By Roger J Kerr

The forces that were expected to pull the Kiwi dollar back from above 0.7400 to below 0.7000 through this period have been coming into play over recent weeks.

The US dollar itself has finally cracked the barrier at $1.1000 against the Euro and will continue to strengthen against all the major currencies as the probability of a Fed rate hike in December increases on the back of positive US economic data.

The RBNZ seem to be realising that their early August OCR cut and accompanying monetary policy statement was not strong enough in its message about continuing low inflation requiring more aggressive policy loosening.

The speech on inflation last week from Assistant Governor/Head of Economics, John McDermott did not say anything new, however the FX markets were keen to interpret the inferences as negative for the Kiwi dollar.

As anticipated, there has been significant unwinding of NZD/AUD speculative positions, pulling the NZ dollar down sharply from 0.9700 highs to 0.9300.

Local exporters selling into Australia in AUD’s have been rewarded yet again for being patient on the NZD/AUD cross-rate and not reacting to parity party predictions from some quarters.

The trading pattern of the NZD/AUD cross-rate over recent years has been rapid declines invariably following the steep movements upwards. The Australian dollar remains very stable against the USD at 0.7600 with no change to Aussie interest rates likely and their commodity prices also stable within defined ranges.

The NZ dollar is being sold by traders and speculators at this time as they reduce long NZ dollar positions, despite the local economic data remaining very positive i.e. strong business confidence and manufacturing data last week.

September quarter inflation data due Tuesday will further confirm why the RBNZ was not aggressive enough with cutting interest rates through the middle of this year.

The RBNZ can take comfort in the knowledge that OCR cuts will not stoke the over-heated housing markets as mortgage interest rates cannot be lowered by the banks, as the banks’ own cost of funds/borrowing margins continue to increase.

