They say that a picture paints a thousand words.

Well, to kind of turn that around - a load of figures can paint quite a picture.

And a very interesting picture emerges when you immerse yourself in the new, vastly expanded, debt to income ratio figures debuted by the Reserve Bank this month.

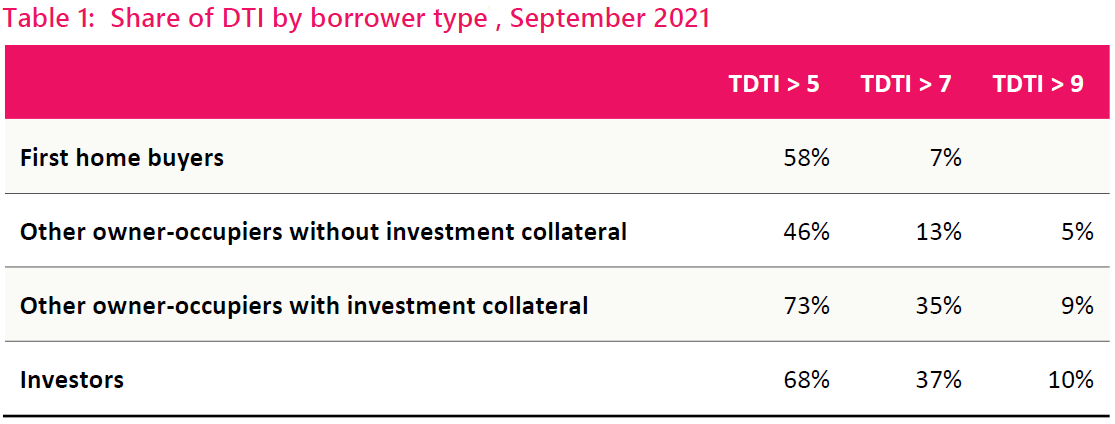

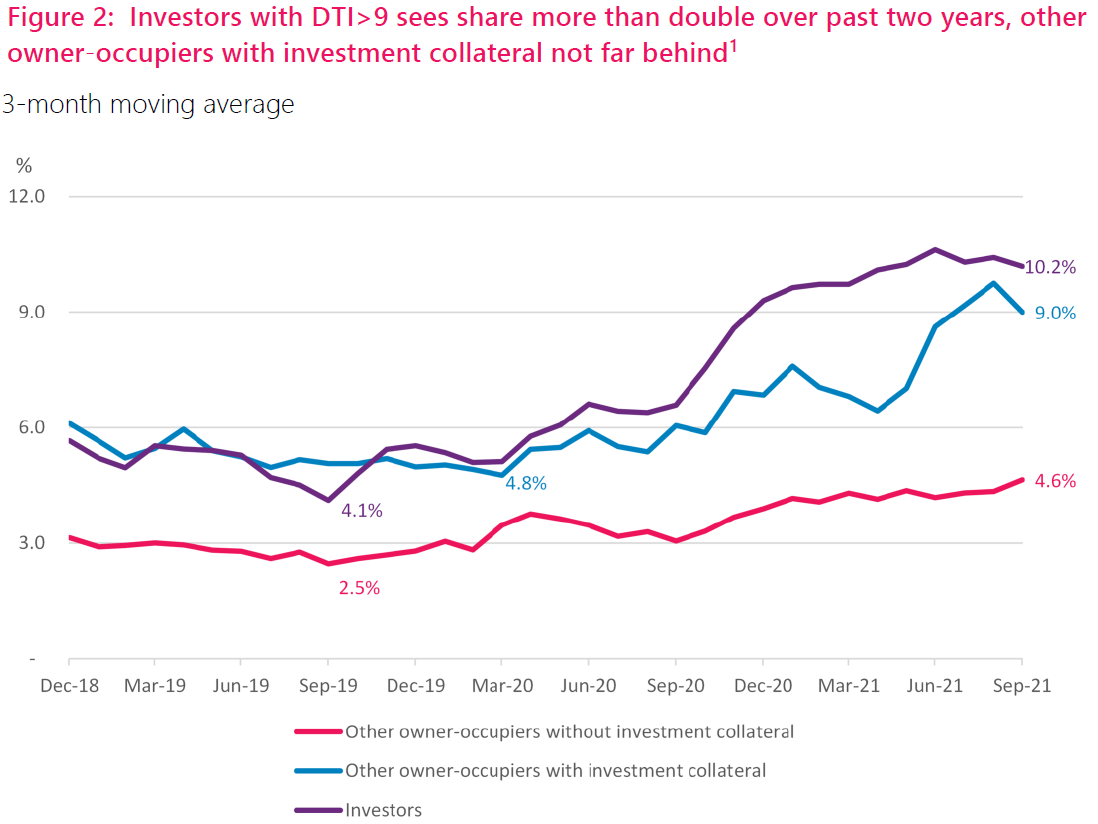

The RBNZ has been running a DTI series for a few years now, but till now these haven't been showing breakdowns of investor DTIs, or owner-occupier mortgages with investment property collateral. And, also, now the new series features more DTI brackets - meaning we can now get a handle on who's been getting mortgages at an eye-watering NINE times annual income.

This more detailed breakdown of the DTI facts and figures comes as the RBNZ readies itself for consultation this month on a proposal to introduce DTI measures into the central bank's 'macro-prudential toolkit' alongside existing measures such as the loan-to-value ratio (LVR) limits.

I already had a quick look on Monday at some of the facts and figures, particularly pertaining to first home buyers and owner-occupiers. Here again, quickly, is the table run with that article, which demonstrates the still rising percentages, particularly of FHBs with mortgages on DTIs of five and above.

The table below shows the percentage of new mortgage money with debt-to-income ratios of over five times:

| Group | Sep 21 | Jun 21 | Sep 20 |

|---|---|---|---|

| FHBs nationwide | 58.3% | 57.5% | 43.3% |

| Auck FHBs | 76.4% | 71.3% | 57.5% |

| Non-Auck FHBs | 47.8% | 45.7% | 32.3% |

| Other owner/occ nationwide | 46.3% | 44.9% | 37.7% |

| Auck other owner/occ | 61.5% | 57.7% | 49.0% |

| Non-Auck other owner/occ | 35.7% | 34.2% | 30.3% |

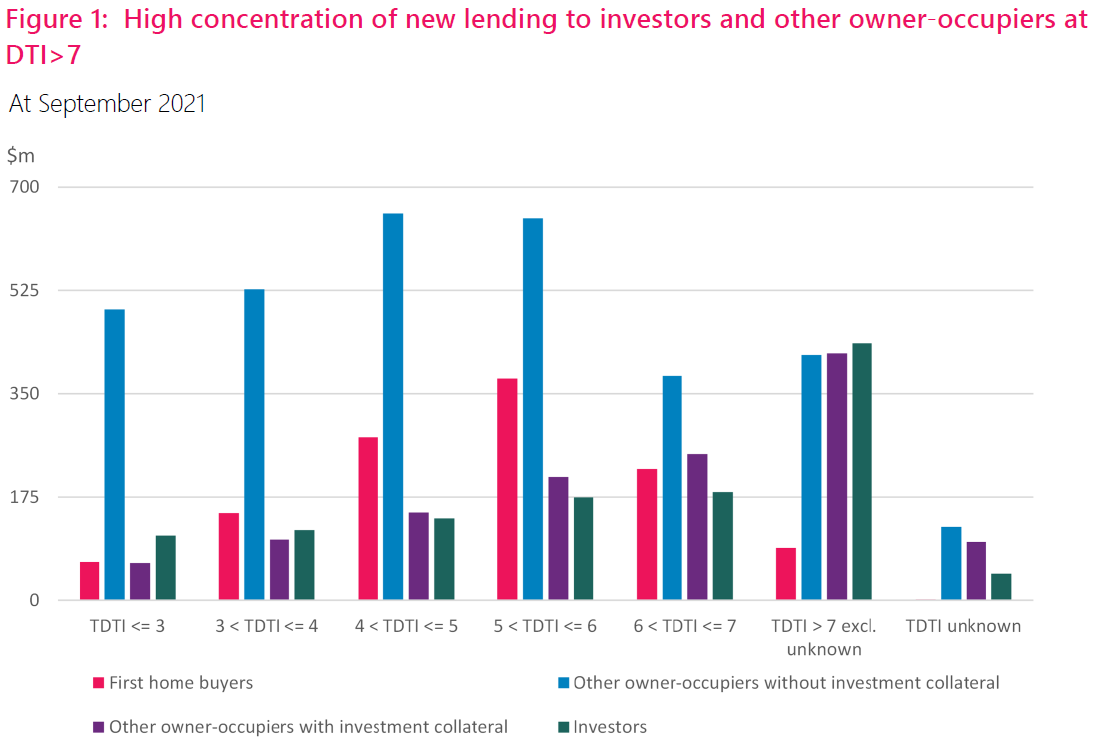

'Impressive' as these figures are, they've actually been outdone at times with the ratios the investors, and also owner-occupiers with investment property collateral, have been achieving.

I should say at this point that the next four graphs sprinkled through this article are courtesy of the RBNZ and refer to the September DTI figures.

And, much as could always have been expected, the figures demonstrate that the investors were quick to take advantage of the Covid-induced super-low interest rates of last year and also the removal of LVR limits - which have of course subsequently been put back on.

I'll try not to bog you down with loads of figures, but here come some examples.

On a nationwide basis, in September 2019, investors borrowed just over $1 billion, of which 55% was on DTIs of five and above. A little under $50 million (4.6% of the investors' total) was borrowed on a DTI of nine or above.

Fast forward to September 2020 when the post-lockdown, 'yippee, no LVRs!', feeding frenzy was getting underway in earnest and investors borrowed a bit over $1.5 billion, with slightly over $1 billion of this - 67.6% on DTIs of five and more. Over $100 million, 7.1% was borrowed on a DTI of 9+.

By December 2020 when the house market was an inferno and LVRs were on the way back, some 71.4% of investor mortgages (over $1.6 billion) were on DTIs of five and more. Over $200 million (9.3%) was borrowed on a DTI of 9+.

Even though the LVRs are back and interest rates are now moving up (more on the latter point shortly) the investors have continued to borrow at reasonably expansive DTIs.

In September 2021 they borrowed nearly $800 million (68.2% of the investors' total) at DTIs of 5+. Over $100 million (9.7%) was borrowed on a DTI of 9+.

