The Reserve Bank says the means of physically distributing money - the 'cash system' - is facing significant issues as the use of cash continues to decline.

And it says in the absence of a "policy response", the ability of physical cash to perform its role as a "trusted value anchor" for private money and the wider financial system will be under threat. ('Private' money includes digital money in bank accounts.)

"In other words, the cash system will be unable to meet our objectives," the RBNZ says.

It has released a discussion document 'Future of Money - Cash System Redesign' that looks at the issues around cash - and suggests solutions. This is the third discussion document in the RBNZ's Future of Money programme series. Submissions are being sought on the latest document by March 7, 2022 and the RBNZ is planning to have a summary of all the submissions to the three documents issued by April next year.

The RBNZ says the need for a policy response in the face of declining cash usage and the issues that is causing is "significant and urgent".

"We conclude that, in the absence of a policy response, the cash system will not be fit-for-purpose: the cash system’s lack of resilience will become acute; the ability of cash to perform its role as trusted value anchor for private money and the wider financial system will be under threat; and there will be a considerable reduction in the contribution cash makes to financial and social inclusion."

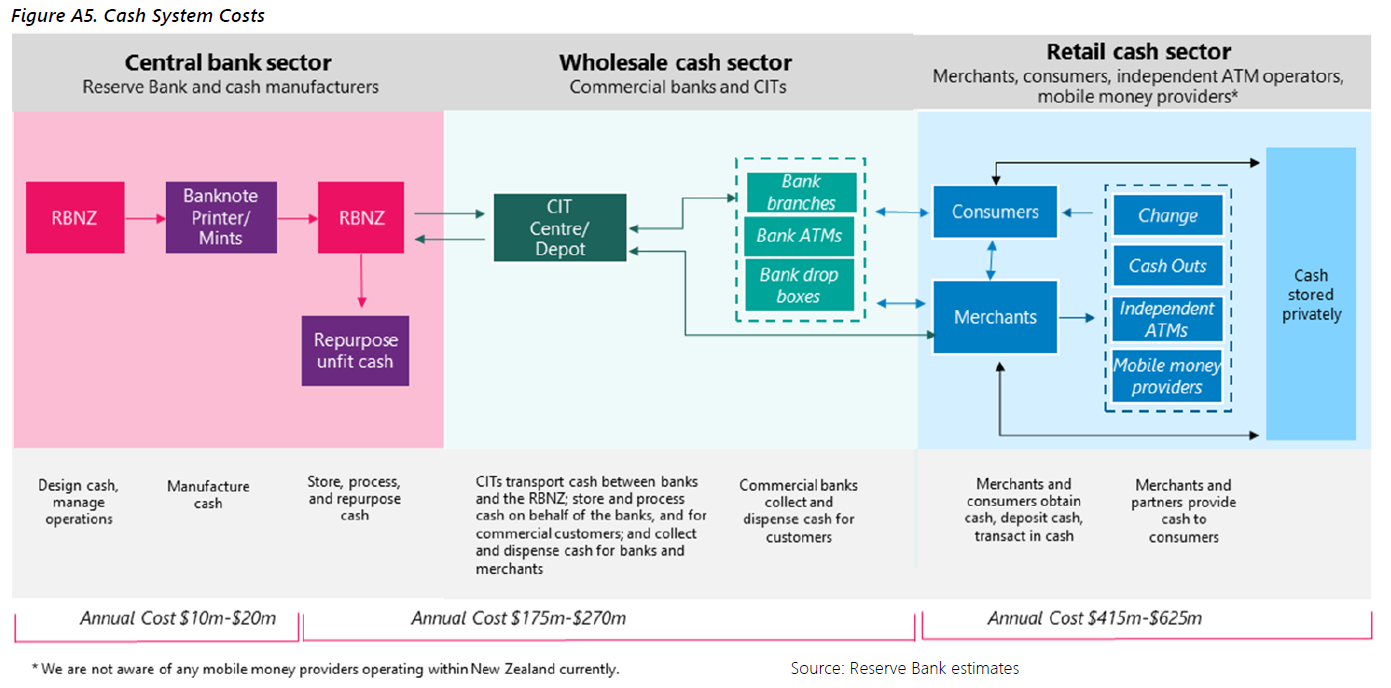

The RBNZ estimates that overall the cash system currently "absorbs resources" worth around $600 million to $900 million annually. The bulk of these relate to merchants accepting and dispensing cash.

