With August's Selected Price Indexes a touch weaker than expected, ASB senior economist Mark Smith says there's potential for inflation to potentially peak below 3% by the September quarter.

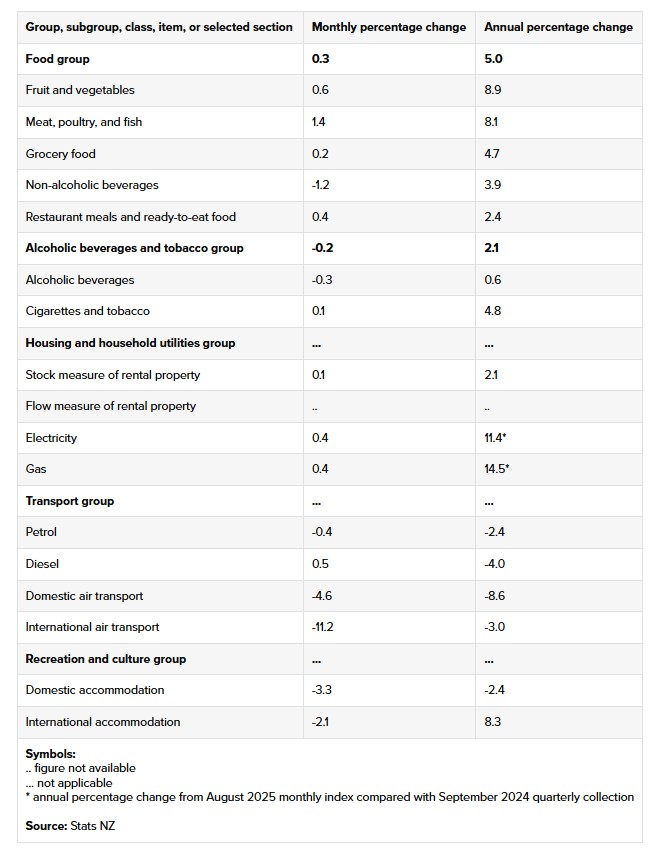

Annual food prices increased 5% in the 12 months to August, according to figures from Statistics New Zealand’s Selected Price Indexes (SPI), released on Tuesday. This is the same annual percentage increase as in the 12 months to July.

But while food prices have surged, rents have not. And the rent increase in the past 12 months has actually been the lowest in about 14 years.

Statistics New Zealand’s Selected Prices Indexes (SPI) is a monthly series that features about 47% of the contributors to the quarterly Consumers Price Index (CPI) - New Zealand’s official measure of consumer inflation.

The SPI includes monthly data on things like food, alcoholic beverages and tobacco, rental housing, utilities, transport and accommodation services.

Food prices make up about 18.5% of the CPI and rent now makes up just over 11% of the CPI so the SPI is a good early guide to what inflation is doing.

'This will be encouraging to the RBNZ'

Smith says the August data suggests "the trajectory for annual CPI inflation is firming but now highlights the possibility that CPI inflation may potentially peak below 3%" by the third quarter.

ASB has pencilled in a 2.9% September quarter outturn.

In its August Monetary Policy Statement, the Reserve Bank’s Monetary Policy Committee expected inflation to remain within the Reserve Bank’s (RBNZ) targeted 1% to 3% range - projecting inflation to reach 3% in the September quarter.

Smith says: "This will be encouraging to the RBNZ."

"There are good reasons to expect inflation to move lower by year end and into 2026 and the RBNZ view the large margin of spare capacity as being sufficient to drive annual CPI inflation towards 2% in time."

ANZ senior economist Miles Workman says following Tuesday’s SPI figures, “inflation pressures are tracking broadly as the RBNZ expect”.

Meanwhile Westpac NZ senior economist Satish Ranchhod says its forecasting inflation will rise to 3.1% in the September quarter but "we continue to expect that overall inflation is heading back to 3% before the end of this year".

