This week’s Top 5 comes from ANZ economist Michael Callaghan.

As always, we welcome your additions in the comments below or via email to david.chaston@interest.co.nz.

And if you're interested in contributing the occasional Top 5 yourself, contact gareth.vaughan@interest.co.nz.

The RBNZ cut the OCR to 1.5% at the May Monetary Policy Statement, to support employment and get inflation back to 2% sustainably. There are a few channels through which the OCR cut have been effective in easing financial conditions, but more cuts are needed to support a pickup in growth, as we discuss in our ANZ Weekly Focus.

1. The NZD has depreciated.

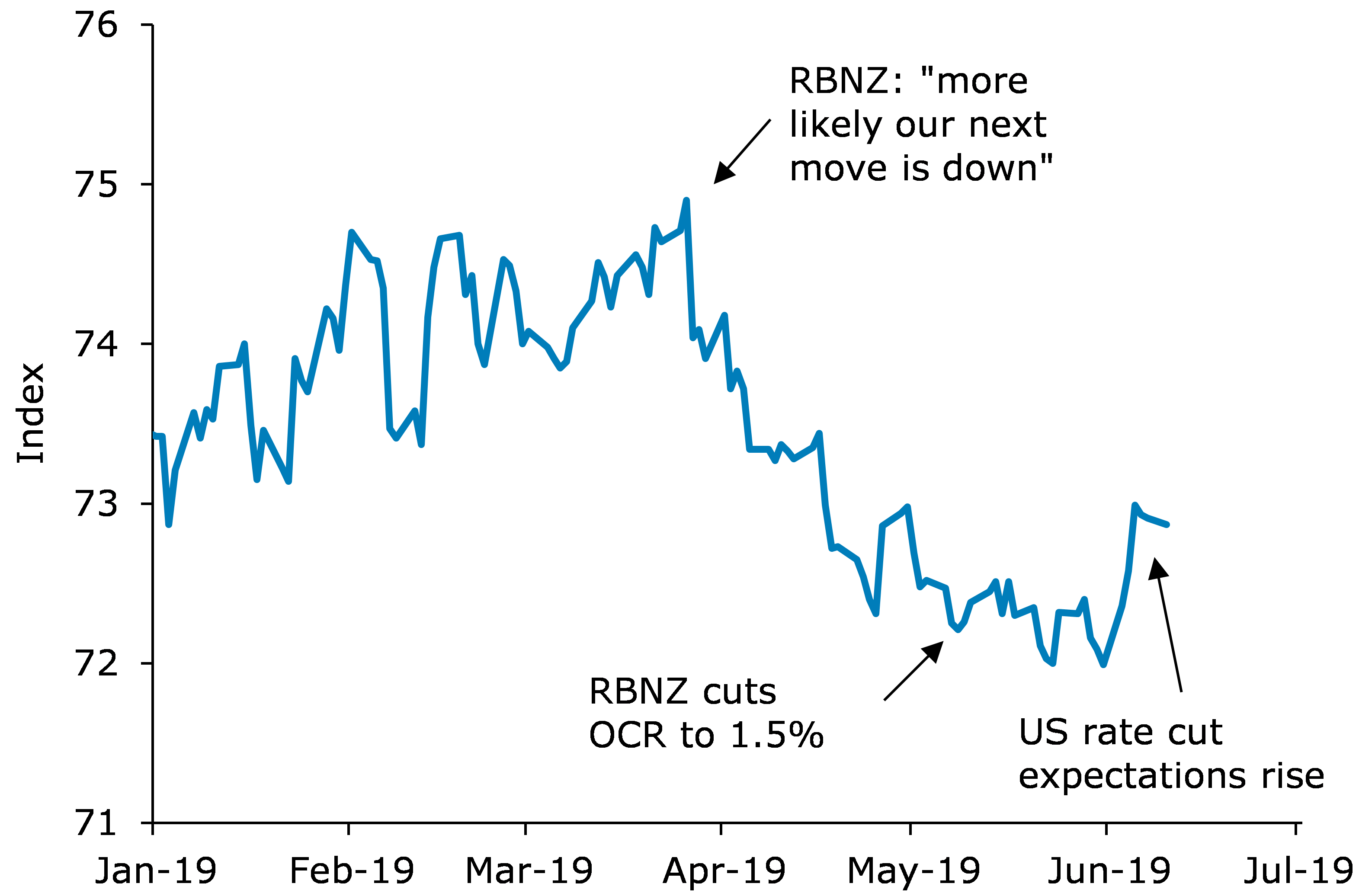

For a small open economy, the exchange rate is an important channel for monetary policy, and interest rate differentials matter for the NZD. Most of the recent fall in the NZD already occurred back at the March OCR Review, when the RBNZ signalled that a lower OCR would likely be needed (figure 1). The OCR cut in May helped to lock in this fall.