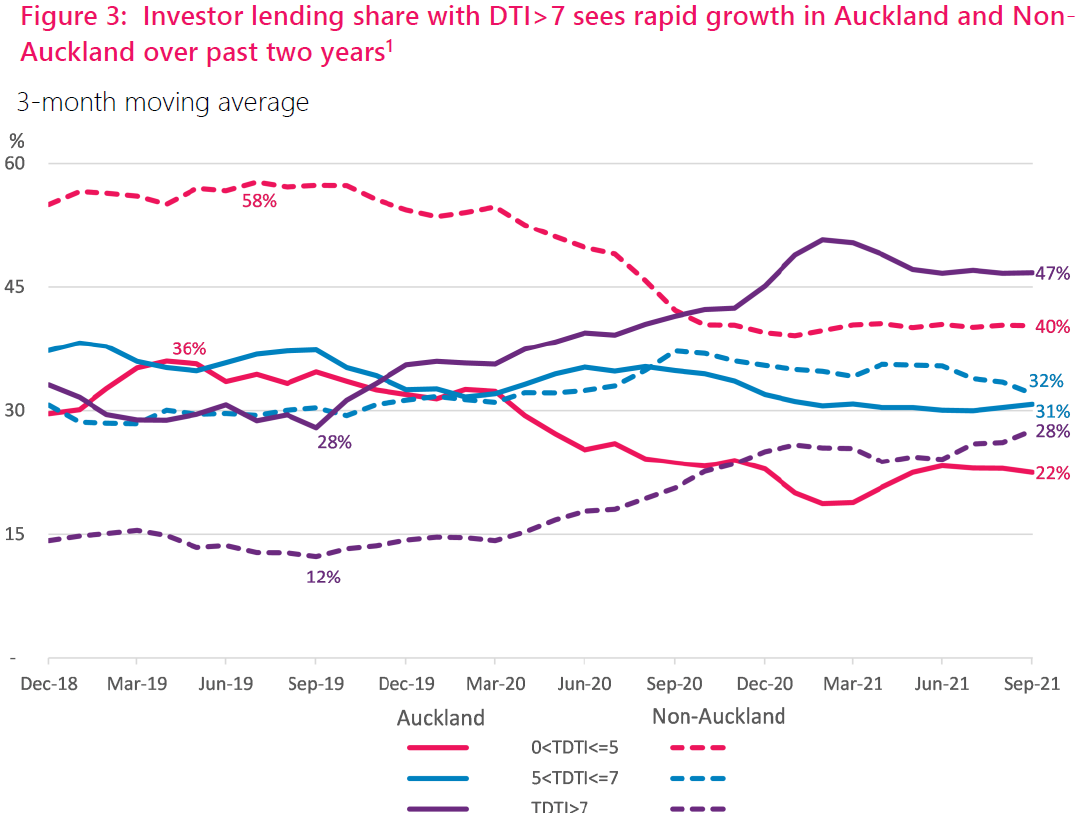

As you might imagine, given Auckland's exhilarating price levels, the DTIs of Auckland investors have been even racier.

In terms of DTIs of five and over, the $960 million borrowed in December 2020 by the Auckland investors at those DTI levels made up just shy of 80% of the total. As of September 2021 this ratio was 'down' to 77.4%.

However, lest you think that was all looking a bit stratospheric, Auckland owner-occupiers with investment property collateral have been doing even a bit 'better' than that. Since September 2020 this grouping has regularly seen in excess of 80% of its mortgage money advanced on DTIs of five and over.

In September 2021 this grouping borrowed over $400 million (80.5% of the group's total) at DTIs of five and up.

Nearly $40 million (7.3%) was on a DTI of 9+. But the latter figure was actually a sharp reduction.

In June of 2021 just over $100 million (15.1% of the total for this group) was borrowed on DTIs of 9+.

How are folk affording all this? Well, clearly they are. And the super-low interest rates have clearly been a big factor in that.

But it's worth putting some of this data up against the backdrop we've now got of fast-rising mortgage rates.

A couple of examples follow.

To go back to our old favourites the FHBs, in September 2021 some $61 million of Auckland FHB mortgage money was advanced on a DTI of 7+. In terms of individual mortgages, there were 64 of them, so roughly $950,000 per mortgage (if we take the average). If we also assume a DTI of seven, this would imply our mortgage holder has household annual income of around $136,000 - again, it's an average.

