Bank workers’ union Finsec has called on the Reserve Bank to analyse bank funding costs in the same way the Reserve Bank of Australia has done in the wake of its decision to put up the Official Cash Rate.

“With interest rates set to rise it is critical that increases are fair and customers are not paying more than they have to,” said Finsec Campaigns Director Andrew Campbell.

“A recent Australian Reserve Bank report, and subsequent analysis by the Sydney Morning Herald, armed Australians with crucial information about what their banks' actual funding costs were. New Zealanders do not currently have access to the same information,” said Campbell.

“Alan Bollard has said the cost of banks’ wholesale funding is a factor in the economy at the moment, yet the public has virtually no information on the actual costs of that funding and therefore what appropriate interest rates should be,” said Campbell.

“New Zealanders should be able to access the same data as Australian customers can. Better information about real funding costs is important for the proper functioning of the market.”

Finsec said it would ask the Reserve Bank to conduct regular public analysis on banks’ funding costs and how they relate to interest rates, including analysis of what part of rate hikes are linked to rate hikes and what are linked to funding bank profits.

My view

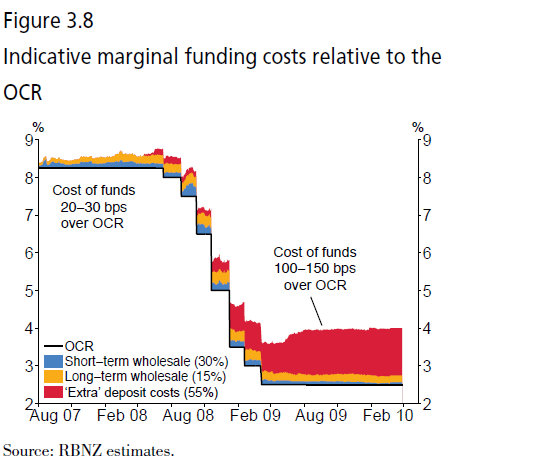

The Reserve Bank already conducts and publishes its analysis of the collective funding costs for the banks. It's in Figure 3.8 of today's June Monetary Policy Statement. It shows that bank funding costs are up 100-150 basis points since the onset of the Global Financial Crisis because of higher borrowing costs in wholesale short term money markets, higher term deposit costs and higher longer term borrowing costs.

Here's what the Reserve Bank said in its MPS:

Bank funding costs remain high compared to pre-crisis levels. Banks have come under continuing pressure from markets, rating agencies and regulators to move away from cheaper short-term wholesale funding and into more stable long-term wholesale and retail deposit funding.

The Bank estimates that the marginal cost of funds is around 150 basis points above the OCR (figure 3.8). There is some risk that ongoing market turbulence places renewed upward pressure on longer-term term funding costs. For now, market contacts have noted that local banks can still access international funding markets, albeit at a higher cost.

Ongoing competition for retail funding has seen deposit rates remain around 150 basis points above wholesale rates, compared to the pre-crisis average of around 50 basis points below (figure 3.9).

Indeed, ‘special’ term deposit rates – which have increasingly become the benchmark for competition – are around 200 basis points over wholesale interest rates in some cases.

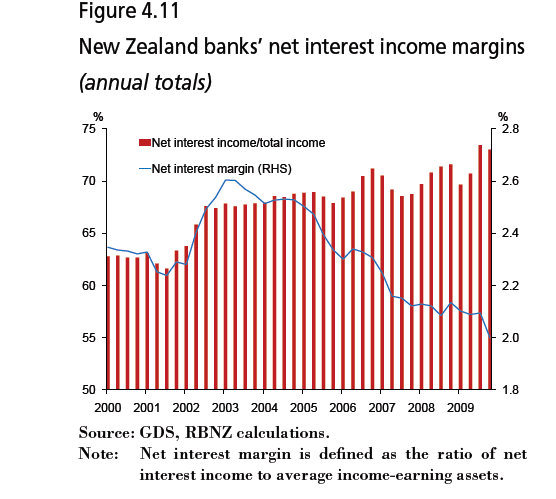

The Reserve Bank also published analysis in its May Financial Stability Report (FSR) on bank margins on lending which showed bank net interest margins have actually been falling steadily since 2003 when Kiwibank entered the market. Here's the chart (blue line) showing the fall. Net interest income as a percentage of total income has risen as fee income has fallen as a percentage. The sharp growth in total lending in the last decade has lifted profits overall.

Here's what the RBNZ said in May. The full FSR is available below.

Banks have generally responded to the increased funding costs by increasing their own lending rates relative to benchmark rates. However, the average net interest margin earned by New Zealand banks has declined slightly over the past year (figure 4.11).

Preliminary indications from more timely information on bank margins collected by the Reserve Bank suggest margins have begun to stabilise more recently, and it seems unlikely the trend decline apparent in figure 4.11 will continue in the near term.3 Net interest margins fell steadily from around 2003 as domestic loan markets became increasingly competitive.

Loan growth through this period was extremely rapid, and in concert with a focus on containing non-interest related costs, banks were able to accommodate declining margins and still lift aggregate profits. This will likely be more difficult in the current environment.

So the Reserve Bank has done analysis and published it, but it may not be as detailed as Finsec would like.

It included this chart below.

It looks to me as if the RBNZ has already done similar analysis to what has been done by the RBA.

But here is the Sydney Morning Herald analysis of bank profits and margins, which says shows banks gouging profits.

The big four Australian banks have used the cover of the global financial crisis to charge borrowers more than the increase in their own costs, resulting in big profits for the lenders and much higher interest bills for many customers.

A Herald analysis of Reserve Bank figures shows for the first time how much extra individual borrowers are paying on a monthly basis as a contribution to bank profits after the financial crisis hit in mid-2007. The analysis reveals that a borrower with a three-year fixed-rate home loan of $300,000 pays a personal contribution to extra bank profit of between $75 and $125 of the monthly mortgage bill.

The extra profit contribution comes about because banks have increased the interest rates they charge customers more than their own costs have increased as a result of the financial crisis.

Meanwhile an Australian Senate recommendation for better analysis of bank funding costs has gone nowhere, Stuart Washington at the Sydney Morning Herald reports.

A recommendation on November 24 for the Reserve Bank and the Australian Prudential Regulation Authority to publish bank funding figures rests with the Treasurer, Wayne Swan. Senate economics committee members accepted arguments that more transparency on bank funding costs would allow people to judge whether banks were unnecessarily increasing interest rates charged to customers.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.