Well, that's typical. It's always the last one that causes trouble.

The Reserve Bank now has three of its own surveys that look at future expected levels of inflation.

And after two of the latest sets of results were reasonably benign, it's the last set that's proven problematic and a bit of a headache for the RBNZ ahead of its decision on the Official Cash Rate on Wednesday of this week.

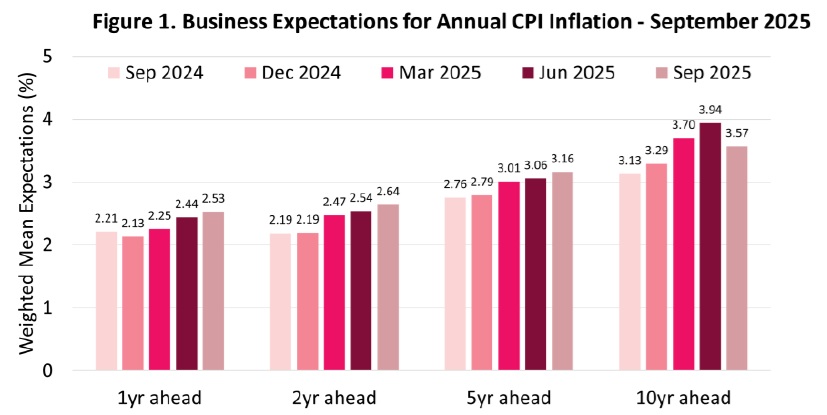

The second set of results of the RBNZ's new quarterly Tara-ā-Umanga Business Expectations Survey show Kiwi businesses are expecting inflation to rise across most of the time periods featured in the survey.

According to the RBNZ's summary of the results, business expectations for annual CPI inflation one, two, and five years ahead increased, while expectations 10 years ahead declined. The latest figures are compared with the June quarter figures that were the first official release for this survey earlier this year.

And the latest results are:

Mean one-year-ahead annual inflation expectations increased from 2.44% to 2.53%.

Mean two-year-ahead annual inflation expectations increased from 2.54% to 2.64%.

Mean five-year-ahead annual inflation expectations increased from 3.06% to 3.16%.

Mean 10-year-ahead annual inflation expectations decreased from 3.94% to 3.57%.

At the moment we have an actual annual inflation rate of 2.7%.

As said above, the RBNZ now has three surveys looking at expectations of future levels of key economic data - particularly expectations of the inflation rate. The new business survey is clearly the one that the RBNZ sees as becoming the key one - and it is likely to have quite an influence on the RBNZ in future when it comes to the bank making decisions on the OCR.

Whether we are yet at the stage where the RBNZ is prepared to completely trust the results in respect to OCR decision making is a key point. But the RBNZ had spent a lot of time trialling the new survey ahead of its introduction.

So, it is hard to say what the RBNZ will make of these results - but generally it wants to see inflation expectations 'anchored' around the 2% explicitly targeted level within the 1% to 3% range it is expected to maintain. It also doesn't want to see inflation expectations going up, as they have in this survey.

As we carried earlier, the more longstanding RBNZ Survey of Expectations that came out on August 7 and the Household Expectations Survey that came out on August 14 offered somewhat more encouraging results.

The RBNZ has spent a considerable amount of time and effort creating the new business survey and clearly intends for it to become a key resource over time.

The notable thing about the new survey - and an obvious reason why it should become influential - is that it has a big sample size.

The data for this quarter were obtained from 545 businesses by Research New Zealand – Rangahau Aotearoa on behalf of RBNZ. Field work for the September quarter survey was run between July 22 and 29 after the release of the June quarter inflation figures.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.