The average household in New Zealand has faced a 31% increase in mortgage interest rate costs in the past year, according to Statistics New Zealand.

Stats NZ's household living-costs price indexes for the June quarter show that the "highest spending" households have actually been more affected by the big rises in mortgage rates between June last year and June this year.

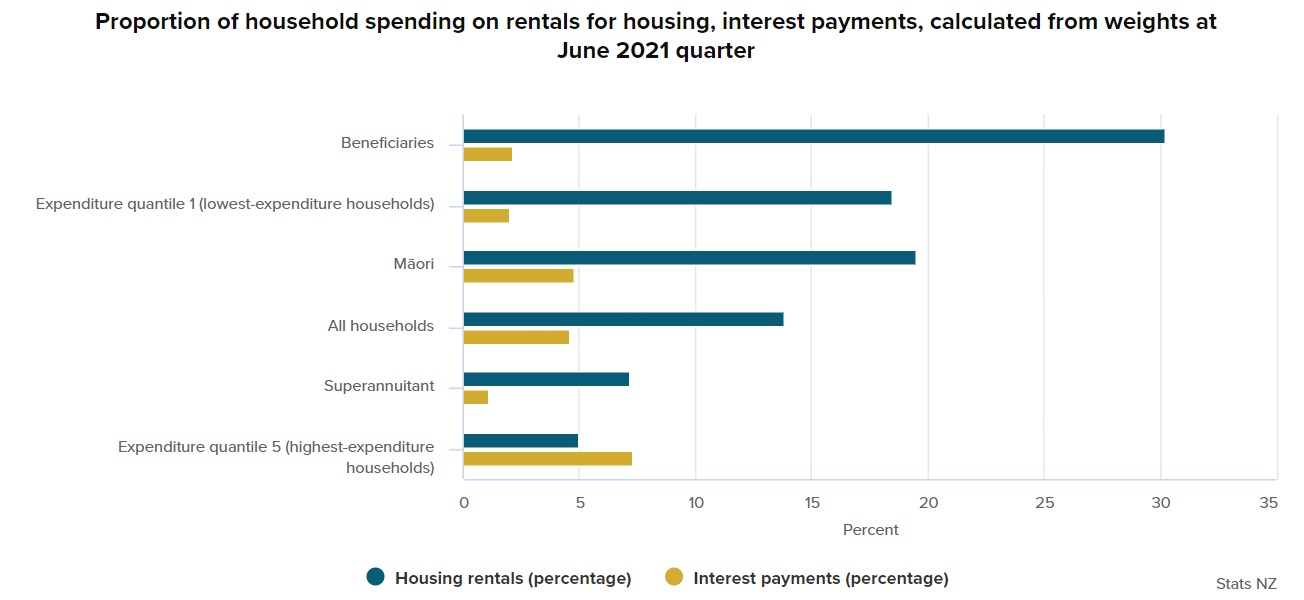

According to Stats NZ the highest-spending household group is spending about 7.3% of their expenditure on interest payments. This compares with 4.6% for the average household and 2.0% for the lowest-spending household group.

"This means the highest-spending households experience the higher interest rates more than other household groups," Stats NZ says.

The Reserve Bank has been rapidly pumping up interest rates since last October, with the Official Cash Rate rising in that time from 0.25% to 2.5% and with more to come.

