By Jason Wong*

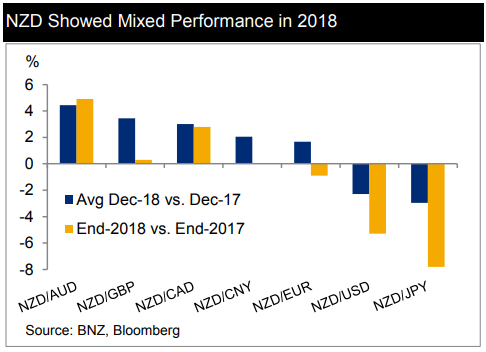

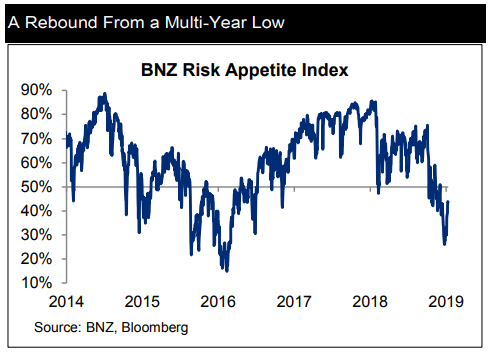

The broadly based strength of JPY reflects the fall in risk appetite, with our risk appetite index beginning the year at a highly elevated 80% and ending the year at a below-average 30%. NZD/JPY is highly sensitive to risk appetite.

Weaker global growth momentum and associated weakness in commodity prices can explain the underperformance of commodity currencies. A big fall in oil prices can explain the NZD doing better than AUD or CAD, as NZ’s terms of trade benefit from lower oil prices, while they reduce Australian and Canadian terms of trade. In the case of CAD, weaker oil prices more than offset the impact of three rate hikes last year by the Bank of Canada.

Uncertainty about Brexit was the key detractor for performance of GBP and that spilled over into EUR, although the latter was also affected by much weaker economic indicators than expected through much of the year.

Strong relative US economic performance and four rate hikes by the Fed supported the USD, more than making up for the concern at the beginning of 2018 about the country’s widening “twin deficits”.

CNY was negatively impacted by the US-China trade war, alongside the Chinese government’s desire to see the economy go down the path of less debt-driven growth.

Is the world economy heading towards recession?

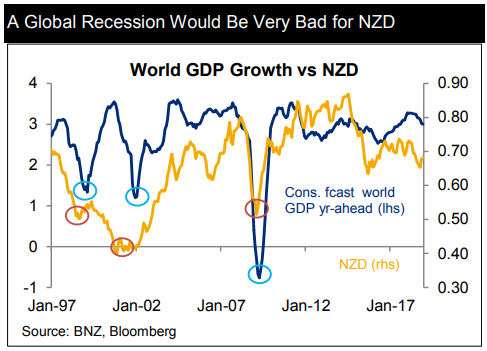

When thinking about the outlook for the NZD through 2019, the most important variable we try to get a handle on is the state of the world economy. How global growth fares over the next 12-18 months and expectations thereof will ultimately drive risk appetite, commodity prices and interest rates – all key inputs for the path of the NZD.

We think that a global economic slowdown is well underway, driven by global monetary policy – higher rates and the withdrawal of liquidity to the system – the Chinese government’s intent to create a more balanced growth dynamic for its economy (for example, less debt-financed growth), and the lingering effects of the US-China trade war. The US fiscal stimulus that supported growth last year will soon begin to wane, while the fiscal impulse should be mildly positive for China and the euro-area this year.

Slower global growth, led by the US and China, is a consensus view which we wouldn’t disagree with. But we wouldn’t back the view of some that a deep downturn is imminent, with the US economy headed for recession later this year or early next year.

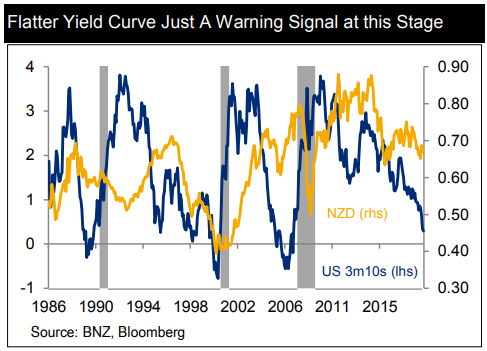

A theme that developed last year was a much flatter US yield curve and the warning sign this provided of a looming US recession. While parts of the curve have turned negative, the 10yr-2yr and 10yr-3mth yield gaps remain positive. Historically, to be an effective signal of an upcoming recession these curves have to turn negative and even then the start of the recession can begin anywhere from 5 to 22 months ahead (looking at the past 7 recessions dating back to 1970).

Suffice to say, we don’t see a US recession imminent over the next six months and we see the flatter yield curve as simply a warning indicator of weaker growth ahead than a portent of recession. Real US interest rates are barely positive and, while some economic growth indicators are softening, these are coming off a high base. After a period of above-trend US growth our central forecast would be for a notable slowdown over the next couple of years, but far from recession.

