BNZ says a week's worth of electronic card spending by its Auckland customers at Covid-19 Alert Level 3 Step 2 has lifted card spending to levels above where things were at before the Delta lockdown.

BNZ Chief Economist Paul Conway says data for the week ending Tuesday, November 16 shows Auckland card spending up 27% on the previous week. That makes it 7% higher than pre-Delta levels.

“Retailers had been waiting a long time for the freedoms that Alert Level 3 Step 2 brought, and Aucklanders dusted off their wallets and didn’t disappoint," Conway says.

“Compared to the previous week, department stores, clothing and furniture have all increased sales this last week by more than 100%.

Bricks and mortar retail stores reopened in Auckland on Wednesday, November 10 after a lockdown was imposed on August 18.

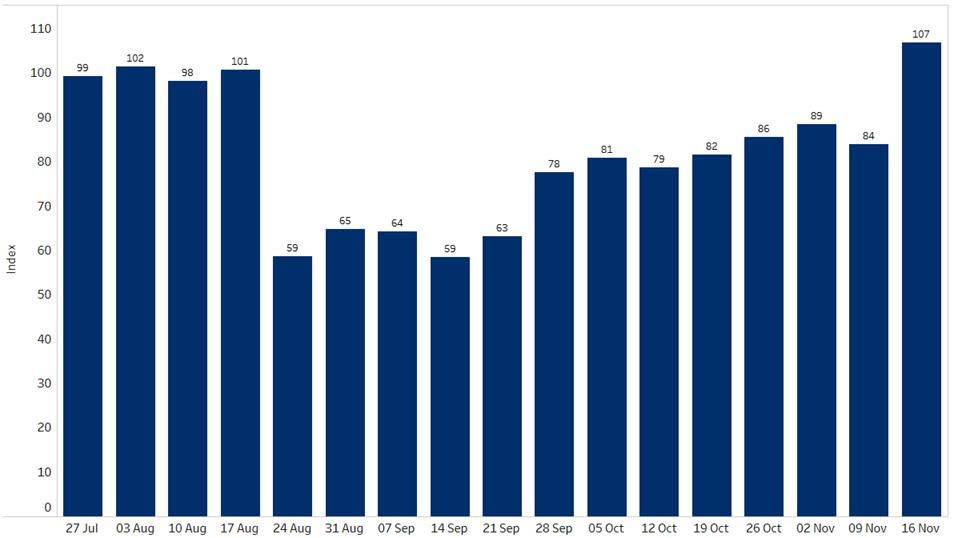

The chart below covers BNZ customer card spend through domestic merchants. It includes all credit card transactions, debit card transactions, and EFTPOS card transactions. BNZ says the index is calculated on the average of the four weeks prior to the Delta lockdown.

Auckland Card Spending (indexed).

8 Comments

Probably filled their cars up with gas.

RBNZ will be carefully noting this data...

Wow, such revelatory findings! Who would have thought!

So shops being open is a driving factor for consumer spending.

Big if true.

All that PENT UP DEMAND from no shopping to "money for everyone" leading this Auckland retail boom.

Aucklanders simply using their smarts because why would any ordinary person would want to pay for postage if you could avoid it during a lockdown

Temporary spending post lockdown, the big test comes in spending in 6 months time when interest rates hit 6%.

Yes, we have had a rush of buying things over the past week or so. Things like sofa beds and shoes, which we want to test for comfort in person.

Now that we've had that splurge, we will return to subdued spending...

This BNZ blog post copy lacks context. It would be better if BNZ compares their index with 2019 and 2020.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.