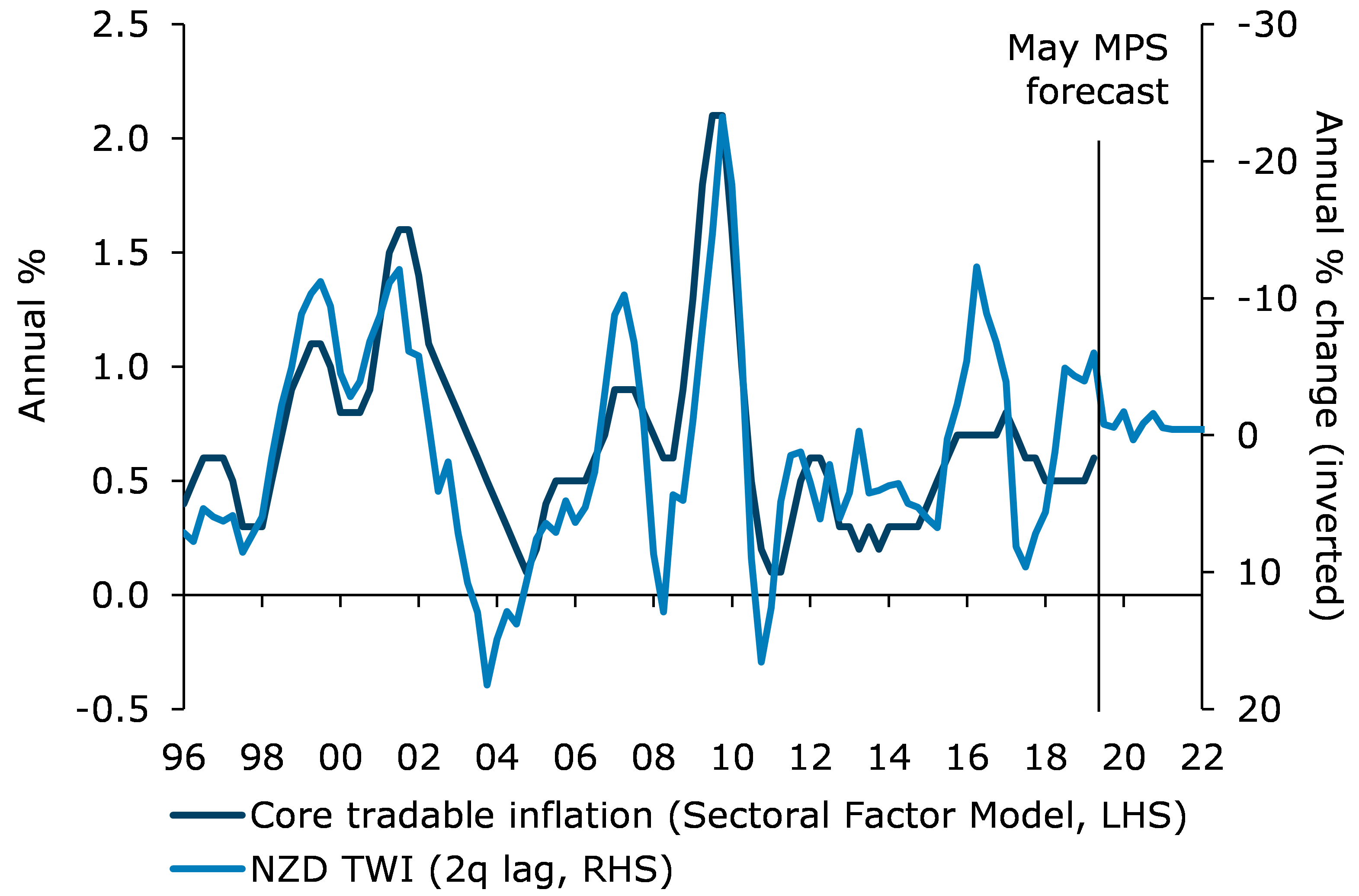

The lower NZD will boost exporters’ incomes and their spending in the economy. But with the global outlook fragile, we suspect the pass-through to the rest of the economy will be a little more muted than otherwise – deleveraging seems more likely than a spend-up. The fall in the NZD will also increase imported prices, which will encourage domestic spending, rather than imported spending, and will give inflation a boost (figure 2).

