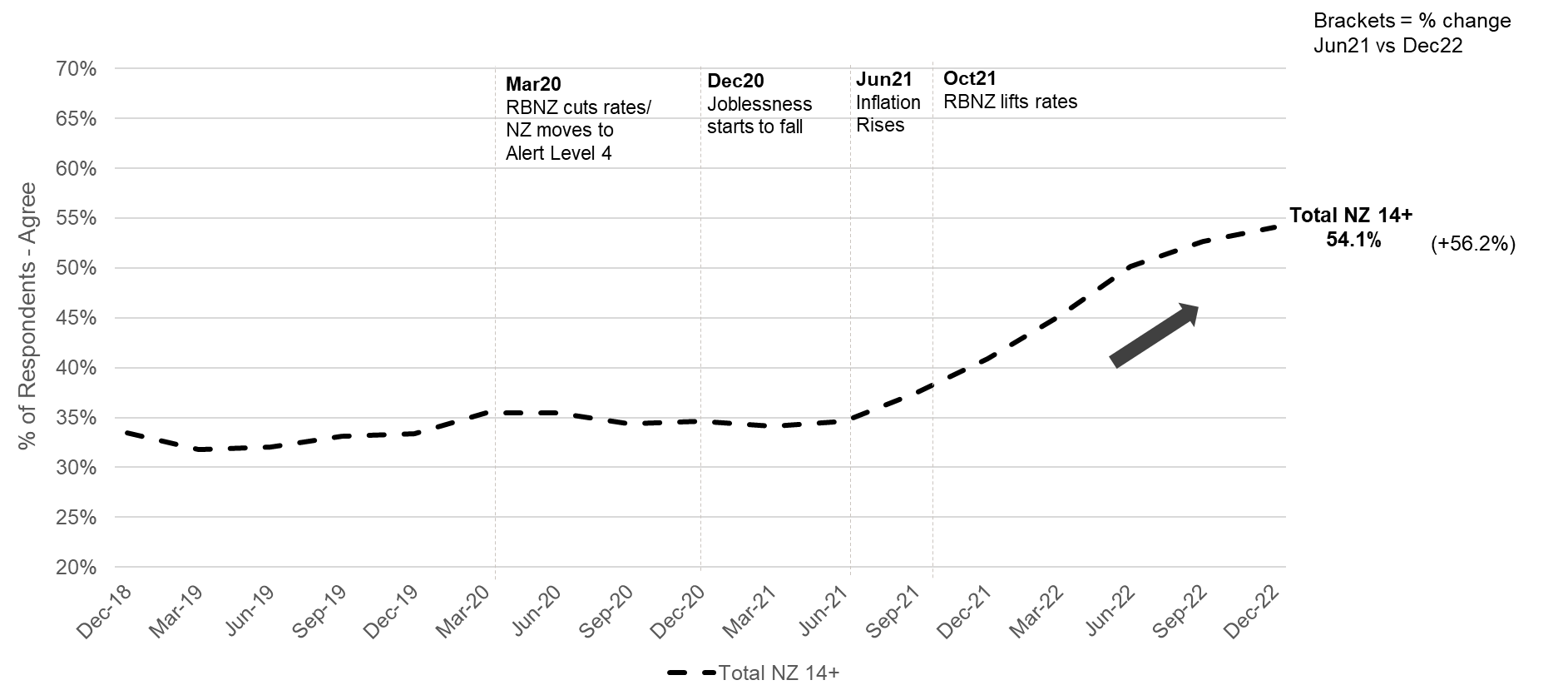

Not surprisingly given how much they've risen over the past 18-months or so, a growing number of New Zealanders are worried about interest rates, market research company Roy Morgan says.

In the year to June 2021 just over a third of New Zealanders, or 34.6%, were worried about interest rates, Roy Morgan says. This increased significantly to 54.1% in the year to December 2022, an increase of 19.5% points, or 56.2% in 18 months.

