ASB has changed its home loan rate card and delivered an inverted set of rates to start 2023.

Their changes are not small.

They have added +30 bps to their one year fixed rate, taking it up to 6.84%.

But they have added only +5 bps to their two year rate, taking it to 6.79%.

However, rates for three to five years fixed have all been reduced.

Their new three year rate is now 6.69%, down -15 bps.

Their four year fixed rate has been reduced by -40 bps to 6.59%.

And their five year rate is down by -50 bps to 6.49%. In fact, this five year 6.49% rate is now the lowest rate on their mortgage card.

The inversion has come quickly, is sharp and quite unusual.

It has been driven by wholesale rate changes that have been building in 2023. See the swap rate chart below.

These new ASB rates enable them to offer the market's lowest five year rate. They also now offer the lowest four year rate.

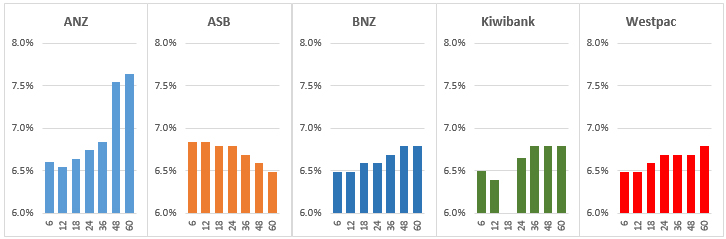

Here is an easy way to view the rate curves of the five main bank lenders and their relative positioning for each fixed term (months).

So far, ASB hasn't yet advised any change in their term deposit rates.

One useful way to make sense of the changed home loan rates is to use our full-function mortgage calculator which is also below. (Term deposit rates can be assessed using this calculator).

And if you already have a fixed term mortgage that is not up for renewal at this time, our break fee calculator may help you assess your options. But break fees should be minimal in a rising market.

Here is the updated snapshot of the lowest advertised fixed-term mortgage rates on offer from the key retail banks at the moment.

| Fixed, below 80% LVR | 6 mths | 1 yr | 18 mth | 2 yrs | 3 yrs | 4 yrs | 5 yrs |

| as at January 23, 2023 | % | % | % | % | % | % | % |

| ANZ | 6.60 | 6.54 | 6.64 | 6.74 | 6.84 | 7.54 | 7.64 |

|

6.84 +0.34 |

6.84 +0.30 |

6.79 +0.15 |

6.79 +0.05 |

6.69 -0.15 |

6.59 -0.40 |

6.49 -0.50 |

|

6.49 | 6.49 | 6.59 | 6.59 | 6.69 | 6.79 | 6.79 |

|

6.50 | 6.39 | 6.65 | 6.79 | 6.79 | 6.79 | |

|

6.49 | 6.49 | 6.59 | 6.69 | 6.69 | 6.69 | 6.79 |

| Bank of China | 6.15 | 6.25 | 6.35 | 6.35 | 6.55 | 6.65 | |

| China Construction Bank | 6.60 | 6.54 | 6.64 | 6.74 | 6.84 | 6.85 | 6.85 |

| Co-operative Bank [*FHB special] | 6.39 | 6.29* | 6.39 | 6.59 | 6.69 | 6.79 | 6.79 |

| Heartland Bank | 5.89 | 5.99 | 6.05 | 5.95 | |||

| HSBC | 6.44 | 6.44 | 6.59 | 6.69 | 6.79 | 7.29 | 7.39 |

| ICBC | 6.29 | 6.25 | 6.35 | 6.45 | 6.65 | 6.85 | 6.85 |

|

6.39 | 6.39 | 6.49 | 6.54 | 6.59 | 6.65 | 6.69 |

|

6.29 | 6.29 | 6.39 | 6.49 | 6.65 | 6.75 | 6.79 |

Fixed mortgage rates

Select chart tabs

Daily swap rates

Select chart tabs

Comprehensive Mortgage Calculator

60 Comments

I'm struggling to interpret this. The only rational explanation for such an inversion would seem to be that the banks think interest rates are likely to head lower, and want to lock people in for longer at the current rates. But both very popular 1 and 3 year rates are exactly the same (6.84%). Plus there's nothing to suggest that rates are on their way down yet anyway, but surely if that's the bet you were going to take, you'd at least wait until after the next CPI print, which is only a couple of days away.

Very confusing.

Edit: Less confusing now the typo with the 3-year rate has been fixed in the table.

Have you seen the level of inversion in wholesale markets?

The market believes inflation will fall quite quickly meaning rates in the short term need to be higher and longer term rates can drop.

Yes, but I've never seen retail rates follow the wholesale inversion like this (or maybe I just haven't been paying attention).

Another interpretation could be that banks believe wholesale rates will remain inverted for longer this time, and since a lot of their funding is expected to come via money markets, they need to follow the curve. If the wholesale inversion was only expected to be short, or there were other significant sources of funding, perhaps the banks could get away with "normal" pricing.

