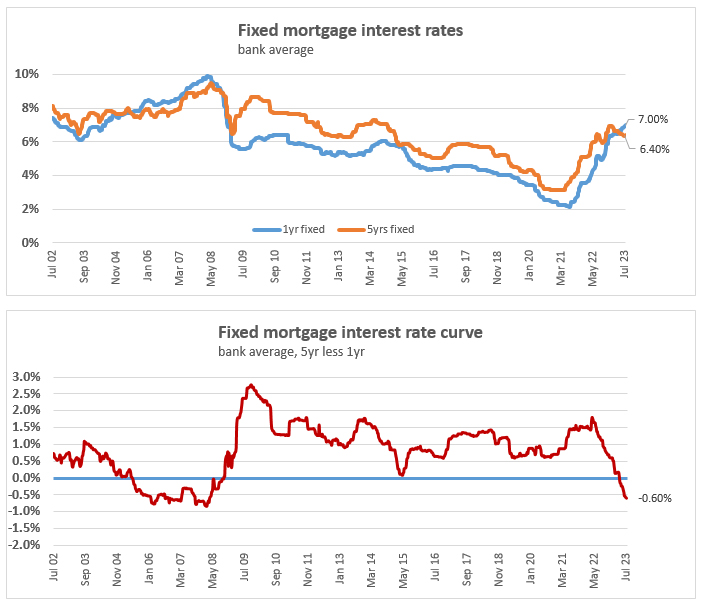

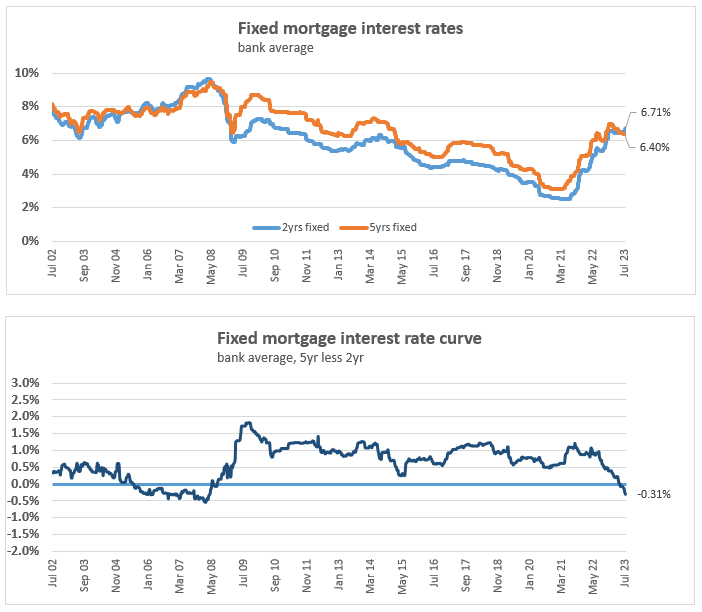

The average bank five year mortgage rate is now lower than both the average one and two year rates.

As the interest.co.nz charts below demonstrate, this hasn't happened since the high interest rate run-up to the Global Financial Crisis (GFC).

At 6.40%, the average five-year bank carded, or advertised, mortgage rate is 60 basis points below the 7% one-year average, and 31 basis points below the average two-year rate of 6.71%.

And at 6.41%, the three year average bank mortgage rate is only just above the five-year average.

So what's going on?

A similar scenario is at play with wholesale interest rates.

At the time of writing the five-year New Zealand swap rate is at 4.78%, with the one-year swap rate at 5.85%, and the two-year at 5.53%. That means the five-year swap rate is 107 basis points lower than the one-year rate, and 75 basis points lower than the two-year rate.

Swap rates & inversions

A swap rate is an interest rate based on what financial markets' participants think interest rates will be in the future. Swap rates allow the likes of banks to manage their interest rate risk by locking in a fixed rate for a set time period. If swap rates rise mortgage lenders typically increase their rates so they won’t lose out. So if swap rates go down mortgage rates normally do too, and if swap rates rise, so generally do mortgage rates.

Inversions, where longer-term interest rates are below shorter-term interest rates, are historically associated with investors believing a recession is coming. The Reserve Bank's changes to and guidance for the Official Cash Rate (OCR), NZ's benchmark interest rate, influence short-term swap rates, while longer term rates take their cue from international influences such as the US Treasury yield curve, which has also inverted.

A similar scenario was at play with wholesale interest rates in early 2008 as financial markets hurtled into what became known as the GFC. At the end of March that year the five-year NZ swap rate was at 7.79%, one-year at 8.61% and two-year at 8.19%. The OCR was then at 8.25%, the highest it has been since its introduction in 1999. (The OCR's currently at 5.50%).