That said, with the exchange rate channel, the RBNZ is always up against other central banks’ policy stances. Increasing expectations for rate cuts from the US Federal Reserve has seen the NZD move higher again in recent weeks.

Figure 1. NZD trade weighted index

Source: Bloomberg, ANZ Research

Figure 2. NZD and tradable inflation

Source: RBNZ, ANZ Research

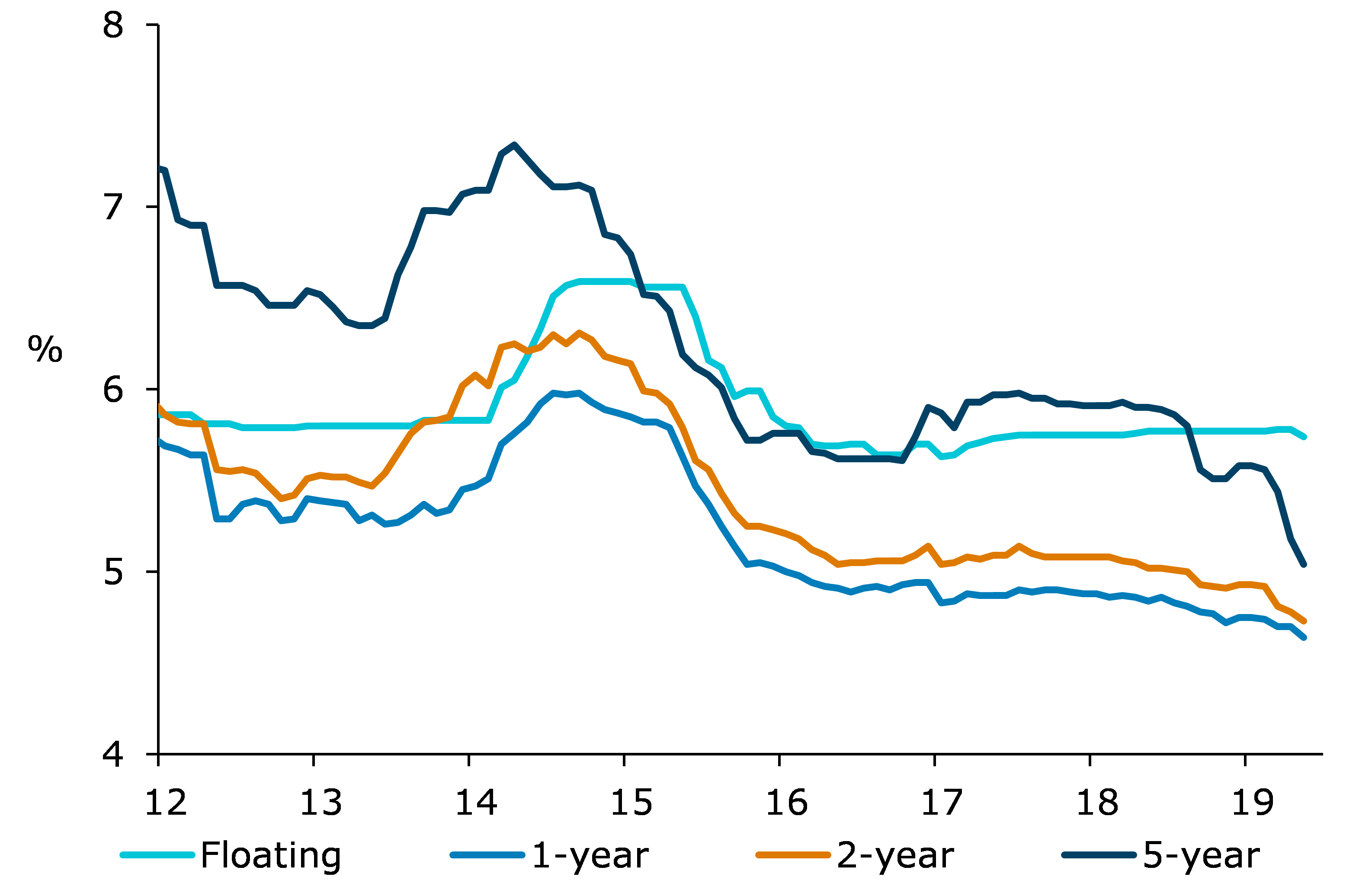

2. Mortgage rates have fallen over the past year.

Mortgage rates have fallen, particularly for fixed terms, which about 80% of mortgages are on. Too much focus is often placed on the current OCR, but it is expectations about the future OCR and the future stance of the RBNZ that are important for moving these longer-term interest rates. At the end of May, the 5-year rate had fallen 54 bps and the 2-year rate had fallen 20 bps since the start of the year (figure 3).

