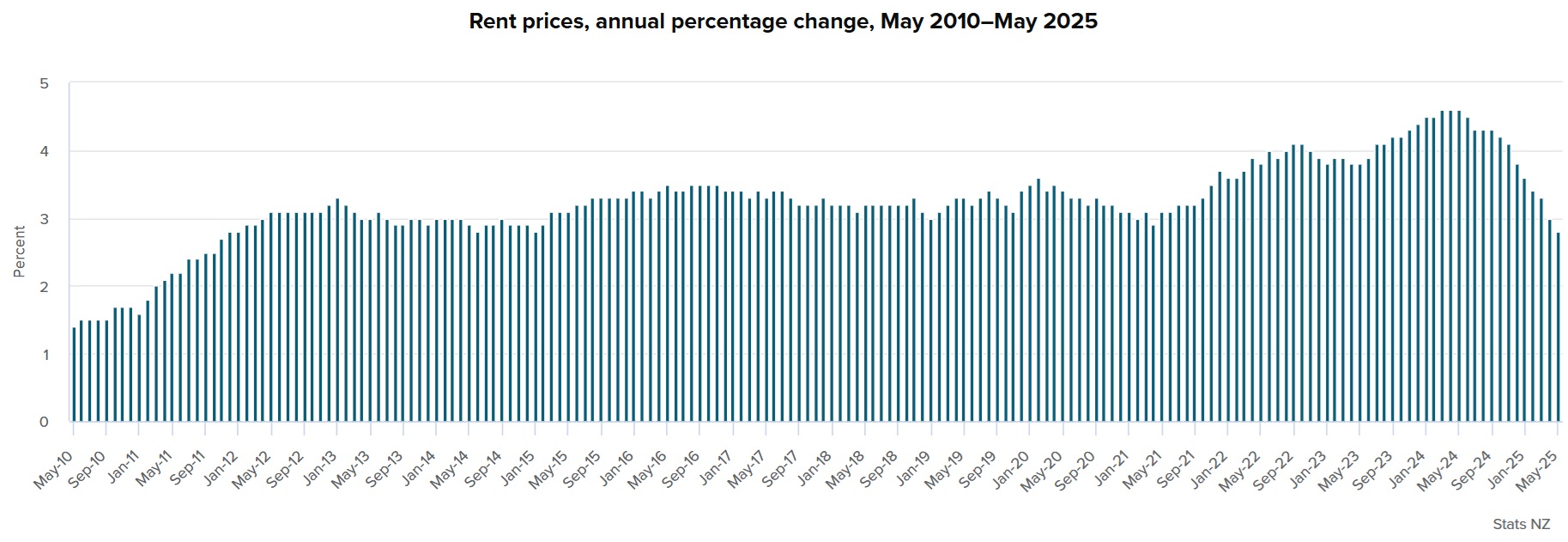

Food prices rose by 4.4% in the 12 months to May, but at the same time rents, up 2.8% in the year, had their smallest annual increase since 2015.

These are figures found in Statistics NZ's latest Selected Prices Indexes (SPI). The SPI is a monthly series that now features about 50% of the contributors to the quarterly Consumers Price Index (CPI) the accepted measure of inflation. So, they are a good early guide to what inflation's doing.

The annual CPI was 2.5% as of March, which is within the Reserve Bank's targeted 1% to 3% range. The RBNZ has been forecasting a temporary spike in prices this year and expects inflation to hit 2.6% for the June quarter and peak at 2.7% in the September quarter.

The June quarter figures are due for release on July 21. Based on the latest SPI figures the CPI looks likely to come in higher than the RBNZ is forecasting, although the lower rents will help. Major bank economists are seeing inflation as being higher than the RBNZ has forecast, and BNZ economists think it will breach 3% later in the year.

ASB senior economist Mark Smith said the SPI showed that underlying price pressures remain evident "in a number of pockets".

"Today’s figures suggest annual CPI inflation will likely remain parked towards the upper part of the 1-3% target range for much of 2025," he said.