Of course, a US recession or significant major global economic slowdown would be materially negative for the NZD, as we have seen in previous cycles. In the chart above we show consensus forecasts for world growth 12 months ahead. It shows the current slowdown in perspective. A global recession would likely see the NZD easily go sub-0.60 and the most recent previous global recessions have seen the NZD trough at 0.50 or lower.

A recovery in risk appetite is NZD supportive

If anything, pricing so far for 2019 suggests that risk assets might have overshot to the downside late last year, pricing in too much pessimism about the economic outlook. The New Year has begun with higher global equity markets, higher global rates, higher commodity prices and stronger emerging market and commodity currencies.

BNZ’s risk appetite index – made up of the VIX index, emerging market and high yield credit spreads – hit a multi-year low on Boxing Day of 26% and has since recovered sharply to 44%, still below the 50% mark which represents an average level of risk appetite.

Normally, a weaker global growth environment represents a headwind for NZD performance through 2019. But to the extent that this might already be well priced, then we won’t necessarily see material NZD weakness. Indeed, the path of least resistance at present is a further recovery in risk appetite that helps support the NZD over the short term.

US-China trade war risks recede

One of the enduring themes last year was the US-China trade war that threatened to get out of hand. Risks receded somewhat when President Trump didn’t go through with the proposed lift in tariff rates to 25% for $200b of Chinese imports into the US. Trade talks kicked off again and the inside word is that Trump wants a deal to be done, after getting the message that a weaker Chinese economy was spilling over into the US economy and equity market.

Some of the recovery in risk appetite this year can be attributed to increased optimism that a trade agreement will be reached. We see an agreement of sorts being completed, either before the 1 March deadline imposed by Trump or after a likely extension if talks drag on for longer than anticipated. US-China tensions run much deeper than just “trade”, with China’s increasing global presence threatening US hegemony. So tensions are likely to linger for years to come, but the silly policy of imposing tit-for-tat tariffs is likely to draw to a close, significantly reducing a risk factor that has been overhanging the global economy and markets for some time.

NZ’s terms of trade recover

Another recent positive variable for the NZD has been the terms of trade. GDT dairy auctions weren’t good for the first part of the season which began 1 June, with the first positive auction not seen until early December. Since then we have seen prices rise for three consecutive auctions. Whole milk power futures pricing on the NZX began their recovery slightly earlier, trending higher from November. At the same time oil prices plunged and only recently have staged a decent recovery.

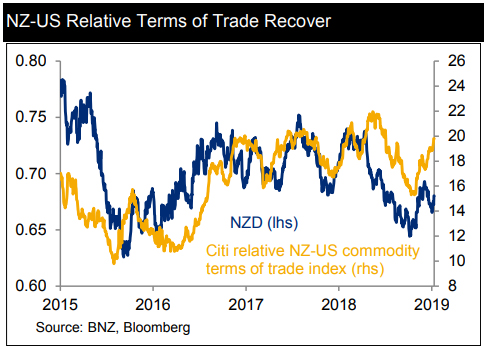

If we look at Citigroup’s commodity terms of trade index, taking the NZ index relative to the US a strong recovery has ensued since November, a tailwind for the NZD.

We believe that NZ’s commodity terms of trade can sustain recent gains, with the outlook for dairy prices positive. With falling Australian milk production, flat EU supply and rapidly declining EU skimmilk powder stocks, the supply side is starting to look a bit tighter. Based on our view that the global economy is likely to experience only a mild slowdown, demand for soft commodities should hold up okay. Overall, NZ’s terms of trade should generally be a neutral-to-positive factor for the NZD through 2019.

Flatter NZ-US rates profile ahead

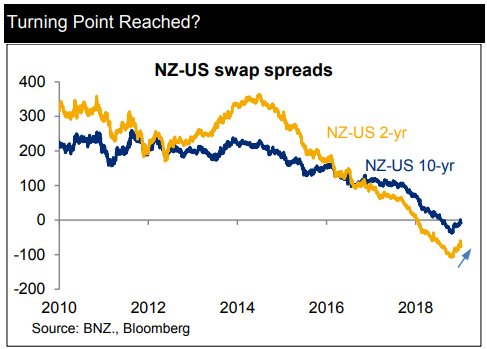

Lower NZ-US interest rate spreads have been a key headwind for the NZD over recent years, driven by tighter US monetary policy against a backdrop of the RBNZ keeping rates steady. Over the next six months we see monetary policy on hold for both NZ and the US and on market pricing neither central bank is expected to be active this year. There is a good chance that relative NZ-US interest rates remain fairly steady over the year ahead, although NZ rates remain below the US, which still means a negative carry for holding long NZD positions. In laymans terms, relative interest rates are still probably a headwind for NZD performance, but not as much compared to the past year.

The current risk is that the market has “overdone” the pullback in US rates. If a trade deal is signed, US equities continue to recover and the US economy tracks as expected, then the Fed might well nudge rates up another couple of times this cycle. But this is probably something to consider much later in the year, into the second half at least.