As of September, according to the RBNZ the average two-year fixed mortgage 'special' rate was 3.15%. Assuming a 30 year mortgage for $950,000, at 3.15% this would, so the trusty interest.co.nz calculator says, require monthly payments of $4083, or a bit over 36% of the monthly income.

To take on the same mortgage now, less than two months later, our FHB could be paying 4.15% (and they could be paying more). This would work out to monthly payments of $4618, which is getting on for 41% of the monthly income. In dollar terms its now $535 more a month. Which would be noticed.

Well, we always go on about the FHB! What about an 'other' owner-occupier.

To take another Auckland example, as of September 2021 the RBNZ figures tell us that some $90 million of mortgages were taken out by 84 owner-occupier applicants on DTIs of 9+.

That's an average-sized mortgage of $1.07 million. Applying a DTI of nine would give us an average household income for these applicants of $119,000.

Running the same set of calculations would see the mortgage as of September requiring payments of $4598 a month - about 46.4% of income.

To get the same deal today, based on 4.15% mortgage rates, would require monthly payments of $603 more, making $5201 a month, or 52.5% of income.

Life is going to get pretty interesting for some mortgage holders if the current levels of mortgage rates stay with us - or increase - over the next couple of years.

79 Comments

Great article, David. I wonder what the breakdown across banks look like; whether some banks have been more liberal than others with their high-DTI lending.

Yeah, very interesting read. Seeing the number of buyers in these categories with IO loans would be very interesting as well. The mortgage calculations for PI look VERY different to IO terms when rates increase from a low starting point.