We expect the fall in mortgage rates to help stabilise the housing market, rather than accelerate it. But as mortgage rate changes flow through, current mortgage holders will be left with more cash to spend elsewhere.

Figure 3. Mortgage rates

Source: RBNZ, ANZ Research

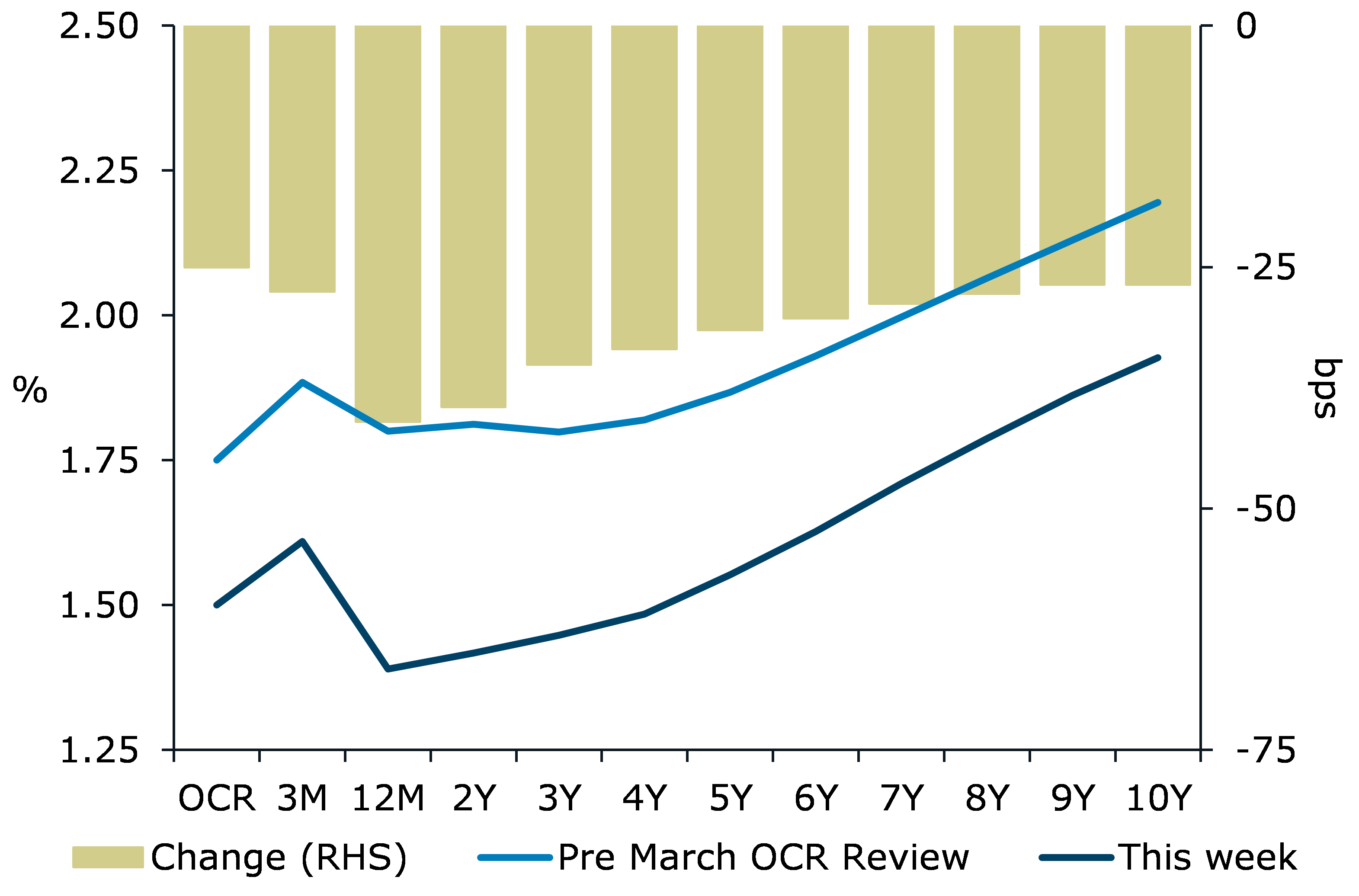

3. Pressure on business lending rates has reduced.

The drop in the OCR will, at the margin, relieve upward pressure on business lending rates. Interest rates in wholesale debt markets have also declined (figure 4), meaning that corporates can now issue debt more cheaply. Business surveys suggest that the investment and activity outlook remains gloomy, with declining profitability, labour shortages, regulatory concerns, and uncertainty holding back production. But with lower financing costs, investment projects are now a bit more attractive than they were. In addition, lower deposit rates increase the incentive for firms to spend and invest, rather than sit on cash.