Food

Higher prices for the grocery food group, which was up by 4.7%, contributed most to the annual increase in food prices.

Statistics New Zealand’s prices and deflators spokesperson Nicola Growden says dairy products continue to be the main driver for the higher annual food prices.

Food prices index

Select chart tabs

The price increase for the grocery food group was due to higher prices for milk, cheese and butter.

The average price for milk was up 16.3% annually - at $4.72 per 2 litres and cheese was up 26.2% annually - at $12.89 per 1 kilogram block.

Butter was up 31.8% annually and its average price was $8.58 per 500 grams.

These average prices represent the cheapest available option for each, according to Statistics New Zealand.

The next largest contributor to the annual increase in food prices was meat, poultry and fish.

This group increased 8.1% and this was driven by higher prices for beef steak, beef mince and lamb leg.

Growden says the average price for beef mince was $22.53 per kilogram in August. “That’s an increase of $3.40 in just one year.”

Fruits and vegetables rose 8.9%, restaurant and ready-to-eat food increased 2.4% and non-alcoholic beverages went up 3.9%.

Alcoholic beverages, which Statistics New Zealand counts separately from the food group, went up 0.6% while cigarettes and tobacco increased by 4.8%.

Rent prices

Rent prices went up 2.1% in the 12 months to August. This follows a 2.4% increase in the 12 months to July 2025.

“The last time annual rent price increases were under 2.1% was March 2011.”

Utilities like electricity and gas saw annual percentage increases of 11.4% and 14.5% - Statistics New Zealand points out this is from the August 2025 monthly index compared with the September 2024 quarterly collection.

Transport

Petrol decreased by 2.4% annually and diesel also saw a dip of 4%.

When it came to domestic air transport, there was an annual 8.6% decrease while international air transport went down 3%.

Alongside this, domestic accommodation went down 2.4% while international accommodation increased to 8.3%.

Inflation

Following the release of July’s SPI figures, Westpac senior economist Satish Ranchhod said at the time that July's figures were firmer than expected, reinforcing "the picture of a lift in near-term inflation pressures".

"We've been forecasting that inflation would rise back up to 3% in the final quarters of this year” and July’s SPI results “suggest that it could rise even higher”, Ranchhod said.

In August, the Reserve Bank cut its Official Cash Rate (OCR) to 3% from 3.25%. And an OCR low point of 2.5% is now seen as a real possibility by the Reserve Bank.

In its August Monetary Policy Statement, the Reserve Bank’s Monetary Policy Committee expected inflation to remain within the Reserve Bank’s targeted 1% to 3% range.

“However, with inflation projected to increase to 3% in the September quarter, there is a material possibility that it rises above the target band,” the statement said.

Inflation was expected to return to around the 2% target midpoint by mid next year.

“The period in which this is most likely to occur is too soon for monetary policy to have any meaningful effect,” the statement said.

“However, if inflation were to remain higher for longer than expected, there is a risk that this influences inflation expectations and wage- and price- setting behaviour over the medium term."

In the June quarter, annual inflation increased to 2.7% from 2.5% in March. Despite the slight increase, economists at the time agreed the annual inflation rate was softer than their expectations.

Here is the detailed SPI information as supplied by Statistics New Zealand:

4 Comments

My guess is this is why retail sales are up, not so much people are spending more voluntarily, but they have to spend more on necessities.

Sales growth can look like its increasing, but it's not. Sales vol is measured in currency value terms. As you say, people are having to spend more on non-discretionary purchases, which means less share of wallet for non-discretionary purchases. So the nice-to-have categories are getting walloped. Starts with all the stuff like craft beer, deli food items, etc, then filters down to more frequent FMCG purchases that are higher priced. Store brand sales positioned on price start to grow.

So up when diesel/petrol down.

So what's going to happen if energy starts to climb?

Nervous?

SPI doesn't include Rates and Insurance?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.