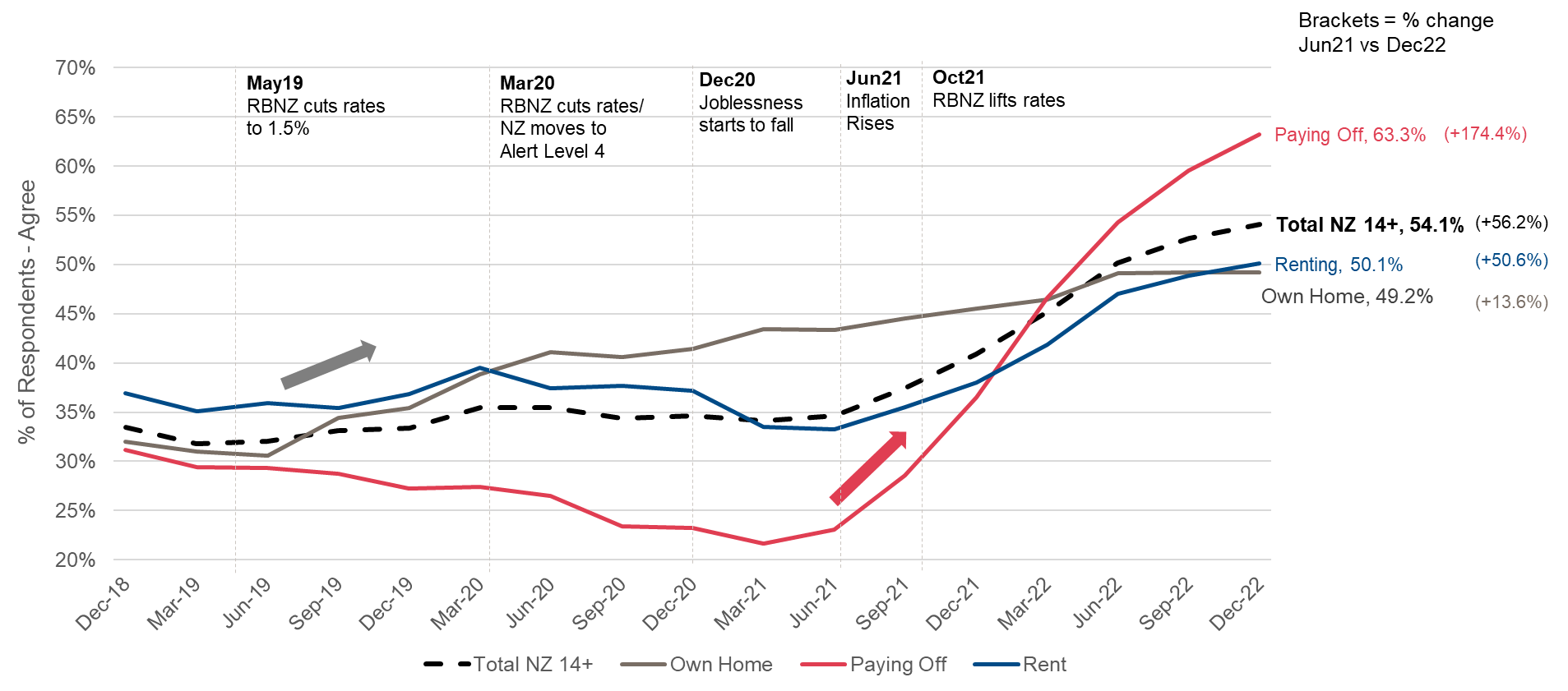

“A look at concern about interest rates by housing category reveals that, unsurprisingly, the rapid set of interest rate increases since late 2021 is hitting New Zealanders with a mortgage harder than anyone else," says Roy Morgan CEO Michele Levine.

“Now nearly two-thirds of New Zealanders who are paying off their home, 63.3%, say they are ‘worried about interest rates at the moment’ – up from a low of only 21.6% in March 2021. This is an increase of over 40% points in a year-and-a-half – and the Reserve Bank has raised interest rates even further since the end of last year."

As it strives to combat consumer price inflation that has risen to heights above 7% which haven't been experienced in more than 30 years, the Reserve Bank has increased its Official Cash Rate by 525 basis points to 5.50% since starting from a record low of 0.25% in October 2021. The average bank advertised two-year mortgage rate is now at 6.523%, up from 2.53% two years ago.

With most New Zealand mortgage borrowers choosing fixed-term, rather than floating, mortgage rates, the impact of higher rates is still flowing through to borrowers' finances.

% of New Zealanders who agree “I’m worried about interest rates at the moment”

% of New Zealanders who agree “I’m worried about interest rates at the moment” by housing category

Charts source: Roy Morgan Single Source, January 2018 – December 2022. Base: New Zealanders aged 14+, 12mma results and n= an average of 6,506 interview for each 12 month period.

52 Comments

I want to work at Roy Morgan! What are you having for lunch today team? Good work this morning.

Roy Morgan is a good company IMO. Yes, a little bit old school in their ways but a solid, credible approach to research and data. I like their alternative unemployment measurement framework.

An issue across the anglosphere where we have loaded up with far too much debt.

