the Reserve Bank by mid-year

28th Feb 13, 9:46am

34

Finance Minister Bill English expects macro-prudential tool memorandum of understanding with the Reserve Bank by mid-year

Banks now voluntarily offering to reduce customers' interest rates in order to avoid bidding war with rivals and keep good customers

27th Feb 13, 4:14pm

4

Banks now voluntarily offering to reduce customers' interest rates in order to avoid bidding war with rivals and keep good customers

Matt Nolan explains that exchange rates are a symptom not a cause of our economic situation. He lists six possible reasons it is high and likely to stay there. Your view?

26th Feb 13, 12:12pm

55

Matt Nolan explains that exchange rates are a symptom not a cause of our economic situation. He lists six possible reasons it is high and likely to stay there. Your view?

Roger J Kerr sees the exchange rate as the main determinant of future inflation and growth, and therefore our interest rates. You agree?

26th Feb 13, 9:45am

1

Roger J Kerr sees the exchange rate as the main determinant of future inflation and growth, and therefore our interest rates. You agree?

Roger J Kerr says watch the Canadian dollar and you may see the future for the NZD is a lower track. Your view?

26th Feb 13, 7:59am

Roger J Kerr says watch the Canadian dollar and you may see the future for the NZD is a lower track. Your view?

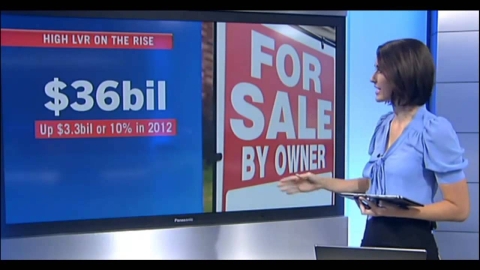

Big 5 banks, combined, post NZ$3.3 bln annual increase in home loans where the borrower has less than 20% equity

25th Feb 13, 4:23pm

4

Big 5 banks, combined, post NZ$3.3 bln annual increase in home loans where the borrower has less than 20% equity

Aggressive mortgage pricing to end as wholesale rates climb; market shifting rapidly to fixed rate deals

21st Feb 13, 8:37pm

5

Aggressive mortgage pricing to end as wholesale rates climb; market shifting rapidly to fixed rate deals

Weekly home loan approvals reach highest level so far in 2013, resuming strong run

21st Feb 13, 12:04pm

Weekly home loan approvals reach highest level so far in 2013, resuming strong run

Offshore analysts were close readers of RBNZ governor Wheeler's speech today. Here is what one thought

20th Feb 13, 6:30pm

1

Offshore analysts were close readers of RBNZ governor Wheeler's speech today. Here is what one thought

RBNZ's Wheeler says NZ$ "significantly overvalued", but no simple solutions; RBNZ ready to intervene in NZ$ "when circumstances right"

20th Feb 13, 3:42pm

27

RBNZ's Wheeler says NZ$ "significantly overvalued", but no simple solutions; RBNZ ready to intervene in NZ$ "when circumstances right"

New Zealand households don't have quite so many of their asset eggs in the housing basket as we thought, says Michael Littlewood

19th Feb 13, 3:06pm

10

New Zealand households don't have quite so many of their asset eggs in the housing basket as we thought, says Michael Littlewood

Roger J Kerr wants the RBNZ to state clearly it will not raise interest rates and it will introduce macro-prudential measures. You agree?

19th Feb 13, 9:08am

2

Roger J Kerr wants the RBNZ to state clearly it will not raise interest rates and it will introduce macro-prudential measures. You agree?