The dilemma

For people taking on or refixing a mortgage, this mortgage rate inversion creates a dilemma. Do they, and/or their advisers, think fixing at a current, lower five-year rate makes more sense than going for a higher shorter-term rate, of say one or two-years? Or choosing a floating rate for a period, with the average bank floating rate currently at 8.48%?

Ultimately it depends on what you think the outlook for interest rates is.

Someone who fixed for five-years in early 2008, when a similar inversion occurred, would've subsequently witnessed mortgage rates fall significantly as the GFC kicked in.

If a similar interest rate scenario to that was to emerge some borrowers fixed via longer term rates, who see lower mortgage rate offers emerge, may then want to break the term of their loan and refix at a lower rate. That would likely mean mortgage break fees come into play.

If mortgage rates were to rise for an extended period from here, someone locking in a five-year rate at the moment might end up thinking doing so was a good move.

See all carded, or advertised, mortgage rates here.

*This article was first published in our email for paying subscribers. See here for more details and how to subscribe.

52 Comments

A good article. Obviously the shape of the curve is the main driver but there are other factors at play. I'd say the main one is managing the term interest rate risk on the banks balance sheet. From a capital perspective, a 5y mortgage requires a lot less capital than a 5y non-sovereign bond. Banks taking long-dated term deposits require long-dated investments - a 5y mortgage is probably the most capital efficient way to achieve this. They also have to manage their capital (ITOC). So the pricing is based mostly on the curve, but also where they want to lend from an ALM perspective and they will price mortgages accordingly.

I'd ask one of the banks ALM teams to write an article for you.

My understanding is that most NZ/Aus banks swap fixed rate mortgages back to floating rate (BKBM/BBSW) so that interest rate risk is largely very short dated. There is of course liquidity risks to manage, where maturity is more relevant.

That's correct, however from a capital/RWA perspective a 5y mortgage is often a more efficient asset than a 5yr swap plus a short dated investment. An interest swap can remove the interest rate risk but you still have the cash to put somewhere.

I am possibly a bit confused now. Sure, mortgages are cheaper assets for banks to fund from a capital perspective due to Basel (rightly or wrongly) and hence a good reason why we have a housing bubble..

But banks are inherently short liabilities vs long assets anyway, e.g. mortgages are 25-30yr maturity (albeit somewhat shorter in terms of average life) and banks simply don't borrow that long to match asset maturities.

Post GFC the regulators have however penalised banks for large maturity funding mismatches and so we have seen a lot more longer term bond issuance and less short dated hot money funding, which is one reason why bank credit spreads relative to swap have generally risen. At the margin, this longer dated funding would also require more fixed rate receiving (assuming the issuance is in bond form rather than FRN) or offering longer dated fixed rate mortgages to get the banks interest rate risk back to BKBM, and this would flatten the IRS/fixed rate mortgage curve which is perhaps here you are coming from.

I think you answered your own question.... There are some complicated regulatory incentives at play with bank balance sheets and asset and liability mixes. It's way too much for me to address here with my stunted understanding. My point was, a bank can take in a 5y depo, or issue a 5y bond, and then hedge that rate risk with a swap - but they still have the funds from the depo/bond as all the swap does is sterilise the irr. SO they need to invest it or lend it still. So a 5y mortgage achieves both all the while being 10% risk-weighted, or whatever it is now.

Surprising the word “inflation” does not appear once in this article.

Current high Interest rates are primarily to try and tame high inflation, the market pricing on swaps gives an indication that the consensus is that inflation will be lower 3-5 years out than current level, and as such OCR (and mortgage rates) are likely to fall.

What does five year mortgage rates being lower than one and two year rates mean?

It simply means that people who fix for 5 years because they believe that interest rates will be minimum 10% by the end of 2023, will pay very dearly!

And how much will it cost anyone who fixes short and has to keep rolling over at rates higher than today's 5-year fixed, if nothing happens for another 5 years? To use your word, they will pay very dearly. It's as much about the Cost of Carry (how long can you keep paying higher short rates than one longer one?) as it is about where mortgage rates might go.

Interest Rates are supposed to be a reflection of Risk, and if there's one thing staring us all in the face today - it's Risk (Where will debt rates go if Wagner, who are spoiling to fight anyone, attack Poland etc?) and it's not been properly priced in. It's been camouflaged by Central Bank interference.

Interest Rates are supposed to be a reflection of Risk, and if there's one thing staring us all in the face today - it's Risk

Then you're seeing risk over 5 years that the many people that do this for a living don't.

That's either super valuable, or super worthless information.

That’s the problem, they simply don’t know what is going to happen - no one does. That’s why people have to make a decision on what is the least risk to them such as a. Fix and risk paying more interest but that they know they can afford, or b. Float and bet on IR dropping.

