By Gareth Vaughan

With significant falls in the term deposit rates offered by the banks to savers over the past few months the term deposit war, sparked by the introduction of new Reserve Bank liquidity rules and a flight to quality after the demise of dozens of finance companies, is well and truly over.

And the bad news for savers is it's unlikely to resume any time soon. Or is it?

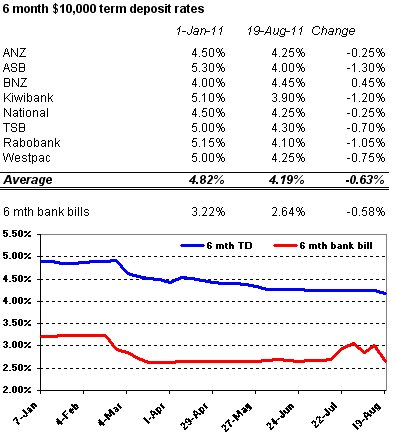

Most term deposit rates have tracked lower through 2011 to date, notably since March. For depositors with at least NZ$10,000 to invest in the popular six month category, ASB's rate has been slashed by 130 basis points to 4% since the start of the year, Kiwibank's by 120 basis points to 3.90% and Rabobank's by 105 basis points to 4.10%. Across the major banks the six month rate is down an average of 63 basis points to 4.19%.

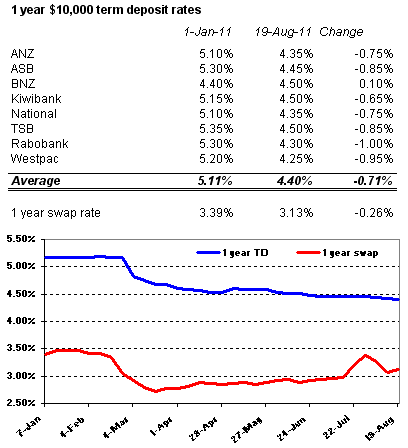

And for one-year term deposits, again requiring a minimum of NZ$10,000, the average rate across the main banks is down 71 basis points since the start of the year to 4.40% with Rabobank recording the biggest fall at 100 basis points to 4.30%, followed by ASB and TSB's 85 basis point cuts to 4.45% and 4.50%, respectively.

Falling term deposit rates a profit driver for banks

In a research note on Westpac's third quarter trading update this week Deutsche Bank Sydney-based analysts acknowledged a reduction in term deposit rates saying it reflected uncertainty in global markets and reduced competition for deposits due to lower loan growth. They said this pattern was likely to continue into the fourth quarter.

The Deutsche Bank analysts said applying the average reduction in term deposit rates to Westpac's A$142 billion Australian term deposit book, implied a potential annual margin benefit of 7 basis points and 4% increase to cash net profit after tax driven by a A$279 million rise in net interest income after tax.

"In addition to this benefit on the Australian term deposit book, we would expect to see less competition in New Zealand term deposits, as well as moderation of pricing on other deposit accounts. As such, the potential benefit to margins and earnings could be higher (than 7 basis points and 4%, respectively)."

Little funding pressure

PricewaterhouseCoopers partner (PwC) Sam Shuttleworth, who oversees the audit firm's twice yearly Banking Perspectives reports, points out that with weak lending growth there's little pressure on the banks' funding now that the core funding ratio (CFR) introduction flurry to boost retail deposit funding is over.

Introduced in April of last year as a move to reduce New Zealand banks' reliance on short-term overseas borrowing, the CFR sets out that banks must secure at least 70% of their funding from retail deposits or wholesale sources such as bonds with durations of at least one year. The Reserve Bank lifted the ratio to 70% from 65% on July 1 and will increase it again, to 75%, on July 1 next year. PwC estimates the big banks now have at least a 5% buffer over the 70% CFR.

With term deposit rates having tracked closely to the Official Cash Rate before 2009, the spread between the two widened to about 2% in March 2010, just before the CFR's introduction.

"They (the banks) were advertising (term deposit rates) in the paper, the blackboard numbers were on the TV, there was massive promotion," Shuttleworth said. "There doesn't seem to be that same fever pitch out there saying 'come and place your money with us' now because I think the banks are quite comfortable with where they're sitting."

Weak credit growth and strong liquidity positions mean the big banks don't have a great need for fresh term deposit funding right now.

According to the Reserve Bank's sector credit data, agriculture debt rose just NZ$50 million to NZ$47.251 billion in the three months to June 30, Business debt rose NZ$16 million to NZ$72.348 billion and total household clams, including home loans and consumer loans, rose NZ$712 million to NZ$184.103 billion.

Furthermore the big four banks, with comfortable capital positions, have plenty of funding in reserve. Combined, ANZ, ASB, BNZ and Westpac are sitting on about NZ$48 billion of liquid assets including cash and things that, in theory at least, can be quickly converted into cash should they need money in a hurry such as treasury bills, government securities, residential mortgage backed securities, bank bonds, and call deposits with the Reserve Bank.

And, Shuttleworth says, despite the ongoing European sovereign debt crisis and uncertainty caused by the recent Standard & Poor's downgrade of the United States' sovereign credit rating, the anemic domestic credit growth means the big local banks don't have a pressing need to tap international wholesale funding markets where they typically source about 36% of the money they borrow to on-lend to their customers.

"There's no push there for the banks to go out and lift things up," Shuttleworth said.

This could change, he acknowledged, if the wholesale funding picture offshore deteriorates further or credit demand "goes off" requiring an infusion of funding.

But for now, the term deposit price war, which had the finance company meltdown - sparking a "flight to quality" - and CFR introduction as its catalysts, is over.

Turbulence offshore could drive banks back to retail deposits

Roger J Kerr, a principal at financial risk management and corporate treasury advisory firm Asia Pacific Risk Management, isn't convinced the banks will back off their retail deposit drive for long given the turbulent overseas picture.

"The world is a riskier place and higher bank borrowing costs is one consequence that cannot be overlooked," Kerr wrote this week. "However, higher overseas credit spreads will encourage the banks to fund more onshore from the retail market, bidding deposit interest rates upwards."

And even with the interest rates offered to customers dropping, ASB's recent annual results show its deposits from customers up about NZ$241 million in the June quarter to NZ$33.7 billion. And Westpac New Zealand, the first bank to release its June quarter General Disclosure Statement, increased term deposits by NZ$453 million in the three months to June to NZ$18.6 billion with total deposits up NZ$412 million to NZ$33.581 billion. All up at the end of June households and companies had NZ$102.1 billion in bank deposit accounts.

Meanwhile, there might just be some good news for term depositors on the tax front on the horizon. The government is still considering a form of tax break for term deposits as it works through the complexities of an idea proposed by its Savings Working Group that would see the tax on interest earned indexed for inflation.

This article was first published in our email for paid subscribers this morning. See here for more details and to subscribe.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.