There's a possibility inflation could go over 3% before the end of this year, Westpac NZ senior economist Satish Ranchhod says.

This comes as food prices continue to rise - jumping 5% in the 12 months to July, according to figures from Statistics New Zealand’s Selected Prices Indexes (SPI).

This tops the previous 4.6% increase in the 12 months to June, which at the time, was the biggest annual rise since December 2023.

The SPI is a monthly series that features about 47% of the contributors to the quarterly Consumers Price Index (CPI) - New Zealand’s official measure of consumer inflation.

The SPI includes monthly data on things like food, alcoholic beverages and tobacco, rental housing, utilities, transport and accommodation services. It’s a good early guide to what inflation is doing.

Ranchhod says July's figures were firmer than expected, reinforcing "the picture of a lift in near-term inflation pressures".

"We've been forecasting that inflation would rise back up to 3% in the final quarters of this year. Today's result suggest that it could rise even higher."

"Some of that is due to volatile items like international transport," Ranchhod says. "But we’re also seeing firmness in other areas, like energy costs, which is unlikely to reverse."

Food

Grocery food was up 5.1% and contributed the most to the annual increase in food prices.

The price increase for grocery food was due to higher prices for milk, butter and cheese. The average price for milk was $4.70 per two litres - this is up 16% annually while butter per 500 grams was at $8.59 and up 42.2% annually.

The average price for cheese was $13.01 per 1 kilogram block, up 29.5% annually.

These average prices reflect the cheapest available option for each.

Statistics New Zealand’s prices and deflators spokesperson Nicola Growden says "in the 12 months to July, milk prices contributed more to the increase in overall food prices than any other food item".

“The price for two litres of milk has increased 33.9% since July 2020.”

All five food groups recorded higher prices when compared to this time last year, Growden says.

The groups include fruit and vegetables, non-alcoholic beverages, restaurant meals and ready-to-eat food, grocery food, and meat, poultry and fish.

Meat, poultry and fish prices increased 7.9% and was the next largest contributor to the annual increase in food prices.

This was driven by higher prices for beef steak which was up 24.6% and beef mince, up 19.3%.

Fruits and vegetables rose 7.3%, restaurant and ready-to-eat food increased 2.2% and non-alcoholic beverages went up 4.4%.

Alcoholic beverages, which Statistics New Zealand counts separately from the food group, went up 0.9% while cigarettes and tobacco increased by 4.8%.

Rent prices

Growden says rent prices are still increasing but at the slowest rate since 2011.

Rent prices went up 2.4% in the 12 months to July. This follows a 2.6% increase in the 12 months to June 2025.

Utilities like electricity and gas saw annual percentage increases of 11% and 14.1% - Statistics New Zealand points out this from the July 2025 monthly index compared with September 2024 quarterly collection.

Transport

Petrol decreased by 3.7% and diesel also saw a dip of 7.2%.

When it came to domestic air transport, there was a 5% decrease while international air transport went up 7.1%.

From July, Statistics New Zealand has expanded the number of international routes it includes in this data for places like Australia, North America and Asia.

Alongside this, domestic accommodation went down 4.4% while international accommodation increased to 20.5%.

Inflation

In July, annual inflation increased to 2.7% from 2.5% in March.

Despite the slight increase, economists at the time agreed the annual inflation rate was softer than their expectations.

While it’s also within the Reserve Bank’s targeted 1% to 3% range, the Reserve Bank has previously said inflation was likely to approach the top of this range in the June and September quarters.

With the latest inflation rate a touch below what economists had predicted and following the unemployment rate rising from 5.1% to 5.2%, this paves the way for the Reserve Bank to make a cut to the Official Cash Rate (OCR) of 25 basis points to 3% in August and a further cut this year.

The Reserve Bank has made six consecutive cuts to the OCR from August last year, but then held tight on 3.25% in the last review in July.