The banks price to the wholesale market, which is pricing that inflation will start to come down quite soon, as it is already in the US. We lag the USA by 6 months. Inflation since JUNE in America has been very low.

Inflation since JUNE in America has been very low.

What. 6.5% for December.

Year of two halves. It was high in the first half of last year, low since mid year. The 6.5% number makes as much sense as REINZ pointing at annual house gains 3 months after the market started to crash.

This chart is a goodie

https://www.statista.com/statistics/273418/unadjusted-monthly-inflation…

That doesn't make any sense. Inflation is relative to a fixed target. There's no fixed target for house prices.

When the inflation target is 2%, 6.5% is high.

What it means is that on the rolling 12 month average the big bump of Q1 and Q2 is working its way through the snake and will be starting to dissappear out the other end.

Have you seen the level of inversion in wholesale markets?

Where can we find this info ? whats this wholesale market BTW ? Is it the overseas USdollar nominated interest-rate market ? Thanks

Banks have the cheap money which they want to give to customers and also want to lock them in for longer.

Stretch to call the current wholesale rate curve 'cheap'

The rates will start coming down in the next 18-24 months. The bank is just sucking in unwitting borrowers by convincing them of a bargain.

It is following the inversion of the wholesale rates and that is only to increase further. The US treasury 28 days Bill sits already at 4.56%, 108 bps above the the 10Y treasury and with the US hitting their Debt Ceiling things could get worse. According to her press release Janet Yellen has said that the treasury will not issue any more debt until Congress has decided to raise the Limit on Debt. I am not 100% sure if she really ment this. Those who have any floating rates will be hit the hardest.

That 1Y-5Y inversion is interesting indeed. Just a 35bp spread across the whole range.

I'd hate to be one of the thousands of households rolling over in the coming months.

Easy decision, fix short, don't take the sucker lolly of a lower, longer rate. Interest rates will be cheaper in 2024 than they are now/

Or they won't. Who knows? Too many variables in the pot to accurately predict interest rates out 6 months, let alone 2 years.

You fix at 6.5% now for 5 years, then you don't really care if the floating rate is 5.5% or 7.5% in 2024, as you're in it for the long haul.

If the rates start falling year-on-year there may be a point where you break your 6.5% and re-fix at a lower rate as the fee incurred is less than the interest saved on the remainder.

But if the rates increased year-on-year then you're laughing. At least until your 5 years is up, then you'll be re-fixing at 9.5% being the new 1 year rate, or 10.5% for 5 year.

They are 'incentivising' people to lock in long. And then when rates fall and people want out they'll have to pay huge break fees. The Bank always wins. Someone on here said recently they'd locked in a six month rate. Can't remember who. Smart move.

Not so sure banks win on break fees. As I understand it, most are calculated using the wholesale funding costs and represent actual cost to the bank, because they would need to unwind the more expensive funding position, or keep it (generating the difference)

Yeah, but those wholesale costs are a fraction of the value of the loan. So yes, the bank wins.

Yes, it's incentivising but it's highly unlikely the bank would be willing to bet against the swaps market. The only reasons I can think of is they think there is risk of higher rates in 12 - 24 months and they don't want they borrowers exposed to even higher rates or more simply they are wanting new customers so they are passing on the inversion hoping to attract new borrowing.

Is it easier now to jump ship with your mortgage and get a good deal? Of so, maybe ASB are hoping to keep their customers longer by offering lower long-term rates. Makes sense.

I think ASB has got this right and expect this inversion to soon spread to the other banks. Will be interesting to see how long they drag the chain on raising the 1 year TD, bearing in mind the next OCR rise is not until late Feb.

There is no chain to drag, that's only a month away and there will be another OCR rise as well. 6% 1 year TD rates by March Guaranteed.

Carlos67, 6% guaranteed NOW, see SBS.

The market is predicting sharp drops over the next 12 months. None of this soft landing nonsense. Interest rates don't just go up 3x with no consequences. If you have to refix this year take a 12 month rate and wait for for a better deal.

I was very relieved that RBNZ had to go on holiday for the summer because they would have only pushed higher, leading to quicker, sharper falls.

Now is the time to be socking away an emergency fund.

YES!

What will any of us do if interest rates fall? Or, worse, another version of QE comes in to 'alleviate' the Inflation problem by flooding the markets with cheap debt to lower input costs?

Answer: Borrow like crazy; run the saving account down to $0 and buy whatever is on the shelf before prices rise.

And then what happens? Inflation will soar. Why wouldn't it, if whatever is 'For Sale' will be snapped up regardless of price? That's the dilemma we face, and if either of those possibilities eventuate, then the next bought of % rate rises (which will be inevitable. The Cost of Debt won't deter panicked buyers) won't see an OCR at 5.5% but 15.5%.

I suspect many my age will probably aggressively re-up our contributions and fix for as long as possible in the event rates sink. The people who spend relentlessly will spend either way.

No we won't because rates will be falling due to a recession. We'll be suddenly worried about our jobs.

And could there be a point of unemployment going up and that making products more expensive, and that will push inflation again?