Interesting chart on the situation in Canada where their private debt levels exceeded Japan before their epic bubble burst back in the 90's.

https://pbs.twimg.com/media/Fi1c7bUXEA4bV2n?format=jpg&name=small

Japanese household debt to GDP has never been as high as it is in the Anglosphere even at the peak of their epic bubble. In fact it's been flat ever since the early 90s. Over the same period, NZ household debt to GDP has increased 4x.

Well I must say we are being inundated with unexpected news today........

Agree with you, King of the whiners.......

That NZers are worried about interest rates is something I can't believe. A huge surprise, indeed. How could it possibly be⁉️

With such a shock revelation now being relayed up and down the country via megaphones, many will suspect there's been an error in the analysis. Things just don't add up.

Prepare for a Palace Uprising......

TTP

Finally the slow thinking kiwi has woken up - too many bright lights shinning during the rock star era perhaps

LOL!

50% of people who own their home outright are worried about interest rates...?

Interest rates affect their house price.

Boomers who have all their savings in bricks and mortar should be worried about interest rates. Their 'savings' will be disappearing. This has a psychological impact on their spending behaviour as they may not feel as rich today as they felt yesterday. This is a vicious circle as less spending into the economy also negatively impacts house prices.

Similar issue in China right now.

Paper becomes vapor. Not a capital gain until its in the bank post settlement.

Paper becomes vapor. Not a capital gain until its in the bank post settlement.

Only thing that remains is the debt. Now a funny thing about the debt. If the debt is 'written off', there's really no drama. It all came out of 'thin air' anyway. But what is really lost is the 'asset' (ownership of the debt obligation).

It impacts the profit and loss of a bank. Losses from bad debts can have a huge impact, its why there are so many bank failures during downturns.

Please list the bank failures here in NZ. Alphabetical order.

A reverse mortgage in 2021 vs reverse mortgage in 2023 and onwards.

Have you seen portfolio report of the last 12 months? It isn't just brick and mortar. Losses and big cap declines for many.

How's your kiwisaver going. I would rather lose my own money myself than pay some over price over qualified broker or CEO to lose my money. Ever wonder why they call them brokers?

From Middle English broker, brokour, brocour, from Anglo-Norman brocour (“small trader”) (compare also abroker (“to act as a broker”)), from Old Dutch *brokere (“one who determines the usages of trade, manager”), from broke, bruyck, breuck (“use, usage, trade”), from Proto-West Germanic *brūkī (“use, custom”), from Proto-Germanic *brūkiz (“use, custom”), from Proto-Indo-European *bʰruHg- (“to use, enjoy”), equivalent to brook + -er.

https://en.wiktionary.org/wiki/broker

Not what you implied, right?

They are worried about their kids and gran kids owning a home in NZ. The Govt should be interested in these same kids remaining tax payer in the NZ tax jurisdiction, v.s. that of a close neighbour starting with the letter "A" just to achieve that objective.

Maybe but high interest rates will also reduce house prices, I am far more worried about house prices for my kids than interest rates which are not even close to historic norms. With high interest rates you can at least save for a house.

People bought at ridiculous prices because insanely low interest rates allowed them to do so, its sad that people are suffering but it has to happen in order for house prices to come back down to earth.

All my kids held off...encouraged by Dado. Dado is now considered wise as opposed to mr negative.

I'm only worried they won't go high enough soon enough.

Did this really fall by 40%?

https://www.oneroof.co.nz/news/43726

If so, someone has just taken it right up the Oxo tower.

Such an absolutely ridiculous article as well, portraying that the market is "hot" and so many bids... In a less f+++++ world the headline would read, "Market Crash as Developer loses 40% in 3 years"

The market is hot for properties priced at 40% below peak.

Yep - absolute spruiking by OneWoof

Have you noticed how you now get 3 spruiking stories in the top 20 news articles on your Herald App?

New stories appear throughout the day and move down the page but the OneWoof stories remain in the same place

If anyone thinks OneWoof is even close to balanced, unbiased, or impartial, consider this story they ran in 2019 with the headline: Bargain time! London property prices are crashing

https://www.oneroof.co.nz/news/bargain-time-london-property-prices-are-…

House prices in London dropped 4.4 per cent in the year to May - which means that more than £21,000 was wiped from the value of the average London home over the 12 month period.

4.4% down in a year!

Prices are have been falling solid here for 12+ months, values are off 20%+ here in many places and we hear nada, zero, nilch from OneWoof about a crash

The place should be a crime scene for the NZ Media Council

I don't do porn. Time you ditched it to.

I counted no less than FIVE Oneroof propaganda slots in the NZHerald top20 links on Wednesday. It was so blatant I took a screenshot for future reference. 1x sponsored ad + 4x property puff pieces.