Figure 4. NZ wholesale swap interest rate curve

Source: Bloomberg, ANZ Research

4. But we don’t think growth will pick up rapidly with the OCR at 1.5%.

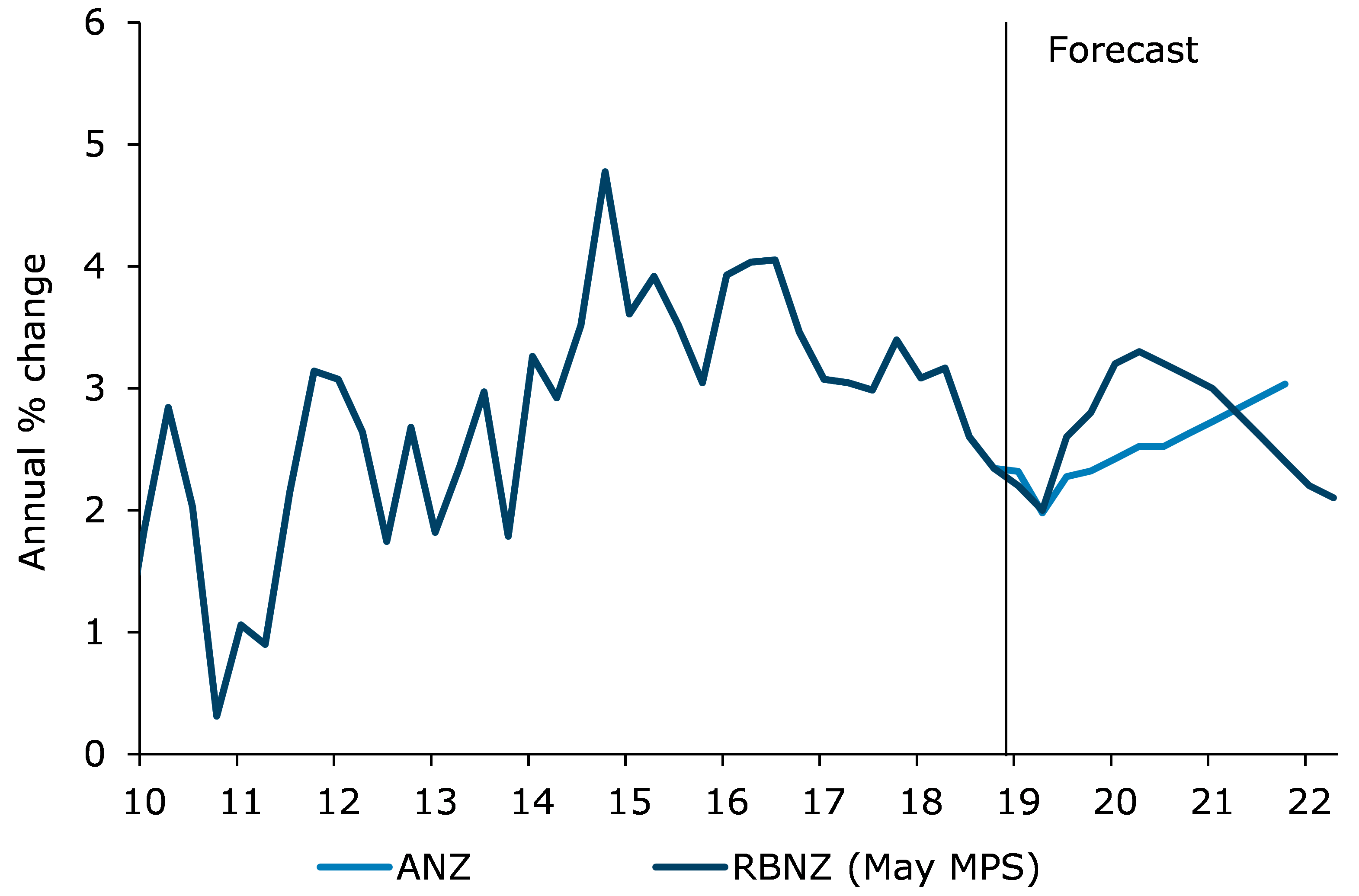

Our growth outlook and the RBNZ’s growth outlook rapidly diverge from mid-2019 (figure 5). While easier financial conditions are providing a tailwind to growth, other headwinds are evident. Growth in residential construction activity has slowed as margin pressures, shortages of labour, and usable land constraints bite. And now household spending is taking a hit, with consumption growth off its 2016 peaks. Amid the housing market slowdown and global growth risks, we think weaker business activity has a little longer to run.