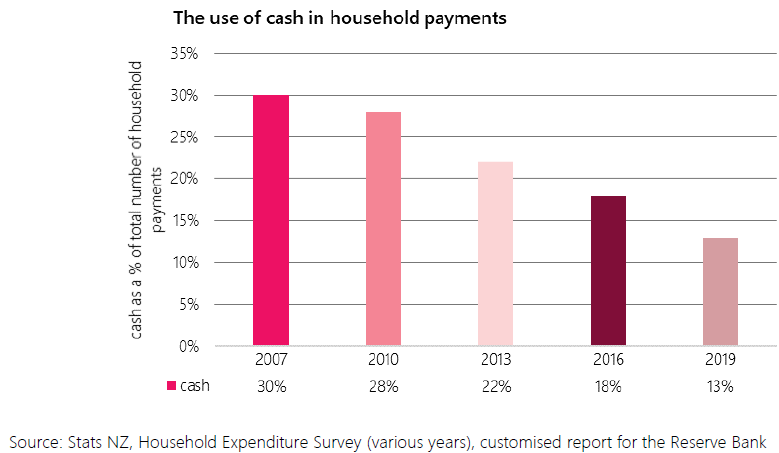

It says that a customised report based on Statistics New Zealand’s Household Economic Survey (‘HES’) that records data on payment methods shows that in 2019 cash was used for 13% of transactions, down from 30% in 2007.

"We expect an even lower figure when findings from the 2021 HES survey are released in 2022. The HES shows that the use of cash in transactions has been on a steady decline since 2007, when payments data was first collected in the survey."

The RBNZ has been surveying the public on cash use since 2017.

"The surveys, while disrupted by the Covid-19 pandemic, suggest there has been a reduction in the number of people using cash as a way to pay (71% of New Zealanders in 2020, down from 96% in 2017 and 2019.

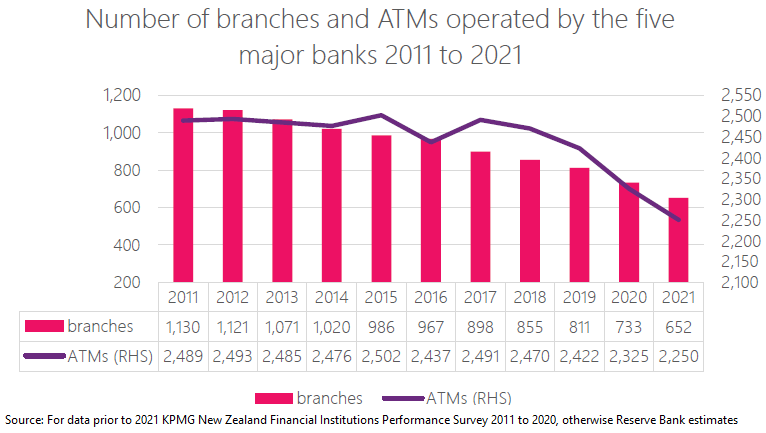

"Whilst the decline in bank branches began prior to 2017, in the period since 2017 alone the five large banks have closed over 25% of their bank branches, and many remaining bank branches appear to have begun operating on restricted hours.

"Based on the HES data, New Zealand appears to be among a small group of advanced economies that could be said to constitute the global ‘vanguard’ of declining cash use. Among the advanced economies, only the Nordic countries appear to report similarly low cash usage."

The discussion document says that in the RBNZ's view, cash continues to perform well as a value anchor as there is no apparent crisis of confidence in New Zealand-dollar-denominated money.

"However, we are not complacent. The decline in access to cash is affecting some people’s trust and confidence in banks. For example, the Banking Ombudsman has reported to us that some members of the public express concerns to them about the security of banks, particularly where banks appear to limit the ability to transact with cash."

The document says cash can only perform its role as a trusted value anchor for private money and the wider financial system if converting private money to cash is easy.

