delta

BNZ has raised some home loan rates too following ANZ, but somewhat surprisingly, it has lowered a key one as well. Meanwhile many swap rates move up to four to six year highs

16th Feb 22, 5:59pm

42

BNZ has raised some home loan rates too following ANZ, but somewhat surprisingly, it has lowered a key one as well. Meanwhile many swap rates move up to four to six year highs

The nation's largest home loan lender takes a chance and pulls up some key home loan rates, with most of its fixed term offers now higher than all, probably hoping its main rivals will follow soon

14th Feb 22, 8:13pm

33

The nation's largest home loan lender takes a chance and pulls up some key home loan rates, with most of its fixed term offers now higher than all, probably hoping its main rivals will follow soon

Challenger banks make changes to some key home loan rates, some up as expected, others down unexpectedly

14th Feb 22, 10:37am

6

Challenger banks make changes to some key home loan rates, some up as expected, others down unexpectedly

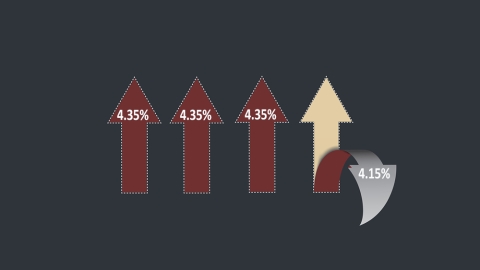

The flat-lining of the two year wholesale swap rate has allowed a few banks to trim a mortgage rate for a competitive advantage in the meantime. TSB is the latest

3rd Feb 22, 10:43am

27

The flat-lining of the two year wholesale swap rate has allowed a few banks to trim a mortgage rate for a competitive advantage in the meantime. TSB is the latest

Job ads end 2021 on a high note with the years, says BNZ/Seek Employment Report, but some Omicron clouds may be on the horizon

13th Jan 22, 12:22pm

1

Job ads end 2021 on a high note with the years, says BNZ/Seek Employment Report, but some Omicron clouds may be on the horizon

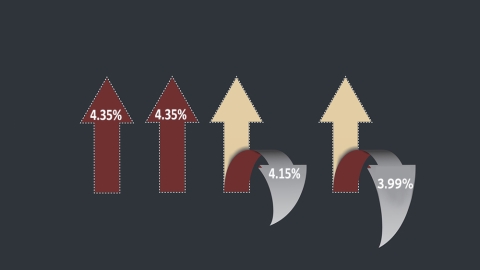

ASB trims its two year fixed home loan rate by 20 basis points to 4.15% as wholesale swap rates make a similar move down. And the CCCFA rules start to bite at loan demand

7th Dec 21, 9:12am

39

ASB trims its two year fixed home loan rate by 20 basis points to 4.15% as wholesale swap rates make a similar move down. And the CCCFA rules start to bite at loan demand

Suddenly, the rise and rise of fixed mortgage rates looks less certain as financial markets recoil at Omicron. Maybe that opens up an opportunity for borrowers to seek discounts off the new higher carded rates

29th Nov 21, 9:33am

21

Suddenly, the rise and rise of fixed mortgage rates looks less certain as financial markets recoil at Omicron. Maybe that opens up an opportunity for borrowers to seek discounts off the new higher carded rates

ASB the first bank to increase floating home loan rates following the 25 basis points OCR rise, but only by 15 basis points, ANZ adds 20 basis points, Kiwibank, Westpac and BNZ add 25 bps

24th Nov 21, 2:14pm

12

ASB the first bank to increase floating home loan rates following the 25 basis points OCR rise, but only by 15 basis points, ANZ adds 20 basis points, Kiwibank, Westpac and BNZ add 25 bps

Following ASB and Westpac, ANZ as the largest home loan lender raises its carded offers, pushing some rates to new higher territory. One year rates now have a 70 bps advantage

22nd Nov 21, 8:37am

86

Following ASB and Westpac, ANZ as the largest home loan lender raises its carded offers, pushing some rates to new higher territory. One year rates now have a 70 bps advantage

Reserve Bank set to increase the Official Cash Rate on Wednesday in the last scheduled review of its key monetary policy tool for three months

21st Nov 21, 6:00am

70

Reserve Bank set to increase the Official Cash Rate on Wednesday in the last scheduled review of its key monetary policy tool for three months

BNZ says increase in Auckland electronic card spending since bricks and mortar retail reopened pushed it above where it was at when the city's lockdown began in August

19th Nov 21, 1:01pm

8

BNZ says increase in Auckland electronic card spending since bricks and mortar retail reopened pushed it above where it was at when the city's lockdown began in August

Westpac joins ASB in pushing through higher fixed mortgage rates, as rising inflation expectations push up wholesale rates, and all eyes turn to how the RBNZ will react

18th Nov 21, 4:06pm

85

Westpac joins ASB in pushing through higher fixed mortgage rates, as rising inflation expectations push up wholesale rates, and all eyes turn to how the RBNZ will react

ASB raises all its fixed home loan rates giving it the highest rates on offer for most fixed terms. Options under 4% are shrinking fast, especially at the main banks

16th Nov 21, 9:02am

98

ASB raises all its fixed home loan rates giving it the highest rates on offer for most fixed terms. Options under 4% are shrinking fast, especially at the main banks

ANZ raises its mortgage rates but only to take up the space beneath its main rivals. It also raised its term deposit rates a minor amount

10th Nov 21, 7:17pm

11

ANZ raises its mortgage rates but only to take up the space beneath its main rivals. It also raised its term deposit rates a minor amount

Westpac raises mortgage rates again, unafraid of having the highest 1, 2 and 3 year fixed rates of any bank, probably confident others will follow

4th Nov 21, 8:23pm

22

Westpac raises mortgage rates again, unafraid of having the highest 1, 2 and 3 year fixed rates of any bank, probably confident others will follow