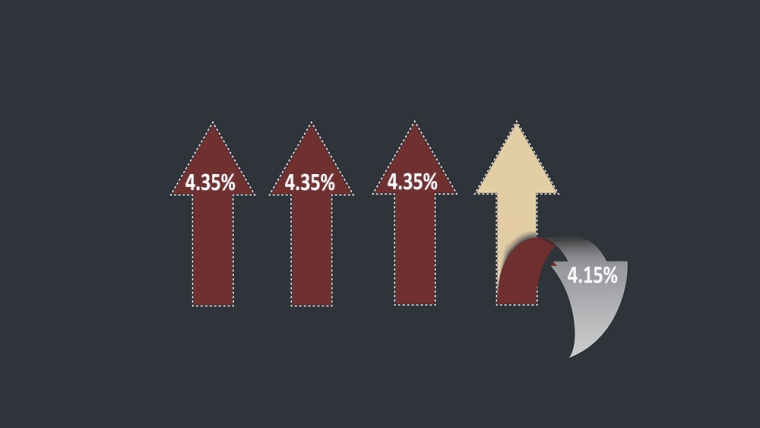

After a long series of rises, today we can report a retracement.

ASB has cut 20 basis points from its 4.35% two year fixed home loan rate, taking it down to 4.15%.

This is the only rate it has adjusted on its website - so far.

But that is enough to give it a noticeable advantage over all its rivals, especially its main rivals.

This also comes at the time the new Credit Contracts and Consumer Finance Act (CCCFA) rules start to bite, on top of a range of other measures all designed to restrain housing demand.

Lower demand for housing may be happening quite quickly now, and it is perhaps not surprising that mortgage rates are suddenly turning lower is an end of year scramble for mortgage business.

ASB's rivals are likely to follow soon.

At the same time, wholesale swap rates have stopped rising. The two year swap rate was 2.25% in early November when the 2 year fixed rate was 4.15%. The swap rate rose +20 bps to 2.45% by November 22, and the mortgage rate rose to 4.35%. Now, the swap rate is back at 2.25%, and ASB's 2 year fixed offer has reduced to 4.15%. From the wholesale rate view, these changes make bush sense

One useful way to make sense of these changed home loan rates is to use our full-function mortgage calculator which is also below. (Term deposit rates can be assessed using this calculator).

And if you already have a fixed term mortgage that is not up for renewal at this time, our break fee calculator may help you assess your options. But break fees should be minimal in a rising market.

Here is the updated snapshot of the lowest advertised fixed-term mortgage rates on offer from the key retail banks at the moment.

| Fixed, below 80% LVR | 6 mths | 1 yr | 18 mth | 2 yrs | 3 yrs | 4 yrs | 5 yrs |

| as at December 7, 2021 | % | % | % | % | % | % | % |

| ANZ | 4.00 | 3.65 | 4.15 | 4.35 | 4.75 | 5.65 | 5.85 |

|

4.19 | 3.65 | 4.09 | 4.15 -0.20 |

4.69 | 4.95 | 5.19 |

|

3.99 | 3.65 | 4.09 | 4.35 | 4.69 | 4.89 | 4.99 |

|

4.19 | 3.69 | 4.35 | 4.69 | 4.99 | 5.15 | |

|

4.19 | 3.69 | 4.09 | 4.35 | 4.69 | 4.79 | 4.95 |

| Bank of China | 3.49 | 3.49 | 3.69 | 3.99 | 4.45 | 4.65 | 4.85 |

| China Construction Bank | 3.65 | 3.65 | 3.85 | 4.35 | 4.65 | 4.95 | 5.05 |

| Co-operative Bank [*=FHB] | 3.65 | 3.45* | 4.05 | 4.35 | 4.69 | 4.89 | 4.99 |

| Heartland Bank | 2.90 | 3.45 | 3.60 | ||||

| HSBC | 3.94 | 3.49 | 3.94 | 4.15 | 4.54 | 4.74 | 4.99 |

| ICBC | 3.59 | 3.29 | 3.59 | 3.85 | 4.19 | 4.59 | 4.79 |

|

3.79 | 3.45 | 3.95 | 3.99 | 4.35 | 4.59 | 4.69 |

|

3.60 | 3.60 | 4.00 | 4.30 | 4.64 | 4.74 | 4.90 |

Fixed mortgage rates

Select chart tabs

Daily swap rates

Select chart tabs

Comprehensive Mortgage Calculator

39 Comments

The Cost of Debt is going to plunge, again. It has to, just to try and keep some semblance of order in a market where asset values deflate.