"That means the infrastructure that enables this is widely available, efficient for users, and resilient."

In the absence of a policy response, there is likely to be a ‘tipping point’ at which the network effects of a diminished cash system act to undermine the value anchor role of central bank money.

In the absence of a policy response, it seems likely that the use of cash in transactions will continue to fall, to the extent that cash might practically cease circulating at all, the RBNZ says.

"Households and small businesses with surplus cash will store it rather than deposit it at their banks; large merchants might gradually replace cash-enabled self-service checkouts with card-only checkouts reducing their need for CIT [cash-in-transit] services; banks will largely succeed in migrating their personal and small business customers to a digital-only bank service model at the expense of genuine choice; pay-to-use ATMs will expand, but taking only some of the business formerly done by bank free-to-use ATMs; and households will transact almost entirely using digital payment instruments, using cash only for cultural activities and then at considerable expense.

"The counterfactual scenario we present does not seem unrealistic given that it bears a close similarity to the present-day reality in some of New Zealand’s more remote communities."

In terms of solutions, the RBNZ says as well as consolidating similar physical infrastructure, integrating functions vertically has the potential to save costs. Combining the supply, maintenance and on-going replenishment of ATMs within one entity, for example, may lead to operational efficiencies and reduced overheads. Business reorganisations of this nature are being witnessed in cash systems around the world.

"We currently conceive of the collaboration in the form of the creation of a ‘utility entity’, a stand-alone legal entity that could be jointly owned by a number of parties and performs a clear set of agreed functions within the system. One or more utility entities could be required."

A relevant question, however, is, ‘Who should pay for the costs of the system: bank customers when they access their account; bank shareholders; taxpayers; merchants; or providers of payment options that compete with cash?’

"This is a complex question. The public good nature of the benefits produced by the cash system suggests taxpayers should pick up some of the tab, and they currently do, covering the costs of the central bank sector and related policy functions."

Underlying the question of who should pay, is the question of who is paying now, the RBNZ says.

"Some of the policies raised for further consideration suggest a rebalancing of costs towards banks. In some ways, the question of what role banks play in the cash system – historically, now, and in the future – goes to the very essence of what it means to be a bank.

"Banks may prefer digital only, or digital-dominant, relationships with customers, but that has consequences for cash availability, which in turn affects the value anchor that we argue underpins private money. This is as much a social licence argument about banks’ relationships with customers, as it is an economic argument.

"Similarly, we raise the prospect of the government shouldering more of the costs by way of accepting cash when its agencies interact with the public and being directly involved in cash system utility entities."

RBNZ Assistant Governor Christian Hawkesby says the central bank is wanting input to develop the right set of policies to ensure the cash system is resilient and efficient in the face of changes in use and availability.

"We hope the option set presented today prompts discussion and debate, and identifies gaps or refinements."

The document sets out 16 possible policy responses that could help deliver a fit for purpose cash system and eight policies that could operate as a coherent ‘bundle’ to appropriately shape incentives and address the Reserve Bank’s objectives.

Hawkesby says the Reserve Bank plans to release a summary of submissions received on all three papers and an indication of next steps before the end of April 2022.

“We will firm up proposals up next year following the feedback we’re inviting now and then consult further before making final decisions,” he says.

This is the RBNZ's 16 recommendations, with what it calls its 'starter for 10' bundle of eight policies in bold:

- Achieve consolidation within the cash system via the creation of utility entities.

- Broaden access to wholesale cash.

- Accelerate setting of cash machine standards.

- Find efficiencies related to coins.

- Outsource core functions performed in the wholesale cash sector to an offshore supplier.

- Mandate acceptance of cash by merchants and government entities (requires decisions about scope, thresholds).

- Instigate the remuneration of merchants (or other retail cash sector cash service providers) by banks when a cash-out service is performed.

- The Reserve Bank remunerates merchants for cash quality checking.

- License ATM providers.

- An agency representing taxpayers contracts merchants (or other providers) to provide cash services.

- Use moral suasion to impact on banks' cost recovery strategies.

- Prescribe minimum standards for the services provided by banks.