I would say a lot of bankruptcies on the way. This is what happens with FOMO people get burnt. If a investor gets in over his head that’s the risk they take. The good investors will be buying later when the prices come down just a matter of time now. I feel sorry for all the young couples who were duped and think they as sitting in million plus houses

I don't think so. Interest rates need to get over 6% and the employment would have to collapse with many loosing their jobs. Something pretty nasty on a global scale needs to upturn the apple cart before things get really bad. People just cut down on discretionary spending and tighten their belts a bit. House prices are going to keep rising for a least the short term so people will hang on tooth and nail to it.

Carlos have you ever been in negative equity what you say about people hanging on sound plausible but when people are in so much debt and just hanging on already and add a couple % interest rates people will just give up sell at a lose or just go bankrupt this will lower prices very quickly put more and more people deeper into negative equity you house becomes a burden. I have seen this happen in uk 1990 I think it took 10 year for market to recover. But now the debt is so many time peoples wages it will be very messy.

Those who hang on for the ride will reap thier reward out the other end of the cycle.

Once discretionary spending gets chopped, job loss will follow.

Back in the days of 20%. Many around me took on second and third jobs working evenings and weekends to meet their re- payments. Others such as my parents couldn't keep up and the bank mortgagee sold their house. It was tough times and I wonder if people today would buckle down and strive or walk away.

Dead right and more interest to the Bank means less Gst from the coffee shop and later on less PAYE and profits tax so as Govt revenue goes down and expenditure increases Grant will need to borrow even more - order another money printing press please and whilst your at it Grant increase taxes and regulations a sure way to fix the problems you've made. Yeah right!

They'll get bailed out in one way or another, we always bail out homeowners. It's moral hazard.

If ever there was an article highlighting why DTI should be implemented immediately this is it.

Are these the same investors who threaten to sell up every time a rule is introduced not to their liking? Yet somehow they seem to buy more...

It’s really worth examining the reasons it seems all the investors jumped in all of a sudden at the same time. I was one if these and can give my reasons ( which I think was the same reasons as at least 50% )

- reason 1: low interest rates that can be locked in for 5 years (2.99%)

- reason 2: threat of government intervention. I was thinking right now I can buy a house, but what’s the bet government or rbnz intervention means I can no longer next year. Best jump in while I can.

reason 2 was the biggest factor in my decision.

The threat of debt to income restrictions will be what’s still steaming things along now.

Risk of getting priced out of the market was a big driver. So were the low TD rates eating away at savings returns.

Snap, bought a holiday home in February and those reasons factored highly. And we fluked it, got ahead of extended bright line and the tax deduction thing - not that we can be bothered with AirBnB to get the opportunity of that, but it’s there for awhile if we did. Five years at 2.99 seemed like as low as it would get for 5 years of certainty. Especially when my early house buying days were as high as 19.75%. I can remember my parents having State Advances loans and I sure they were 3%. I can recall thinking that would never happen again, so when it did it was a big factor. I wonder how many went 5 year terms this year, bank said not that popular even when 2.99.

And the liquidity crisis is on its way once again cash will be king.

Does this mean the banks have done a poor job of managing risk....again? Looking forward to the GFC part 2 and the next banking bailouts.

Which might explain why Mr Bascand has resigned (leaving in Jan)

Central bank has done a horrific job of managing risk. The retail banks have just filled their boots, given the signals from the RBNZ and government (which was essentially - there is no risk to you lending for the next wee while, lend as much as you want, even though we know you lend mostly to residential housing investors). Removing LVRs was a mistake of epic proportions, which I (and hopefully many others) outlined in our submissions to the RBNZ, where we showed that they were throwing away their mandate of financial stability EXACTLY when we needed it the most. If Bascand has been given his marching orders for this massively incompetent move, I would be much happier. However it appears his stepping down is his decision, so getting out before his stupid actions come back to haunt him.

That statement aged poorly. Kind of sums up the incompetence (or duplicity) of the RBNZ over the last few years.

Remind me who is the RBNZ Governor and who appointed him.

This video gives a pretty good explanation on how politicians and policy makers can ruin the system.