Those that believe interest rates will be 10% by the end of the year will never have a mortgage to (re)fix anyway.

Very good point Pragmatist!

Probably, but not certainly

The rule is, fix for as long as you can if you can't afford higher interest rates - don't gamble against interest rate moves thinking you know where things will go. Even skilled bond managers only get it right 60% of the time.

But if you can afford for rates to go materially higher and you are likely to have surplus cash flow to prepay debt (pay rises, inheritance, saving habits) then it makes some sense for a portion of your debt to be floating or in various fixed tranches, to avoid break fees when paying down. Offset accounts, if still offered, also make sense.

Haven't you heard about Hawkes Bay? He knows where interest rates are going 100%, he even guarantees that they'll be minimum 10% by the end of this year. That's a great deal, because if he's wrong he will reimburse your money !!!

Yvil, your complete obsession with this particular prediction aside, what assurances are you offering others that they won't reach 10%? Why are you dodging this reasonable question?

As always with ‘The Prophet’, and indeed all prophets, there’s intentional haziness in ‘the prophecy’.

If he’s talking fixed rates, then no chance.

But there’s a remote chance on floating rates.

RP, as I already replied before, I give NO assurances because, unlike another poster, I'm not conceited enough to GUARANTEE any interest rate in the future!

You're not conceited - funny :)

Why not calmly put your energy into offering some assurances they won't? It would be much more productive than banging away hoping for a payout.

I'll take it from your lack of counter assurance, like me, you're thinking it can't be ruled out they'll reach 10%.....

I'll take it you're just a grumpy old man looking for an argument. From the many, endless treads you have with multiple other posters, it's clear that arguing is your favorite pass time. Have fun, I have better things to do.

How convenient. Now the biggest critic of "10% interest rates by years end" has better things to do :)

This has been a fantastic thread about 10% Interest Rates This Year, Guaranteed !

Lets keep this the Main Topic.

Yvil has kindly explained to us he also believes Interest Rates are going to 10% This Year Guaranteed ! In his own flirty way.

Now can I get everyones attention please. Yvil has made us a beautiful video to explain to those who do not yet understand where Interest Rates are going this year.

Thank You Yvil for all your hard work, you really are something special.

https://www.youtube.com/watch?v=0zVLWGaLi7g

Bahahahaha!

Perhaps it indicates the lag effect of the Reserve Bank's tightening wrt fixed term mortgages coming due will tip NZ into a recession

> some borrowers fixed via longer term rates, who see lower mortgage rate offers emerge, may then want to break the term of their loan and refix at a lower rate.

Why is this myth, that you should break when current offers are lower than your fix, perpetuated? The break fees are equal to the savings you would make on a lower rate. So there is no financial benefit in breaking.

The only reason to break would be if you gaze in your crystal ball at what rates will be at the end of your fixed term, and you want to lock in the current rate on offer because you think it's better that what will be on offer when your 5 year fix ends. BUT, that reasoning has nothing to do with the current offer being less that your current fixed rate. That reasoning is equally valid when the current offers are higher than your fix, but you believe at the end of your fix it will be even higher still.

Agreed. And what is worse, if you break the fixed rate mortgage for any reason but the economics are in the banks favour, you get zero compensation for breaking.

There will be many with rate refixes impending by the end of the year who are wishing they broke and refixed long late last year.

ACB, I don't understand the point you are making. In Nov of 2020 I broke a fixed term of 3.45% that had 11months to run in order to take out a 5 year @ 3% fixed. Therefore that 5 year fix means I still have another 17 months to run at 3%. How did I loose out? I remember reading about a year later that David pointed out only about 3% of the Banks mortgage books held 5 year terms, and that amazed me how so many mortgage holders couldn't see that this was the deal of a lifetime, and that offering of 5 years @ 3% lasted for many months.

What’s he is saying is that you gained no net financial benefit from breaking over the 11 months of the remaining term of your initial fix due to break fees. After that 11 months expired you are now benefiting as interest rates obviously climbed but there was no guarantee that was going to happen just like no one can guarantee what interest rates will be in the future.

> that offering of 5 years @ 3% lasted for many months.

what was the 5 year rate 11 months after you broke?

Your question assumes I may have been just fine to wait the 11 months, and then maybe grab the 3%-5yr rate then at no cost for a break fee. Well maybe it would have been still available and maybe it wouldn't. I figured there was too much money at risk over the 4 years 1 month to take that chance. Logic played a big park in the decision. Very little chance rates would go any lower for a 5 yr term-and great chance they would move higher. In hindsight I was dead right.

To me yield inversion just the mechanical OCR influence on short term rates as expected.

Government puts the OCR to 8%, oh look short term rates have gone up, what a surprise!