- Create new tools that allow the Reserve Bank to direct banks to provide cash services, and at low cost to customers.

- Campaign to increase public awareness of cash issues.

- Financial incentives to use cash (e.g. a discount).

- Limit use of consumer rewards by payment card issuers.

24 Comments

"Use moral suasion to impact on banks' cost recovery strategies." A big stick would be better.

Regardless, customers will pay somewhere along the line- as they should.

How about increasing consumers confidence in the currency by implementing immediately a depositors guarantee at least equal to Australia's scheme .

A Deposit's Guarantee is all a bit psychological.

If it ever gets to the stage where one is needed, a forced merger between the failing bank and another will be organised. That's what always happens; be it another commercial bank or a Government entity. (NB: Even the relatively recent BNZ failure was engineered into the NAB. The St.George Bank/Westpac & BankWest/CBA 'mergers' at the onset of the GFC are probably other examples.)

Not in NZ, the OBR law bought in by National in 2014(?) says that depositors of the bank are the guarantors and hence can have their deposits taken.

Sure, there might be a financial crisis then a revolution if such a thing were allowed to occur on one of our big four banks, but that's the rules in this country. If house prices were to drop say 30% and the accountants of the aussie banks decided their NZ branch was no longer viable, depositors would be in the gun.

Thanks for looking out for the people of New Zealand, Don Key. Oh, amazing how you just happened to get that nice cushy role with ANZ just after you left huh?

It is interesting that the article has this statement "('Private' money includes digital money in bank accounts.)". Legally once deposited it becomes the bank's property. But that statement implies what i suggest the case should be, that depositors money remains the property of depositors. and more, that the banks are accountable to the depositors as to how they handle it (banking practices).

An important aspect to this debate is that banks have too much power now in my opinion and the big trap is if not handled correctly this will just give them more. Plus the lower socio-economic classes will be much more impacted by what happens in this area.

Legally once deposited it becomes the bank's property. But that statement implies what i suggest the case should be, that depositors money remains the property of depositors. and more, that the banks are accountable to the depositors as to how they handle it (banking practices).

A regulatory impact statement released by the Government alongside its plans for the incoming Deposit Takers Act. last week highlights some of the key points the IMF made. [my emphasis] Can someone point to a reference on the RBNZ's website where a record of banks' deposit taking actions can be viewed as opposed to deposit creation actions?

Because banks don't take deposits and they never lend money. They are in the business of purchasing securities. When one gets a bank loan, the loan contract is a promissory note. The bank purchases that contract from the borrower. Now the bank owes the borrower money and it creates a record of the money it owes, which we call deposits - source.

Same principle as central bank QE.

Demand deposits referred to by the public as “cash in bank” is recorded and reported by monetary financial institutions (MFI) in units of account by double-entry bookkeeping in a process which the MFIs call “lending ” — but which is effectively a nullity — by debiting loans receivable and crediting demand deposits.

These so created units of account are then denominated at will in dollars, pound sterling, euros, etc., depending on the terms of the documentation or underlying promissory note, or whatever is the legal document giving rise to this type of “lending,” using whatever is the name of the currency in the jurisdiction in which it takes place, but legal tender the “demand deposits” are not.

Banks do not have pre-existing funds in the form of legal tender to lend, except in miniscule amounts relative to the size of their loan portfolios.1 In other words, banks create demand deposits out of nothing, and it therefore remains a nothing. The malpractice continues because public accountants as auditors sanctify the aforementioned practice by “certifying” the banks’ financial statements, provoking credit expansion, moral hazard, asset bubbles, liquidity-stressed financial markets, bank runs, and eventually global financial crises. Link-pdf

Haven't they already said there is eventually going to be a 100k per bank guarantee. But as we have a relatively small number of banks some cash rich people maybe exposed even if they have the cash distributed across all the banks. I can imagine the outrage if anyone had money in deposits in banks , had some of it taken from them. FHBs who are saving for a deposit and only use one or two banks could ironically be some of the worst affected again.

Just incentivises the banks to gamble with even greater risk, really. A la South Canterbury Finance.

They take the profits, and if something goes wrong we foist the cleanup costs on the younger generations.