"International oil prices are currently about 15% higher since the start of the month and if sustained could result in a higher annual CPI peak than our 2.8% Q3 expectation."

ASB economists have "pencilled in" a further 50 basis points of cuts to the Official Cash Rate by the end of 2025 [which would take it from the current 3.25% to 2.75%.

"But [we] suspect the RBNZ will want to see concrete signs that pricing pressures are easing before pushing the OCR lower. Readings for CPI inflation and inflation expectations will be pivotal."

ANZ senior economist Miles Workman said the figures "remained in the ballpark" of the ANZ's forecast for the June quarter CPI of a 0.6% quarterly rise and 2.8% annual increase. However, compared with ANZ forecasts there were "unders and overs" in the latest data.

"These data are pointing to slightly stronger tradable [imported] inflation than our [quarterly] forecast (ANZ: 0.0% q/q; RBNZ: 0.1% q/q) but weaker [quarterly] non-tradable [domestic] inflation (ANZ: 1.0% q/q; RBNZ: 0.7% q/q).

"Importantly, we continue to see mild upside risk to the RBNZ’s Q2 non-tradable inflation forecast."

Westpac economists raised their June quarter CPI forecast to 0.6% (quarterly) from 0.4% previously, mainly on the back of higher than expected food price rises.

Westpac senior economist Satish Ranchhod said under the surface, domestic (non-tradables) inflation is easing, but only gradually.

"Although rents and the more interest rate sensitive parts of the domestic economy have cooled, we’re continuing to see strong increases in regulated prices like household energy. We also expect another large increase in local council rates next quarter."

Ranchhod said 0n the tradables [imported] side of the equation, the earlier softness in prices has turned around.

"Notably the high food prices, which are boosting agricultural incomes, are also being felt at the checkout. That’s pushing tradables inflation back to firm rates after last year’s falls," he said.

"Our updated forecast for June quarter CPI is higher than the 0.5% increase the RBNZ assumed in their May forecasts. Importantly, it looks increasingly likely that inflation will rise back to the top of the RBNZ’s target band before year end."