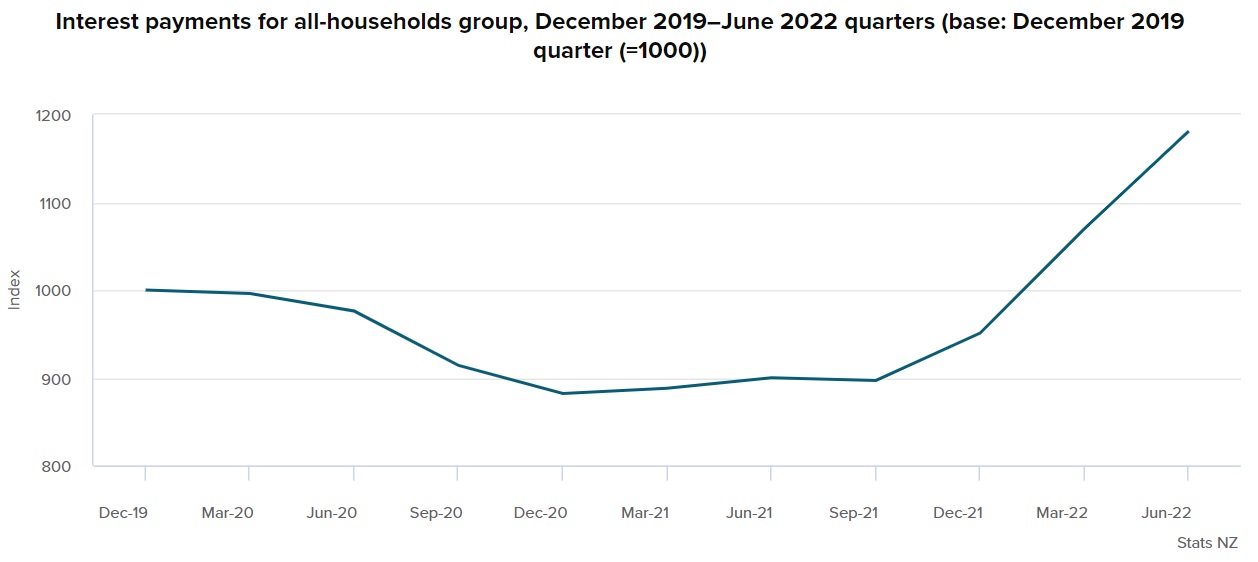

Most of the interest rate hikes have actually been this year, and the latest Stats NZ figures show that as well as 31% increase in interest costs for the year to June, the costs actually increased over 10% in just the last quarter between March and June.

Mortgage interest rates pretty much bottomed in June 2021, so, the latest figures from Stats NZ will have captured a big part of the subsequent rise. Future increases may not be as dramatic in size.

The release of the figures on Tuesday followed last week's Consumer Prices Index release, which showed an annual inflation rate of 7.3%.

The CPI doesn't include interest costs, but it does include inflation due to rising costs of building houses - which soared 18% over the year to June.

The living-costs price indexes include both interest costs and much more granular information on how specific earnings groups, and ethnic groups are affected.

"Each quarter, the household living-costs price indexes (HLPIs) measure how inflation affects 13 different household groups, plus an all-households group. The consumers price index (CPI) measures how inflation affects New Zealand as a whole," Stats NZ says.

The cost of living for the average household, as measured by the household living-costs price indexes, increased 7.4% in the June 2022 quarter compared with the June 2021 quarter. The cost of living for highest-spending households increased 8.1%, while it increased 6.5% for lowest-spending households and beneficiary households. All the household groups faced their highest annual cost-of-living increase since the series began in 2008.

Higher prices for housing and petrol were the main contributors to the increase across all the household groups.

Annual inflation for lowest-spending households and beneficiary households was 6.5%. These households faced higher prices for petrol and rent, as well as grocery food and interest payments.

Beneficiary households spend about a third of their expenditure on rent. This compares with about 14% for the average household and about 5% for highest-spending households. Therefore, increases in the cost of rent impact beneficiary households more than other household groups.

The cost of living for Māori households was 7.6% higher in June 2022 compared with June 2021. This compares with 7.4% for the average household.

The increase was largely due to higher prices for petrol and interest payments, as well as for rent and grocery food.

Māori households spend a greater proportion of their expenditure on rent than the average household, at nearly 20%. This compares with about 14% for the average household. They also spend slightly more on private transport supplies and services, such as petrol. These contributed to their cost-of-living increase.

30 Comments

The idea of the RBNZ and the government of keeping a stable system: create the conditions for a huge house bubble with ultra low interest rates and printing billions of dollars, and then increase the interest rate of the most financially unsustainable mortgages in the world, what can possibly go wrong?

Indeed. Just loaded up on Proctor & Gamble shares. Picking Pepto-Bismol sale are going to spike as globally speculators increasingly wake up to the fact they are the Naked Emperor as the tide of cheap debt retreats.

The Bull Trap moment. Where the past peak smart money offloads to the last sucker...

Yes, when are these OCR hikes going to stop or reverse? They are not sustainable, the financial system is freezing up.

Is the RBNZ in any way sovereign? Or do they have to borrow from the FED, at the FED's rates?

"Mortgage interest costs rise 31% for average households"

If OCR, as per experts will peak at 4% and we are at 2.5%, so this 31% will be 60% shortly.

31% is average rise but in reality some may be hit as hard as 60%.

Wait and Watch.

Time is needed for this to play out as many have their mortgages locked away for longer terms. Its currently a guessing games as to what interest rates these people may hit as their terms expire.

I seem to remember that around a third of NZ homeowners don't have any mortgage so this should also be included in the "average household".

The Facebook posts of a year ago when some where piling in, looking for second and third tier lending because they were maxed at the bank(s). There is some seriously concentrated debt out there.

Only 32 percent of households have a mortgage on their primary residence, so 2/3rds don't have a mortgage.