Finally some banks are waking up to the existential threat that central bank digital currencies pose for banks: Japanese banks are taking the initiative and announce they are going to issue their own digital currency. Of course we've had bank DC for ages. - Link

A war on cash. https://youtu.be/tKdIh8WkGQ4

I think we should do the opposite of what the RBNZ proposes: abolish cash (notes and coins) and give everyone an account directly with the Reserve Bank using a new block-chain-based currency, and the means to transact between individuals whether in New Zealand or overseas, and between the NZ currency and other sovereign currencies and cryptocurrencies. Trading banks would survive as mortgage lenders and interest-paying deposit-takers. The 'cultural' practices for which cash is now cited as necessary would quickly adapt. This would help to tame the black economy.

A financial transaction tax could be added at some point whereby the blockchain could painlessly clip the ticket of each transaction while maintaining anonymity; this might replace part or all of GST.

Why not put a chip in you hand so you don’t need cards also put in tracking device so government and banks know all about you forget about privacy lol muppet

That's a bit harsh. When you move money between bank accounts in NZ, I am pretty sure the bank and probably the RBNZ knows about it through their settlement information. So you are being "tracked" anyway when not using cash (debit/credit cards) now...

The worry is expired digital money. i.e credited to you account with direction on what you can spend it on and by when. i.e the ability to control you and how you spend.

The coming "chip" in the hand", or something that will resemble the evolution of the vaccine passport, containing financial and all other details, is no theory. Loss of the use of cash is the inevitable transition to everything digital where no transactions are anonymous and money is never out of the system. They will continue to tell us how the use of cash is in decline, whether a reality or not, because it is part of the preparation.

It's customary to add a /sarc tag....

According to the document, "cash in the hands of the public" has more than doubled since 2010, yet use of cash in household payments has more than halved over the same period.

I can only assume this means that there are a lot of people out there holding cash as a hedge against banking system failure. If this assumption is correct, it speaks volumes about the prevailing mood.

With regards to policy, the days of policy are long gone; we use fear to achieve political objectives now. If those in power decide that holding wealth outside the banking system is unacceptable, cash will quickly become demonised. It'll be the tool of drug-dealers and tax-dodgers, and probably a vector for disease, so if you're caught with it you must be a criminal, or a terrorist, or an anti-vaxxer or something. CBDCs will be the only way to keep our friends, whanau, and communities safe; they're also the only way ensure that modern monetary policies like deeply negative interest rates actually have the desired effect, even if they still don't make any sense.

You notice that not once the RBNZ makes the connection between the use of money and its property as a store of value. There are reasons for that. The main one being that they are actively diminishing money as a store of value.

What a load of twaddle. Talk about a smoke screen, Inflation and house prices through the roof but hey look over there this looks like this could be a problem, people are using less cash ! WooHoo no kidding since pay wave came along who can be bothered with cash anymore.

The reason why cash wont fit a trusted value anchor is because its not backed by anything only peoples confidence and the RBNZ keeps printing more of it to prop up the Ponzi scheme to keep the economy turning over in turn devaluing the dollar which causes assets to increase in value. They dont have anymore tools in the toolbox to use. This is not new it been going on for the last 1000 years and on average a currency last approx 50 years and then there is a reset and it starts again.

And when electricity fails? Sounds like not many lessons have been learnt from the Christchurch quakes.

Remember we live in NZ, the shaky isles, and on the rim of fire.

In other words, Fiat is imploding so the rules are going to change

Never waste a crisis

Bank statement to the PR people, Press Release needs to say: "People aren't using cash because we've made it harder to access it, as it eats into our profits and we can't have that.", "If we have to instigate negative interest rates having shafted every other option, if you take out cash we lose control. We can't have that either." Not in so many words, obvs, dress it up nicely, (and yourself too - I'll see you at Lunch!).

What's wrong with the cash economy anyway? Tax evasion on a $2,000 job? Or the fact that you can buy drugs with it? Last I looked the biggest tax evaders weren't plumbers and tilers, not sure that drug dealers are the biggest criminals in society either.

Once again, we would be screwed without Bitcoin.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.