You can count on one hand the people who think retail interest rates will be materially lower than now, come mid 2024.

You, Yvil, me - have I missed anyone, maybe JFoe?

Might be a few fence sitters but most seem to think they will be higher than now in 2024.

I believe a lot of people on this site want interest rates to keep going up so people who bought a house in the last couple of years feel more pain, so that's what they tell themselves will happen, it suits their ideology.

The current data in the markets say otherwise. Data may change and I'll revise my opinion of course.

I think it’s a strong possibility, but not a lock yet. Still too many people out and about spending freely for that.

The answer (excluding black swans) is almost certainly that the OCR will come back to somewhere between where we are now, and zero. Within 2-3 years.

It will be a compromise position that does not truly revive the economy, but neither leads to another crazy housing boom.

I really, really hope we have learned that you need a suite of policy that allows you to peg back house prices to something reasonable before you go dropping the OCR.

Agree.

Not that confident we have, though….

Yes, but has the National Party learnt ? But it seems RBNZ has, thus dont expect an OCR under 2.5 anytime soon.

DTI would be a very useful piece of the puzzle for future low interest rate periods, hopefully we can get it over the line in time. Could have neatly prevented, or at least mitigated, the Covid boom and current bust.

Agreed. DTIs are the perfect tool that will allow lower interest rates for the general economy without another housing spiral.

Yes exactly

Has the 3 year changed?

I noted it as 6.84% on interest.co.nz last week?

Just confirmed via asb.co.nz that 3 year is now 6.69%, so 15bps drop from 6.84%

Yes, that was originally posted at 6.84% in error (as no change) when the correct rate should have been 6.69%. Sorry.

Just waiting for the TD rates to invert also. Was saying only yesterday go long at ASB as there is no penalty if you change your mind after 12 months but now they could try tempting you for shorter terms on higher rates.

ICBC, BNZ, and WBC already have started the TD inversion, although small at this stage. Reading some comments here, when the 1 year mortgage rate falls again (next year?) a 'low' rate will still be in the 4s. Dont expect 3% mortgages to return any time soon. It could be quite a while before inflation drops below 3% again. First home buyers, make sure you are comfortable with a 5.5% mortgage rate over the long term, and can handle 6.5% if it happens in the future.

Really hoping you aren't a financial adviser with advice like that..

Officebound, the average mortgage rate over the last 40 years is 5.6%.

Really hoping you aren’t either Officebound…

IMO, this is more a reflection of ASB's marketing tactics rather than their expectation for interest rates. With the CPI data coming out soon, why would you low ball the 4-5 yr, unless you were trying to take some market share?

Because economists are not expecting big growth as we come out of this in years 3 to 5. What they are certain of is high inflation for the next 12 months.

We haven't even finished January and that magical seven is slipping away.

Good thing I didn't spent all of 2022 gagging for it.

Great graph DC, the contrast between ANZ and ASB is stark!

enjoyed the graph also DC - perhaps a line graph of all the banks and include a line of the average of the rates or weighted average by market share based off the RBNZ's data? Current average of ANZBNZASBKiwibankTSBWestpac for floating through to 5 years (ex the 4 year rate)

8.04

7.14

7.11

7.26

7.31

7.37

but interestingly weighted by market share

7.69

6.87

6.85

6.97

7.00

7.06

for the banks standard rates

So here we have it, the first retail rate inversion (long term rates lower than short term rates).

To my fellow readers, in the wild hope that someone will listen to me and save themselves thousands of $ (I'm forever the optimist), this inversion is a clear signal that rates are expected to go lower within the foreseeable future. Do not to take up the cheaper, longer term loans, you will be wasting your money!

What happens when the OCR goes up 75bps in Feb ? What is available now could still be cheaper than as little as a months time. You would be brave to say that rates have already peaked. Reality is that its a total crap shoot as to where the market will be even in 12 months time.

How much the OCR is lifted by, in February is largely irrelevant, you're not fixing a mortgage for one month. What is much more relevant is where the market sees interest rates in 12 months, and the inversion tells us a clear signal, it's going down!

Problem is the market is known to partake of some strong mind bending substances.. Hallucinogens like Hopium will leave "the market" seeing all sorts of things that just ain't there.

So just checking, the OCR goes up say 100bps in Feb and the banks are going to do nothing with all the existing rates ? Pretty debatable that we have already reached the peak. Rates look very volatile to me, the next couple of months is going to be popcorn time, the RBNZ are going to be forced to put all their cards on the table. We are about to find out whether they truly care about crashing the housing market or not.

Crashing the housing market will make a low wage economy more attractive if one can afford a home for 3-4x DTI. Perhaps then we will get all the skilled migrants the government so dearly wants to attract

Since 28th Dec 2022 (recent peak in Interest Rate Swap curve) the whole NZ Interest curve has dropped with the one year dropping 14bps and the five year dropping 66bps. This move looks more like "we have plenty of fixed rates rolling over shortly and most people will refix them one year - lets lift our margin there and look like the good guys giving back 50bps of a 66bps move lower"

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.