But how many investment properties have mortgages?

https://www.stats.govt.nz/news/mortgages-and-other-real-estate-loans-dr…

I knew there was a reason the supermarkets started all of a sudden doing price windbacks and selected 'food basket' items started appearing discounted (cheap brands largely) around the stores...lol, Im gonna suggest fuel prices were tweaked to offset some of the inflation that began seeping into the economy initially but as the credit river turned to a drought ...it all started to crumble... Ive come to learn that it is not how much you earn rather it is how much you can save and it is little wonder that depositors took a hammering from the rockstars and their somewhat misguided followers....soon many of those on the mortgage ladder will understand they own nothing until that final payment is made to clear their title and that they may have signed up for the ride of their lives. Yes for now many are ahead in the game... the problem they face though is solidifying that perceived value the markets keep spewing out..... increment OCR rises are inevitable for now....yes those that can ride it out will sit pretty ....but for now its tighten the belt or be exposed...

why do you think OCR rises are inevitable? Couldn't they just stop them?

I was paying off the mortgage over 15 years, so I'll increase that slightly when my loans come up for re-fix. That should keep fortnightly repayments the same, albeit I'll be at the mercy of the bank for longer. I see no real way around this with cost of living increases across just about every household line item.

I can remember the good old days where you got 18% in the bank and 21% mortgage rates

Looks like we are now back to normal and anyone banking on cheap rates for ever are in dreamland

would love to get 18% TD, but doubt it will ever come to that.

With high mortgage rates keeping a lid on house prices, and high TD rates, have to wonder why people didn't just save a little harder and buy the house with cash.

Sounds like the ideal time to buy a first home to me? Instead of trying to save 3 - 4 x the average income just for a house deposit with TD rates at less than 2% these days.

People should of been tested to make sure could pay higher rates as banks and people should of understood emergency rates were only for a while and would go back up to normal levels and with inflation so high will need to continue to climb, if they paid to much for property because of FOMO or were just speculating in housing market it is now time to pay the piper for many years or sell at loss if still can. The housing market is going to continue to crash as is way over valued compared to income.

people were tested its not all going to hit the fan until rates hit 7% and above. You have had 6 months warning already this was coming how much notice did you need ?

The rates were already low before the 'emergency' bit. As for 'overpaid due to FOMO' - mate, some of us just wanted a house. How many years should people have spent sitting on the sidelines waiting for a long-overdue correction that was arguably already seven years overdue, and with every institution in the country (including governments specifically elected to fix it) openly stating they would do what it took to keep the party going?

I have no sympathy for investors looking for a quick capital gain. But this is going to hurt families who just wanted one singular house to live in and those with multiple houses will just be able to cash out and make the pain even worse. It's just as immoral on the way down as it was on the way up, except now people have decided to be smug about it for some reason.

GV27 are you saying you have just purchased a house to live in for yourself and have not sold in same market.

response to DTRH

Or...everything is just fine as interest rates come back down a bit next year as foreign bond markets are currently pricing in.

Not nearly as dramatic though....I think I forgot to use the words crash, collapse or ponzi. Shame on me.

People shouldn't listen to someone who writes "should of" "could of" etc they're just a faker. You've certainly demonstrated your expertise in hindsight, and yet still think people weren't being subjected to test rates LOL.

Nzdan the point is as you seem to be a bit slow in understanding is if you over paid for a property don’t cry about it, we all have stepped in market at some point, some people bought and sold in last couple of years making huge amounts of profit just read the market correctly. It’s sounds like you are one of the people who purchased at high price and believed markets can only go up that was your choice. As for me being a faker I have been predicting downturn in housing on this website for over twelve months maybe if you listen to many people on here you wouldn’t be so upset.

Hope those people paid their due income tax when buying and selling houses for profit. Unfortunate if we've seen mass tax evasion.

high inflation = higher interest rates = lower house prices.

but also… high inflation = invest in inflation-proof assets of which housing will be one, if not the main one. (rents seems to be holding up for example).

will be interesting to see how these two opposing forces play out..

With new builds going up 18% no idea why people think house prices will crash. Sure if your quick there will be some bargains from overleveraged sellers but from what I have actually observed people are holding to get the price they want or else simply withdraw the house.

Sellers currently have the luxury of waiting for the right price since the broader economy is doing alright (low unemployment, few mortgage defaults). If and when enough people were to lose their ability to pay rent or service their mortgage, the market would be more akin to a fire sale.

NZ may have relatively stable economic fundamentals but an external shock with the epicenter elsewhere (Italy, China, etc.) could spell doom for our housing-led economy.

The old withdraw technique eh. Still get left holding the baby...

Crash in nominal or real terms?

Chinese money now dried up..Govt is stopping withdrawals from Chinese banks

Major correction coming .. Hope this website prints the news about China GOVT arming the banks with TANKS and Police to stop customers withdrawing their own money...

Destination NZ with Chinese funds drying up very fast..

The NZ housing market is literally becoming international news and lots of eyes are looking at the predicted crash in NZ. Why any international money would be pouring into NZ housing until the outlook changes, is beyond me anyway.

Does "highest spending" equal higher earning household compared to average and lowest spending households?

In which case it could be rewritten as highest earners borrowed more.

I'm guessing they still have more discretionary income available compared to other households.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.