1 Mortgagee frenzy: Bargain hunters push price of South Auckland home to $1.2m

2 Tony Alexander: The towns investors should be targeting before prices start to rocket

3 'We're seeing supply dry up': Act now or face a 3 year drought, buyers warned

4 Q&A: Will NZ house prices bounce back like AU? Sellers across the Tasman are sensing the good times are back.

I agree, it's so blatant it's embarassing. It's quite obvious that spruiking property pays the bills with some sub-par journalism bolted onto the side.

There should be a disclaimer. That property I linked was a catastrophe.

Sadly - it might well work and fool a few sheeple.... propaganda is a powerful weapon, but it’s hard to see how the market can turn or rally on a dime when test rates are still 8%+ plus

Or it could backfire if it motivates and restores confidence in vendors to hold out for their inflated prices believing a sellers market is returning… and as such stall the market even further

I don't mind that the market is stalling. I had to be realistic in Feb when I sold a place. Lower price than I was hoping to get but the peace of mind now is amazing because nobody knows how low prices may get or how long it is before prices rise. If ever....

As I said earlier this week, that Nikki "spinster" from One Goof is a spruiker for RE agents ... Who pay her wages.

Take this example. Listed at 995k, passed in at auction today and now at 789k ...

https://www.trademe.co.nz/a/property/residential/sale/northland/whangar…

There are 2 more this week in the same area that dropped 200+k this week to get an urgent sale.

6 Onley Crescent and 16 hoihere place.

Talking to the Agents, they say the sellers are wanting out asap.

It's crashing very fast now up north. The bottom is not here yet .. the sellers have blinked!

It's relieving to see others share this sentiment. It's gross. What is worse is that it must be worth doing given the amount of Kool aid drinkers that are available to rinse. Damn shame

They are an absolute joke, with zero credibility. Is there anybody who still take them seriously, honestly ?

From the point of view of the person who sold the property in 2018 this week's sale would be a good profit, from 996k to 1290k. The sale in 2021 for 2M seems odd. 1M to 2M in three years in Te Atatu? Not really typical.

40% in 18 months

One swallow does not a summer make

Given that we're trying to solve inflation by raising interest rates, thereby causing a recession, while simultaneously pumping immigration to ward off recession, thereby causing inflation. The only future that exists is an upward spiral in interest rates.

We're doing it! Another world first here in New Zealand!

We'll call it the Immigration rate spiral! A trendy new alterative to the wage price spiral.

We're doing it! Another world first here in New Zealand!

Aussie is winning this race. Going for broke on immigration from developing countries to protect their bubble. Go figure.

And low ticket sales for woman's footy work cup.

People/ tourists are not interested in shitty expensive NZ

It's women's football in New Zealand. Don't overthink it. It's not inherently sexist to state the obvious

I like the term "burnout economy" - one foot on the gas, one foot on the brakes..........

https://www.macrobusiness.com.au/2023/06/australias-burnout-economy-car…

Should the below not be 300% if it went from 20 to 60 ? Alternatively it could read as 4000 basis points.

This is an increase of over 40% points in a year-and-a-half

“A look at concern about interest rates by housing category reveals that, unsurprisingly, the rapid set of interest rate increases since late 2021 is hitting New Zealanders with a mortgage harder than anyone else," says Roy Morgan CEO Michele Levine.

The German property bubble, which I predicted in 2009 would begin, has ended. Made unavoidable by the German gov't's policies. After bubbles, property prices tend to fall 80% from peak. Takes several years. As I've said, this will take down the banks, forced into property by ECB Link

Given the percentage of our so called wealth that’s tied to property (lots of it being crap) we should collectively be shitting bricks right now. Meanwhile the most important distraction is some obscure cabinet minister and a few penny stocks. What a backwater we’re becoming.

Being told 12 times to sell the shares, promising to do so and then not doing, that’s a sackable offence. Either incompetent or lacking integrity.

As a govt minister, he has to be whiter than white. How do you expect people to follow the law if you won’t follow parliamentary rules?

"Half a dozen" times is 6. But yes, owning shares not only in an industry that you're a minister with oversight in, but to also decline a potential competitor's application for Airport Authority status is a massive conflict of interest.

Still have another 300 basis points to go before we reach OCR from pre GFC in 2008.

Imagine that. That independent ocr guide from Massy uni indicates that rates need to be circa 10% to slow inflation.

It's vapor bank debt. Burn it down already.

Big Tone would tell you it’s a great time to buy before rates go to 10%

Only ones with mortgage are worried.

The ones who want to sell, still want prices for their property as if interest rates are at 2% and going down.

So many sellers and their agents seem deluded. They need to get off the green stuff and come to real world.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.