And so here we are, witnessing the switch from 'risk-on' to 'risk-off' in real time. Retail investors will buy every dip with gusto...and insiders will sell quietly but furiously as they race to dump all their over-valued (assets) on buy-the-dip believers in the permanence of risk-on euphoria and valuations. (CH Smith)

I was asked yesterday, "So. When is all this going to happen?" and to me, it's as inevitable as the next Wellington Big Earthquake - it will happen. The only question we have to answer is: "When do I take action to protect myself?" Now? Tomorrow? Next Decade? Because the day after it happens will be too late.

Yes some time in the next 1-2 years interest rates will recommence their inexorable gravitational dip towards zero...

You really think so? Have you thought about why banks are tightening their lending so hard at the moment? Why ASB only changed their 2 years fix? If the interest rates are dropping back to zero, surely they could keep the party going as they make more bigger profits from that. Even Tony Alexander said

"It's really the biggest tightening I think we've ever seen, quite frankly, and it has come at the same time as we've seen the fastest increase in fixed interest rates since they appeared in the early 1990s."

Banks, bless them, don't actually posses the knowledge of where rates are heading. They are subject the the same unknown future events as the rest of us.

I don't fully agree with you on this. It's true that they can't predict unknown future events, but they can use their data that collected to forecast where the future economy heading. If you compare today's rates with 2019's rates. You would notice that there is a big difference for 4 years and 5 years fix. If you care to ask yourself why, you might find out that they may not be as blinded as the rest of us.

ANZ cuts six month, 1 & 2 year fixed-term mortgage rates | interest.co.nz

They match their loans and deposits each day and week, so they dont really care if the rates are up or down, as long as they have their margin locked in on the match balances.

I guess we'll see won't we?

My view is based on a housing and construction collapse triggered by rising interest rates and construction costs.

I know almost everyone here dismisses this opinion of mine, so maybe I will be the sole person with egg on his face.

You may be right. Another "New build phase" was an event that happened prior to the GFC. "New builds" happen late in the cycle.

But Govts will do what is necessary to prevent such a collapse this time, which includes dropping benchmark rates (IMO)

If you look at the last 30 years you will see that as night follows day, new construction drops away as interest rates increase.

For that to happen, the inflation will need to come down to less than 2% with unemployment rate goes higher. The assets market will be facing a serious correction. If we want to see soft landing for our house market, the interest rate will stay high for a while until inflation comes down to normal level.

Inflation is artificially high because of global supply chain issues, the lack of movement of people (i.e. hard to hire people), and finally the low productivity due to the first two points. If it wasn't for these three things (caused by COVID), inflation would not be this high.

The question we should ask is when does this artificial inflation disappear? Or do we continue to do knee jerk decisions based on artificial data that we know is not real and cannot be sustained.

COH, I'm afraid your post and quote don't make sense, the banks don't decide whether interest rates go up or down, they simply follow swap rates and the OCR, which are heavily dictated by inflation. The world hasn't "fixed" it's overconsumption of debt at all, HM is most likely correct, interest rates will return towards "0", I would predict in 2023

My post was mainly asking questions to get people start thinking. I never said banks decide whether interest rates go up or down. They have their own economists to collect and analyse their own data to forecast future economy and OCR trend. Due to this, we need to think why the 4 years and 5 years fix haven't come down if you and HM saying interest rate will return to 0 by 2023? Remember that 2 years ago, most of 4 and 5 years rates were still around 4% which are more than 1% lower than where they are today. This is why I disagree with your prediction. Your prediction could be true if there is a serious housing market correction.

Inflation is set to stay high for some time forcing the Reserve Bank to combat it with steadily rising interest rates, according to two of the central bank's most senior officials.

Outgoing deputy governor Geoff Bascand has told a financial services conference that inflation is likely to stay above 4 percent for a year or more.