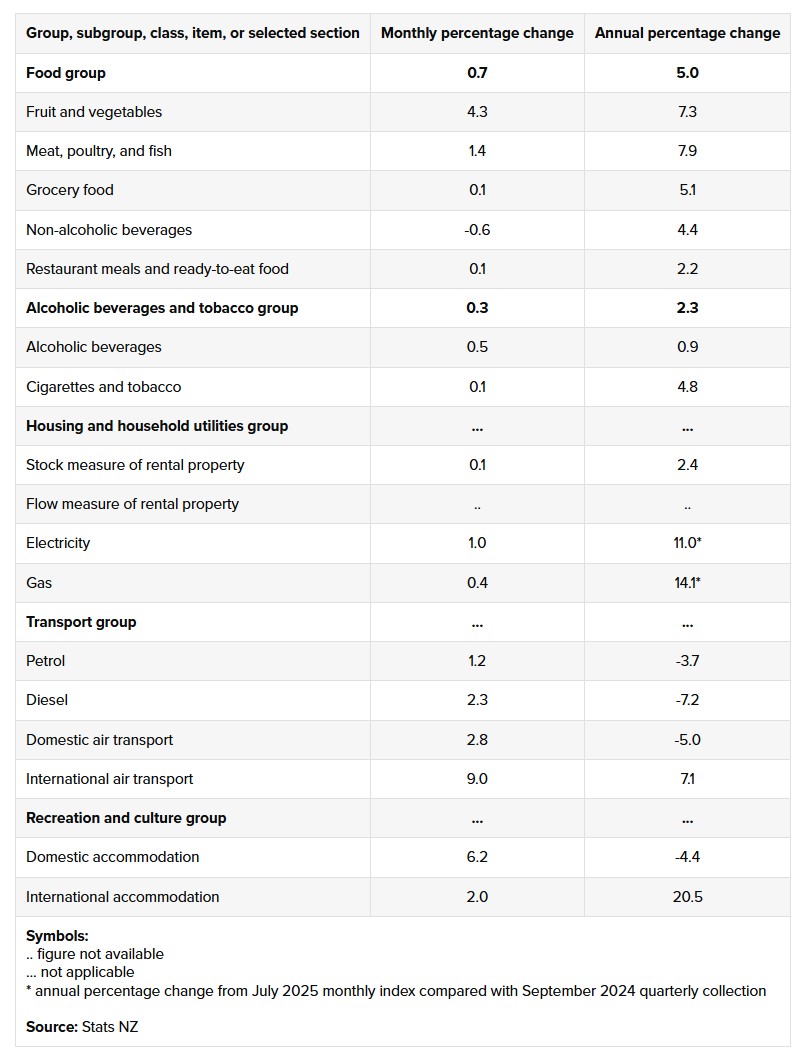

Here is the detailed SPI information as supplied by Statistics New Zealand:

31 Comments

NSS and higher if you like red meat

Quick bit of research - 2L bottle of Pam's milk on Pak n Save website = $4.55.

In AUD that is $4.13.

Farmdale milk 2L at ALDI's in Australia is $3.19 AUD.

Why is milk 29% more expensive in NZ?? Compounded by the fact our wages are lower in NZ than Aus. We are 100% being shafted by someone in the supermarket supply chain.

15% of that 29% is due to the Aussies not paying GST on basic food items including dairy. The other 14% maybe due to the Fonterra monopoly?

"Consumer surplus" is an acknowledged issue in all serious analyses of the NZ dairy industry.

But there's then supposed to be "trickle down" through the wider economy (LoL)

The other 14% is mostly Aldi selling milk at a loss.

Ok - I checked rump steak and NZ and AU prices are comparable (albeit very high at the moment).

Cheese - Pam's tasty cheddar cheese $12.59 for 1kg.

On Aldi's $8.99 AUD for 1kg.

So we are paying 27% more for cheese.

We are apparently the most efficient dairy producing country in the world....but it appears to be quite difficult to get it onto our shelves at a decent price.