For many years, our governments and RBNZ are trying to seed the money illusion into our mind to let us think we have always been in a recession or close to a recession, that we need more money to be injected into economy. But if we care to think about it, it's not to hard to find out the contradictions in their narrative. If a scenario of recession or close to recession is happening, then there should be less people spending and investing. This contradicts with soaring housing price for last 7 years and also with their "wealth effect" (or shall I call it money illusion?) theory. If their so call "wealth effect" is true, then we were out of recession long time ago. This means RBNZ has been injecting exceeded money for many years now, especially last year by removing LVR and 75 base points OCR reduced. So now they are saying inflation "transitory"? Come on, people are not as dumb as they think any more.

Prof. Antony Davies: Why the US doesn't want inflation, explained - YouTube

None of it matters. Median Akl price to $1.5m by June 2022. Greed and fear have won and will keep winning

Who is going to buy them 1.5 million 300k deposit 1.2 million loan would have to have salary of 300 k not many of them around in NZ

I guess all those people that prefer their DTIs above 9

Suspect there's still a lot of offshore money somehow floating around being invested via resident/citizen family members. It is certainly supporting a lot of residential development activity.

I get what you are saying and maybe you are right but eventually you run out of buyers for "lower end" houses when they cost north of $1 million. Friends of ours who earn far above median wage are totally tapped out at a purchase of $1.4 million. Joe average literally cannot afford these places now, with higher rates and tighter lending rules.

Nice article.

Will someone take responsibility for LVR removal?

Hypocritical and career insecure lot is leading the govt. and RBNZ.

Yes, exactly. I know the argument at the time was that these things would help support the economy - I guess that argument might hold water for lowering interest rates, but I cannot see for the life of me how making it really easy for investors to buy a lot of residential properties by removing the investor LVRs was a good idea. That money just goes into driving up house prices in an already insane housing market. How exactly is that really really great for the economy as a whole?

The reasons they gave to remove the LVRs were weak and pretty much invalid if you took a look at the data (which they claimed they had). The reasons a lot of us submitted as to why they should NOT remove the LVRs were because it went directly against their mandates, particularly that of financial stability. RBNZ ignored us, decided they were right and we were wrong, and have made financial stability a whole lot worse.

Now the rats that made the decision are jumping off the boat. They should be prosecuted for their incompetence and poor decision making, instead, what's the bet they will be land in cushy roles in retail banks?

I've said it before, but their idea of Financial Stability is "make sure the bubble doesn't pop on our watch". They don't seem to care about the long term impacts this will have on the country. They only think short term.

Just like politicians

Anyone who doesn't see 50-Year Mortgages becoming the norm here, as 25 was just a few years back, is choosing not to look. Transgenerational Mortgages, here we come!

The Reading of the Will is going to be interesting soon. It won't be "who gets the house(s)" but who gets to keep paying the mortgage.

AKA farming

Farming has an income portion which residential housing does not, a return from asset utilisation. Apples and oranges...

No point doing a 50 year mortgage, put the numbers into a calculator the monthly savings over a 30 year are minimal. The monthly repayment amount just flatlines and you just repay a HUGE amount extra. Its the reason I went for a 15 year mortgage, that extra $50 a week slashes years off the term. You simply have to cut into that principal with your repayments that are as frequent as possible or you get screwed forever.

Heh....$50 per week...okay.

$500k @ 30 year 4.5% = $584 per week. @ 15 year = $882 per week.

Serfdom: a labourer bound by the feudal (banking) system who is tied (by debt) to working on his lord's (the bank's) estate

It's well known that NZ property investors have 👊iron fists👊 and ✋diamond💎hands✋.

To think otherwise would be a folly.

Waiting on a illusionary hope is not just expensive but futile.

The way they bleat every time a change is made to try and slow the runaway gravy train, you would think they have paper hands

And shit for brains

Be quick?

You are a curious commentator. You occasionally put out some quite intelligent stuff, but 90% of your comments are simply inane trolling.

CWBW is very smart. He uses his comments to get a reaction. I think it appeals to his humour. This site is definitely better for having him here, just learn to smile at some of his comments.

So despite Andrew King ringing the ‘it will hurt first home buyers’ bell, we learn the actual data shows it will hurt investors. I know their tricks but it is always good to see the proof.

Church sings off the same song sheet.

"New Reserve Bank debt to income figures show the extent to which housing investors filled their boots during the low-interest, LVR-free days of last year and into this year"

We all know except RBNZ and Government.