But people don't expect the OCR to still be 8% in five years time, and so the rates they will lend for 5 years don't go up as much.

I still feel like there is an "Oh Sh*t" moment coming for the global economy when all these hikes finally break something big. Just look at all these articles with "highest since just before the GFC". I have put my money where my mouth is and only fixed for 6months, but who knows?

Those graphs did actually make me double take a bit, as I didn't realise how long it was from when the inversion happened (2006?) to the actual GFC

So I will ask the question- who will all the buyers be supporting the recovery? Surely a fairly small number of FHBs and cashed up investors isn’t enough to fundamentally support a recovery.

Are any of our ‘pro-property’ commenters looking to buy? Or do they know people who are?

Due to the downward trend of interest rates over the last 20years theres probably only been 2002/2003 maybe 04 and Now 2020-2022 where you could have beaten the banker by locking in for 5 years rather than rolling 1 years (would love a statistician do model out the odds of it). But the way i look at it, averaging it out over the 21 years you'd be much better rolling 1 year, than rolling 5 year rates. Anecdotally from what i read in the states future premiums tend to more competitive and with longer terms available on home loans the same exercise may be vastly different over there.

Thats mostly due to the downward trend of interest rates over the last few decades. If the trend had been upwards then locking in for 5 years would have come out ahead more often.

yes if the trend had been the opposite of reality, then locking in for 5 years would have come out ahead.

Likewise, if Auckland had good Jazz cafes, then going to a Jazz cafe in Auckland would be good.

Who is to say the next few decades is the same as the last?

Well it's more like the being the same as the last 7 centuries, but sure in the short term rates might go up. Point is no one has a crystal ball.

trend over the last 20 years? The downward trend has been going for 700 years.

https://economics.rutgers.edu/downloads-hidden-menu/news-and-events/wor…

What surprises me is that Australia's longer term fixed mortgage rates are higher than their short term rates (their floating rate is the lowest rate option for the borrowers it seems). In NZ it's the complete opposite with our long term rates being lower than short term fixed rates (and with our floating rates being the highest rate option for the borrowers). You'd expect that the two countries would have similar views in regards to shorter/longer term mortgage rates, given that many NZ banks are owned by Aussie banks.

Presumably the bank's experts anticipate a worse recession in NZ than Australia. Is property a smaller fraction of the Australian economy?

Australia has mineral wealth to fall back on whenever the times get tough. This money flows through the economy and albeit downturns happen, the cycle continues. Boom and bust in the mining sector, time are good: more mining and jobs, times are bad: loss of jobs and mining activity. Then they have a benefit to fall back on just as we do until the next mining cycle comes

That 'wealth' goes to private firms, tax on profits are still quite low there.

There's serious discussion on taxing superannuation income now as well.

Had mortgages for 50 years on and off. From the home buyers financial perspective a longterm fixed mortgage may or may not be the best decision. Nobody knows the future. However from the peace of mind perspective a long term mortgage is best - I know I can pay it so except for ill-health I've nothing to worry about for years ahead.

I would go 6 months or 1 year

Interested in knowing your reason for that.

Presumably you think there will be multiple cuts to the OCR within the coming year?

Cannot see cut in next 3months. But after that it will happen because things are going to fall of a cliff.

I find it strange that banks can just change the interest rate on a 30 year mortgage. In the past a State Advances mortgage were 3% for the full term weren't they?

They can't lend money at fixed rates for 30years unless they can also borrow money at fixed rates for 30years, or unless they load a massive margin on the short term rates to allow for rates increases.

That is the vital piece of information that many people don't realise. The money the bank is lending you is not theirs in the first place. They borrowed it from someone else, usually central banks but also global markets.

On some days, it really gets my goat that banks are making massive profits from being the middleman, and it seems that one of the reasons banks get bailed out of their own financial woes is because banks are supposed to be a lot less risky than individuals or businesses.

Given I have a credit rating of 1015 out of 1000 (go figure), would I be considered as having a AAA+++ rating? Should I be able to borrow directly from RBNZ as being less risky than a bank?

I think so, but central banks aren't in the business of lending to small fish.

Look at the recent increases in the 1 and 2 year rates when there wasn't an OCR increase. Banks are trying to make short term loans less appealing as they see interest rates dropping in the next 3 years, and are offering lower long-term rates to lock borrowers into paying higher interest when the rates do fall.

The risk is whether or not the interest rate will drop sharply, as it did on the back of the GFC, or be more of a gradual slide to the 3%~4% historical averages.

If it's the former, taking on 6.5% for 5 years is throwing money away, as floating rates would be lower than that for over half the term. But if it's the latter, you may find the crossover happening just as you need to re-fix, which would make you a financial wizard.

Unfortunately, my crystal ball is broken.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.