Remember to keep taking off 15% for GST. The fact we make it here is irrelevant when buying in a global market, which we are penalized in due to size. Global shipping is pretty cheap.

We also don't have an ALDI alternative, it's more relevant comparing to Coles or Woolworths.

Yes, no point looking at one item. The cheapest loaf of bread I could find on aldi au was $2.29, which in NZD and GST added would be $2.88. At Pak and Save its $1.69.

Best bet is to do your whole shop both places. I can't say I've walked out of an Aussie supermarket thinking I got a hell deal.

The only thing I've ever noticed substantially cheaper was some fruit, and that can be accounted for by the more favourable climate.

Booze is more expensive there so my shop wouldn’t be great.

Jokes on you, you can't even buy piss at the supermarket there.

3rd world country

And its tasteless piss to boot compared to here

Fonterra always bang on about their "international pricing policy". I, like many others, wonder how we aren't seeing a noticeably lower price given that we would expect to be avoiding the costs of international shipping.

I have an idea this has been put to the head of Fonterra but I can never recall what their response is - possibly because I'm yelling incoherently at the radio/TV and don't actually catch the reply.

So these comparisons suggest New Zealand consumers are subsidising other markets. Can any other subscriber answer this?

International shipping is really cheap. Cheaper than sending goods overland in NZ.

We're a smaller market, so the costs are higher, as are the desired margins by distribution and retail.

Volume also plays a role, much larger markets will be paying a lower price per KG. One retail chain in one state in the US will sell more beef in a period than our whole country consumes.

Yeah, getting some random item out of China - like a USB cable - is implausibly cheap.

Getting some small car part out of the UK though - freight is 70% of the overall price.

Mind you, high freight prices within NZ not affecting the relative price of dairy suggests all farms and processing plants are right beside an international port.

Some of that freight cheapness is due to Chinas exploitation of international mail loopholes.

Mind you, high freight prices within NZ not affecting the relative price of dairy suggests all farms and processing plants are right beside an international port.

If not a marine port, then one of the internal ports we have developed over recent years. Many of which have been made close to the source.

"Volume also plays a role, much larger markets will be paying a lower price per KG.'

Some contracts will be but remember the 20-30% of Fonterra's output that is auctioned. International shipping may well be relatively inexpensive but offshore markets also have internal freight and handling costs.

Due to their larger sizes and geographic advantages their internal freight is usually more efficient.

I would give imported butter and cheeses a try if someone was willing to supply it.

I paid $3.90 at the warehouse yesterday. Just saying.

That would be a terrible outcome, genuine stagflation.

OCR needs to be cut about 1% I reckon to get the economy moving again. If we get >3% CPI then there won't be any more cuts and we may even see an increase.

1% OCR will get inflation moving again….. I had hoped the lesson of 5 years ago might have been learnt. Be careful what you wish for!

So what we're looking at is putting up the OCR because of a global demand/shortage for dairy and red meat?

Dairy and red meat alone won’t be enough. It will need increases from several sources to keep the CPI increasing, but the direction is looking bad.

Because higher NZ OCR will mean less global demand for red meat diary and other things..... and a lower NZD so everything else can go up as well....

This is nuts.

U.S. PPI y'day and it might shock Aotearoans that prices for fresh and dry vegetables surged 38.9% in July. This increase has significant ramifications for food producers, retailers, supply chain managers, and investors.

So count your lucky stars.

So the govt is choosing uncap inflation again to save the housing ponzi and bankers profits. Let's throw in foreign buyers again....oh wait NZF will announce its capitulation to the Nats property interests.

Remember though, it's not just a housing ponzi, it's a consumption and employment ponzi.

What you get when your main concern are figures in quarterly or annual increments, instead of the longer term ramifications.

Without the Property Ponzi flying you need to keep whatever other balls you have in the air....

Looks like they are about to fall.

They're all interlinked.

Property is more sexy, because while we're paying $4 for a bottle of water we can decry a million dollars for a house in some suburb we wouldn't be seen dead in.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.