RBNZ knew that interest rate will have to be dropped last March and also was aware lose monetary policy and Government subsidy along with mortage holiday, which was needed to protect existing home owner BUT what was the ne÷d to remove LVR as at that time need was to protect existing home owner than promoting house buying frenzy by removing LVR in uncertain time.

Definitely Mr Orr is not stupid to know the effect will be by going LEAST REGRET and throwing everything to support ponzi.

His argument that in March when panademic hit, was not aware as in uncgartered water BUT what about now, when everyone knows, why is not going with least regret policy to contain ponzi.

Put him in public square for question and answere - allowing to be grilled with counter question and will not know where to hide.

I had seen dataa that suggested that FHB share is more than investor.

So were lying and manipulating to prove a point and get away.

I just hate what housing has become in this country, a means for a smaller demographic of rentiers basically 'farming' the livestock that are people more and more shut out of ever having somewhere to call home - people farming basically,

If I had my druthers I would smash this all to bits.

Agree.

Modern NZ society has become a cesspool of greed and self interest.

Now you are saying they came, they saw and they ....

Where were you all, when it was happening.

Even now, are you raising it enough to force them to respond or is it the situation so blatantly obvious that even you too are trying to potray of being a good journalist.

It is mind blowing what this people has done, saw a two bedroom unit 65sqmt sold for 1.35 million / CV 665000 and was purchased in 2019 for 635000, nothing extraordinary nor excellent location and a part of three units.

Interest.co.nz has some fantastic journalism, compared to most of the mainstream dross out there. As I remember it, there were a number of opinion pieces and quite scathing/sarcastic statements in their journalism when it came to the changes that wrought this impending disaster. Yes, I think there could have been a lot more mongrel to some of their journalism (and still should be), but they are one of the few places where you will actually read that the RBNZ have screwed the pooch (even if they can't say it directly, un-biased and all that).

I mean just read this article. Certainly they aren't saying directly "the RBNZ really screwed up", but they are suggesting it by having the article and showing these graphs. Which if you read into, they tone is "the RBNZ really screwed up, try and spot where"...

Blame the RBNZ they created this

Yet it's the banks which are lending the money to fund this splurge. So without any regulation who knows how much more crazy this might be now? I wonder if the RBNZ has actually created moral hazard through imposing credit policy on the banks and then by removing it, the banks know they're going to get bailed out directly (or indirectly through negative rates) if things go to custard.

I don't think DTI ratios are a good idea in NZ as our incomes are low compared to many countries esp Australia and the already high prices of houses means most First home buyers don't meet the criteria.

When you look at how low our mortgagee sale rate is you'll realise people always find a way to make things work, so the reserve bank and retail banks should just chill out a bit as these new rules are going to impact the wrong people (ie first home buyers and investors with stable jobs and good equity)

'When you look at how low our mortgagee sale rate is you'll realize people always find a way to make things work'

Before pandemic...Yes...Now....NO.......DTI is required to protect FHB from being over exposed under FOMO. No able to buy a house is a disappointment but buying a house by over exposing and than repenting even if situation changes slightly or interest rates goes up will be a disaster.

I have to say, this DTI data is scary.

The system is very fragile, I suspect.

Banks test borrowers lending capacity at around 6 to 7 percent so no immediate issues with increasing interest rates.

Based on some numbers I have seen, its a pretty bendy ruler.

Also assumes borrowers/brokers have been honest on loan applications. UBS Australia uncovered widespread dishonesty about income and expenses on Ozzie loan applications. We're only slightly more honest here I suspect!

5%of US car loans are 90 days overdue - 58,000 loans average value US$20,000 = 11.6 Billion! Will these loans become the next subprime crisis that creates another Lehman moment. Liar loans are a problem and NZ Banks are unwittingly falling into the trap of no face to face involvement, its so easy to lie on your website application, humans are quite good at spotting liars although in the case of Politicians especially in NZ not good - Baa Baa.