Steadily-rising interest rates on the way, NZRB officials say | RNZ News

Also just out of curiosity, have you and HM fixed your mortgage rate to 2 years if you think OCR will come down close to zero in 2023?

Sorry COH but I do think you have what is driving interest rates all muddled up

It's interesting that you deny other people's view but with nothing really to back up your point. We made a huge thing here when one bank just cut 0.2bps for one of its six fixed home loan. There is no point to argue here. We will just see how it goes in future, shall we?

Indeed

Apologies I was so harsh on you yesterday Yvil.

One of your good qualities seems to be that you move on, forgive and forget.

In the good old days (the 70s) we would have a bar fight, and afterwards everyone would be friends again.

These on-line punch-ups aren't healthy.

The lack of "holding a grudge" must come with the lack empathy, LOL.

Seriously, this is a financial website, I look at it as a tool to make good financial decisions not to feel sorry for a complete stranger, I prefer to show my emotions to my wife, kid and friends. If I think you make a good point, I say so, if I think you're making a bad point I say so too but some get all offended. I don't care

At one stage the interest might hit negative since we were so close. Something to add to the history book just like no one saw covid coming.

So those who signed up with a $1M loan earlier in November and were eager to lock in a similar amount in a 2 year fixed rate is paying about $39K extra throughout the life of the loan.

Everyone makes their own calls based on advice and analysis, life circumstances, tolerance of risk etc.

I have been saying consistently that I think the OCR will start dropping again probably by late 2022. But that's simply my view.

If your loan is not too big then it may pay to float for a few months if dropping out of a fixed period.

Then see if rates start dropping again later in 22.

I think your maths (or logic) is a bit off. The extra rate is 0.2% of 1 million only over the 2 years. Once that time is up the person can just re-fix at whatever the prevailing rate is at the time.

And maybe they're better off if rates uptick again in a couple of month's time. There's just no point analysing decisions like that - just aim to achieve a good average outcome, timing will never be perfect.

How much of these interest rate movements are due to the maturing time table of the loans with individual banks ? Banks can manipulate them to profit out of the expected rollovers, right ?

Lol 'panic panic rates are increasing, fix for 5 years!' Next minute, rates drop...

Endless mind games...

Precisely. Never follow a mob!

I count exactly one rate on that entire chart that is below my 5 year fixed rate. But then, I broke-and-fixed over 6 months ago. If one is going to panic, panic early.

I have 75% of my mortgages at 5 years, 2.8-2.9%.

Shaken, not stirred. Cheers

Sums up the current state of affairs...

https://m.washingtontimes.com/news/2021/nov/15/the-fraud-of-bidens-infl…

The world is going to increasingly move to private money because of the fraudulence of central bankers.

Will they really though? Surely no one stores money under the mattress anymore, they invest it don't they?

I don't think people are buying Bitcoin because they don't trust Fiat, they buy it because it has been a bloody good investment / bubble.

Your job isn't to predict the weather. Your job is to build the ark.

Make your moves before you need to.

Yup i agree, rates will fall big time once supply chain clears out and inflation falls off a cliff

Just look at all the input costs for food such as fertiliser etc and you can see food isn’t going back down, neither are things like rates , insurances etc . Wages will move up next which just fuel more input cost increases. Inflation is here to stay for the next few years.

Nothing has changed mate except way more debt.

Wages have risen already but not as much as inflation.

Everyone will stop spending and interest rates will have to fall to sustain the larger amounts of debt.

Once the supply chain clears the prices for almost everything will drop.

Playing silly buggers?

It's a trap!

Interest rates starting to drop... highly unlikely... just a blip. There seems to be plenty of houses for sale in Wanganui and houses for sale in Marton. Property listings have gone up by nearly 50% so there are more properties to choose from. Prices have certainly gone crazy but I would expect prices may now level off with better supply. If you are looking to buy a house in Wanganui I would highly recommend Whanganui Mansions www.whanganuimansions.co.nz which is a free online real estate magazine and real estate search facility featuring houses for sale in Wanganui, Waverley, Marton & Bulls, New Zealand. You can find all the local real estate agents & private listings in all price ranges. And if you are a real estate agent or a private seller, your listings are all free.

🤡

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.