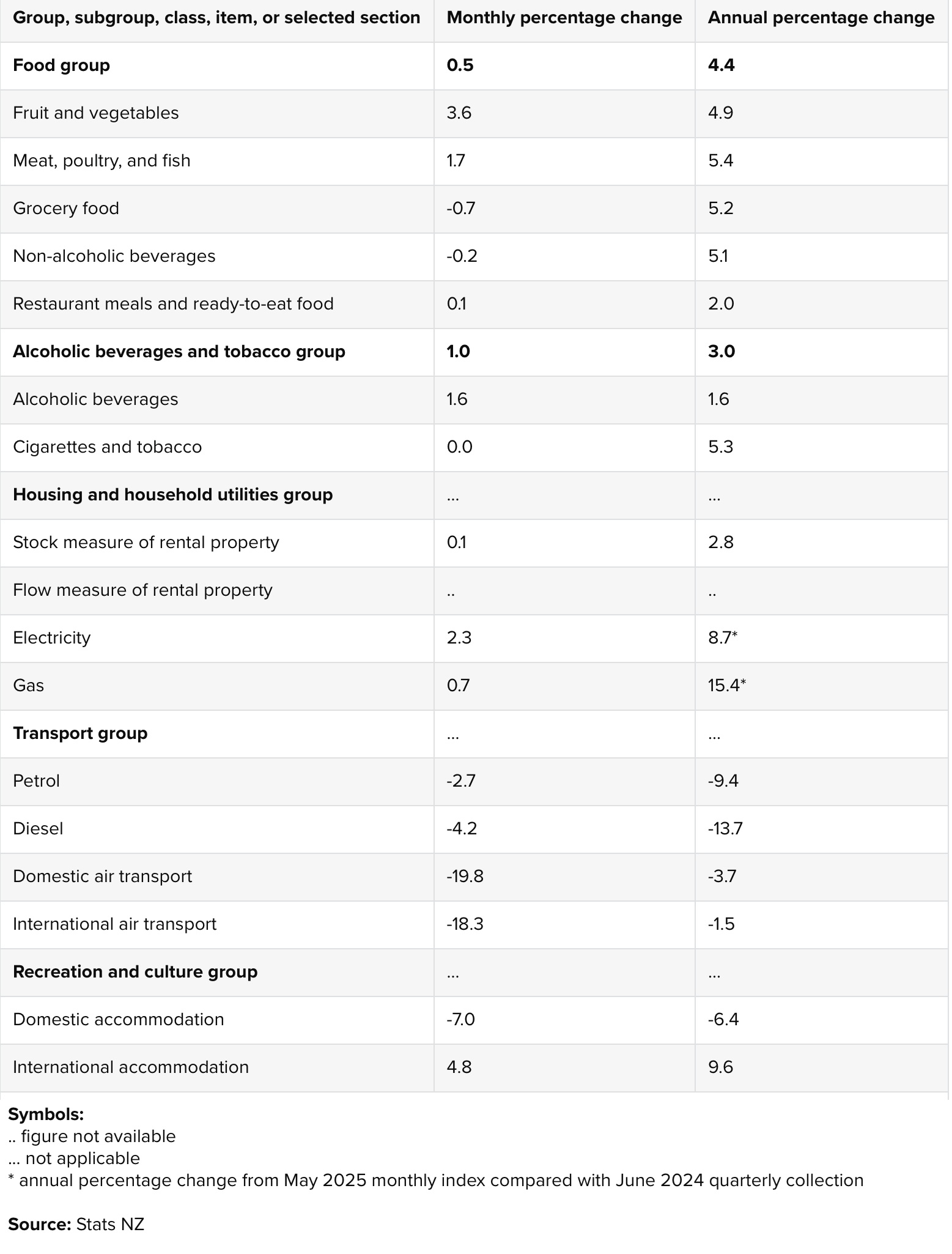

Stats NZ said food prices were up 0.5% in May, following a 0.8% rise in April.

Higher prices for the fruit and vegetables group and meat, poultry, and fish group drove the monthly increase, up 3.6% and 1.7%, respectively.

More expensive tomatoes, avocados, and cucumber drove the increase for fruit and vegetables, while higher prices for chicken nuggets and lamb leg drove the increase for meat, poultry, and fish.