USD headwinds

Without conviction that the Fed will continue to hike rates, the USD has come under pressure early in the New Year. Adding to this tone is the expectation that the US economy’s period of growth outperformance is set to moderate, as the fiscal stimulus wanes and the lagged impact of tighter monetary policy takes effect.

A year ago there was some focus on the US economy’s growing “twin deficits”, a rising fiscal deficit alongside a widening current account deficit. This theme ran out of fuel as the economic outperformance and Fed tightening path ended up being a bigger influence on the USD. As those positive forces fade, we think that the twin deficits issue could come back into focus again. Historically, a rising dual fiscal plus current account deficit has seen broad USD weakness.

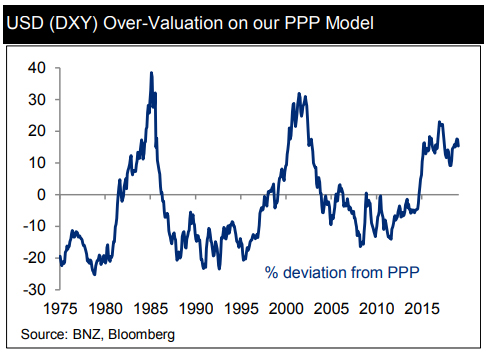

To those macro forces we can add the starting point for the USD which looks “over-valued” against all the key majors on a long-term purchasing power basis. On our PPP modelling this valuation gap ranges from 5% over-valued versus CHF to 23% versus GBP. On a DXY Index basis, current over-valuation of the USD is around 14%.

Where to from here for the NZD?

In our last forecast update in early December we suggested downside risk from the prevailing 0.69 cents level and suggested the currency would be anchored around 0.67-0.70 through 2019 (not denying periods outside that range of course, with the median high/low gap on daily closes being some 15% since 1990). That downside played out and we begin the year with a more constructive view given two key events since then – more conviction on a US-China trade deal and more conviction that the Fed will be on hold for some time.

Our short-term fair value model suggests that the NZD is only marginally rich, with fair value around 0.66-0.67, certainly nowhere near statistically significant. We think that the market already prices in some of the good news around a possible US-China trade deal – the NZD spent several months last year in “under-valued” territory when concern about the trade war was at its greatest and there was no deal in sight. The lack of any deal over coming months would be a blow to risk appetite and the NZD.

More fundamentally, summarising the earlier sections, a weaker global growth backdrop would normally be a headwind for the NZD, but we wouldn’t overplay this at present, given some chance that the market became overly pessimistic late last year on the outlook. Risk appetite has fallen steeply from year-ago levels to below-average suggesting less concern that a bout of weaker risk sentiment will drive the NZD lower.

Weaker terms of trade last year were mostly a negative force on the NZD and that factor has now faded, with recent data suggesting a recovery underway. That said, a slower global growth environment tempers our view on how much further NZ’s soft commodities will recover.

Relative NZ-US monetary policy was a clear negative factor last year, which doesn’t apply in the year ahead, although we’d note that NZ short-term rates are likely to remain below US rates for a considerable time yet.

Overall, after the 5% fall in the NZD last year, we think the odds favour a better year in 2019. As per our last forecast update in early December, our year-end target remains at 0.70. There might well be times when the NZD trades above that level. The best chance for a sustained move higher would be some focus on the “over-valued” USD and structural headwinds in the face of a rising twin deficit.

The key downside risk for the NZD would be a potential US-China trade deal turning to custard, or a renewed bout of weaker global risk appetite on fears that the growth environment is taking a turn for the worst, with the US economy on a path towards recession. However, if the Fed doesn’t hike rates again we find that scenario unlikely.

Mixed crosses

Our view on the crosses hasn’t changed since our NZD Corporate Update of 17 December:

NZD/AUD: Focus on a weak Australian housing market to continue which sees the recent higher trading range sustained. The Australian Federal election to navigate in May is an added risk factor which should keep the cross elevated in the mid-0.90s through the first half, receding back to the low 0.90s in the second half.

NZD/GBP and NZD/EUR: Largely at the whim of Brexit developments. Our projections of weaker NZD cross rates assume a positive outcome that might include either a soft Brexit or an extension of the exit date, supporting a strong rally in GBP with a positive spillover effect for EUR. We don’t see a “no-deal” Brexit as likely, given the lack of Parliamentary support for such a dire outcome.

NZD/JPY: A further recovery in risk appetite could see a return to the mid-70s, although we see significant resistance beyond that level as the yen remains very cheap. We see a 72-77 trading range at present that drifts lower over the medium-term.

Jason Wong is a senior currency strategist at BNZ in Wellington. This article is a repost of the original, here. It is reposted with permission.

6 Comments

NZD/AUD parity coming soon as the Sydney housing market drops further?

Hopefully

Maybe time for single AU NZ currency

China-Aus-NZ$ & Huawei bitcoins

Yes I recon we should switch to the AUD as soon as we hit parity. We really are too small and the AUD is stronger than the NZD almost 100% of the time.

then the RBA would decide our monetary policy.

Will never happen. NZD is tied to the global dairy prices and our exchange rate needs to float in relation to that and other commodity prices.

I'm going to print this off and use it as toilet paper.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.