Figure 5. GDP growth

Source: RBNZ, ANZ Research

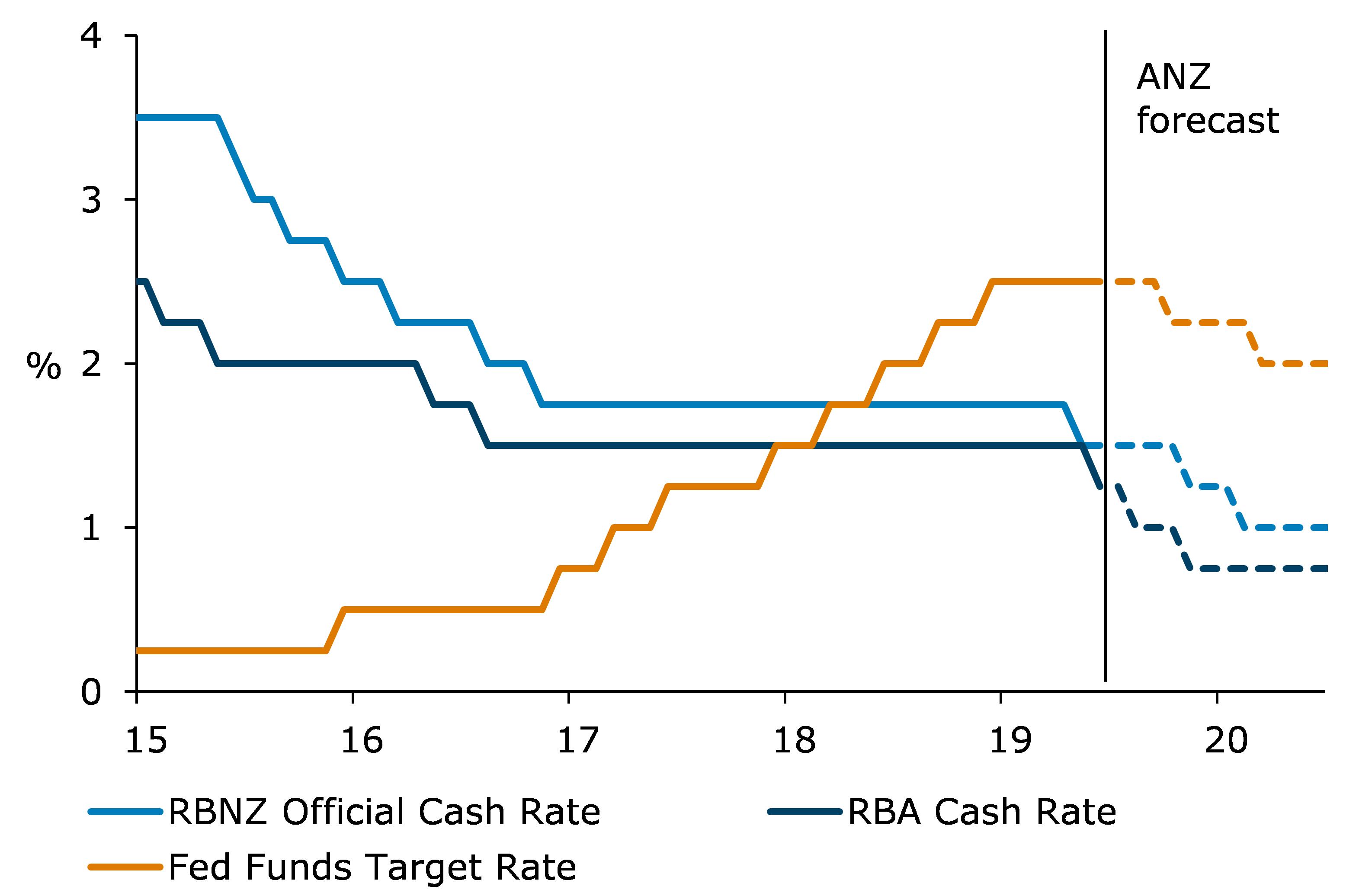

5. So central bank policy rates are likely to fall further.

With domestic growth unlikely to accelerate sharply, we expect additional rate cuts by the RBNZ in November and February to take the OCR to 1% (figure 6). Further cuts in the OCR should help ease lending rates and the NZD further and see domestic growth gradually recover.