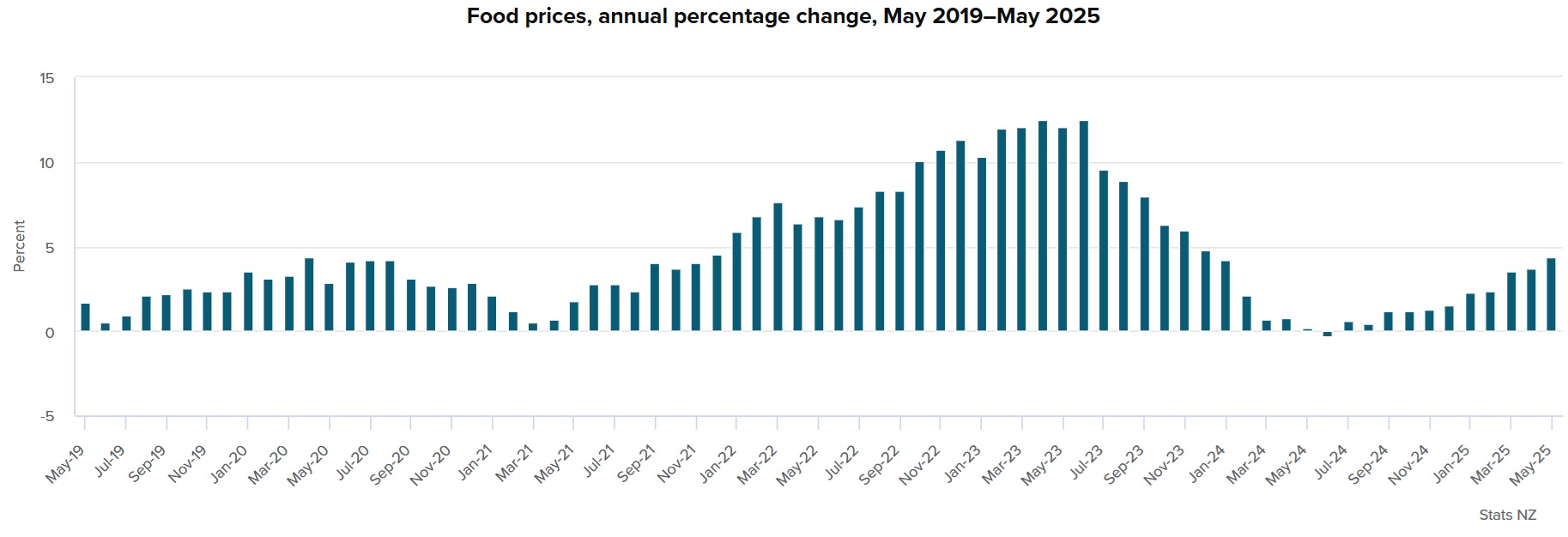

The 4.4% annual increase to May, was up from a rate of 3.7% as of April and is the highest 12 month figure since December 2023, at which point prices were coming down from the huge increases seen earlier - with food price inflation having hit 12.5% in June 2023.

Higher prices for the grocery food group and the meat, poultry, and fish group contributed most to the annual increase in food prices, up 5.2% and 5.4%, respectively.

“All five food groups recorded an annual price increase in May,” Stats NZ's prices and deflators spokesperson Nicola Growden said.

The price increase for the grocery food group was due to higher prices for milk, butter, and cheese.

The average price for:

- milk was $4.57 per 2 litres, up 15.1% annually

- butter was $8.42 per 500 grams, up 51.2% annually

- cheese was $13.04 per 1 kilogram block, up 30.1% annually.

“The cost of a 500 gram block of butter is nearly twice as expensive as the lower prices seen in early 2024,” Growden said.

The increase in the meat, poultry, and fish group was driven by higher prices for beef steak and beef mince, up 18.6% and 13.0%, respectively.

On the rent prices - these increased 2.8% in the 12 months to May, down from 3.0% in April and hitting the lowest rate of annual increase since January 2015, when prices also increased 2.8%.

“Annual rent price increases haven't been below 2.8% since 2011,” Growden said.

Other SPI prices showed that there was a partial reversal of some of the very big air fare rises seen in April, while the new electricity index showed a price rise of 2.3% in the month and an annual increase of 8.7%.

Here is the detailed SPI information as supplied by Stats NZ:

11 Comments

Inflation back on the trot upwards.....I just had another 20% hike in insurances.

OCR back to 5%. This inflation monster is getting out of hand again.

Still getting insurance increases? Mine hasn't risen since early 2024.

Why doesn't dairy have its own category?

Using System 1 thinking, people will complain about Chinese demand. In April 2025, consumer prices for dairy products were down 1.2% year-on-year. The annual average inflation rate for dairy in 2024 was -1.6%, indicating that retail dairy prices fell over the year.

https://www.statista.com/statistics/1446958/china-monthly-dairy-product…

Food prices up 4.4%

The Grocery Commissioner as set up by Labour is working as predicted.

So far as useful as ComCom as they have issued stern warnings XD

You have been a very naughty boy.....

So clearly rising dairy commodity prices are good for NZ Inc as we heavily rely on dairy to pay our way in the world.

But the double edge sword is that ordinary Kiwis then have to pay the 'world price' for dairy products leaving the inescapable conclusion that we get ripped in our own country.

We pay 'world' prices but we don't get 'world' salaries.

The fires of inflation are still burning and look to be hitting flash point again. Those taking the short term fix may eish to consider otherwise.

What if interest rates have to go up again....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.