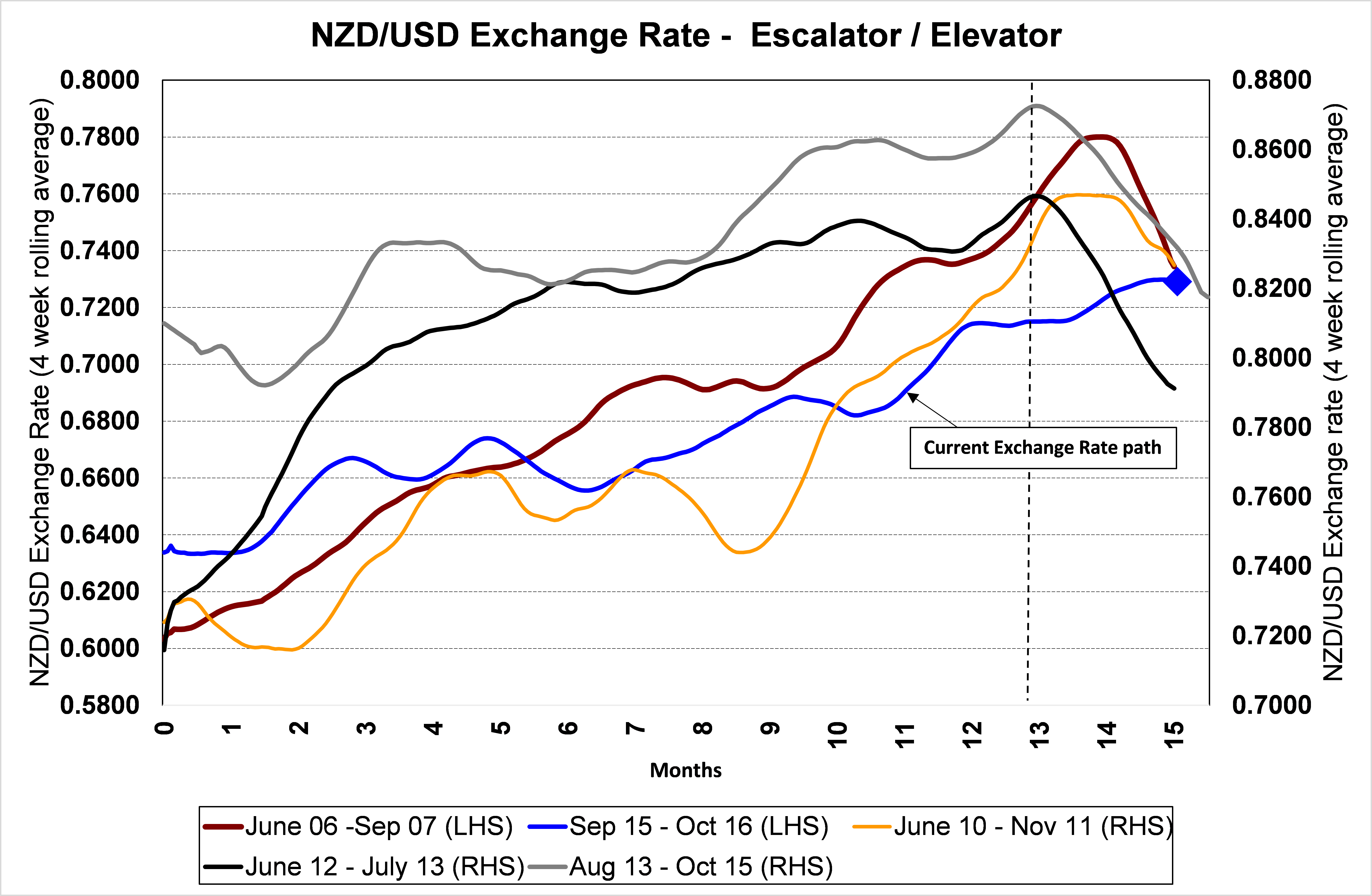

After 12 months of consistent gains from 0.6400 to 0.7400, the Kiwi dollar was very much overdue for a sizable correction downwards judging by the well-documented price movement patterns in the past of the Kiwi dollar climbing slowly up the stairs and then ultimately plunging down the elevator shaft.

The chart below confirms how history does repeat for the Kiwi dollar, however the latest 10 cent appreciation has continued for a couple of months longer than the typical uptrend period.

Daily exchange rates

Select chart tabs

Roger J Kerr contracts to PwC in the treasury advisory area. He specialises in fixed interest securities and is a commentator on economics and markets. More commentary and useful information on fixed interest investing can be found at rogeradvice.com

4 Comments

The issue with an OCR drop is that it's meaningless if the banks can't afford to lower their interest rates. How does the OCR drop contribute to more consumer spending if there's no additional cashflow available to borrowers? All it means is the clock is ticking on those who are borrowing to cover their interest payments.

I think the RBNZ has a view that the only way to achieve the 1-3% inflation target is to import inflation by reducing the exchange rate, via the OCR. As history now tells us, the exchange rate has gone up on at least the last 3 OCR reductions. As an importer, even if the OCR forced a small sell off of the NZD, I wont be racing out to increase prices as there is too much competition, so there goes that inflation theory.

As Mr Kerr points out - the majority of our currency movements are the result of currency speculators and traders who don't give a toss about the true value of the NZD or our economy - they are margin traders.

We were at 0.8559 in June 14 and yet today at 0.71 (which some drums still beat as being too high) - that's a 20% decrease and all that has really happened, is the US has stopped printing money and dairy prices came down (which if I remember correctly accounts for less than 20% of our economy). What needs to happen is the NZ Govt changes the inflation target of the RBNZ to 0-2% soon before the RBNZ goes down the same sorry path of Japan and ECB.

I think the RBNZ has a view that the only way to achieve the 1-3% inflation target is to import inflation by reducing the exchange rate, via the OCR.

The RBNZ should be careful what it wishes for.

Now Rogers called it, it's safe to say a good bet would be to do the converse.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.