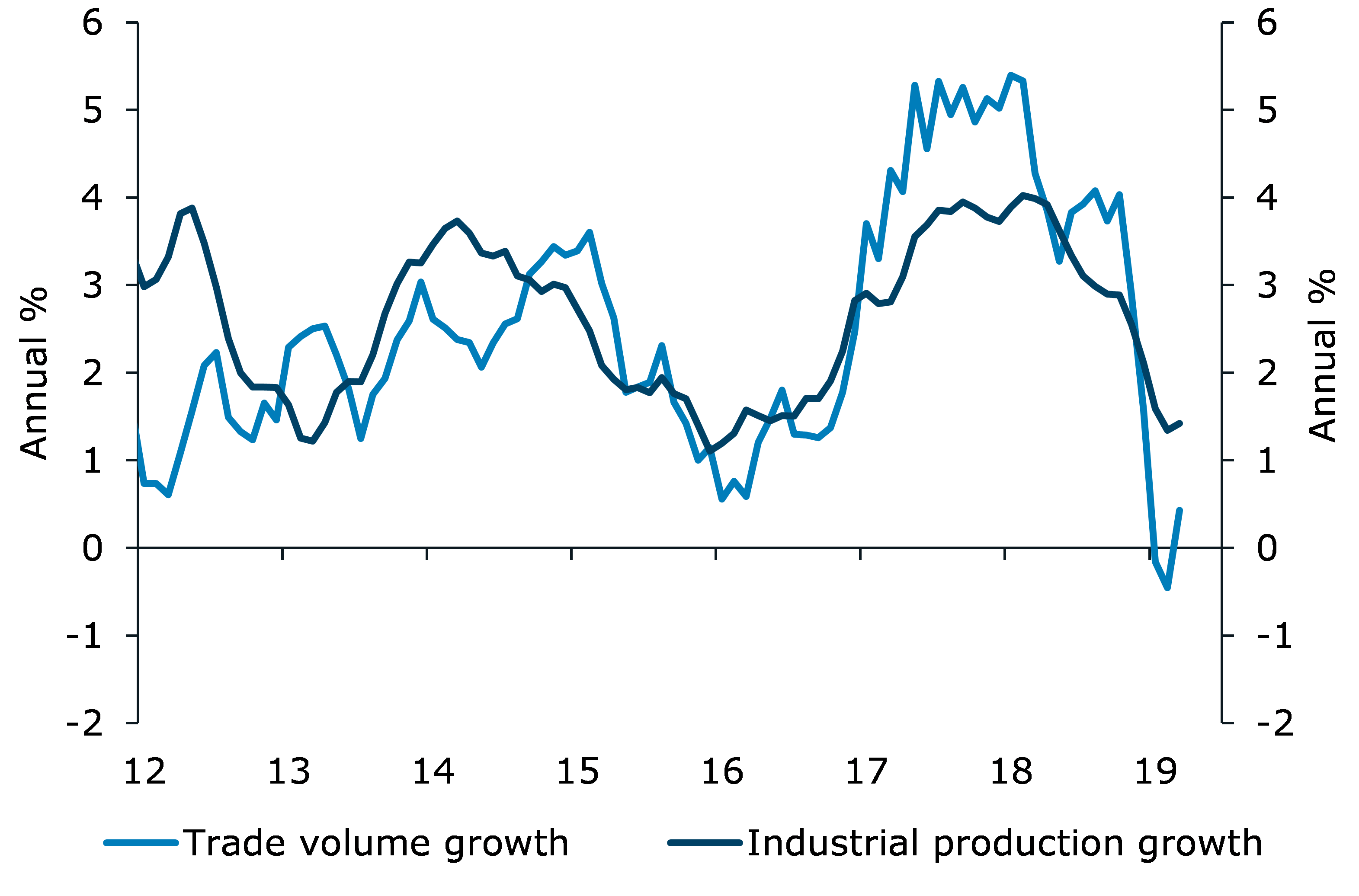

But New Zealand isn’t the only economy with weak inflation and slowing growth. Global risks are elevated, with global industrial production and trade growth slowing sharply over the past six months (figure 7). The RBA has begun a fresh easing cycle, and we now expect the Fed to follow suit.

But central banks globally have little room to move if a crisis hits. Domestically, the RBNZ has been exploring unconventional monetary policy, such as negative interest rates and quantitative easing. Regardless, the next crisis can’t be borne by monetary policy alone – fiscal policy needs to be ready to step up.