The housing investor frenzy of 2020-21 - They came, they saw, they bought up large

RBNZ gave them on a platter, so what else do you expect...even today.........no change in rbnz attitude, whatever little sound they are making is as being forced under pressure as the monster has grown beyond and if left to them will like it to grow.

extension to below: if DTI's were implemented in march 2020, hse prices would have stayed sobre, and we did not want that, did we?, we wanted unprecedented growth to make us "feel" rich and so to get us to keep spending and continue the "feel good" effect created by you know who. The brakes were applied in the wrong corner, typical of ......- to crush long term investors who provided alternatives to buying for buyers who could not afford to buy while they saved for a deposit. i know some long term investors with more than multiple properties, although not out of the market, but holding off until the inevitable happens. interesting times!!!!!

by Averageman | 16th Nov 21, 4:14pm

If ever there was an article highlighting why DTI should be implemented immediately this is it.

We sanitise the words profiteer and hoarder with the word investor. Give me a dole bludger any day, at least they dont expect someone else to pay off their debts. Unproductive and largely untaxed money making at the expense of others should be called out for what it is. Scurrilous and immoral.

banks borrow to on lend to keep things moving for households, supermarket operators/ hardware stores etc , etc, pick from factories to deliver goods to households. investors do a similar thing. when tall poppy syndrome sets in, no amount of rhyme and reason will do, will it?

Using the hard work of others to make you rich does not, in any way, shape or form make you a tall poppy. It just makes you callous

It makes you smarter (assuming that people make their own choices freely).

I've observed the 'Tall Poppies' in my flower bed - it's not the lower ones that bring them down; It's merely the fact that they have grown too high for their stems to support them ...

All of those business have payroll, and have real work completed...daily. Debt stacked up on mouldy old houses exploiting the basic need of shelter, with a bit of adhoc repair here or there is different. Its return at high DTI is purely speculative.

The supermarkets must really rile you up then.

Where would all the people who dont own houses live, if an "evil" property investor didnt do the governments job and supply one.

Grass Huts ?

Or would you wait for the government to provide all the social housing required, should be ready in about 10,000 years.

Your comment would hold water if landlords built to rent, most dont.

Surprisingly, the housing stock wouldn't disappear without investors. It would probably become a whole lot more affordable.

I didn't realise that when landlords sold a house, they burnt it down as well!

I bought 6. All absolutely fkked and rotten, average renovation cost $200k+ and I nearly went broke, still doing one up (400k spend). Selling 3 now, will pay tax on sale but save on tax on debt later, keeping the others as two are multi-unit flats and good investments, no homeowner would want them, I live in the other one. Debt locked in for 5 years at a low rate. Apparently immoral speculation but I put of few tradies kids through uni last year.

Your behaviour here is actually fantastic and is the sort of thing we should be commending investors for, it's not immoral speculation. Buying screwed houses and fixing them up, then selling them is simply upgrading houses, which is a good thing and you should be compensated for. Providing you upgrade them to a healthy home standard.

It's not what we rage about on this site, that is when "investors" flip houses, sitting on capital gains while making zero improvements. Or keep houses empty (because it's too much bother) during a housing crisis to bank capital gain. Essentially these are unscrupulous people who are riding higher land prices which are being pumped up by the RBNZ and government through poor policy and even worse execution.

DTI is no ones business but the borrowers. Only under a socialist communist government would the Reserve Bank and Government stick their beaks into this. As long as the owner has the asset base for a firesale of property to cover the debt, and the cashflow to pay interest if it rises. These are are allready covered in lending rules, it is very difficult to get finance now already, in addition are the new responsible lending rules.

DTI is not required and it is not lawful.

One more step towards serfdom, peasantry and socialism, we will all be able to line up for our daily loaf of bread soon.

Cheap loaves because it's not fair

I do get where you are coming from here. However DTI is also the business of lenders, not just borrowers. The RBNZ stated concern is if there is a lot of poor lending then the banks collectively get into trouble which causes a lot of mess and taxpayers might have to bail them out in some way. However I wonder whether DTI and LVR rules are creating a moral hazard for the banks themselves i.e. "look, the RBNZ says we can lend to here, they have our back, so lets go for it" rather than acting prudently themselves. I think the best solution is requiring the banks to hold more capital against residential lending.

You need to read up on risk, and the way to manage it.

I know in my own business, we have been using pricing to kill demand on items we are struggling to get. A DTI would have the same net effect. Some people do need to be saved from themselves, you only need to read "investor" farcebook pages to work that one out.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.