Figure 6. Central bank policy rates

Source: Bloomberg, RBNZ, ANZ Research

Figure 7. World industrial production and trade growth

Source: Bloomberg, ANZ Research

18 Comments

But central banks globally have little room to move if a crisis hits. Domestically, the RBNZ has been exploring unconventional monetary policy, such as negative interest rates and quantitative easing. Regardless, the next crisis can’t be borne by monetary policy alone – fiscal policy needs to be ready to step up.

Hmmmmm...because:

There is, and has been, no money in monetary policy; the one thing that might’ve been handy during the only monetary panic of the last four generations. To monetary authorities, money is that unknown. There just aren’t any circumstances where they can act on this fact.

Upon hearing the truth, I suspect the vast majority of the world would react with anger, something along the lines of, “what have you been doing this whole time” and “why did you just let 2008 happen and the world suffer the increasing consequences?” Link

Every commentator should be required to divulge their financial interest in the opinion they are pushing as news. I have no doubt the ANZ has its own agenda and they ought to reveal what they are doing before telling the reserve bank what it should do.

Arguably, central banks wotk in tandem with retail banks. FFS, it is without a doubt that the economy has been driven by credit that has been lent into existence to h'holds.

I would go further, the RBNZ has chosen to be a captive regulator. Its policy is to modulate interest rates to a level that keeps defaults low, ie to a level that maximises cash flow to the Aussie banks. That sounds like a good thing, but it results in silly house prices and low profitability in export businesses, and transfers wealth from depositors to borrowers. They win the battles but lose the war. They appear to have walked into a trap.

This is unfair from me perhaps, but more so from ANZ and interest.

I am a bit disappointed that an article has been published by an economist who left education in 2016 and has only been in the private sector of banking for 4 months. I admire the young man immensely for writing a very nicely worded piece that doesn’t offend, but to have worked for ANZ for such a short time and be offered up for sacrifice, speaks volumes of the employer. Let’s have something from Mr Hisco, maybe on the private banks ‘credit creation’ and how it’s done. Where are the banks’s Directors to defend the attestation mishap? This lad’s a smart guy, I hope he has a great career ahead of him, but let’s be clear on this, this is lambs to the slaughter.. I’d like to hear from someone who has been at the bank a while and who actually knows what’s been going on.

This is like sending out the U13’s to play the First XV.

My apologies to the author. I have criticised without providing him with anything to help him in return.

Lord Turner’s interview here will I hope atone for my criticism of the article. Monetary Policy doesn’t work anymore.

They blood them young these days. A baptism of fire. Presumably they are being paid top dollar to do the job

"Regardless, the next crisis can’t be borne by monetary policy alone – fiscal policy needs to be ready to step up".

There's the end of the 'free market' nonsense, right there; Socialise the debt, please, we're in trouble. The problem is that Keynesian moves won't work this time either.

An ultimately, the next one will result in the outlawing of interest - if systemic interaction survives. Which might change banking a little

2) I'm not sure that the cuts both past and future will stabilise the housing market. Lending is still growing but house prices are not stable.

With respect to the rate cuts putting more money in people's pockets. That is the case, typically I would have churned the interest savings into the mortgage principle but I didn't see a point this time. I have better uses for the money. For those under pressure this does offer more breathing room but only a marginal amount. Perhaps it'll help keep the mortgage payment defaults at roughly 2% as indicated in C35.

This is nonsense:

But with lower financing costs, investment projects are now a bit more attractive than they were. In addition, lower deposit rates increase the incentive for firms to spend and invest, rather than sit on cash.

A sensible businessman sees the lower interest rates as a sign that the economy is slowing. He or she will defer capital investment and hoard cash in order to have the option of taking advantage of such opportunities as may arise.

Agree with you. And this is exactly the case with many Japanese companies and businesses who wouldn't invest or spend but are sitting on monutains of cash.

Yes.

As I said the other day, ANZ has been on the slide downhill since Bagrie left, in terms of economic analysis.

Funny how the Anz don't mention pronounced housing unaffordability as a reason why residential construction is looking so weak.

Sounds like a lot of dogma and ideology!

Sounds like a lot of dogma and ideology!

Nail on head

Finish uni in 2016. 3 years at the RBNZ and 4 months at ANZ.

It’s unfair on this lad for interest to publish this to what is a very educated and highly vocal audience.

Nah. He's young enough to question things still - although Economics turns out some dogmatic fodder.

Better we put stuff up for him to learn from.

https://www.zerohedge.com/news/chris-martenson-trouble-money

https://ourfiniteworld.com/2019/04/09/the-true-feasibility-of-moving-aw…

https://ftalphaville-cdn.ft.com/wp-content/uploads/2013/01/Perfect-Stor…

That shoud get him started.

agreed.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.